Do you feel it? The temperature of the housing market has started to change. Let’s talk about what’s going on, and what this means and doesn’t mean. I’d love to hear your take in the comments.

Think Like an Appraiser Class: I’m teaching my favorite class on April 28 from 9am-12pm. We’ll talk through choosing comps, making adjustments, and lots of practical scenarios. Hope to see you there.

DON’T CALL IT A DULL MARKET:

The housing market is still lopsided. We are far from normal, but we are likely starting to feel some of the effect of 5% mortgage rates. In short, the real estate market is ultra-competitive, but the temperature has begun to cool from ultra white hot to white hot. Or like my friend Jonathan Miller said when describing Manhattan, “Not as frenzied, but still blistering.” If you have a better word picture, speak on.

WHAT THIS MARKET LOOKS LIKE:

A few days ago, on my Facebook page, I mentioned there was a temperature change, and Realtor Tony Yuke shared the following. I think this helps describe how the current market feels. Still very competitive, but not as competitive as 30 days ago.

WHAT THIS DOESN’T MEAN:

I’ve heard some people talk about the housing market starting to correct, but there isn’t any statistical support for that right now. What we know is the market is starting to show a temperature change, and we’ll see that change in sales stats down the road. Frankly, a cooling should be happening somewhere around April anyway, so we need some time to understand if this is a normal seasonal thing or something else. For now, we are far elevated beyond a normal market, and demand is still outweighing supply. My advice? Be objective, pay attention to stats, avoid sensationalism, and change your narrative based on the numbers.

One more thing. It would be healthy to see price deceleration ahead. We need this wild stallion of a market to stop growing so rapidly.

THE WORD ON THE STREET:

The stories of today become the stats of tomorrow. A couple of weeks ago I asked Instagram if they’ve been seeing fewer offers, and the results were definitive. I know, this isn’t a scientific poll, but the word on the street matters in real estate. And this lines up with what I’ve been hearing on my social feeds from boots-on-the-ground people. However, I also had a number of agents tell me it’s a bloodbath at entry-level price points still.

ACTUAL STATS:

Sales stats from March are insane, but glowing sales stats really tell us what the market used to be like in February when these properties got into contract. This is why it’s key to watch other metrics beyond just sales. Here are a few things on my radar (without writing a dissertation).

Mortgage applications have dipped:

Across the country we’ve started to see fewer mortgage purchase applications. This is something to watch. Will fewer mortgage applications lead to fewer pending contracts? And then fewer sales?

Price reductions are starting to increase (barely):

We’re starting to see price reductions inch up according to Altos Research. However, the number of reductions is WAY lower than a normal year (but slightly higher than last year). Keep in mind around April we should start to see an increase in price reductions as a part of a normal seasonal trend.

Mortgage payments are skyrocketing:

Added later on 4-14-22. I wanted to post this image from Tim Ellis of Redfin. This is what is happening in the background. Mortgage payments are skyrocketing. Keep in mind this doesn’t affect everyone the same way though. I suspect this will disproportionately impact buyers at lower prices. This type of massive change in a short period of time means it’s important to do a housing market play-by-play each week to gauge any difference in buyer demand.

More listings are hitting the market (not enough):

The number of listings has been increasing. Yet, we still only have about three weeks of supply in the Sacramento region, which is ridiculously low. On one hand, an increase of listings can help tame the temperature a bit, but be careful about getting sensational. So far, the level of new listings looks very seasonal, and it’s not at an elevated level beyond the appetite of buyers. By the way, we’ve now had twenty-one months in a row with less than one month of supply.

Paying above the list price has started to “soften”:

We’re starting to see buyers get into contract at slightly lower levels. The irony is the “lower” numbers are completely elevated. What I mean is during a normal year, buyers should be paying 1-2% BELOW the list price around this time. But buyers have been paying more than 3% ABOVE the list price on average. So we might see a subtle sign of “softening,” but we need to take this “slower” trend with a grain of salt. If anything, this reminds us the market is still quite lopsided.

When looking at these visuals, do you see what looks like a spring peak a couple of weeks ago? Technically, we need a few more weeks to understand if this was a peak or not. Keep in mind it’s not uncommon to see demand crest around April. This is in part why I think it’s premature to call this temperature change a price cycle peak. We need time to see the trend.

More analysis soon. In the meantime…

I hope that was helpful. What else are you watching?

Thanks for being here.

—–——– BIG MARKET UPDATE FOR THOSE INTERESTED ———––

Skim or digest slowly.

Skim or digest slowly.

QUICK SUMMARY:

The market has seen explosive price growth during the first quarter in the Sacramento region. Frankly, the growth has started to feel unhealthy because it’s just been too quick. But this is what happens when supply is next to nothing AND buyers rush the market to lock in a low rate.

As I mentioned, the temperature has begun to change though. I suspect I’ll get some hate mail from a few people accusing me of saying the market is slow (I didn’t say that). The truth is the temperature in real estate is constantly changing, so it’s important to recognize that. If you cannot embrace that, ask yourself why.

In short, March stats are unreal. Two words. Freaking bananas.

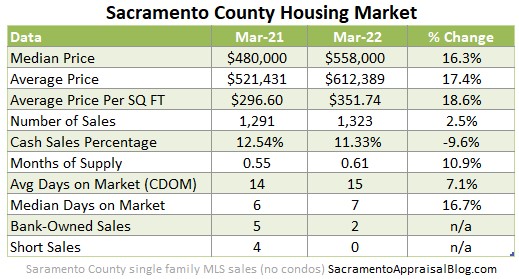

A quick recap:

Some visuals eh…

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

SOLID SALES VOLUME IN 2022:

So far sales volume has been strong in the region in 2022. The black line represents monthly sales this year compared to last year (red line). The key will be watching what happens with volume over time. If buyers start to pull back, it’s possible we’ll see lower volume. That’s what some bigger data firms are predicting, and it seems plausible.

SELLING QUICKLY:

Properties have been selling very quickly. Technically it took one extra day to sell this March in Sacramento County, but look how fast properties have been selling compared to normal. Moreover, current pending contracts in the region over the past two weeks have spent two days fewer on the market compared to March sales. This reminds us the market is moving quickly and there is still heavy competition out there.

MASSIVE PRICE GROWTH:

We’ve seen massive price growth in the region in 2022. It’s normal to see prices rise through March and beyond, but this has been really hefty growth – especially in the eleventh year of this price cycle.

BUYERS ARE PAYING WAY ABOVE NORMAL:

On average buyers paid nearly $23,000 over the asking price last month. This is far above a normal March where buyers tend to pay closer to $10,000 BELOW the list price. It’s important to note March 2022 was about twice as much as March 2021 (which was previously our most aggressive market ever). Keep in mind this is the average of every single escrow. This number doesn’t perfectly describe every individual transaction. In other words, some buyers went way above this number and some went lower. The takeaway here is to know how disconnected this number is from normal. Also, when people talk about the market temperature changing, ask yourself how disconnected we are from normal still.

BUYERS MADE MORE AGGRESSIVE OFFERS:

These numbers are freakish. It’s wild to see only 6.47% of homes sell below the list price. We should be seeing easily about twice as many homes selling at or below the list price. Again, this tells us the market is still imbalanced. But in the background, sellers ought to pay attention to any temperature changes. My advice? Price reasonably and see what the market gives you.

YEAR OVER YEAR:

Year over year stats are important to digest, but don’t forget to look at month to month stats to understand what the market is doing right now. Also, not every location and price range have the same trend.

MONTH TO MONTH:

Looking at sequential months is key too so we don’t just get stuck or hyper-focused on last year (the past).

OTHER VISUALS:

As if anyone really wanted more…

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What are you seeing out there in the market?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

It is so sad. Due to political ineptitude and influences of covid, “supply chain” issues, our entire country has made a knee-jerk reaction to the market. Everyone says the market will adjust but … all the houses that went up in value 30% to 40%. Adjust to what? Are we going to have another drop like the 80s to 90s? $400000 houses dropping to $120000? It has happened once. 2008 was not much better. What is Biden going to do then. Peoples incomes are not keeping anywhere close to the cost of inflation. Government is not governing!!!!

Thanks John. The supply chain is no joke, and we’ve seen a massive impact on the world because of this. I’m certainly reminded of this every time I buy lumber at Lowes… I hear there is a lockdown in portions of China right now, and that’s not going to help either. The struggle for buyers today is there hasn’t been anything to buy, so it’s helped create an erratic environment. Though there are many influences that have helped usher in the market we have right now. I share your concern about inflation and income. We have some real issues on our hand where home prices and rents have risen dramatically. To be fair, the government raising rates right now is meant to curb inflation.

Great analysis as always Ryan. I hope we’re seeing a market that is starting to calm down to a more normal market. We’ve had the boom, let’s skip the bust. That would be good for all.

No. That would be good for you people who already own real estate. Not everyone is so fortunate.

Normal would be a good thing. The problem right now is we are so far disconnected from normal. And it’s possible we are going to have low inventory for some time. If buyers back off, that will naturally produce more listings, but I suspect the struggle will be getting sellers to sell. We’ll see though. The market is always moving…

Where can I get a Sacramento Appraisal Blog shirts, socks, water bottles, and totes ;-?

Haha. I should make stress balls and frisbees…

I want a water bottle or two….

I should have some swag of some sort. Mullet combs, beer mugs, 80s half shirts…

My Shelby GT500 was going 150 mph down I-20 but has slowed to 120 mph…….Still speeding but the foot is off the gas a little bit. A severe shortage of inventory of both existing and new home inventory continues in Augusta/Richmond County, GA MSA pushing prices higher by the day. Most houses still have multiple offers above the list price but the number of offers has lessened. Contracts continue to have escalation and appraisal gap clauses.

Bingo. Thanks for the word picture. And this is where I suspect some people will read the title of this post rather than the details. They’ll walk away with the idea that the market is slow. Not at all. It’s just not going 150mph. It’s definitely important to recognize the difference in speed, but at the end of the day we have to still recognize we’re still driving 120mph… Multiple things are true at the same time. The temperature has changed. And we are far above normal levels. Still.

You are spot on – the temp is definitely changing. I feel like it’s a canary in the coal mine moment right now with change ahead. I had two listings in Folsom during March that only received one offer each, but both buyers obviously had PTSD and went big. I think we’ll see that impact on April closings. Move forward to April and a Sacramento listing had very few showings, ending in one offer at asking price after a week on market. My guess is that May closings will be different than April / previous closing stats. These days, my phone is not ringing, my email is not busy, new buyers are not starting up searches right now, and lenders that I haven’t heard from for a year are calling for a lunch date….the true sign that their pipeline is empty and they’re looking for business. I’ve had multiple buyers put their search on hold, claiming high rates. It’s going to be an interesting second half of the year.

Thank you for sharing, Lauren. I appreciate hearing your perspective. I don’t think we really know yet how much demand has shifted in the region. We’re going to need some time to see (just as you said). I wish we had a stat to see what mortgage applications are like right now. So far pendings since April 1st have been really competitive though in terms of days on market and the percentage of multiple offers. But this is something we need to watch over time to gauge any change. Let’s stay in touch. Please keep me posted. And yeah, loan officers are feeling it right now since refinances took a 60% or so nosedive. Purchase applications aren’t anywhere close to that thankfully. I’ve heard this sentiment from a few people. Classic move to not call or stay in touch…. and then all of the sudden reach out to build relationship. In my mind, the goal is to keep it about relationship no matter how busy we get.

I put a listing on last Friday at $400K, had 9 offers over list price, 3 were 10% or more over. List price was right in line with comps, and it felt comfortable to price since I was able to pull comps from within the same PUD. I had explained the nature of the market to my sellers up front, so fortunately there was no questioning of my pricing when offers started coming in. Have three more listings coming on the market within a month, interesting to see what happens.

Thanks Michael. And congrats. This underscores that the market is still lopsided. I’m really glad the seller listened to your pricing strategy. I wonder what price point this was? Entry-level = super competitive.

Hi Ryan, great data & commentary – as always! We are having some very difficult conversations with clients these days and it’s especially tough for first-time homebuyers. Rates going up has been bittersweet for those who still qualify and can afford the higher payments though, as it’s been easier to get them into contract. We are competing against 3-5 offers and not 20 anymore! Rates went above 5% in 2018 and people still bought homes. The difference this time around is more people are choosing to be content. For example, we have 3 sets of pre-approved buyers who have chosen not to sell and lose their sub-3% rate. Why move to a modestly better home to take on thousands more in debt/payments? This will be an interesting year for sure!

Thank you for sharing. I really appreciate hearing from the trenches, Candice. The last question is definitely something people are going to be asking. While lifestyle is the ultimate trump card for moving, there is certainly incentive to stay put. And one of the struggles with 5% today is prices are so much higher, which makes payments higher. I suspect there will be many difficult conversations ahead as people navigate their lifestyle and finances. It shouldn’t be this hard to secure shelter, but that’s the market we have right now.

Trends, history, examples, come on, without the lowest interest rates ever, you would have never had these home price increases past the levels of 2007, period, no past graph could have predicted the horror on the horizon, greed and pure stupidity fuels this coming not to blame PG&G housing inferno.

Thanks Nick. I agree. We would not have had the market we did if mortgage rates did not go below 3%. 100%. There is something to be said for demographics shaping demand of course as Millennials have come of age for home-buying, but rates this low have been like rocket fuel. There is no glossing over that. And it hasn’t helped to have incredibly anemic supply.

Hey Ryan, just getting caught up. I asked for a heat check at the Yolo Association yesterday and it’s still hot: still seeing multiple offers, rising prices, very low inventory. In my area, we still have a significant supply imbalance. I wonder how much longer that will be.

Thank you Joe. I really appreciate hearing that. This is basically what I’m hearing throughout the region. An investor told me yesterday he thinks offers have been chopped in half. Still getting multiple, but more like three at most on many properties. The stats are still on steroids. We are still imbalanced. There aren’t many listings. Heck, in light of Easter this week, we didn’t have many listings hit yesterday either (Thursday being the highest day of the week usually). Yeah, we need to watch to understand the trend. Let’s keep watching.