Temperature changes all the time. It’s a reality whether we’re talking about a cup of coffee, the weather, or even the real estate market. Today I want to show you one of the ways I use a CMA to take the temperature of a neighborhood real estate market. This helps me communicate well with clients, and I hope it will do the same for you.

NOTE: “CMA” stands for “Comparative Market Analysis”, and it’s a tool real estate agents (and others) use to communicate about the market to clients.

Three steps to gauge the market with a CMA:

1) Draw Neighborhood Boundaries:

All your data is going to come from the boundaries you choose, whether you draw them with a polygon tool in MLS or pick an MLS area (you choose since you are the market expert). I don’t recommend using a radius search because you’ll probably pick up sales from other neighborhoods that could skew the accuracy of what you are trying to present to a client.

2) Run a CMA in your MLS system:

Now run a CMA in MLS so you have access to current listings, pendings, and sales over the past 90 days. The final product may look something like this. I truncated the images below, but you can see the total count of listings and sales in yellow.

Active Listings:

Pendings:

Pendings:

Sales over Past 90 Days:

Compare listings, pendings, and sales: As you can see, actives have been on the market for 103 cumulative days, it took pendings 61 days to get into contract, and recent sales took 49 days to sell. In other words, buyers have been pulling the trigger in about 50-60 days, but at the same time a whole host of homes in the neighborhood are not selling.

BIG POINT: If listings have been on the market for longer than sales, something has changed in the market. Maybe it’s the real estate season, or sellers are trying to “test the market” at higher prices. It could also be that inventory has increased, buyers have become more picky, or maybe current listings consist of different types of homes that take longer to sell. This is key to communicate with clients since clearly some properties are selling and others are definitely not.

3) Figure out Monthly Inventory:

You can quickly figure out monthly housing inventory in the neighborhood. There were 61 sales over the past 90 days, which means the market absorbed about 20 sales per month (61 divided by 3 months = 20.33). Note there are currently 47 active listings. If you want to figure out monthly inventory, all you need to do is divide the number of current listings by the number of sales over the past month. In other words, 47 listings divided by 20.33 sales equals 2.31 months of housing supply.

WHAT TO SAY TO CLIENTS: Here is an example of what you might be able to tell clients about this neighborhood:

Right now there are about 2.5 months worth of houses for sale in the neighborhood. This isn’t very many listings, BUT when houses aren’t priced right, they are sitting instead of selling. Most homes are taking 50-60 days to sell, but overpriced homes are literally on the market for over 100 days. These homes will probably sell for even less than they would have had they been priced right from the beginning.

General Tips:

- Don’t make sweeping interpretations because of one CMA.

- Be sure you have enough data since few sales can lead to skewed results.

- Remember that trends for a larger county or even an entire neighborhood may not reflect trends for the property you’re trying to value. This is why it might also be worthwhile to run a CMA for competitively-sized properties instead of the entire neighborhood.

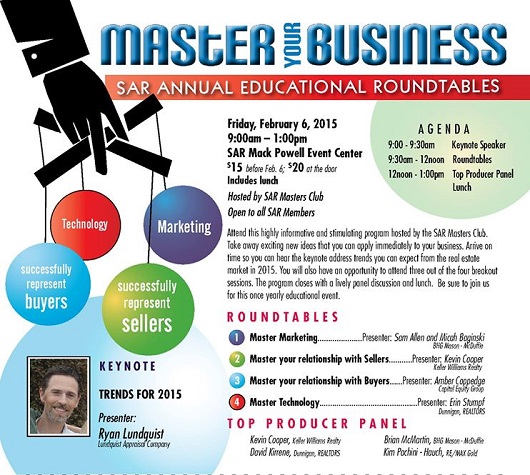

Keynote Speaker on Friday: By the way, I will be the keynote speaker on February 6 at the Masters Club Roundtables event at the Sacramento Association of Realtors. My 30-minute talk begins at 9am and is called “How to tell the story of the market to your clients”. I’ll focus on unpacking what the market did last year, where it is right now, and how to talk with clients about trends. Swing by if you can.

Questions: How do you use a CMA? How else do you gauge the temperature of the market?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I usually include a CMA in appraisal reports prepared for non-lender work. I run comparables for the prior 12 months, not all sales in the neighborhood. I also include a map showing the neighborhood boundaries and all the CMA data points. It brings context to the discussion.

Good stuff, Mike. I like how you said “it brings context to the discussion”. Very true. The way I used the “CMA” here is obviously not for competitive sales, but it easily could have been. I definitely recommend for others to do that. One other way I use a CMA is to support the boxes I check on the first page of the appraisal report. If I say marketing time is above or below 90 days, what am I using to support that? Or if I say there is a balanced supply of inventory, where does the support come from? The CMA is a very powerful tool for the appraiser because it helps provide some support for those boxes that are checked.

Great post as usual Ryan. Clear, concise, informative. CMAs are a great, simple tool when used as you described. Thanks for all of your great input into the Real Estate Industry and the local community.

Jeff

Thank you so much Jeff. I hope this post resonates with others too. It’s a powerful combination when we know how to pull data, but then interpreting it for clients takes it to a whole different level.

Great blog post Ryan. You’re very good at finding useful tips for agents to talk about. As an appraiser, I’m often asked by agents how to improve CMAs.

Thank you Gary. I appreciate the kind words. Good for you to help agents out when they ask questions. There is so much knowledge to share and absorb on both sides.