“Why is there not a pandemic discount? I don’t get it. The market has been going down.” Someone was angry with me recently after an estate appraisal didn’t come in low enough in his mind. The thought was prices should be dipping because we’re in a pandemic, but that hasn’t been happening.

The Truth: Lots of people expect the market to be weak right now.

The Takeaway: Let’s be careful not to impose ideas on the market about what we think should be happening. Instead, let’s look to the numbers to form our understanding. Likewise, it’s critical to be objective about the present and keep an eye on glaring uncertainties regarding the future. But let’s do this without viewing stats through a rose-colored lens or painting every conversation with a doom and gloom brush.

Anyway, that’s what’s on my mind…

———————— big monthly update below ————————

BIG MONTHLY UPDATE:

BIG MONTHLY UPDATE:

This is long on purpose. Skim or digest slowly. Your call.

FREE MARKET UPDATE: On Monday June 22nd at 10am PST I’m giving a one-hour free market update via Zoom through the Sacramento Association of Realtors. Please sign up here.

WEEKLY VIDEO: Here’s my weekly video update to talk through the latest trends (shorter this week too). Watch below (or here).

Now some big topics…

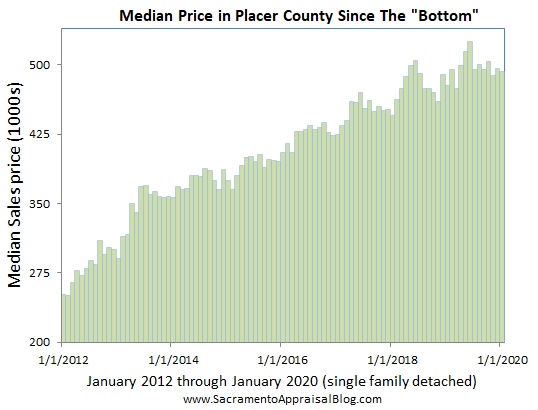

FLAT PRICES: When we look at the latest price trends, it’s pretty flat. As you can see, the stats show modest price gains since last year. Granted, this month was more subdued than last month, so before writing home about this trend we need a few more months of data to fully understand the market. Remember, this doesn’t mean the market is dull because it’s actually quite competitive. It doesn’t mean every price range and neighborhood are flat either. But it does remind us prices haven’t been going insane despite the market feeling ultra-competitive.

CRESTING FOR THE SEASON: Based on the next three images, it looks like the spring season has started to crest. We’re seeing a dip in prices and we’re having less multiple offers.

NEXT MONTH THOUGH: When sharing about flat prices, I’ve been tending to get reactions saying price metrics in a couple months may show an uptick again because mortgage rates have gone down lately. Look, that’s possible and we can adapt our narrative if that happens. To be fair, there’s nothing normal about life and real estate lately, so anything is possible for the future and we’re certainly experiencing some abnormal pent-up demand right now.

SALES VOLUME DOING THE LIMBO: Here’s a brand new visual to show most counties in May were down 30% or more in volume from 2019. Do you like this one? Should I keep making it?

LEARN TO MAKE A GRAPH: In case you didn’t see this on my YouTube channel, I put out a new tutorial for how to make a graph with three price metrics. This can be made for a zip code, city, county, etc… My advice? Set aside an hour in your schedule to make learning this happen. Becoming more visual changed the way I see the market and it frankly changed my career.

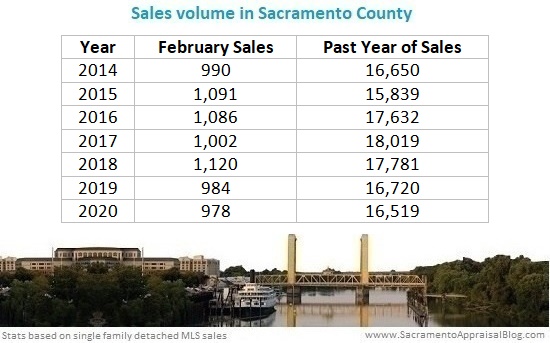

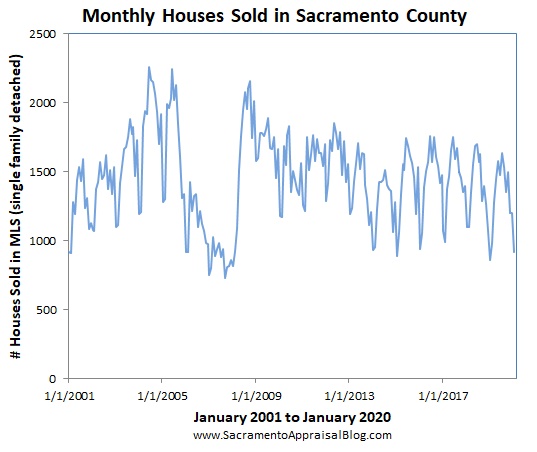

LOW RIDING: We had the second lowest month of sales volume for May in Sacramento County over the past twenty years.

BUT VOLUME IS ACTUALLY INCREASING: When we look at sales volume by the week instead of the month, we’re starting to see more sales close. In fact, for four weeks now we’ve seen an uptick. This change reflects pending contracts from about 4-6 weeks ago finally starting to close. I suspect in coming months we’ll keep seeing volume increase since pendings have been on fire lately.

MORE PENDINGS THAN NEW LISTINGS: For the fourth week in a row we literally had more pending contracts than new listings hit the market in the Sacramento Region. This shows buyers have been coming back to the market more quickly than sellers. Let’s remember buyers have strong incentive to get into contract quickly to lock in a historically low mortgage rate, but sellers just don’t have that same sense of urgency.

CHANGE BY THE RANGE: Here’s a look at what’s happening with different price ranges. These two images compare the change in April and May from 2019 to 2020. I don’t know that there’s anything revolutionary here, but what we want to watch over time is whether different price segments are slowing or speeding up. I think with a few more months of data we might have more to consider.

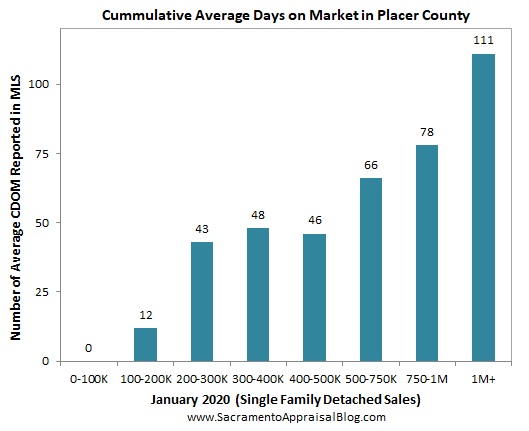

INVENTORY AT DIFFERENT PRICE POINTS: What’s happening with inventory in different price segments? Well, it’s actually pretty tight, but let’s watch above one million closely because it’s trending a little higher. Granted, it’s pretty normal to have 8-10 months of housing supply at the highest prices, but still we’ve seen more of an uptick lately.

2,651 FEWER LISTINGS SINCE THE PANDEMIC: Over the past three months there have been over 2,500 fewer listings compared to the same time last year. No wonder why it feels so competitive…

Now here are more visuals. As if this post wasn’t long enough already…. See my sharing policy for 5 ways to share my content (please don’t copy my posts verbatim).

SACRAMENTO REGION:

SACRAMENTO COUNTY:

PLACER COUNTY:

EL DORADO COUNTY:

Okay, let’s wrap this thing up.

Questions: What stands out to you about the market right now? What are buyers and sellers saying? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

THE SHORT VERSION:

THE SHORT VERSION: