Did prices really go up in February? What’s happening in this market? Today I have a few things on my mind (including a Hot Pockets analogy). Scroll quickly or digest slowly. I hope this helps – whether you’re local or not.

UPCOMING (PUBLIC) SPEAKING GIGS:

3/06/23 Matt the Mortgage Guy YouTube Live 3pm PST

3/09/23 Matt Gouge Event (sign up here)

3/10/23 PCAR Market Update Lunch & Learn

3/24/23 How to Think Like an Appraiser (at SAR)

3/28/23 Downtown Regional MLS meeting

4/1/23 NAA Conference in Sacramento

4/13/23 Realtist Meeting

5/4/23 Event with UWL TBA

1) DID THE MEDIAN PRICE REALLY GO UP IN FEBRUARY?

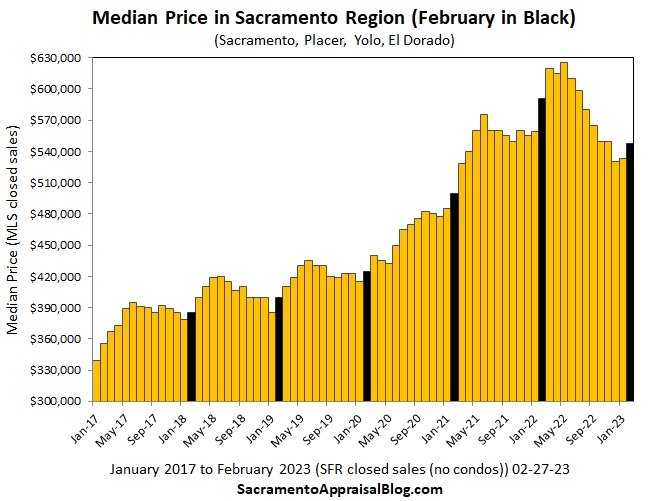

Yes, the median price so far is up in February in the Sacramento region. The dark bars below are February each year, and it’s normal to see an uptick from January to February. This doesn’t mean every neighborhood went up in value though because the median price doesn’t translate rigidly to every location and price range. My advice? Look to the comps to understand the trend.

2) DOES THIS MEAN THE MARKET IS RECOVERING?

Any hint of positive price news tends to stoke housing optimism, but let’s talk about this. The bar chart below shows median price change from January to February over twenty years, and there’s been an increase EVERY. SINGLE. YEAR. Even in 2007 when the market was tanking. Ultimately, it would be a mistake to say, “Prices went up last month. It’s a sign of recovery.” I’m not trying to be a killjoy, but this is a sign of seasonal normalcy. In other words, an uptick from January to February in the region is what should be happening, so let’s be careful about confusing normalcy with recovery. Keep in mind rates rose in February, and that could damper the price trend ahead.

NOTE: The regional median is up, but NOT every local county is up. The month isn’t over yet, but it looks like the median will hold (I could be wrong).

3) WORST VOLUME EVER

Okay, now for a glaring stat. Monthly sales volume has been below 2007 levels for four months in a row in the region. This isn’t about not having enough listings. This is the byproduct of buyers stepping away. As I keep saying, the way to get more buyers back is to see affordability improve.

ADVICE: For real estate friends, my advice is to focus on the part of the market that IS happening rather than the part that isn’t. Find buyers and sellers who have incentive to participate in today’s market (see #5 too). Oh, and graphs like this are EXACTLY what sellers need to see to understand there is a smaller pool of buyers in the game today.

By the way, who is watching The Last of Us? If you’re not, you won’t get the meme (sorry). My wife and I are glued to this show.

4) SPRING IS HEATING UP (LIKE A HOT POCKET)

Do you see that orange line? Those are monthly sales in 2023, and we’re starting to see an increase in closed sales. This is normal for the time of year, but hey, any hint of normalcy right now feels pretty nice to lots of people. A good way to describe the housing market at the moment is heating up for the spring, but also still frozen. In other words, the housing market is like a Hot Pocket taken out of the microwave too early. It’s somewhat hot, but it’s sort of frozen too.

5) PAY ATTENTION TO RATES & FHA LOANS:

RATES: Mortgage rates have risen this month, and that’s taken some heat and affordability out of the market. In January, it seemed like lots of people were predicting mortgage rates to go down, but now I’m hearing many thinking they’ll go up. This just goes to show very few people get it right. What happens with rates ahead will make a huge difference (duh, thanks).

FHA: Last week it was announced FHA will lower its mortgage insurance, which will help buyers save a modest amount each month. Look, I don’t expect this to transform the housing market since FHA is only a small sliver of volume in Sacramento. However, loan officers have been reporting conventional loans are getting more expensive lately, so FHA becoming slightly cheaper can be meaningful for buyers. The new FHA savings really won’t kick in until March 20th, but so far FHA loans have already been up in 2023.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What do you think is going to happen to rates? What are you hearing from buyers and sellers right now? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The Reality: Appraisers are not trained to identify whether wood is sealed or not. Maybe some appraisers have that skill set, but most probably don’t. While on the phone with HUD yesterday I even asked them how an appraiser would specifically identify a fence that was not sealed. Crickets. The person on the phone did not have an answer other than to say FHA requires a fence to be sealed from the elements. This means a reasonable focus for appraisers would be to call out defective paint on fences, but otherwise assume the wood is sealed unless there is evidence to suggest otherwise. Does that seem like good common sense? One further point to consider is something my friend Realtor

The Reality: Appraisers are not trained to identify whether wood is sealed or not. Maybe some appraisers have that skill set, but most probably don’t. While on the phone with HUD yesterday I even asked them how an appraiser would specifically identify a fence that was not sealed. Crickets. The person on the phone did not have an answer other than to say FHA requires a fence to be sealed from the elements. This means a reasonable focus for appraisers would be to call out defective paint on fences, but otherwise assume the wood is sealed unless there is evidence to suggest otherwise. Does that seem like good common sense? One further point to consider is something my friend Realtor