Did prices really go up in February? What’s happening in this market? Today I have a few things on my mind (including a Hot Pockets analogy). Scroll quickly or digest slowly. I hope this helps – whether you’re local or not.

UPCOMING (PUBLIC) SPEAKING GIGS:

3/06/23 Matt the Mortgage Guy YouTube Live 3pm PST

3/09/23 Matt Gouge Event (sign up here)

3/10/23 PCAR Market Update Lunch & Learn

3/24/23 How to Think Like an Appraiser (at SAR)

3/28/23 Downtown Regional MLS meeting

4/1/23 NAA Conference in Sacramento

4/13/23 Realtist Meeting

5/4/23 Event with UWL TBA

1) DID THE MEDIAN PRICE REALLY GO UP IN FEBRUARY?

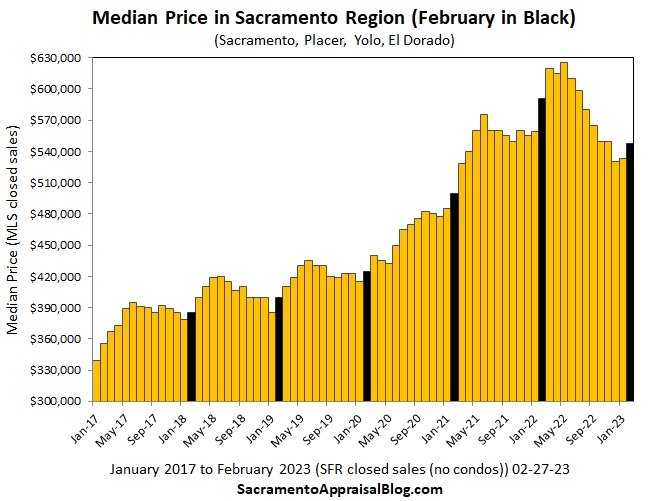

Yes, the median price so far is up in February in the Sacramento region. The dark bars below are February each year, and it’s normal to see an uptick from January to February. This doesn’t mean every neighborhood went up in value though because the median price doesn’t translate rigidly to every location and price range. My advice? Look to the comps to understand the trend.

2) DOES THIS MEAN THE MARKET IS RECOVERING?

Any hint of positive price news tends to stoke housing optimism, but let’s talk about this. The bar chart below shows median price change from January to February over twenty years, and there’s been an increase EVERY. SINGLE. YEAR. Even in 2007 when the market was tanking. Ultimately, it would be a mistake to say, “Prices went up last month. It’s a sign of recovery.” I’m not trying to be a killjoy, but this is a sign of seasonal normalcy. In other words, an uptick from January to February in the region is what should be happening, so let’s be careful about confusing normalcy with recovery. Keep in mind rates rose in February, and that could damper the price trend ahead.

NOTE: The regional median is up, but NOT every local county is up. The month isn’t over yet, but it looks like the median will hold (I could be wrong).

3) WORST VOLUME EVER

Okay, now for a glaring stat. Monthly sales volume has been below 2007 levels for four months in a row in the region. This isn’t about not having enough listings. This is the byproduct of buyers stepping away. As I keep saying, the way to get more buyers back is to see affordability improve.

ADVICE: For real estate friends, my advice is to focus on the part of the market that IS happening rather than the part that isn’t. Find buyers and sellers who have incentive to participate in today’s market (see #5 too). Oh, and graphs like this are EXACTLY what sellers need to see to understand there is a smaller pool of buyers in the game today.

By the way, who is watching The Last of Us? If you’re not, you won’t get the meme (sorry). My wife and I are glued to this show.

4) SPRING IS HEATING UP (LIKE A HOT POCKET)

Do you see that orange line? Those are monthly sales in 2023, and we’re starting to see an increase in closed sales. This is normal for the time of year, but hey, any hint of normalcy right now feels pretty nice to lots of people. A good way to describe the housing market at the moment is heating up for the spring, but also still frozen. In other words, the housing market is like a Hot Pocket taken out of the microwave too early. It’s somewhat hot, but it’s sort of frozen too.

5) PAY ATTENTION TO RATES & FHA LOANS:

RATES: Mortgage rates have risen this month, and that’s taken some heat and affordability out of the market. In January, it seemed like lots of people were predicting mortgage rates to go down, but now I’m hearing many thinking they’ll go up. This just goes to show very few people get it right. What happens with rates ahead will make a huge difference (duh, thanks).

FHA: Last week it was announced FHA will lower its mortgage insurance, which will help buyers save a modest amount each month. Look, I don’t expect this to transform the housing market since FHA is only a small sliver of volume in Sacramento. However, loan officers have been reporting conventional loans are getting more expensive lately, so FHA becoming slightly cheaper can be meaningful for buyers. The new FHA savings really won’t kick in until March 20th, but so far FHA loans have already been up in 2023.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What do you think is going to happen to rates? What are you hearing from buyers and sellers right now? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Excellent taste in TV shows. Put Everything Everywhere All At Once on the top of your list if you haven’t seen it.

I spoke to an agent today who said her activity was starting to pick up. The evidence above tells a different story.

Oh, thanks Joe. I’ll have to look into that. It sounds familiar.

I’m hearing about increased activity too. It’s happening, but it’s also subdued. I’m hearing of phones starting to ring again. But yeah, it’s sobering to look at closed volume stats right now. I’m not sure if you’ve heard the narrative about Sacramento being the number one destination of out-of-town migrants, but I chuckle because that narrative has not fit actual stats. I think what we’re seeing is search queries from out-of-town might be high for Sacramento, but searching for Sacramento and moving are not the same thing. Granted, search queries from out-of-town could lead to buyers at some point, but it hasn’t seemed to be an immediate thing.

https://www.imdb.com/title/tt6710474/

Best movie I’ve seen in years.

I’ve always thought the moving stats reports were a little uncertain/suspect. Here’s hoping we see continued migration into the region.

Thanks. I’ll definitely check it out. Yeah, the danger of search queries is the word “search queries” is often replaced with “buyers” in the narrative. These really could be eventual buyers, but it seems misleading to say buyers. I’m really behind this type of research, and we are so lucky to have access to stuff like this, but we just have to call it what it is. These are people searching for various markets online instead of buyers right now. I guess the irony is we’ve had a few rounds of published research about search queries and Sacramento being a top destination… while having miserable volume. Ultimately, the narrative just feels out of sync with the market that actually exists. And let’s be real. The last thing sellers need to read in the headlines is Sacramento being the hottest market on earth…

Joe, Off topic but how is this new Fannie Mae situation about not using appraisals as default valuation going to effect us? Are they driving us out of business? Is the appraisal industry going to die?

Hi Greg,

Interesting question. I’m moderating a panel at ACTS 2023 in Sacramento next month with the chief appraiser of Fannie Mae, Lyle Radke. I will certainly ask about this if he doesn’t cover it.

To take over Ryan’s blog for a sec, he and I were in a class in 2007 offered by Barry Cleverdon at his facility in Roseville. The speaker was Steve Smith, a top appraiser from Southern California, who strongly urged appraisers who wanted to have a career to expand beyond lending into private party work. Both of us took that to heart and worked to develop non-lending appraisal business. Non-lending business is the path out of the interest rate driven, commodity lending rat race.

Thanks Joe. And great question Greg. I hope to attend that panel at ACTS. For now it looks like Fannie at least still wants appraisers to be a part of the equation, which seems positive (though it’s clearly not in the traditional form). I don’t feel entirely clear on what they are doing though, so I’m anxious to get more details. I’ve heard the hybrid model pays substantially less, so this could be a real struggle for appraisers in a market where purchase and refinance volume is diminished. It’s hard to make up a lower fee with volume if volume isn’t there. I’d love to hear what any onlookers think though. And agreed with Joe on private work. That is exactly why I started a blog 14 years ago.

I like your past twenty years January to February chart. This February is up, no surprise, but it’s in the 50th percentile. From that standpoint, it seems pretty average for February. Not great, but not bad. I’ll take it. I’m hoping for a not great, but not bad year.

Thanks Gary. I appreciate it. Yeah, I hope this chart resonates.

At 6-8% per year inflation, the price to build a house will rise dramatically, around 25-30% by 2026. While high mortgage rates push home values down, inflation pushes home values UP. The rapidly rising raw costs of building a home will be a price-equalizing factor moving forward, keeping home values (in real dollars) from dropping much further.

Remember, with inflation comes wage increases, which will be applied towards higher home payments. Unless we enter a deep, prolonged 2023-4 recession, I think we’ve reached that “equilibrium point” in home values. I don’t expect any further erosion in home values, not at this rate of inflation. Consider it a bottom, or near-bottom.

Thanks Josh. I appreciate the commentary. Now we need to watch what happens with wages. One of the problems for years has been home prices have outpaced inflation, so we have a ton of appreciation on top of inflation. This makes it challenging to afford. We are missing about 40% of the local market right now, so wages would have to grow substantially to get these buyers back into the market. Nothing wrong with nominal price declines to help get these buyers back, but I don’t make the rules. We’ll see how it shakes out.

My educated guess is we will see FHA start gaining market share even with the low inventory. It will be the ability to get a lower monthly payment that will drive the gain in share.

Thanks Dennis. FHA does seem poised for more market share. By the way, I keep hearing about a CalHFA program that is supposed to roll out to give assistance to buyers in March 2023. I have seen nothing in writing, but if you’ve heard of anything, I’m open ears.

I haven’t seen anything official yet. I think they may be working on an equity share program. I will be excited to see what they come up with as borrowers need help with affordability at this point.

Right on. Thanks Dennis.

I absolutely love your analogies. “…the housing market is like a Hot Pocket taken out of the microwave too early. It’s somewhat hot, but it’s sort of frozen too.” While I understand the numbers and trends, your analogies make it something that anyone can relate to and grasp the underlying concept. I always enjoy when you have these in your blog.

Thanks so much. I really appreciate it, Kelley. Yeah, a good word picture can go a long way (and it’s especially good if we can somehow include mullets or Hot Pockets…). Thanks again for the kind words. 🙂

We are seeing everything you mentioned with the asterisk that agents who are consistently lead generating have seen an uptick in their business in the last 60 days (even with volume so low)

The real estate market can influence an agent’s business, but they aren’t always in lockstep.

Good news for the pros bad news for the dabblers!

Thanks Johnny. This makes total sense. I appreciate you chiming in. I suspect lead generation is incredibly painful for lots of agents. I know if I was an agent, that would be the worst thing possible for me. Haha.

It’s all about building a network, being good to the network, and finding people who have incentive to participate in today’s market regardless of market conditions. Who is moving due to lifestyle? Debt? Death? Disease? Divorce? Moving up? Moving down? Moving out of state? Moving back to California? Other issues? Real estate came very easy for a few years, but we’re not in that market any longer. Or like you said, it’s not a market for the dabblers.

Hot Pockets! Love the perfect analogy. Wonder how long it took you to come up with that! Great writing! As always, keep up the great work!

Thanks Jon. Haha. You know, I’ve used this analogy for years actually, but I’m now morphing it a bit for today to help fit the climate right now. Here’s to finding more word pictures and ways to describe the market ahead… Keep me posted with what you are seeing. Thanks.

Have no idea what the movie / tv reference was. The title “Last of Us” sounds like the theme song of some appraiser forums I hear about.

Interesting take on the housing costs to build comment earlier in the posts. That could be a huge issue if the cost of building gets back into wonder mode again (wonder when prices will stop going up).

Question when will the US gov stop the big Venture capital boys and girls from acquiring SFR’s for rental portfolios. If there is a way to free up that inventory back into home ownership, that could prove interesting.

Now onto the uptick in the market. During my confirmation calls with agents, most are saying the end is over as the buyers are back and they got use to the 5.5% or 6% interest rate. Hmmmm hang on their buckaroos. Yes, interest maybe, but I am not seeing a swing in pending sales numbers yet and measurable drop of active listings. Time will tell on that front. I am thinking we haven’t seen the end yet, because Uncle Jerome hasn’t finished decimating the RE market yet. If he can’t get the workforce / labor numbers to change then he will continue to come after RE market thru money supply tightening and interest rate hikes to influence the 10-year treasury.

For the custom homes that I deal with, the # of sales per month depending upon home size is down in the 0 – 2 sales per month range and I am not even considering any price point filters. The larger custom homes down here have gone quiet to almost nonexistent. Without move up buyers, it is moving sellers to the sidelines. The custom home market isn’t falling on a sharp dagger stake yet, but it also ain’t dancing with joy and harmony. This is as bifurcated a market from pricing, GLA, location and condition/amenities as I have seen in my 32 years of appraising.

Always great stuff Ryan.

Love it. Thank you Brad. Yeah, The Last of Us is sort of a zombie-like show. I’m not normally into stuff like this, but consider me a rookie convert.

When analyzing multiple offers among recent pendings over the past two weeks in the Sacramento region, the bulk of the pendings with multiple offers were under $600K, which isn’t a shocker. But there is a little surge happening above $1M too, which is something I’ll be watching. The % of multiple offers is pretty normal right now when considering pre-pandemic trends (nothing like 2021).

Uncle Jerome isn’t done, and that’s an x-factor. It’s hard for buyers to get used to rates when rates keep changing so quickly. In January, the narrative was that buyers have adjusted, but I’m not hearing that so much right now with rates hovering around 7%. I’m with you on the number of pendings too. We’ve seen a spring heating, but the number of pendings isn’t yet normal. The hope is over time to see the gap of low pending volume begin to get closer to normal levels. Time will tell.

Thanks, Ryan. When omitting distressed sales, the years 2006-2013 had lower sales than 2022. But 2022 non-distressed sales were lower than the last 8 years.

Thanks Jay. That’s an interesting way to think about it. Yeah, distressed sales were a massive part of the real estate experience for years. I know in Q1 2009 we had about 84% of all sales in Sacramento County as either bank-owned or short sales. How insane is that? Please keep me posted with what you are seeing out there in the trenches and in your stats.

As an old timer I have had the pleasure of being in transition markets multiple times. They are the most difficult of times for pricing a seller’s home. There are still buyers out there who pay over market for homes as they had been shut out in 2022. Making the market appear higher than it really is. Houses always sell, even in the toughest times. The best house at the best price, the worst house at the cheapest price in tough markets. I have been surprised at some markets, 95747, West Roseville has 144 Actives and 100 pendings in February. There are lots of new homes here (48) in pending, so the builders are still siphoning off a lot of the buyers. I believe the summer market will start to show life but it will be competitive for sellers.

Very interesting. Thank you George. Please pitch in your thoughts any time. I agree about properties being able to sell in any market. The right price tends to speak to buyers…

I’ll keep my eye on new construction vs resale. I appreciate the thought. The last time I heard from The Gregory Group, Roseville had 22% of newly constructed homes for the entire region, which is remarkable. But stats at the time also showed Roseville had the most new construction listings.

On a side note, yesterday I noticed 29 units with a price increase over the past week in the region, and 21 of those happened to be from builders listing on MLS. This is interesting to see. I wonder if it’s a matter of builders changing the price to hopefully stand out on MLS. That’s my guess.

I have found that builders will try and keep prices up in order to keep those homes in pending in escrow. What I have seen is additional incentives offered and or upgrades in order to keep their prices stable.

Exactly. I imagine rate buydowns have been quite meaningful lately as a tool too.