There’s a stat that doesn’t get much love. It’s not sexy, nobody really writes about it in the newspapers, and most people don’t even know what it is. But it’s really important because it helps us tell how hot or cool the market is. I’m talking about the sales to list price ratio. Oops, did I lose you? I know, a topic like this sounds painful, but let’s consider why this actually matters. Then if you’re interested I have a huge local market update below to discuss slumping volume and slowing momentum. Any thoughts?

What is it? The sales price to original list price ratio is one of the best ways to gauge the temperature of the market. It’s the relationship between the final sales price and the original list price, and it’s expressed as a percentage.

If we only had one stat: We could likely get a pretty good understanding of how hot or cold a market is based on this metric alone. So without looking at price, inventory, or sales volume, if we simply saw a market had a 100% sales to original list price ratio, it tells us properties on average are selling for what they listed for. That’s a sign the market is hot or at least buyers are willing to pay what sellers are putting out there.

When we see this ratio moving up or down, it helps us get an idea of what the market is doing. For instance, over the past six months the sales price to original list price ratio has declined in Sacramento County, which tells us the gap has been growing between what sellers are asking and what they are actually getting. The most recent ratio is 96%, and that means on average properties are selling 4% lower than their original list price. That’s a powerful stat, right?

Not being anal, but ORIGINAL matters: It can make a huge difference if we’re looking at the original list price or the most recent list price.

Looking at the most recent list price makes it seem like the market isn’t cooling all that much. After all, a 99% sales to list price ratio still sounds pretty good. Yet this stat hides the real trend that properties on average are actually selling 4% lower than their original price. Thus if we’re not careful we can totally misunderstand the market despite good intentions. That’s sobering, right?

The “Bubble” years:

Right now 96% feels dull, but imagine 87%. Yikes!

Action Step: With so much talk about the market softening these days, it’s a good idea to pay attention to lots of different metrics – and especially the sales to original list price ratio. Keep in mind if the ratio isn’t available through MLS, it can always be run manually by dividing the final sales price into the original list price. For instance, all sales in Sacramento County this month totaled $512M while the original list price for all these sales totaled $533M. When I divide $512M into $533M I get 0.96 (or 96%).

I hope this was interesting or helpful.

—–——– Big local monthly market update (long on purpose) —–——–

Dull is a perfect word to describe this fall season. Actually really dull would be more accurate. Let’s consider some of the bigger themes happening right now in the market.

Dull is a perfect word to describe this fall season. Actually really dull would be more accurate. Let’s consider some of the bigger themes happening right now in the market.

DOWNLOAD GRAPHS FOR YOUR SOCIAL MEDIA: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy my post verbatim).

A week longer: It’s been taking about a week longer to sell this year compared to last year in the region (technically 8 days).

Prices softening: Prices normally soften during the fall season. If you don’t believe me, look at the graphs below. This year the median price is down by 6% from the height of summer in the region. This doesn’t mean every neighborhood or price range is down by that much, but there is a more defined softening present this year in many price ranges. Sellers would be wise to price according to listings that are getting into contract rather than the highest sales from spring.

Sales volume slumping (please read): Sales volume is only down by 3% in the region this year, but the bigger stat is volume is down 11% over the past four months. This is definitely something we need to watch closely to see how it unfolds. In short, if volume rebounds to normal levels as 2019 begins, then we’ll chalk this slump up to a dull fall season like we had in 2014. If volume persists to decline though we’ll correctly call this a new direction for the market. So is this seasonal or not? I’ll tell you in a few months or so….

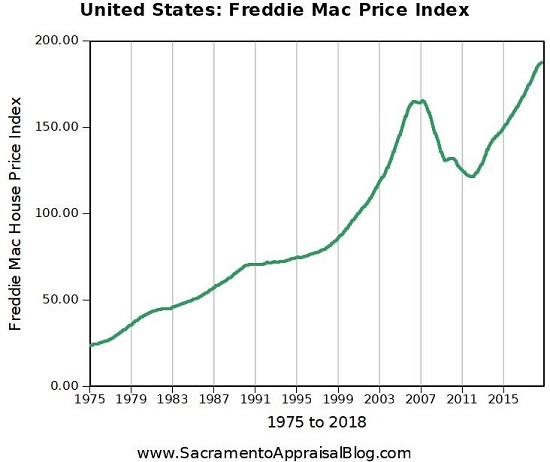

Momentum change: The rate of price changes has slowed lately. What I mean is in years past we’d regularly see 7-10% price increases when running stats, but over the past few months we’re starting to see only 2-6% increases instead. I talked about this last month, and the new stats show this same trend.

Ironic power exchange: There has been a power exchange lately where buyers have been gaining market share and sellers have been losing it. Of course we know sellers have struggled with being out of touch with the market as they’ve been prone to overprice. It’s been easy to point this out all year long, but ironically we’re starting to see something similar with some buyers thinking they’re completely running the show when in fact it’s not quite a full-fledged Buyers’ market.

I could write more, but let’s get visual instead.

BIG QUESTIONS:

1) How did the market change from last year?

2) How did the market change from October to November?

3) What’s happening with sales volume?

SACRAMENTO COUNTY VOLUME:

Key Stats:

- November volume down 6.5%

- 2018 volume down 1.4% (January to November)

- Annual volume is down 2.1% (past 12 months)

SACRAMENTO REGION VOLUME:

Key Stats:

- November volume down 12.1%

- 2018 volume down 3.3% (January to November)

- Annual volume is down 3.4% (past 12 months)

PLACER COUNTY VOLUME:

Key Stats:

- November volume down 9.3%

- 2018 volume down 5.6% (January to November)

- Annual volume is down 6.1% (past 12 months)

4) MOMENTUM IS SLOWING:

November:

Past 90 Days:

Entire Year:

DOWNLOAD 100+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

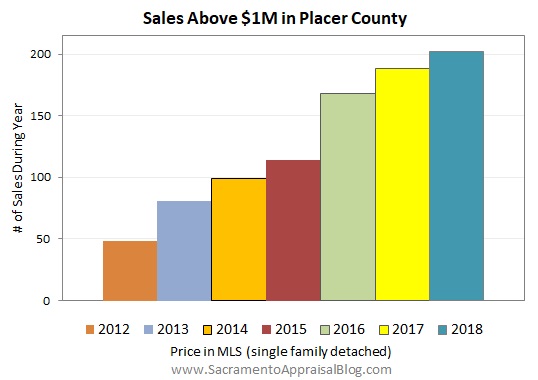

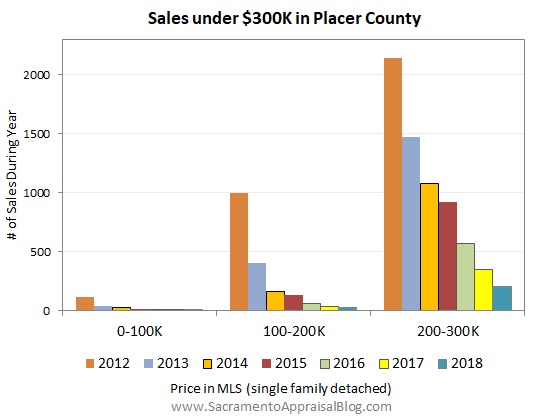

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 100+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: Do you ever use the sales price to list price ratio? Why or why not? What do you see happening in the market right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Prices actually went up last month. What the? Yes, the market is softening, but prices saw an uptick from August to September. That might seem confusing since we’re talking about the market cooling, but it highlights exactly what I’ve been talking about lately in that

Prices actually went up last month. What the? Yes, the market is softening, but prices saw an uptick from August to September. That might seem confusing since we’re talking about the market cooling, but it highlights exactly what I’ve been talking about lately in that