Dear Sellers,

The market feels aggressive out there and you’re probably going to get multiple offers, but let’s have some real talk. Last week I wrote an open letter to buyers, but today I want to share some perspective to help your end of the transaction. Whether you are in Sacramento or elsewhere, I hope this is useful. Any thoughts?

Advice for sellers in an aggressive market:

1) Don’t get high on the headlines: It’s easy to read articles that say “the market is hot” and then ignore data in the neighborhood. It’s as if we see something in print and price according to the headline instead of actual sales and listings. Right now there are no shortage of articles saying “Sacramento is one of the hottest markets in the nation”, so be careful about getting distracted by the headlines.

2) Don’t aim for the unicorn: It’s easy to price for that one magical unicorn buyer who is going to pay more than anyone else for some reason, but I would advise you to price based on recent similar sales and similar listings that are actually getting into contract. I find some sellers say things like, “A cash investor from San Francisco is going to swoop in and pay top dollar for my property.” Yeah, maybe. But what might also happen is you sit on the market instead of sell because you priced for a mythical buyer instead of a real one.

3) Be careful to not treat the contract price as holy: We like to think there is something holy about a contract price as if price negotiation is finished when a contract is written, but that’s simply not true. If a buyer finds repairs are needed or if an appraisal rightly comes in lower than an inflated contract price, it may be prudent to reduce the price.

4) Remember the difference between “comps” and sales: We like to think all sales are “comps”, but there is a difference between properties that are actually comparable and ones that are simply sales. It’s easy to get distracted by a few high sales in the neighborhood, but if they are nothing like your property, then don’t give them much weight and pay the most attention to homes that are actually similar to yours. In simple terms, if your home was an apple, what have other apples sold for in the neighborhood? Don’t price your apple according to orange or banana sales.

5) Be aware of appraisals being scrutinized: If you haven’t sold a home in years, know the lending world has changed from what it used to be over ten years ago. These days lenders scrutinize appraisals like never before, so be careful about accepting an offer that is incredibly high if there is no way it is going to appraise that high. Of course if the buyer has cash to make up the difference, then you are fine. But if the buyer is strapped for cash, then the highest offer probably isn’t your best option. This is why many agents tell sellers to look for the strongest offer instead of the highest one.

6) Don’t hijack price per sq ft: One of the biggest pricing mistakes sellers make is to take a per sq ft figure from another sale down the street and use that figure to price their property. Here’s the thing though. There isn’t just one price per sq ft figure that applies to every single property in a neighborhood. For example, in East Sacramento the price per sq ft range for all sales last year was $169 to $552. So when a seller says, “Let’s use $552 to price my property,” my question would be, why not $551? Or why not $525? What about $436? Or maybe $278? We can quickly get a price that is far from reasonable if we are only looking at price per sq ft. Keep in mind smaller homes tend to have a much higher price per sq ft too (which I explain with my Starbucks cup analogy). My advice is to pay attention to price per sq ft, but don’t forget to look at actual similar sales in the neighborhood.

7) Try to be objective about your house: Buyers are going to look at your home with a microscope, which means they’ll see the wonderful things as well as the faults. Remember, it’s easy to get sentimental about your property because you have a history there, but memories can also be a mask for not seeing flaws. A seller recently told me, “My house is the most well-built one on the block” (the same builder built the entire tract). Another seller said, “My house is really unique for the neighborhood, which is why it’s worth so much more” (it was totally outdated though). Agents are trying to tell these sellers to price lower because that’s where the market is, but both these homes are likely going to be overpriced because the sellers cannot get past their own subjective views.

8) Be FHA-ready: One in four homes in Sacramento county sold with an FHA loan last year, so it’s a good idea to have your home ready for an FHA appraiser if you think your home might go FHA. Your agent can most likely bring you up to speed on some repairs that might be required or maybe look over an FHA list. Keep in mind 34% of all homes under $300,000 went FHA in 2016 in Sacramento County and the current FHA loan limit is $474,950. This is also a reminder that financed offers are closing escrow and actually far outweighing cash transactions.

9) The market isn’t the same at every price range: We like to think the market is doing the same thing in every price range and neighborhood, but that’s not true. For instance, the market under $300,000 is more aggressive than the market above $1.5M. Thus the market could be “hot” in one price range or neighborhood and cool in another. This is important to remember because all day long we read about how hot the market is in Midtown and how rents are rising there, but that same dynamic might not be present in your neighborhood.

10) Listen to your agent: In a market that feels aggressive it’s easy to ignore pricing advice from agents, so some sellers price at completely unrealistic levels. Despite values showing upward pressure in many price ranges, we are not in a market where you can command whatever price you want (even with anemic inventory). So if your agent is telling you where the market is and showing you similar sales and listings, ask yourself why you are not listening.

I hope this was helpful.

Sincerely,

Ryan

Questions: What piece of advice resonates with you? What is #11? Did I miss something? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

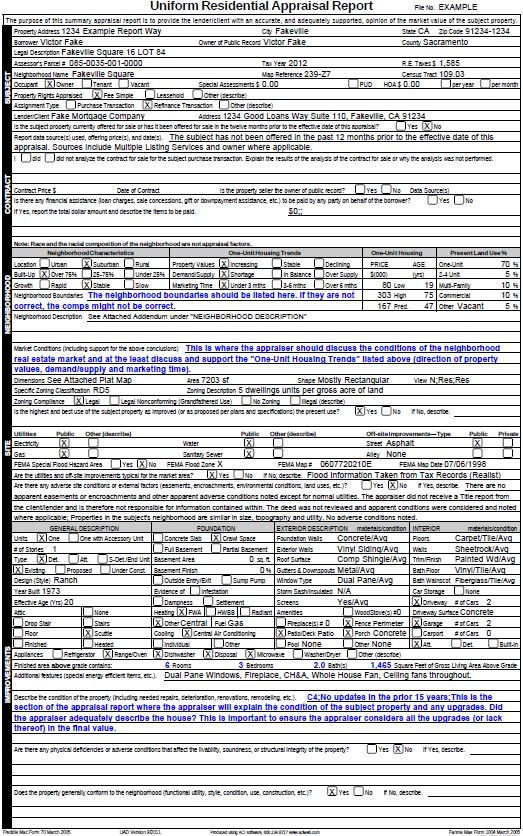

Over the past couple weeks I’ve shown you some of the big-ticket items to look for in an appraisal report (see

Over the past couple weeks I’ve shown you some of the big-ticket items to look for in an appraisal report (see

Messy: This is when some things that are not perfectly tidy. The kids

Messy: This is when some things that are not perfectly tidy. The kids