Is the market starting to tank? Or is it just a seasonal slowing? I’m getting asked this question all the time, so I wanted to share some thoughts. Then I have a big local market update for anyone interested.

How would you know if the market was sliding? I wish this was a 10-second answer, but it’s a big conversation, so let’s unpack some thoughts.

1) Change in inventory: It’s normal for housing inventory to increase as a market begins to cool for the season, but when a market starts to make a big turn we’d likely notice new listings aren’t being absorbed and the number of listings keeps growing beyond a normal pace.

2) Change in sales volume: Sales volume usually slows down as the market cools, but during a big shift we’d expect to see a more substantial change in sales volume over time. I’m talking about a market where buyers put on the brakes and properties stop selling. Currently in many areas throughout the country we’re seeing some smaller changes in sales volume. Could it be the start of something? Sure. But in my mind we need more time to see if this is a consistent pattern or just a slower end of the year.

3) Word on the street: What are people saying? How does the market feel in the trenches? We can learn so much when talking with informed local buyers, sellers, agents, appraisers, and other real estate professionals. Ask things like, “What are you seeing out there?”, or “What’s the market doing?” This is important because before we see a change in stats we’ll hear of change in the trenches. As an FYI, here’s a Twitter poll from a few days ago.

4) Less pendings: When a market starts to slide we can expect to see less pending sales, which is a big sign of waning demand. Let’s just remember though around this time of year we usually see fewer pendings as the market cools. This means we have to be cautious about saying the market is crashing just because pendings soften. My advice? Look for abnormal changes beyond a regular seasonal dip in pending sales.

5) Price changes aren’t the big issue: When a market shifts directions we often look to prices to tell us if things are changing, but it takes time for prices to catch up with the trend. For example, in Sacramento in 2005 we saw housing inventory triple and sales volume drop 43% in one year. Yikes! Those are insane stats, but price changes weren’t all that dramatic during this time period.

6) Other metrics: Lots of experts say to watch the number of new homes built as an indicator of the market changing. That’s huge. Others say it’s the GDP or economy, easy credit, housing affordability index, or flux capacitor sales (kidding on that one). There are definitely important indicators out there, and we should tune in, but for a local market I might suggest paying the most attention to inventory, sales volume, and the word on the street. If new construction is booming in your market though, definitely watch that too.

7) A closing dating analogy: Just like a dating relationship needs time to figure out what it’s going to be become, the same thing happens in real estate. Right now in many areas of the country we’re seeing inventory increase and sales volume starting to slump. At the least these are signs of a slowing market for the season, but it also makes us wonder if it’s something more. What does it really mean? Where will things go? The truth is we don’t fully know yet because the future hasn’t happened and we need more time to see how things unfold. I realize that’s frustrating to hear, but it’s honest.

CLOSING TIPS:

1) Crystal balls: If you don’t have a crystal ball that works, be careful about making very specific real estate predictions.

2) Watch local data closely: More than ever it’s critical to watch local data. Lots of articles are talking about “national” trends, but what’s happening locally?

3) Don’t just regurgitate headlines: It’s easy to read headlines and let the titles become our talking points. Be careful of that since headlines are designed to get clicks and they may or may not reflect the market.

4) Know the season: It’s not always easy to understand what a market is doing at this time of year when things usually slow down. My advice? Understand normal seasonal trends by studying past years. What does the market normally do at this time of year? This will help us spot normal vs abnormal trends.

I hope that was helpful.

—–——– Big local monthly market update (long on purpose) —–——–

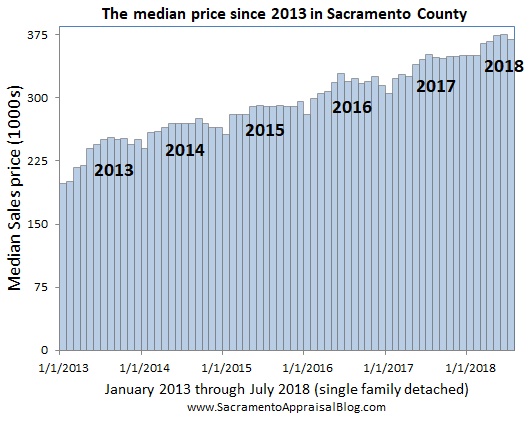

The market has been slowing for the past few months in Sacramento. We’re seeing what we’d expect to see at this time of the year like softer prices, more price reductions, a lower sales-to-list price ratio, and it’s taking longer to sell. We’ve had a hefty uptick in housing inventory though, and that’s something to watch – especially if it continues over time (that would be a problem). But for context, housing inventory is actually still historically low, so it’s not like we have a crazy high level right now. Some have wondered if the market is a bit stalled right now, but sales volume is still looking pretty strong and so are pendings. But I’d say there is some shock in the market because of the rise in inventory. Keep in mind one of the problems is so many sellers are overpricing, and that only makes inventory increase because these properties end up sitting instead of selling. On the other hand homes that are priced well are moving quickly, and 48% of all sales in the region last month had more than one offer. So despite a slowing narrative, the market isn’t painfully dull either.

The market has been slowing for the past few months in Sacramento. We’re seeing what we’d expect to see at this time of the year like softer prices, more price reductions, a lower sales-to-list price ratio, and it’s taking longer to sell. We’ve had a hefty uptick in housing inventory though, and that’s something to watch – especially if it continues over time (that would be a problem). But for context, housing inventory is actually still historically low, so it’s not like we have a crazy high level right now. Some have wondered if the market is a bit stalled right now, but sales volume is still looking pretty strong and so are pendings. But I’d say there is some shock in the market because of the rise in inventory. Keep in mind one of the problems is so many sellers are overpricing, and that only makes inventory increase because these properties end up sitting instead of selling. On the other hand homes that are priced well are moving quickly, and 48% of all sales in the region last month had more than one offer. So despite a slowing narrative, the market isn’t painfully dull either.

I could write more, but let’s get visual instead.

DOWNLOAD 64 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

JULY 2017 vs JULY 2018: So how did this past month do? One of the ways we find the answer is to compare last month with the same month in 2017.

JUNE 2018 vs JULY 2018 (NEW CHARTS): The problem is if we only look at July this year versus July last year, we’ll miss what the market is doing right now. So that’s why I have new charts to show the previous month vs the most recent month. But there’s still an issue because if we only look at this chart and don’t understand that the market normally softens around this time of year, we might walk away with the idea that the market is utterly tanking when it’s normal to see inventory increase, sales volume decline, etc… Look at graphs below to help see seasonal changes (or check out this older YouTube video where I talk about seeing the seasonal market).

SALES VOLUME: One of the things we need to watch is sales volume because if we start to see a trend of slumping sales, it could be a sign the market is in trouble. The truth is we’ve technically had a couple of months in a row of lower sales volume in the region. But volume was only off by 4% in June and it was barely off at all this past month (which is why I said “technically”). When you really look at it, sales volume this year in 2018 so far has been stronger than last year. But when we look at the past 12 months as a whole it’s clear volume is down (still only slightly though). Ultimately volume is not crashing right now based on the stats, so let’s be careful about saying it is.

NOTE on Trendgraphix: I have some thoughts on the way Trendgraphix is pulling stats. This month their stats show sales volume in Sacramento County is down by 6%, but that’s not accurate. I can explain why if anyone wants to know. And I love Trendgraphix. What an incredible resource. I just find when we’re looking at the market carefully in a time like this, it’s critical to know how the numbers work.

2005 vs CURRENT: In case you wanted to compare current price metrics with 2005, here you go. A couple of months ago I talked about peak prices because some metrics were showing 2005 levels. But with the market softening right now we’ll expect over the fall season to see current prices grow further apart from the “top” so to speak.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 64 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What would you look for to know the market was turning? What are you seeing out there right now? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

What’s the issue with Trend Graphix? I use it occasionally and would like to know.

Thanks for asking Joe. I use it too.

First off, I love Trendgraphix. What an incredible resource. I’m not attempting in any way to throw this valuable service under the bus. I only want to point out an issue with data that I happen to see in Trendgraphix. I mean, it’s actually understandable and it’s the nature of the way pulling stats works, but still I think it’s important to at least understand how the numbers work.

Here’s the issue:

In July 2018 right now Trendgraphix shows 1,553 sales in Sacramento County compared to 1,638 sales last July. That’s a 6% difference, so we pause and think, “Wow, maybe the market is starting to slough.” But here’s the deal. In reality last year around this same time (the 10th of the month) there were only 1,592 sales listed as sales instead of what Trendgraphix shows today at 1,638. Why the change? It’s common for monthly sales volume to show a slight uptick over time as more data gets entered into the system. This happens, and it’s frankly one of the struggles of pulling stats because there are still pendings out there that aren’t being counted yet because they simply haven’t closed.

But the problem is there were 40 more sales entered into MLS after data was pulled last year, and so we start to have a comparison problem if we use the new updated accurate number of 1,638 sales from last year (it used to be 1,592 last year) compared to today’s number of 1,553. The issue is the latest sales stats from July 2018 haven’t had the benefit of all the sales being entered into the system. So essentially what we have is an example of comparing enhanced numbers from last year to numbers that aren’t as full this year (yet). It’s cool that Tendgraphix updates their sales stats for last year, and they should over time. I just think it becomes a problem for us if we are going to use these numbers without understanding how this works.

Granted, this doesn’t make an enormous difference in the numbers in most cases, but it can lead to some conclusions that may not be accurate. Again, in many cases this makes little difference, but if we were to use last year’s numbers around 1,592 sales in July 2017 and compare them with this year at 1,567, we’d say sales volume was down in Sacramento County 1.5% in July 2018 compared to July 2017. But if we use the new updated number from last year at 1,638 sales in July 2017, we’d say sales volume is down 6% compared to this year. The big issue though is the sales numbers for July 2018 are bound to increase as more pendings close in coming months, so using 6% may not be the most accurate trend.

Does this make sense? Again, I absolutely love Trendgraphix, but we simply have to know how the numbers work. This isn’t really something that I would fault them for, and I want them to update their sales numbers over time, yet I think it’s fair to say it may not lead to accurate stats for the moment either.

To be fair, at some point we just have to pull the numbers. Even in my own stats there is this issue of incomplete data and there is no escaping it unless we are looking at really old data. For me I wait until the 10th of the month to pull sales stats because most sales have been entered by then. Trendraphix actually pulls on the 5th or 6th in many cases. While I think that’s slightly too early, it really doesn’t make too much of a difference. For instance, housing supply was actually 1.7 months this month in Sac County after waiting a few more days to pull sales instead of their published 1.8 months. No big deal. That’s not significant. The bigger issue is down the road over the course of the next few months there could still easily be 2-3% or so more sales for July when the pendings eventually close.

Ultimately if we waited months to publish data we’d never get to talk about real estate, so we simply have to do our best and put stuff out there. Thus in this regard there is always an issue with data changing over time (for anyone and me too).

When I pull sales stats on the 10th of the month I compare them with sales stats I pulled on the 10th of the month last year because that’s looking at the market in equal chunks. I’m very hesitant to pull on the 10th of the month today and then use sales stats from last year that are fuller today because they’ve had a year to compile. Otherwise I could use stats that are higher from last year and then report a trend this year that is slightly off because the latest month of stats is naturally slightly lacking right now. In other words, sales volume from last year could easily be up 2-3% because of the advantage of more time.

In closing, this is about comparing the market in equal chunks, and we have to do our best to do that whenever sharing numbers. Honestly, I don’t think Trendgraphix even needs to change anything they’re doing. I love their stuff. I just think we need to realize what is happening here with the very latest fresh monthly stats so we can better explain the numbers. This is especially important when we are looking very closely at sales volume figures in a market that has some uncertainty to it right now. On a related note, it’s probably a good reminder not to get too tied up on one month of data either.

Thoughts?

UPDATED COMMENT: Trendgraphix now shows 1603 sales from July 2018 instead of 1553. Moreover, for August 2018 stats their regional volume showed a 12% decline whereas my stats showed 7%. I’m wondering if their stats for sales volume are going to be off by about 5% because of the way data are pulled.

Thanks Ryan. Makes sense to be consistent about how you pull your numbers and that Trendgraphix continues to add to their data.

Thanks Joe. Well said.

So many valid points…

– Headlines are designed to sell newspapers and magazines, not inform you. Yellow journalism for the win.

– Just because something is happening in the Kansas / Idaho / Indianapolis market doesn’t mean that’s what is happening everywhere. Especially if you’re comparing it to California.

– Markets are cyclical. Every year there are slow downs and ramp ups in price, volume, etc. Please don’t be so sensationalistic about it. Not that big of a deal and to be expected.

Great advice as always Ryan. This article should be required weekly reading for anyone with an opinion about what’s going on in the market.

Thank you Wes. I appreciate the kind words and points. Good stuff.

It’s so true that what’s happening elsewhere may not be here. Though I will say I definitely am paying attention to different markets like Seattle, Southern CA, the high-end in New York, etc… Part of it comes down to different blogs I subscribe to, but there are some markets generating some interesting headlines. While these markets are not connected to Sacramento per se, if a pattern starts to emerge in many markets across the country, it’s definitely something we need to watch. While I don’t put much weight on national metrics either, I’m still paying closer attention to different indexes just to see what they say. So on that note I’d say let’s definitely read these articles, but let’s just be cautious to not project trends elsewhere on a local market unless that trend is really present locally.

I blame CNN/networks for creating buzz to sell ads and creating a sense of panic in 2006+.

I firmly believe there was fraud going on BUT it would not have happened if there was not opportunity for greed….

which would not have happened if sheeple were not led by media to panic for panics sake.

In other words, a false sense of urgency/panic was generated and perpetuated itself right into reality…

A convergence of events that got pushed over the edge by media marketing and sales directors…

At lease now we are still within the same generation of “remember when” and at least on the ground/in the ditches, people have memory of panic and appear to exercise caution slightly…

hopefully.

Thanks Mark. I hear you. The media can definitely play a role in shaping beliefs about the market. I think we are seeing that today as I find many are reading national headlines and projecting them on to local markets. We can do that if we’re not careful. On one hand I think what you’re saying could be part of the equation, though the market was ripe for a big change as many ARM loans were beginning to reset and prices had been driven up by rampant speculation too. It was a ticking time-bomb just waiting to explode. As always, I really appreciate your take.

Hi Ryan! What a great comprehensive list of market conditions. I love the dating analogy. Great stuff! I also appreciate you comments about pulling stats. I’ve learned a lot from you in this regard.

Thank you Jamie. I appreciate it. I’m glad you’re hip to the dating analogy too. As a side note I actually shared it the other day with a reporter and I was tickled he used it in the story. Yes!!! 🙂

That is very cool! Nothing more effective than a good illustration or analogy. ?

Always great stuff Ryan. I hope we aren’t going to see a tank, maybe just a hybrid or a crossover.

Yeah, that sounds better Gary. 🙂

I was actually talking with an investor this week and he’s pumped and hopeful at the idea of the market crashing. It’s amazing how that works.

Your blog is great, thanks for addressing this. One additional metric to watch is layoffs in the mortgage space. Lenders do tend to be very concerned with being overburdened, so watch for layoffs when a down-turn is expected or starting.

Thanks Rachel. Let’s keep an eye on that. The refinance boom really dried up, so there are some lenders who have closed up doors recently. There is also the other lender who was purchased by Zillow, though that’s a different story…

On a different note, I know you’ve written about the 1004MC in your recent blog. Last night I was at a monthly appraiser meeting and a colleague pitched an idea to me about the 1004MC form being retired. You’ve probably thought of this already, but my colleague thinks Fannie Mae is ditching the 1004MC as they anticipate the market declining. The idea is having less detailed market information will potentially help enable Fannie Mae to make more money by having less buybacks when loans go south. The premise is Fannie think appraisers won’t actually say “declining” in the report or describe real trends, so they’d be off the hook when it comes to buybacks. On one hand it sounds so cynical, but then again it sounds like something that could happen and a marketing ploy to be in a position to make money. I do wonder why they got rid of the 1004MC in a time like today when we ought to be watching market trends very carefully. Thoughts?

That’s an interesting take. It’s kind of scary too that they have the power to manipulate things so much to bend things to their benefit. Even more reason for appraisers to ramp up their market support for their results and study trends more closely.

Thanks Tom. I just can’t wrap my mind around why they would eliminate this market conditions form in a time when market conditions are at a place where many people are beginning to think the market is starting to change or will be changing soon.

I agree that appraisers would be wise to support the trends they say exist and maybe add a few new tricks into their bag on how to do that. Let’s think out of the box and tell the story of the market as best we can no matter what those trends are. When I first entered the industry I’d hear about appraisers ignoring a declining trend and simply mark “stable” by saying “The market appeared to be stable on the date of value” (even though the market was clearly declining. It was like there was this pressure that if you mark “declining” you’ll lose the lender client.

I was waiting for this post because really there is nothing else in real estate to discuss at the moment. It is the elephant in the room.

The bubble deniers at this point in the market are people who make a living selling, flipping, financing, or appraising real estate. I don’t mean that as an insult it is generally very true though. As a former commercial broker myself (F/T RE investor since 2008 though) I get it, but objectively this thing is a bubble.

I will say it again, when prices are completely detached from underlying economic fundamentals folks, it is a Bubble. It doesn’t matter if there aren’t NINJA loans or subprime borrower. A bubble forms when there is a total detachment from economic fundamentals (like that thing we call income.)

Put lipstick on a pig and it’s still a pig. Call a subprime borrower Non-Prime and they’re still not excellent borrowers. Wow, different name. Tricky.

It is so easy to see this bubble. Someone please give me one argument for why this market will ‘level out’ or ‘flatten out’ as all of the house jockeys are saying. Please, I’m listening.

Silence, you can’t defend that position because prices need to come way down to match fundamentals. Stop fighting it and accept that prices are coming way down. I’m excited because I like sale items, don’t you?

Why do so many people fight the reality that markets boom and bust. It’s called a K-Wave. Study some Econ, you’ll see.

Stop fighting it and being scared of the reality that there will be major price retrenchment like every other market since the beginning of time.

-Mr. Miyagi

Thanks Mr. Miyagi. I agree this is the elephant in the room and I wrote this post because of that. We have a market where we are trying to sift what is happening, so it’s important to watch inventory levels, sales volume, and the word on the street to gauge things (along with other metrics). Of course it’s easier to see the market and clearly explain trends with the benefit of hindsight, but right now all we have is the current trend, which is why we must watch these metrics above very closely to try to interpret what is happening.

Let’s be real though that for the past five years we’ve had many people and articles saying, “The market is starting to turn right now”, but they were wrong. On that note I appreciate the humility in your comment below, “I’m not saying it is crashing right now and this is the Big Shift, but I think there is a very very good change this is it.” Only time will tell, so I’ll keep watching very closely and reporting what the market is doing. In all of this my plan is to be cautious about reporting what the market will do in the future though because I’m still honing my Jedi prophetic gifts.

It’s hard to argue against prices surpassing wage growth and the local economy. These have been red flags for years, and it’s a real problem that the market is growing less and less affordable. To be fair, I think part of the struggle when using the word “bubble” is it is a term with baggage (and often not clearly defined either (which matters)). So if someone thinks of a “bubble” as values rapidly tanking because of risky loans and adjustable rate mortgages (2007), I get that person saying it is not a “bubble” today like it was then since we don’t have the same exact risky loan dynamics in today’s market. That really ticks some people off, but the reality is when many people ask whether it’s a bubble or not, they are essentially asking if it’s the same exact market as back then. This is where terminology matters, and it also reminds us it’s a loaded conversation where a simple YES or NO answer is not always a quick or possible response. So if someone says, “Well, we have way different market conditions today, we don’t have the ticking time-bomb of adjustable rate mortgages or rampant investor speculation, but values have been inflated for years”, I can understand where that person is coming from. There is also a complexity to calling something a housing bubble too as the following Freddie Mac article points out. http://www.freddiemac.com/research/insight/20171109_next_house_price_bubble.html

One more thing. I’m glad you brought up housing inventory. While housing supply is a key metric to watch, we have to remember a couple things: 1) We often hear that a 5-month supply of homes is normal, but that’s not true locally and it’s probably false in many markets. Frankly the market might struggle to handle even three months in Sacramento. It may have been true in the past about a 5-month supply, but it’s definitely not true now; 2) The market is really sensitive to increases in inventory, so it doesn’t take much of an increase for the market to feel different. Thus on one hand inventory really is still technically low, but we also must realize smaller increases start to change the feel of things too. I will say inventory levels are currently still favoring sellers, so we haven’t reached a point of market balance (or oversupply). That could change in coming time of course, but that’s why posts like this exist. We’re watching closely.

I appreciate your quest for truth. I really do. Let’s keep our eyes open and trade thoughts. As always, thanks for your take.

These are definitely things to be aware of. Sounds like what you are saying is that in a market that is tanking we’ll see higher levels of typical seasonal trends. Seems like if we do go off the rails then we probably might still see seasonality but with lower pricing, volume, and new construction numbers, which makes sense.

Hi Tom,

Yes I think it’s safe to say when the market tanks, which is a ‘when’ question only, we will see exaggerated Fall (seasonal) trends.

Of course inventory will spike, more deals BOM, price reductions etc.

House jockeys that lean on “But inventory is so low!!” are simplistic. Inventory can change overnight when owners decide to become sellers for any myriad of reasons including but not limited to a perceived market top, or job loss.

The bottom line is that if it was a Bubble in 2006 then it is a Bubble in 2018. Prices at same level with no relatively zero accompanying wage growth and even higher consumer prices in the form of consumer staples and construction prices etc. So I think it is safe to say it is even worse this time.

The consumer is maxed out. Credit card rates at 20 year highs, personal debt at all time highs. And coupled with these factors we have soaring high prices which have exceeded our last bubble peak and our way beyond the avg. household income where houses normally trade. The real/nominal RE pricing is a silly discussion because it’s already inflation adjusted, sorry.

There are two sides of the mountain. We ascended, have hit the peak, euphoria is in the air, and now people are starting to try and take profits. That is where we are in the RE cycle.

This bubble will crash as do all bubbles. I’m not saying it is crashing right now and this is the Big Shift, but I think there is a very very good change this is it.

If not it is coming, so prepare accordingly. Don’t be a Bubble Denier. Let’s all accept reality together. No amount of positivity or yoga chanting will change this economic reality.

Thanks Tom. Yeah, that’s pretty much it. Let’s look for changes beyond a normal season. That will help us gauge if this is seasonal or not.

Mr. Miyagi, I love your last line. Thinking positive thoughts about the market is meaningless. The market doesn’t care about our feelings or even what we say about the market. Our yoga pants or chanting doesn’t change the trend.

Well, I believe there could be a cooling of sorts in the housing run up we have had. I also believe that getting a mortgage post 2008 was painful but those who did got a fantastic low rate. I find it hard to walk away from that historically low rate due to a market corrections. I do however feel like we are due for a pause in the appreciation run up but we could have a lengthy time before another major housing downturn. Demographics are still good and folks need to live somewhere as long as affordability doesn’t get to much farther out of wack we could keep chugging along. At a snails pace though. Of course, this is just a theory of mine.

Thanks Dennis. I appreciate your two cents. Affordability is no joke. I was spending some time with a Baby Boomer couple a few days back and affordability is on their mind too. They own their house outright, but they need more money in the bank. It’s one thing to be real estate rich, but an issue if you’re cash poor. So a move out-of-state is on their mind to essentially trade for a smaller house and pocket some money so they have enough each month.

Just remember…Between Jan 2012 and Now…This market — Especially in the HOT SEATS,,NYC, SF, Seattle and Los Angeles have been driven up by “FOREIGN INVESTORS”..Namely Chinese, Canadian and Russian Investors….And Now They are “Pulling The Plug”….Which means “Stagnation at Best”…and a “Down-Turn” just around the corner…..Who has eyes to see and ears to hear ????

Thanks Jim. Foreign buyers really have been a big deal in some markets. I have family in Southern California and it’s incredible to see the power of Chinese buyers. Let’s watch closely to see if they do exit or if it’s just news hype. In Sacramento our version of outside buyers happened to be big investment funds like Blackstone. These funds swooped in at the very bottom of the market in 2012 and bought in mass for about 12-18 months before making their exit from purchasing. They really made a huge difference in the market at the time though because they created competition and helped propel prices upward. Now they are landlords in mass. In fact, Blackstone merged with the Starwood fund and they collectively own a whopping 82,000 homes in the United States. How crazy is that to have Wall Street own Main Street in mass? Anyway, thanks for the comment. Let’s keep watching.