I love the original Back to the Future movie. Do you too? Well, I can’t help but think of today’s housing market compared to the film. Sellers have tended to be stuck in the past expecting the market to be hotter than it actually is right now. And some buyers are stuck in the future, anticipating lower prices ahead, and therefore expecting to score a deal below what the market will allow.

Tension is real: The tension between buyers and sellers is real, but the remedy is simple. Pay attention to stats and let the numbers form your perception. It’s key for buyers and sellers to be realistic about the market that actually exists. Staying connected to the present is the goal here instead of fixating on a hot past or a colder future. Ultimately, sellers need to listen to buyers, be open to the idea of offering credits, and recognize there’s a really good chance the property is going to sell below the list price. And buyers can take more time shopping, but also recognize it’s not January 2008 when properties on average sold a whopping 13% below their original list price in the region.

Thanks for being here. What are you seeing in your area?

UPCOMING (PUBLIC) SPEAKING GIGS:

9/08/22 SAFE CU “Stats & Mimosas” (sold out)

10/07/22 Market update with SAR (Sign up here – On Zoom)

10/13/22 Market update in Midtown (details TBD)

—–——– DEEP MARKET UPDATE (FOR THOSE INTERESTED) ———––

Here are some quick thoughts about the latest stats. There is so much to talk about. Scroll quickly or digest slowly.

Here are some quick thoughts about the latest stats. There is so much to talk about. Scroll quickly or digest slowly.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

HOW I’M DESCRIBING THE MARKET RIGHT NOW

THE QUICK VERSION:

1) Buyers are gaining power.

2) Sellers are losing power.

3) The sharp change in recent months has begun to level.

4) Seasonal price declines have been more pronounced.

5) 25% of the market is missing right now.

6) Lots of stats are now softer than pre-pandemic normal levels.

7) Uncertainty remains present in light of rates above 6%.

THE LONGER VERSION:

1) Buyers are gaining power:

Last year buyers had to basically bend to the will of sellers, but now they are able to take more time shopping, they’re getting in below the list price in many cases, and credits from sellers are on the rise. About 40% of sales last month included concessions in Sacramento County, and that’s a sharp change from previous months. I expect this percentage to increase through the fall season.

2) Sellers are losing power.

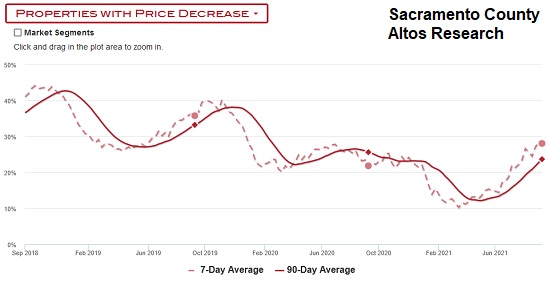

Sellers used to have the luxury of reviewing eight offers from the weekend, but that ship has sailed. About half of all active listings have had a price reduction from the original list price. Even though sellers are starting to listen more to buyers, they are still behind the ball because of how many price reductions we’re continuing to see.

3) The sharp change in recent months has begun to level.

The market showed a sharp change with sales volume, but over the past month or so we’ve started to see the numbers go sideways a bit. This means instead of showing yet another month of massive change, the market has sort of stabilized. Granted, volume is still down 25% or so from last year, but the market has seemed to find a little more balance lately. Of course, this could change with mortgage rates shooting up again. All I’m saying is a number of stats have gone more horizontal lately, so the sharp change from May onward looks to be subsiding (well, besides prices). And the real culprit for change has been seeing fewer new listings hit the market since June. That’s given some breathing room for sellers and buyers to figure out the new market.

Inventory didn’t spike: By the way, inventory actually dropped last month too. Monthly supply saw a huge uptick in recent months, but that spike didn’t continue last month. Scroll below for an image.

4) Seasonal price declines have been more pronounced.

It’s normal for prices to drop at this time of year as the hot spring market fades away. But price declines have been much more pronounced this year. In other words, we’re seeing easily about twice as much price deceleration compared to normal. We still need time to understand the long-term trend, but for the time being prices have seen a more dramatic dip lately. The median price is down about 7% since May in the region, which is about $45,000. Keep in mind this doesn’t mean every property has gone down by that much, so please look to neighborhood comps to understand neighborhood dynamics.

NOTE: Prices this year crested in May, so it makes for an awkward comparison when we analyze May to August this year with previous years. Prices normally crest in June, so that’s why I’m making charts to show change from June onward too (as well as May).

5) 25% of the market is missing right now.

We’ve seen about a 25% dip in volume over the past few months, so on the negative side, one quarter of the market is missing. And on the positive side, about 75% of the market is still happening. Both things are true.

6) Lots of stats are now softer than pre-pandemic normal levels.

We saw a really sharp change toward normalcy in recent months, but some of the stats are now going above “normal” levels. For instance, on average it takes 29 days to get into contract in September, but this year it looks like the number will be 32 days. Or 34% of sales typically sell above the list price in a normal August, but that number was 25% last month.

Normal: When I say “normal,” I’m referring to the pre-pandemic average of 2016 to 2019. Sometimes people get bent out of shape about this word, but this is a solid stat to consider.

7) Uncertainty remains present in light of rates above 6%.

The market has sort of been leveling in quite a few ways lately, but mortgage rates are now above six percent again, so we have to watch the stats to understand the trend over time. But it’s really a simple thing. When rates go up, it takes demand out of the market. Bottom line.

YEAR OVER YEAR STATS:

Annual stats are important to digest, but don’t forget to look at month to month stats. And remember, closed sales in August really tell us what the market used to be like in July when the bulk of these properties got into contract. Also, not every location and price range have the same trend (big point).

MONTH TO MONTH:

Looking at sequential months is key too so we don’t just get stuck or hyper-focused on last year (the past).

OTHER VISUALS:

Here are lots of visuals. Probably more than you wanted. Enjoy if you wish though, and let me know what you like best.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What stands out to you above? What are you seeing out there in the market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

How did I get this data? A few years ago our MLS started including fields for “multiple offers” and “number of offers”. I’ve been watching these metrics and reporting on them for the past year or so, but today I’ve taken it to the next level.

How did I get this data? A few years ago our MLS started including fields for “multiple offers” and “number of offers”. I’ve been watching these metrics and reporting on them for the past year or so, but today I’ve taken it to the next level.