Last month the Town of Paradise, CA was destroyed during the Camp Fire. The flames showed no mercy as they took lives and leveled nearly 14,000 homes. The devastation is simply unreal and hard to fathom.

Today I wanted to do a Q&A about the aftermath of this fire and what’s happening in the surrounding real estate market as a result. It’s sobering to know there are tens of thousands of people trying to figure out what to do and where to live, which is why this is important to talk about. I asked Parke Noble with California Appraisals to answer some questions since he’s a sharp guy based about 15 miles from Paradise. We didn’t talk about post-disaster appraisals because a different interview covered that, but I hope you find some insight here. And for reference, the Town of Paradise is about 90 or so minutes from Sacramento.

Ryan: I guess this is a heavy start, but what was it like to witness the Camp Fire? I know Chico is about 15-20 miles away.

Parke: I live in Chico, so my direct immediate exposure to the tragedy of the Camp Fire was from a distance; I can’t begin to imagine the chaos that those who witnessed the devastation experienced. And I can’t fathom the heartbreak that they continue to experience now that access restrictions for the Town of Paradise and the communities of Magalia and Concow have been lifted. Please keep in mind that although “open”, the Town of Paradise access is intended for those directly affected.

Ryan: Do you think people are going to rebuild in Paradise? Why or why not?

Parke: With regard to rebuild options, it has been my experience that less than 50% of those who lost their home intend to rebuild. Although the reasons are numerous, the primary concern has focused on the fact that as an aged demographic many survivors have indicated that they don’t want to spend the requisite time that it’s going to take to rebuild. They’re either attempting to secure a “turn key” option in neighboring communities or moving out of area altogether. Additional factors include a lack of qualified contractors and the fact that as a ridge community another fire could possibly occur in the future. On top of this we have to remember the lack of infrastructure in Paradise; no services. There is apprehension for those that do choose to rebuild. What if the town doesn’t “come back” and you’re left with a house without infrastructure?

Ryan: We’ve been reading reports about housing inventory being depleted in Chico because of the massive amount of Camp Fire refugees. Is that true?

Parke: Single family residential inventory in Chico has been dramatically impacted since the November 8th Camp Fire. Per CRMLS data, detached single family residential active listings numbered 252 on November 7th. As of December 4th that number had dropped to 91 offerings (-36%). That number had increased to 106 active listings as of December 19th.

Ryan: What do you see happening with prices in Chico right now? Is the market as aggressive as people are making it out to be?

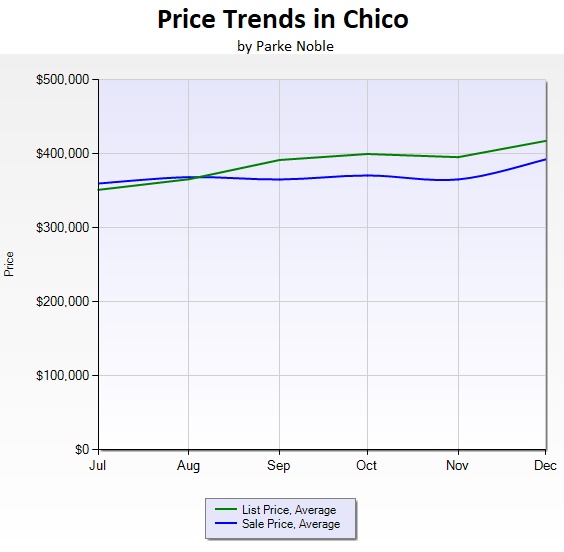

Parke: Prices across every market segment have experienced substantial demand and consequently higher median resale prices. The current Chico market indicates sales 5-25%+ above list price. List price average increased +10% from November to December. Sale price average has increased 9% from November to December and days to sell declined from an average of 54 days in November to 19 days in December. As an example, a listing at $485,000 sold for $612,000 in three days with multiple offers. Ongoing sales above list are the market norm right now.

Ryan: How long do you think this type of activity can keep up in the market?

Parke: The current Chico market dynamic is vastly different from anything experienced in the past and was virtually an immediate impact with the sudden loss of about 14,000 homes in the Camp Fire. It’s unlike the consistent, sustained price creep and gradual inflation experienced in Chico in 2006-2007. This type of sudden market hyperinflation will continue as long as demand supports the small inventory. As a side note to ask appraiser peers: How will the sales during this period of artificial inflation be handled as comparables when these current conveyances don’t qualify as standard, arm’s length transactions?

Ryan: What advice would you give to sellers and buyers in Chico?

Parke: Depending on what side of the transaction you’re on, you’re either quite happy with the value increases or extremely discouraged. As with any market anomaly, there are parties looking to capitalize. Numerous active listings saw increases in asking price after November 8th. And the increases were absorbed by a desperate market willing to bear. Any advice for a seller and/or buyer would virtually be a moot point; the entire current market is a deviation from an outlier in an anomaly…..

Ryan: How would you go about valuing a property in Paradise right now?

Parke: Valuations in Paradise will be for vacant parcels. I can’t imagine attempting to demonstrate the influences/effects of such vast devastation on those residential structures left standing. An adequate data set does not exist at this time.

Ryan: You’re a numbers guy, so what numbers (or data) do you plan to watch over time to help you understand the market?

Parke: I’ll continue to track inventory, list-to-sale ratios, sale price averages, days on market, etc. Time will be required to collect and analyze.

Ryan: Thank you so much for doing the interview. You killed it and I appreciate your time and insight.

Parke’s Bio: Parke Noble has been serving Northern California since 1997. Experience includes appraising single family residences, multi-family residential (2-4) units, in addition to condominium, PUD, manufactured housing, proposed construction, and FHA/HUD roster work. Additional experience in narrative reports, highest and best use studies and HUD Rent Comparability Study (RCS). Service area within Butte County. Parke is a graduate of Chico State University and he is originally from Sacramento.

I hope this was helpful or interesting.

Video Market Update: I made a Sacramento market update video yesterday to walk through numbers and talk through some trends. Enjoy if you wish.

Last Post of 2018: Merry Christmas and Happy Holidays from my family to yours. I’ll be taking the next week off and I’ll see you again in 2019. On a serious note, thank you so much for enhancing my life this year. I’m truly grateful to be connected and I’m honored you came with me on this blogging journey in 2018. It was a fun ride for me, and I hope it was for you too.

Questions: What stood out to you most about what Parke said? Anything else to add? Also, do you have suggestions for where to donate to help Paradise residents? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

A similar event occurred in Yarnell, AZ after a fire on June 30, 2013. I would expect not much to happen for a while and concur about 50% or less rebuild. I would also monitor infrastructure replacement for progress. Santa Rosa should provide some guidance.

Thank you Mark. I appreciate you mentioning that fire. I don’t know much about that one to be honest. I think you’re right about looking to Santa Rosa, though there is so much more money there too, so in that regard it’s a different ballgame. The median price in Santa Rosa is about $400,000 higher than Paradise too for reference.

Thank you for sharing. It makes me stop and think about what the people of Paradise are going through if they stay or relocate.

I hear you Gary. This is very sobering. The stories coming out of Paradise are unreal. Heroism, bravery, anguish, etc… This fire simply devoured the community very quickly. It was said to spread one football field every second.

Great interview, Ryan. The real estate market after a disaster is crazy. The recent hurricane disaster in Panama City, FL is one I have a connection too because my wife’s family is from there. It seems like the market takes on a life of its own depending on the local dynamics. I think many of the residents of Panama City will leave as well so it will be interesting to see how each of these two cities stories will parallel each other or how they will be different.

Thank you Tom. That’s right. I remember seeing all the photos you and your wife posted on Facebook after that disaster. You definitely have some roots there. What a crazy world we live in.

https://srcity.org/2720/Quick-Facts

http://santarosa.maps.arcgis.com/apps/opsdashboard/index.html#/56920daa553a410880bc277fd298c78f

2 links from City of Santa Rosa who are 15 months past losing ~3800 houses (in jurisdiction-Tubbs took >5,000). ~115 houses with keys and ~900 in the pipeline and ~500 planning for building.

so 15 months later and less than half are in rebuild mode.

Take that speed and percent and apply it to Camp Fire.

At that speed Camp Fire will rebuild ~5,500 and it will take 5-6 years to reach the same point in the construction process(not completed).

(Paradise future policy on MH?)

~14,000 SFR destroyed and ~500 multifamily gone. Estimated 16-18,000 households affected.

https://tinyurl.com/y7grjdmp

Median CA age=31

Median Paradise age=51

extrapolate that ~1/3 of the population was not employed or directly tied to the area.

So ~600 households will not return for sure. Anecdotal information says that number may reach the 50-60% range per conversation with individuals, assessor office, and appraisers.

My semi-informed guess is that in 10 years less than 50% will be rebuilt, it will be come a low priced bedroom community.

*MAYBE*

and heres the 2 caveats;

—how will Paradise city react? will it be free with permits or super regulatory? Will they require armored houses made of iron and adobe with sprinklers inside and outside and a fireproof water storage tank with live-in firefighters?

—how will insurance be handled?

Historic in town rates for SFR tract were not terrible BUT rates for edge of ridge homes were $3,500 or more… pre-fire.

Many people may not consider that cost when rebuilding.

Some have and no insurance company so far has been willing or forthcoming in releasing future rates once the 2 year state cap date is reached.

It very well may become a severely depressed price market as that ~1500 house payment will come with a ~600+/month insurance payment IF you can get it and then prices will have to drop substantially to make that affordable payment affordable.

And since we all are all-knowing tellers of the future, this is wild speculation… and will continue to be until 20 years from now.

Wow Mark, thank you for taking the time to scratch out this information. I really appreciate it. I keep hearing a 50% figure from quite a few real estate professionals regarding various disasters throughout the state and country. To complicate matters here price for many homes are not very high in Paradise, so money from insurance really might not move the needle.

With most insurance paying anywhere from 100-200% of value plus contents of 100-300k, there is an awful lot of panicky cash flying around.

that 250k homeowner who owed say 50% just got $3-400k or more handed to them in “cash”

(1 who owed 160k got loan paid off and still walked with 475k) 1 who owed 250k is walking with over 900k)

Homeless people who have never been homeless in their lives living in spare bedrooms, Rvs, or hotels freaking out and jumping on anything with a roof for cash. I am seeing effects as far as Red Bluff and Redding to the north and Yuba city to the south-commuting distance for some.

A very tight rental market as of 11/7 became insane with almost zero vacancy for 50 miles

That’s wild Mark. Thank you. It’s unreal that people would walk away with so much, but I’m glad for them. If they do rebuild the cost is going to be a pretty penny. I know in wine country there were construction costs that basically doubled in some cases, so for those who do rebuild they may actually need significant cash.

Also-look at Katrina for a city-wide affecting event.

1/3 of school age children returned as of today.

1/3 of houses are occupied….