There are more cash buyers right now. Bottom line. Well, technically. Today let’s unpack the housing market’s cash trend, some myths, and things to watch ahead. This post is designed to scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

9/26/23 Orangevale MLS Meeting

9/28/23 Yuba City Big Market Update (in Yuba City (details TBD))

10/4/23 KW Sac Metro Big Market Update (register here)

10/6/23 SAR Think Like an Appraiser (TBD)

10/27/23 AI Fall Conference (San Francisco)

CASH PURCHASES HAVE BEEN INCREASING

Ever since mortgage rates shot up in early 2022, we’ve been seeing more cash buyers. The uptick has become very noticeable lately in Sacramento, and probably in other markets too. The percentage of cash buyers this quarter so far is 21% of all sales. That’s nothing compared to 32% in 2012 when investment funds were playing the market like Monopoly, but we are still seeing a growing trend at the moment technically (see below).

BUT THERE’S AN ASTERISK (PLEASE READ)

Yes, there is more cash right now as a percentage of all sales, but it’s not that there are so many cash buyers flooding the market. What I mean is when you look at the number of cash buyers over the years, we aren’t seeing a crazy high level today technically. But what we are seeing is the cash buyers that are here today represent a greater percentage of the sales that are happening (see graph above). Does that make sense? It’s as if buyers who aren’t tied to what happens with mortgage rates are finding it easier to play the game today.

IT’S A CASH SANDWICH

We are seeing more cash at the bottom and more at the top. It’s like a cash sandwich. This is a normal dynamic with more investors purchasing stuff at the lower end and higher-dollar buyers flexing cash at the top. I shared this chart yesterday, and people were blown away at the percentage of cash above $1M, though there is always more cash at higher levels (this percentage is still a little higher than usual though).

Here’s another way to look at the same data. I think this is a cool way to see the trend, but I’m not sold on this image either. Thoughts?

DON’T BLAME INVESTMENT FUNDS

It’s easy to blame the cash trend on investment funds. I can’t tell you how many times I hear people say things like, “Dude, Blackrock and Blackstone are buying everything and destroying the housing market.” Look, I’m not an investment fund fanboy. I’m just saying the stats don’t line up with that narrative. The truth is investment funds are NOT playing a noticeable role in Sacramento region housing market right now. As far as I can tell, Invitation Homes hasn’t purchased anything in Sacramento since last summer.

DON’T BLAME IT ON THE BAY AREA

It’s also easy to blame the local trend on Bay Area buyers, but some recent stats from John Burns Real Estate Consulting suggest Bay Area outbound migration has gone cold, and Sacramento is NOT a hot inbound migration either at the moment. This sort of lines up with the word on the street from what I’m hearing from the real estate community too. Keep in mind this doesn’t mean there are zero Bay Area buyers. It’s just the fire hose of pandemic migration has seemed to turn into a slower drip.

AIM FOR THE MARKET – NOT THE UNICORN

It’s easy to aim for a Bay Area unicorn buyer who is going to drop fat stacks of cash and overpay. My advice? Aim for the market.

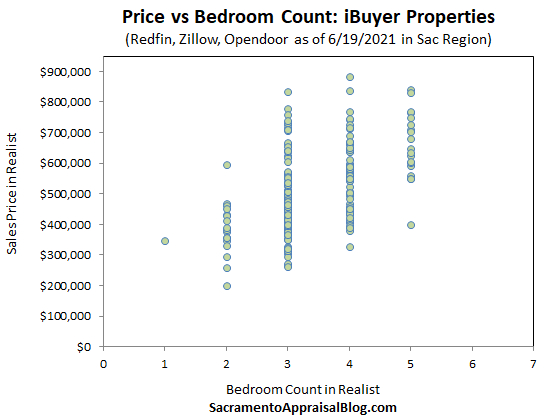

IT’S NOT THE iBUYER MODEL

The market shifted last year, and the iBuyer model has suffered. Opendoor currently owns 42 properties in the Sacramento region, and while they look to be trying to turn things around, just over one year ago they owned over 300 units at any given time, so they have really cut back. I would mention other iBuyers, but Zillow, Redfin, and Offerpad all stepped back from the market (failed), so the iBuyer model locally is basically Opendoor.

CASH DOESN’T ALWAYS MEAN INVESTOR

It’s easy to think cash represents only investors, but there are many buyers who purchase owner-occupied units with cash, so cash stats aren’t the end-all solution to determining the number of investors. With that said, in my experience the number of investors is often pretty close to the percentage of cash buyers locally. Here’s a cool tool by Redfin to gauge the percentage of investors in many markets across the country. Their stats show a 17% investor share in Sacramento. Over the years I’ve noticed John Burns Real Estate Consulting tends to show a little bit higher. In short, if someone said we have about 20% investors locally, I wouldn’t bat an eye. That seems legit.

WHERE IS CASH COMING FROM?

Someone asked me where the cash is coming from, but that’s not a question I can answer. The joke on Twitter is that it’s money laundering, but I’ll let you decide on that. Haha. If someone has a way to research this, I’m open ears. By the way, speaking of cleaning money, did you watch Ozark? Loved it.

THERE IS HOPE FOR BUYERS

While cash has been increasing, let’s remember 79% of the market is NOT cash. I think sometimes the narrative is that nobody can compete with cash, but that’s not actually what the stats show. For instance, $400,000 to $500,000 is an incredibly competitive price point in Sacramento County, but only 12.9% of sales were cash in this segment last month. Isn’t that a powerful stat? All I’m saying is we have to let the stats form our narrative instead of imposing a narrative on the market. It’s easy to get clicks and attention when we say “Blackrock is cutting out first-time buyers,” but that’s fake news in the local market.

DOES CASH ALWAYS PAY LESS?

I know this visual is a hot mess, but work with me. Anything above the 0% line went above the original list price last month, and anything below went below. In short, it’s not just one thing with cash buyers. 51% of cash transactions over the past couple of months went below the original asking price, 36.6% went above, and 12.4% sold at exactly the original price. These percentages are a little softer than the rest of the market in terms of going above, so it tells me cash buyers do tend to go a little lower than the entire market. Or maybe they’re getting better deals after properties have been lingering. There are many ways we can look at this. Ultimately, it’s not just one thing. Every escrow has a different story.

CASH BUYERS BID UP IN THE FIRST WEEK

It’s during the first week where cash buyers noticeably go above the original list price. And the longer a property is on the market, the lower it tends to sell when dealing with a cash buyer. But honestly, this trend looks just like the rest of the market, so there isn’t anything different here. What this shows us is cash buyers have to compete with everyone else to get it done. In other words, cash isn’t so strong that it’s somehow exempt from the market trend.

A MISTAKE BY CASH BUYERS

One mistake I see cash buyers make is to think they have so much power since they’re bringing greenbacks to the table. Look, sometimes cash is super convenient or necessary due to condition, but financed deals end up being all cash to the seller after escrow closes. And the vast bulk of the market is financed locally (79% lately). In short, if you’re coming with cash, you still have to compete and make a strong offer in the midst of a market with limited supply.

MORE AFFORDABILITY WILL CHANGE THESE STATS

Affordability improving will lead to be more financed buyers, and that can quickly change the total percentage of cash buyers in the market. For now, we’re in a place where there is a smaller pool of buyers, and a growing percentage of them happen to be cash at the moment. We’re missing nearly 40% of buyers from the pre-pandemic average, which is sobering.

I hope that was helpful. Thanks for being here.

Questions: What are you seeing with cash in real estate right now? Anything to add? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Big news – Invitation Homes is back: Invitation Homes is back to buying homes in the Sacramento market. Over the past month or so they started buying again and they’ve had seven deals close between $410,000 and $495,000. All properties were purchased on MLS for reference. So far this doesn’t look like it will be 2012 again where Invitation Homes purchased thousands of units in a very short period of time, but we’ll see how it shakes out. I’ll be paying close attention, so stay tuned. What I find striking is that institutional investors are even able to make the numbers work after ten years of price growth in the region. This underscores

Big news – Invitation Homes is back: Invitation Homes is back to buying homes in the Sacramento market. Over the past month or so they started buying again and they’ve had seven deals close between $410,000 and $495,000. All properties were purchased on MLS for reference. So far this doesn’t look like it will be 2012 again where Invitation Homes purchased thousands of units in a very short period of time, but we’ll see how it shakes out. I’ll be paying close attention, so stay tuned. What I find striking is that institutional investors are even able to make the numbers work after ten years of price growth in the region. This underscores

The skinny on BlackRock: When viral news about BlackRock broke I read this

The skinny on BlackRock: When viral news about BlackRock broke I read this