A couple weeks ago a viral story came out about a fund called BlackRock who was reported to be buying everything in sight and paying 20-50% above market value. Let’s talk about this as well as other institutional investors right now.

This is a longer post, so scroll topics (or digest slowly).

Market update on Thursday: On June 24th 10-11am I’m doing a big market update for the Sac Assn of Realtors. I can’t wait. Sign up here.

Some things on my mind:

Big news – Invitation Homes is back: Invitation Homes is back to buying homes in the Sacramento market. Over the past month or so they started buying again and they’ve had seven deals close between $410,000 and $495,000. All properties were purchased on MLS for reference. So far this doesn’t look like it will be 2012 again where Invitation Homes purchased thousands of units in a very short period of time, but we’ll see how it shakes out. I’ll be paying close attention, so stay tuned. What I find striking is that institutional investors are even able to make the numbers work after ten years of price growth in the region. This underscores how much rents have increased to facilitate this type of activity. For reference, KCRA shows Invitation Homes is the second largest landlord in Sacramento County behind the City of Sacramento.

Big news – Invitation Homes is back: Invitation Homes is back to buying homes in the Sacramento market. Over the past month or so they started buying again and they’ve had seven deals close between $410,000 and $495,000. All properties were purchased on MLS for reference. So far this doesn’t look like it will be 2012 again where Invitation Homes purchased thousands of units in a very short period of time, but we’ll see how it shakes out. I’ll be paying close attention, so stay tuned. What I find striking is that institutional investors are even able to make the numbers work after ten years of price growth in the region. This underscores how much rents have increased to facilitate this type of activity. For reference, KCRA shows Invitation Homes is the second largest landlord in Sacramento County behind the City of Sacramento.

If you are in a different market, what are you seeing with Invitation Homes?

How much do institutional investors own? Here’s an image from John Burns Real Estate Consulting via Rick Palacios Jr. See this tweet with additional cities. I know the font is tiny, but in Sacramento about 5% of the market is said to be owned by institutional investors. I honestly have questions about what this 5% figure represents, but I figured it was still worth sharing.

Not Blackstone: By the way, Invitation Homes is not Blackstone. Blackstone sold their interest in Invitation Homes years ago, so it’s not accurate to say Blackstone is currently buying homes in our market.

The skinny on BlackRock: When viral news about BlackRock broke I read this Wall Street Journal piece like many others. This may not be a popular take, but I felt the article was lacking data to support some of the sensational narratives being spun. Look, I’m not a BlackRock fanboy and I’m not glossing over the reality of institutional investors targeting residential real estate in the midst of a housing shortage or some of the horror stories we hear from tenants. I’m just saying I’d like to see data to support if they really are looking to buy everything in sight and pay 20-50% above market value like so many threads have been discussing. And yes, I know BlackRock was involved in the acquisition of an entire brand new neighborhood in Texas from D.R. Horton, though Financial Samurai states this neighborhood was already fully leased as it was built to be rented and was not going to be offered to individual owners. Again, I’m not pro-BlackRock and I could care less if people despise the company. I’m only thinking critically about the narrative and I haven’t seen data to back up some of the ideas. For reference, I haven’t been able to confirm any BlackRock activity thus far in the Sacramento market.

The skinny on BlackRock: When viral news about BlackRock broke I read this Wall Street Journal piece like many others. This may not be a popular take, but I felt the article was lacking data to support some of the sensational narratives being spun. Look, I’m not a BlackRock fanboy and I’m not glossing over the reality of institutional investors targeting residential real estate in the midst of a housing shortage or some of the horror stories we hear from tenants. I’m just saying I’d like to see data to support if they really are looking to buy everything in sight and pay 20-50% above market value like so many threads have been discussing. And yes, I know BlackRock was involved in the acquisition of an entire brand new neighborhood in Texas from D.R. Horton, though Financial Samurai states this neighborhood was already fully leased as it was built to be rented and was not going to be offered to individual owners. Again, I’m not pro-BlackRock and I could care less if people despise the company. I’m only thinking critically about the narrative and I haven’t seen data to back up some of the ideas. For reference, I haven’t been able to confirm any BlackRock activity thus far in the Sacramento market.

Not easy to track: One of the problems with tracking institutional buyers is they don’t always acquire properties under only one name, so it’s not so easy to gauge their activity. For instance, Zillow has four names they are currently using to buy in the Sacramento market and Invitation Homes has had at least a dozen names they’ve used through the years. As an example, here is a post I wrote in 2013 to show my numbers compared to a few other media publications and everyone had slightly different numbers (at the time I was using Blackstone and Invitation Homes interchangeably too).

The iBuyer Model: The most dominant expression of institutional investors in real estate right now is the iBuyer model (in Sacramento at least). Unlike Invitation Homes, these companies are flipping rather than holding and some of them are attempting to make their money by becoming a one-stop shop for consumers. Here are some stats and a few observations:

FOUR THINGS TO KNOW ABOUT THE iBUYER MODEL:

A) Beyond pre-pandemic levels: When the pandemic started the iBuyer model pretty much paused, which brought criticism because the idea was this model could only exist in an up market. Anyway, after a hiatus these companies ramped up their efforts and have now surpassed pre-pandemic buying levels. Well, technically this is more about Opendoor since Zillow and Redfin weren’t much of a factor as iBuyers before the pandemic.

B) iBuyers have a 1.4% share of the market: iBuyers get a ton of attention, but they only have a 1.4% share of all inventory in the Sacramento region (this includes pendings and listings). In other words, 98.6% of all listings and pendings are the traditional real estate model. In specific terms, among over 5,000 pendings and listings throughout the region iBuyers have 1.4% of that total right now. Granted, it looks like 68% of the properties they own are not on the market yet, but for what is on the market it’s only 1.4% of everything. At some point I’d like to track total volume of iBuyer sales, but that’s likely going to be impossible unless local iBuyers give me their numbers. So for now this is the best I can do.

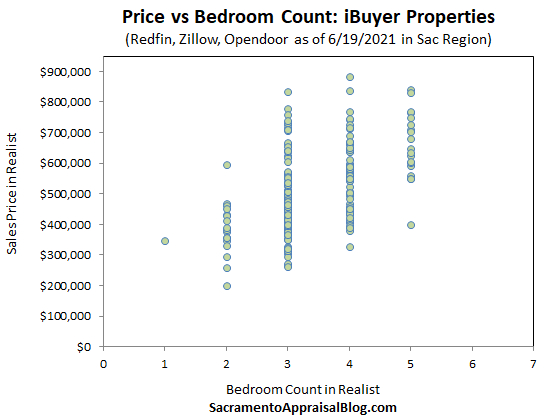

C) Evolving strategy: Some iBuyers have seemed to increase their price threshold to compete in a market with rapid price increases. See visuals below.

D) Playing it safe: These models tend to focus on standard homes that can be easily flipped, though lately there are a few units hovering around the lower end of luxury prices. Most of what these companies buy is built after 1950, has three or more bedrooms, is located on a 0.25 acres or less, and is below 3,800 sq ft.

What iBuyers own in the Sacramento region:

At some point I’ll likely move away from scatter graphs to help visualize iBuyer purchases, but for now this is what I have.

Region = Sac, Placer, Yolo, El Dorado

CLOSING TRUTHS:

1) A growing trend: Institutional investors have been in the real estate space for years, so this isn’t something new. Yet there is no mistaking a growing focus on residential real estate whereas in the past it was all about multi-units. In short, we are still at the beginning of this trend and it’s to be determined how much it grows in the future and what sort of effect it has on the market.

2) Sifting hype: These companies are not playing a massive role in today’s housing market for now. I know that’s not popular to say, but that’s what stats indicate. I’m not downplaying the importance of watching BlackRock and this certainly doesn’t mean consumers shouldn’t be alarmed to see institutional investors flex deep pockets. This is a huge deal. It’s just not a huge chunk of the market for now.

3) Watch investors and iBuyers closely: We have to watch what happens between investors and iBuyers. For instance, this Bloomberg piece reported an investment fund named Cerberus Capital Management bought a few hundred homes directly from Zillow before the public had the chance to see them. This seemed to fly under the radar. I would think the public would be upset, but maybe everyone just loves Zillow too much to say something? Ultimately how will institutional investors and tech companies leverage their relationships with each other and big banks? We’re often so focused on how companies interact with consumers, but how about with each other?

4) Food for thought for real estate pros: For my real estate friends, I know it can feel stressful to be in the midst of change and to wonder what the future looks like. Believe me, I know this well as an appraiser as my profession especially feels like it’s on the chopping block. My advice? Focus on what you can control, have a vision for the future, realize the VAST bulk of the market has nothing to do with the iBuyer model, become your market’s expert, don’t keep doing the same thing, find ways to be more efficient, and serve like no other. Sorry for the unsolicited advice, but that’s what’s on my heart.

UPDATE: Here is a video Mike Delprete put out about iBuyers. This came out the day after my post. I figured others might like to listen.

Okay, this is getting long.

Thanks for being here.

SHARING POLICY: You can share my stats and visuals above, but please attribute the source. Here are 6 ways to share my content (not copy verbatim).

Questions: What stands out to you most above? What do you think about institutional buyers? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.