Being an appraiser is sort of like being Magnum PI. Well, I guess it’s just the same except for the tropical island, mustache, red Ferrari, and short shorts. I’m kidding. On a serious note though, appraisers are vaguely similar in one regard in that they investigate details. This brings us to our topic today. Why are appraisers always asking real estate agents about concessions in the purchase price? And how do appraisers use this information?

What is a concession? “A sales concession is cost or consideration given by a seller to motivate the buyer to complete the purchase” (homewyse.com). In other words, the seller is offering something to the buyer to help get the deal done.

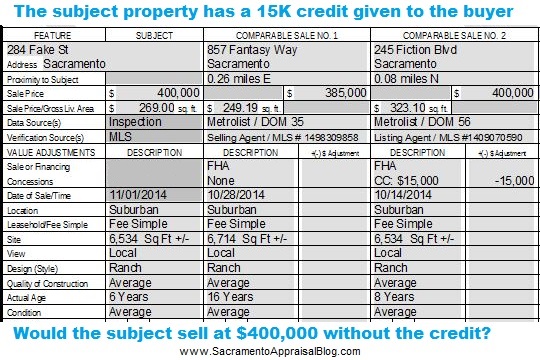

Why do appraisers ask about concessions? There are two reasons why appraisers need to know about concessions. First, there is a place on the appraisal form for appraisers to list any concessions for the comps, so it’s a matter of filling out the form correctly. Secondly and more importantly, appraisers need to understand what impact any concessions might have had on the purchase price of the comps. Would the comps have sold at the same level if there were no concessions? That is essentially what the appraiser is asking so the appraiser can figure out how to make value adjustments to the comps.

Common concessions: Some of the most common concessions include the seller offering help with closing costs, paying for HOA fees, including personal property in the sale, or giving credits for repairs. We see this in new construction all the time where a builder will offer $10,000 to help pay for the buyer’s closing costs. While this might be the only listed concession, if a builder has also offered $15,000 in “free” design options (upgrades), that’s also considered a concession. On the financing end there are concessions too such as interest rate buydowns or other below-market rate financing.

Examples of Sales & Financing Concessions Straight from Fannie Mae:

- loan discount points;

- loan origination fees;

- closing costs customarily paid by the buyer;

- payment of condo, PUD, or co-op fees or assessment charges;

- refunds of (or credit for) the borrower’s expenses;

- absorption of monthly payments;

- assignment of rent payments; and

- inclusion of non-realty items in the transaction.

- (Examples taken from page 615 Fannie Mae Selling Guide Nov 2014)

Do appraisers adjust comps when the subject property has concessions? No. Adjustments are NOT made to comps if the subject property has concessions padded into the contract (or outside of the contract). Adjustments are only given to comps if there should be an adjustment given (see below).

When are adjustments given to comps? Appraisers will adjust for concessions to a comparable sale when concessions ended up impacting the final sales price of the comp. Would the comp have have sold at that level without the concessions? If an appraiser researches neighborhood sales and notices the sales with credits to buyers are selling at higher levels, then clearly credits are boosting those prices. In this case an adjustment would be made to the comparable sale for whatever amount the concession boosted the sales price to be sure the subject property’s appraised value reflects the market instead of padded prices from the comps with concessions. Keep in mind an appraiser doesn’t have to adjust the full amount of the concessions. It all comes down to how much of an impact, if any, the concessions had on the purchase price. Sometimes an appraiser might not make any adjustment at all.

Tips for Real Estate Agents:

- Be Specific in MLS: Disclose any concessions in MLS. Be specific and write a sentence if need be instead of writing “CLA” (Call Listing Agent). You will get less phone calls from appraisers too if you include more specific information.

- Be Cautious of Padding: Be realistic about padding concessions above market value. If a property listed at the top of the market, and now you are writing or accepting an offer that pads the list price with an extra 3% above that price, realize this may push you into “no man’s land” where the property cannot appraise that high. Sellers always want to net more, but when a market slows down, it’s not always possible to get those higher prices.

- The Truth: If asked about concessions, please tell the truth so appraisers can consider if there is any adjustment needed to the comps. If appraisers use bad information on the comps, it can lead to the wrong value for the subject property. If there are confidentiality issues about sharing these insider details, just let the appraiser know that.

- Know How it Works: Remember that appraisers do not make adjustments if there are concessions in your listing they are appraising. They are only making adjustments to the comps if needed. Your seller can offer substantial credits back to the buyer for your listing, and no adjustment will be given because of that. However, the key is that there are comps out there that support your contract price (comps without boosted prices from concessions too). If your contract price reflects market value, that’s good news for your seller.

I hope this was helpful.

Questions: What type of concessions do you see most commonly in purchase contracts? How have you seen concessions impact the price on a property?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great post as usual Ryan. In our area, it is the same story, concessions are not listed in the MLS, so appraisers are forced to call or email. I would add to the conversation that appraisers should always ask the follow-up question when there are concessions, “Were the concessions a result of repairs that the buyer would need to make?” If the buyer needs to replace something big, often concessions are thrown in after the inspection so that the can fix that issue. In that case, the buyer contracted to buy a property that did not need repairs and found out in the inspection that repairs are necessary, so the concession would not be an adjustment (because the buyer is going to need to spend that money to get the property that they contracted to buy), unless the new information changes the way the property is compared in terms of overall condition.

Well said, Gary. I’m glad you mentioned that. Excellent point. I appreciate that your comments enhance the post and make it better.

I agree with Gary’s comments Ryan. In fact I may ‘borrow’ parts of this for an upcoming blog post I send out to local Realtors!

Thanks for the comment, Mike. When it comes to sharing, I’m always game for others to share within the confines of my sharing policy at https://sacramentoappraisalblog.com/share. Thanks hombre.

Great post Ryan! Great Blog! One item of note, agents at times say “this property really sold for” and try to make a positive or upward adjustment in price; however this is not allowed by Fannie Mae or any lender. If an agent buys a house and gets credit for their commission that is a separate issue and does not increase the price of the house. Also we are required to disclose any credits or fees paid on behalf of the buyer from ANY one, not just the seller. Sometimes folks seem hesitant to disclose this as it may effect value, but as you note if your talking about the subject it does not effect appraised value.

Great point, Cynthia. Thank you. On a related noted I came across a comp last week that closed at $498,000, but apparently would have closed at $510,000 if the selling agent’s commission was included. The selling agent was the buyer in this case and apparently went with a discounted price instead of receiving a commission. In this case I could not make a positive adjustment on the grid in the place of concessions, but if this property did sell for less, I could probably make an adjustment upward for marketing (in another portion on the grid) or end up giving the property less weight if it really should have closed for more. But you are hands-down correct that a positive adjustment at the concessions field is not allowed.

Great post as always, Ryan! Depending on how much lower the price is from the listing buyers are not asking for concessions and sellers are not agreeing to any lately. Most often sellers have offered to give a certain dollar amount for repair work needed verses doing a bunch of small items from the home inspection and or pest inspection.

Happy Holidays to you!

Thanks so much DeeDee. I always appreciate your insight. I think you’re right that we don’t see concessions being given across the board, and definitely not in every price range either. They are certainly more common these days than they were though – particularly at the lower end of the market and/or with FHA financing. Also, they are really showing up in new construction. For a while seller concessions basically disappeared when investors were gutting the market, but they’ve returned as the market has transitioned to more of a buyers’ market.