Let’s talk about real estate cycles. Are we at the top of the market? Lots of people are wondering, so I figured I’d throw out some charts to help fuel conversation. My goal here isn’t to say YES or NO, but to focus on stats for the sake of discussion. Well, and if you need something to talk about at Thanksgiving dinner besides politics…

CYCLE CHARTS: Here’s some charts to show the annual median price in various local counties. What do you see? Look at price changes and cycle lengths. If you’re not local, what would charts like this look like in your market?

NOTE: The market started increasing in the late 90s, but stats from then are limited. Just know the first cycle above would have been a couple of years longer.

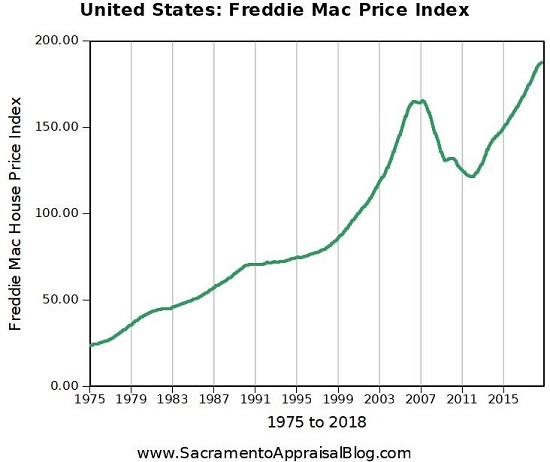

What about the ’70s and ’80s though?

Someone in the comments wanted to see price trends in previous decades, so here’s the 70s and 80s for context from the Freddie Mac Price Index. I’d love to expand my charts above, but I don’t have quick access to mass stats to make that happen. I’ll keep my eyes open though.

THOUGHTS ON REAL ESTATE CYCLES:

1) Up and down: Sometimes we get stuck talking about real estate like it only increases in value, but that’s fiction. The reality is markets go up and down – just like relationships, the stock market, or my pants size. The truth is we see longer periods where prices increase, decline, or persist in stability.

2) The seven-year cycle: Some say the market changes every seven years, which is a nice idea, but there’s no universal rule that says the market has to behave a certain way after a specific period of time. I definitely buy into the idea of market cycles, but I’m not dogmatic about a fixed number of years.

3) Momentum change: Right now as charts show we’re seeing momentum slowing in the market. What I mean is we’re typically seeing more subdued appreciation rates over the past few years. That’s not really a surprise though as affordability is becoming more of an issue with today’s prices.

4) Other: What is point #4?

I hope that was interesting or helpful.

HAPPY THANKSGIVING: From my family to yours I wish you a very happy Thanksgiving. I’m glad we’re in this together and I appreciate our weekly conversations. Over coming days I hope you get some time off and find refreshment. I honestly hope you don’t bring up real estate cycles at the dinner table. But then again if you do, let me know how it goes….

Questions: What do you see in the charts above? What stands out to you most? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.