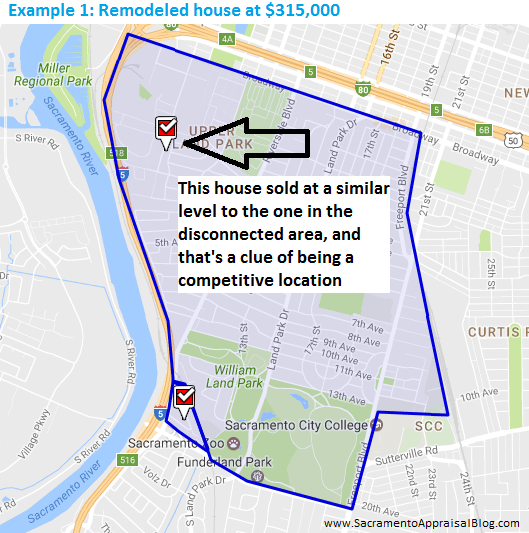

On paper it looked like value was going to be so much higher. Why? Because comps to the north were easily 10-20% higher, and even Zillow came in $100,000 above the appraisal (ahem). The big cause of such a legitimately lower appraisal boiled down to one thing. Location. Today I want to show a situation where a small section of the neighborhood was blocked off from the rest, and it was a big deal for value. Have a look below and let me know what you think. Anything to add?

The value issue: As you can see, this pocket of housing in the Land Park neighborhood isn’t accessible from the rest of the neighborhood besides a frontage road next to I-5. In other words, this section is disconnected. What sort of impact is there (if any) for being cut off from the rest of the neighborhood?

Methodology when only 5 sales in 5 years: When appraising something in this section, there were zero sales over the past 2 years and otherwise only 5 sales in the previous 5 years. This means I had to really study older sales to understand how value works. Here are the five sales:

What I ended up doing was comparing sales in this small pocket with similar sales at the same time in other areas of Land Park. Also, my goal was to find other patches of housing in the expanded neighborhood that seemed to sell at the same level. If I could find other areas selling at similar price points through the years, then current sales in those areas are probably my best comps for today.

Conclusions: After looking through all five sales I observed the following:

1) Some of the lowest prices: This small housing patch has some of the lowest prices in the neighborhood as shown with the yellow dots in the graph below.

2) 10-20%+ easily: If I were to cherry pick “comps” directly to the north, there is easily a 10-20%+ price difference for otherwise similar houses. The truth? Location matters. So does being connected to the rest of the neighborhood. In some cases a few streets that are disconnected might not sell differently than the rest of the market, but it could also be a big deal like the example above. The truth is if we cherry-picked nearby higher sales, the value would’ve been inflated by $60-80K+.

3) Limited by 90 days: It’s tempting to only look at the past 90 days of sales, but that can be far too limiting – especially in a situation like this. Also, a 5-minute comp check isn’t realistic. At times we might spend hours researching before beginning to understand how the immediate neighborhood compares to the rest of the market. We might even call colleagues and seek out other opinions too.

4) True comps: Other patches of housing in Land Park that tended to command similar prices were very busy streets or homes having a huge influence from nearby commercial properties (or heavy fixers that would have otherwise sold at much higher levels in average condition). I don’t say this to be negative about any of Land Park, but only to be objective as an appraiser trying to explain how value works in some areas compared to others.

I hope that was helpful.

Two classes I’m teaching in May: By the way, I’m teaching a class at SAR in a few weeks called How to Think Like an Appraiser. I’m also doing a blogging class. Click here for details.

Questions: What point above stands out to you most? Anything else to add? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great post Ryan, I wish all appraisers would follow your blog. Sadly, I know that there are some appraisers that would have just looked at only five sales in the past five years and said, “There are no comps.” and gone with the conclusion that is quick, easy, and wrong.

Thanks Gary. It’s not always easy to see value. Sometimes we need to spend some real time crunching numbers to figure out the most important thing. Context. How does the subject property fit into the context of the market? Quick and easy research isn’t useful for seeing context for something like this.

Hi Ryan, might want to try clicking on the Rob Saxe blog site. Pretty strange, at least on my end. Thanks for your insight. Always love your info.

Thanks Cassie. I’ll remove that link now. Not sure what’s going on with that.

Great post, Ryan! I like the way you break this down for others to understand. This is also a great example of there can be pockets in a neighborhood in a general area. Sometimes it can be hard to determine with limited sales but it can be done. Thanks!

Thank you so much Shannon. So true on pockets in neighborhoods. This area is definitely not a cookie-cutter market either as values change quite a bit from one street to another. It was interesting to choose comps after my research as I had to pick a few different areas throughout the neighborhood that trended at a similar level.

Great post, as always, Ryan. I have been using the technique of graphing sales over 8 years in one area versus the broader area and that really helped me deal with some difficult assignments. It also makes you 1000 times more confident when you submit your report.

Thank you sincerely Abdur. I really appreciate it. I totally agree about graphing like this. To me it was very convincing to see the graph. It was fascinating to explore what areas were really competitive too. I ended up getting to use a couple other houses I appraised a while ago as comps too. Ha. 🙂

So just because I am two weeks late doesn’t impact my response does it??? Hi Ryan as always good info. Here is a thought which I am sure you covered in your report / analysis, but I didn’t see in your blog. What impact would a lack of inventory have on your analysis. I clearly see your picture on this market, but down in the land of So Cal, right now I have communities that have little to no inventory. Spoke with an agent that had an open house on a 1200 sf starter home, 2 bedroom 2 bath. Her open house had over 100 visitors, 11 offers all over asking, took the one that she felt made the most sense, which was about $15,000 over market, This agent understands the market. So in this scenario I might argue that the lack of inventory would and could sway your analysis regarding the location issue, especially if this is being seen in the general market as well as immediate neighborhood or as in your case pocket neighborhood. Right now my thought of Location, Location Location, huey, if a buyers can’t find a home then the market just might not be what we think it should be or want it to be. Curious your thoughts on this item.

Hey Brad. Thanks so much. No, you are not too late. 🙂

I’m so glad you mentioned this. I think to a certain extent anemic inventory can change things up a bit and throw out some of the rules to a certain extent. I find when inventory gets lower and lower, buyers tend to get more desperate and will tend to overlook some issues. Thus an adjustment for a negative influence is now a little less in a market with no inventory. Or buyers are willing to look at that home that smells like Virginia Slims…. Yet I also find the rule book is not thrown out altogether though either. In my market at least I’m finding buyers to be discerning and to not pull the trigger on anything for any price. Sometimes the real estate community and sellers price like it’s a “name your price” sort of market, but I don’t think we have that dynamic right now for a number of reasons. In early 2013 it was a complete bloodbath, and I think the dynamic you are bringing up was a bit more present. These days I don’t think we are quite there yet in my market, but if inventory persists at one month or below for too much longer it could get interesting.

On this note it’s easy to discount how much buyers really are willing to pay for something. At the lower end of the market if appraisers aren’t careful it’s easy to not adjust properly. There is definitely upward pressure we need to account for.

Thus in this case this small pocket of housing still experiences lower values. Could buyers be willing to pay more sometimes? Of course. But educated buyers in my mind still won’t pay 10-20% more just because inventory is low.

Thoughts?

Enjoyed this post. Great job.

Hey Shawn. Thank you so much. I really appreciate it. I loved writing it and finding out more about the market when doing an appraisal in this little patch. There is always something to learn….

Great job and a good reminder to not be scared to go back x years to find comps and then time adjust. I MUCH prefer a sale next door model match 3 years ago to something thats not the same bed/bath, GLA, site size…etc…

This is daily life for me in a rural Mt market.

Thanks so much Mark. I really appreciate it. In this case I actually used the old data to find out what was truly comparable. I didn’t use the old comps, though I really could have. I don’t have any problem with that and I’ve definitely done it. That does sound like daily life for you. I definitely would give strong weight to that older sale next door too. 🙂