The housing market pretty much sucked this year for so many real estate professionals. Look, it’s easy to feel like God’s gift to real estate when business is flying off the shelves, but it’s tough when the transaction faucet gets turned off. The truth is everyone feels like an expert when things are good, but true expertise shows up when things aren’t so good. On that note, as we look to 2024, it’s going to be an opportunity to flex market knowledge, find creative ways to get deals done, and stand out as an expert.

UPCOMING (PUBLIC) SPEAKING GIGS:

01/12/24 Prime Real Estate (private event (I think))

01/17/24 Gateway Event (private)

01/31/24 Joel Wright & Mike Gobbi Event 9am (on Zoom here)

2/09/24 PCAR WCR Event (details TBA)

2/13/24 Downtown Regional MLS Meeting 9am

3/11/24 Yolo Association of Realtors (YAR only)

4/11/24 Lindsay Carlisle Event (private)

4/25/24 HomeSmart iCare Realty (details TBA)

MY ENCOURAGEMENT FOR 2024

UPPING YOUR DATA GAME IN 2024

Speaking of expertise, I made a free spreadsheet below as something that could help up your data game in 2024. Maybe spend some time figuring it out over the next couple of weeks. I’d love for you to take it for a test drive. But no matter what, I hope you are filled with optimism and drive for 2024.

SEEING THE EFFECT OF 8% RATES IN THE SALES

I’m not doing a big market update this month, but two quick things. First, we had a lackluster month of sales in November, and that’s due to lackluster pendings from when rates were closer to 8%. This reminds us how sensitive buyers are to rates. Secondly, I now have a stats tab on the navigation bar where I’ll post visuals every month to show eight counties.

LOOK MOM, I CREATED A SPREADSHEET

I made a free spreadsheet to download data from MLS to make graphs. I did something like this a few years ago, but I think this one is better. Anyway, the goal is to get more visual so we can see trends, explain the market, and maybe have some stuff to share on socials. Download spreadsheet HERE.

VIDEO TUTORIAL

Watch below or here. This is over forty minutes, but it’s because I have three examples. Skip around sections if you wish.

Intro: 0:00

The types of graphs: 1:42

How to create export: 10:10

Example 1: 13:48

Example 2: 24:42

Example 3: 36:28

Closing Graph Tips: 39:44

WHAT TYPES OF GRAPHS WILL THIS MAKE?

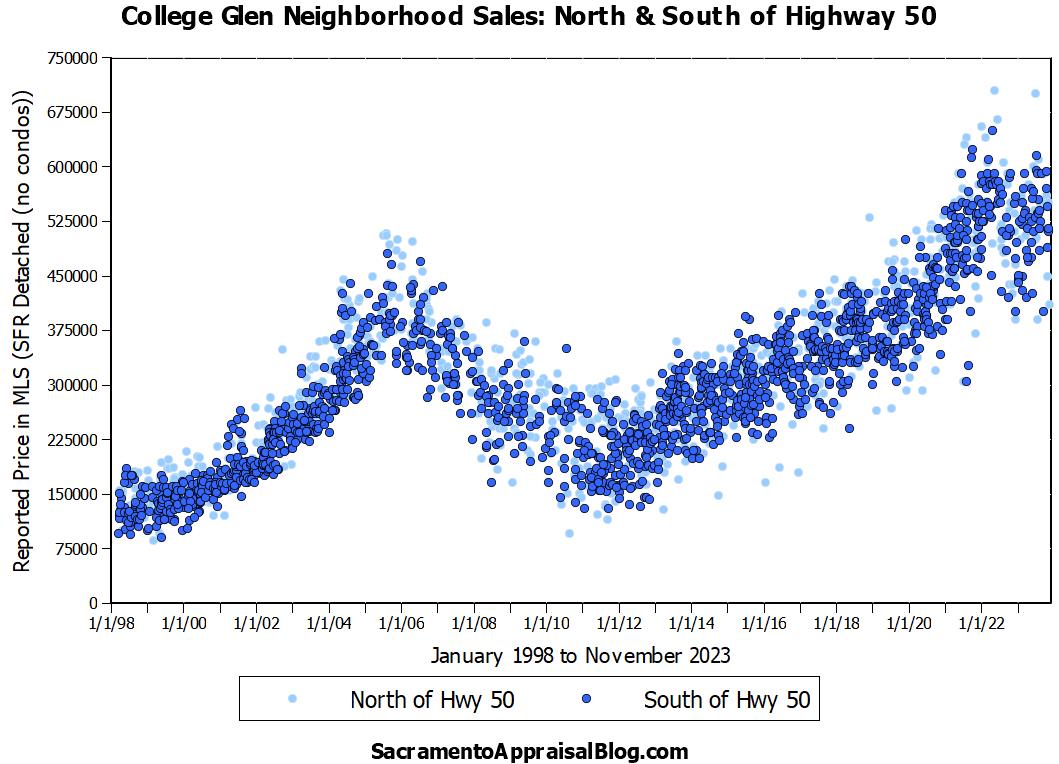

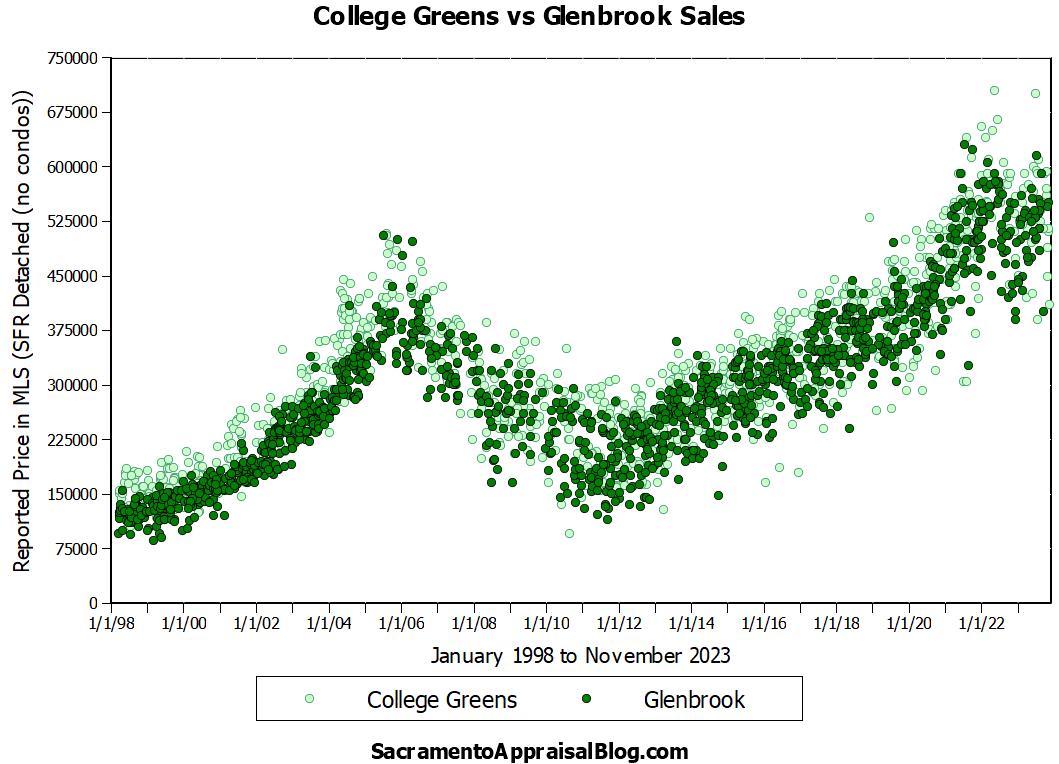

Here are some examples. Remember, not all graphs are going to be meaningful every time you do this. And it’s only as good as the data input, right? The goal is to look at visuals on a neighborhood level – not just the county.

STEPS TO USE THE TEMPLATE:

1) Download the spreadsheet here.

2) Decide what data you want to show. It’s up to you.

3) Create a custom export in MLS (see video).

4) Paste data from MLS into the template (see video).

5) Edit graphs as needed

6) Share graphs on social media, newsletters, etc…

LEARNING CURVE

There is a learning curve here, but this is highly doable. It transformed my real estate career when I started getting more visual, and I hope some will have a similar experience. You don’t have to be an Excel nerd to get this either. And if you don’t want to use my spreadsheet, just learn how to make a custom export so you can start looking at data more specifically in neighborhoods. You can easily export neighborhood data into an Excel file so you can just quickly see whatever you want (maybe similar to my export or other stuff that might be important to you).

ORDER OF CUSTOM EXPORT:

1) Address – Full

2) Close Date

3) Close Price

4) Approx SqFt

5) CDOM

6) Bedrooms

7) Bathrooms

8) Lot Size – Acres

9) Price Per SqFt

10) Year Built

11) Original Price

12) Concessions Amount

13) Number of Offers (don’t worry if you don’t have this field)

FEEDBACK IS WELCOME

I made a neighborhood template three years ago, but I really only liked a couple of the graphs. In this version, I’m definitely using more of the graphs for my appraisals. I’m not crazy about everything, but it’s a work in progress. If you give me feedback, I can maybe change some things in a few months to keep making this better. Let me know what you think.

CLOSING TIPS (SUPER IMPORTANT):

- I suggest putting your website on each graph at the bottom

- You are in charge, so you have to figure out if there is enough information to be credible. Don’t share if it’s confusing or not credible.

- You need enough data to be meaningful, but multiple years is going to be weird since prices have changed so much. So, not too much. Not too little. Try 3-6 months to start. Or maybe try year-to-date at most.

- The spreadsheet will hold 2,500 sales (or more if you change it). That’s probably WAY too much. Just wanted you to know.

- Maybe try this by neighborhood, ZIP code, all FHA, all cash, above $1M in Placer, etc…

- Sometimes the trendlines can get wonky, and if the trendline isn’t resembling what it looks like the market is doing, you might have to click on it to change it. Or delete it if you can’t get it to behave.

- I suggest you customize each graph to say “past 90 days” or whatever you think is going to help tell the story well. Or maybe you do a monthly neighborhood update, so the only thing you have to change is the listed month (and maybe x-axis and y-axis if prices have changed).

- I typically only include single family detached units instead of condos because condos tend to water down the stats. If you are in an area where condos should be included, then definitely include them (don’t forget to change the label on the x-axis to show what data includes).

MY LAST POST IN 2023

I appreciate all the conversation this year, and I’m so thankful for you sticking here with me. I am incredibly grateful too for the business you sent my way with appraisals and speaking. I cannot thank you enough. From my family to yours, Merry Christmas and Happy Holidays!!! This is my last blog post of 2023. Next year is going to be big. Let’s get focused!!!

IN TROUBLE IN THE 80’s

And yes, I would’ve been in trouble in the 80s for saying “sucks” like this in my title. But language changes.

Questions: What are your plans for the holidays? I’d love to hear.

If you liked this post, subscribe by email (or RSS). Thanks for being here.