Nobody predicted 2020. Who would’ve thought during a pandemic we’d see such an explosive year in real estate? The expectation was that the market would start to tank, but we saw the exact opposite. It’s not just Sacramento either because many areas of the country experienced this same dynamic. Anyway, enjoy some brand new visuals if you wish. Thanks for being here.

THE SHORT VERSION:

Here is a highlight reel to talk through some of the bigger themes this year. In short, the stats are stunning.

What stands out to you?

THE LONGER VERSION (organized by county):

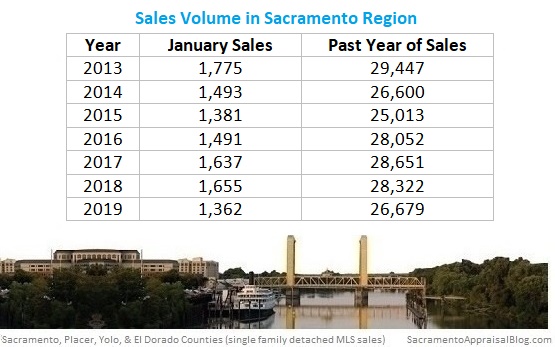

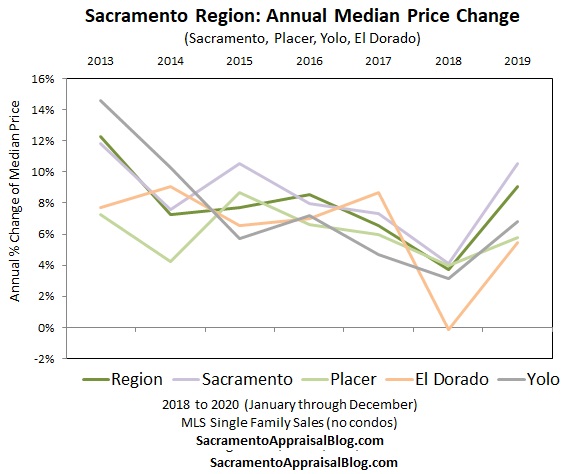

1) Sacramento Region

2) Sacramento County

3) Placer County

4) El Dorado County

5) Yolo County

6) Bonus visuals

I welcome you to share some of these images on your social or in a newsletter. Please use this stuff. In case it helps, here are 5 ways to share my content (not copy verbatim). Thanks.

1) SACRAMENTO REGION:

2) SACRAMENTO COUNTY:

3) PLACER COUNTY:

4) EL DORADO COUNTY:

5) YOLO COUNTY:

6) BONUS VISUALS:

Here are some extra regional graphs to show how various counties are moving together.

Other visuals: Not that you needed more, but check out my social media in coming days and weeks for extra visuals. I am posting daily stuff on Facebook, Twitter, and LinkedIn. Oh, and sometimes Instagram.

Thanks for being here.

Questions: What stands out to you most about 2020 real estate? Any stories to share? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.