Today I wanted to share some of the small but interesting things I’ve seen lately while out in the field during appraisal inspections. All of these images help illustrate something about real estate.

1) Iron Bars & New Construction:

Does anything catch your eye about this house? When driving through a two-year old neighborhood in Elk Grove, this property caught my attention because it’s literally the only house with iron bars on the front. I’m not saying there is anything wrong with bars or even that they adversely affect value, but they are definitely not typical for this neighborhood. It’s always important to consider that the type of fence or front yard presentation can impact value. Is this a positive, negative or neutral feature? Would it be a big deal if every house on the street had bars?

2) A fireplace chopped in half:

What’s the story here with this house on 12th Avenue? Maybe a recent attic conversion along with other additions? Or maybe a fireplace relocation? By the way, I asked a handful of real estate agents recently if they would ever recommend removing a fireplace and their response was overwhelmingly no. What do you say?

3) Loose straps

Appraisers aren’t code enforcement officers, but they do know something about code for water heaters. While many conventional lenders do not require the appraiser to verify if the water heater is double-strapped (some do), FHA appraisers do need to ensure the water heater complies with local standards. In the instance above, the water heater was clearly not properly strapped since I shouldn’t have been able to easily fit my entire hand between the strap and the heater. And no, I’m not a hand model. 🙂

4) A “shocking” light switch location:

I was surprised to find this light switch literally inside of the shower. Do you think this might be a safety issue?

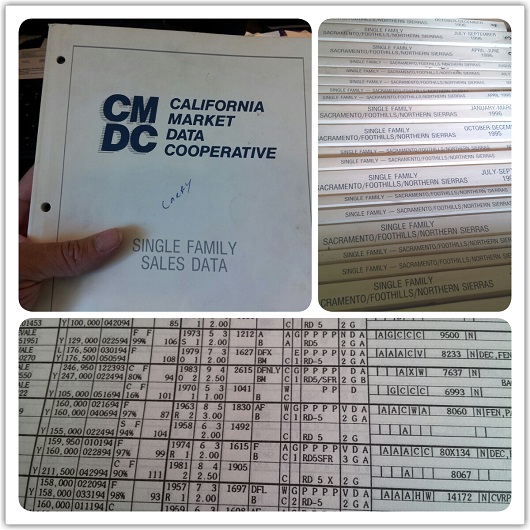

5) An appraisal in 1996:

This is a California Market Data Cooperative book from the 1990s. These books are full of charts of real estate sales information, and they used to be published almost monthly before sales data went online in 1998 through Metrolist in Sacramento. I have a stack of these books in my office right now since I’m doing a “Date of Death” appraisal based on a date in 1996. I’ll use these CMDC books to find comps, verify sales data and analyze market trends. It’s definitely a tedious process to establish a value this way, but I’m grateful these books are at my disposal thanks to my membership with the Real Estate Appraiser’s Association of Sacramento (REAA). Otherwise I was going to need to contact some long-time brokers to find someone willing to lend or rent me these books.

6) My backyard garden

Lastly, this is personal real estate for me. I mentioned in the beginning of the year one of my goals was to finish the backyard garden that was supposed to be done last year. I’m pleased to announce that after ripping out 30% or so of my rear lawn last year, and then putting the project on hold for about nine months, I finally finished the job last week. I’ll be honest, it feels really good to check this goal off my list.

Have you seen anything interesting lately relating to real estate?

If you have any questions or Sacramento home appraisal or property tax appeal needs, let’s connect by phone 916-595-3735, email, Twitter, subscribe to posts by email (or RSS) or “like” my page on Facebook

This is one of those things that many of us may not know much about until we actually experience personally. My hope in this entry is to offer a bit of insight into the process of estate settlement as it pertains to real estate valuation.

This is one of those things that many of us may not know much about until we actually experience personally. My hope in this entry is to offer a bit of insight into the process of estate settlement as it pertains to real estate valuation. Retrospective appraisals can be challenging in that the appraiser needs to decipher the trends and perceptions of market participants in a previous time period instead of whatever is happening right now (which could be completely different). In a market like today, if much time has elapsed since the death of the property owner, the difference between the retrospective value and today’s current value can be striking, huh.

Retrospective appraisals can be challenging in that the appraiser needs to decipher the trends and perceptions of market participants in a previous time period instead of whatever is happening right now (which could be completely different). In a market like today, if much time has elapsed since the death of the property owner, the difference between the retrospective value and today’s current value can be striking, huh.