People ask all the time. Is the market good or bad? I have some quick thoughts and then a huge market update for those interested.

The truth: The market isn’t always good or always bad. What I mean is it’s either good or bad depending on whether you can move, sell, buy, or invest. At times we get so focused on what prices are going to do that we forget to think this way. Remember, no matter what prices do in the future, the market will still be bad or good for various people.

College Admissions Analogy: Real estate is sort of like getting into college. It’s good if you have the grades and financing, but bad without a high GPA (or rich parents who can bribe school officials). Too soon?

The big point: I don’t say this to gloss over prices seeming to be closer to the top of a real estate cycle. I’m just saying sometimes we label a market good or bad without digging deeper. Who is it good or bad for? Who are the players in the market? Who will become the players if the market changes?

Any thoughts?

—–——– Big local monthly market update (long on purpose) —–——–

The market slumped during the second half of 2018, and now it’s an interesting spot. Let’s talk about it.

THE SHORT VERSION:

- Pendings were fairly normal for February

- Sales volume has slumped for 9 months

- We’re starting to see prices tick up

- I’m now publishing El Dorado County stats

- Most metrics are doing what we’d expect for the spring

- This post is long on purpose. Skim or pour a cup of coffee.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE LONGER VERSION:

Here’s some of the bigger topics to consider right now.

That weird place of spring: We’re in a place in the market where a hotter seasonal trend is happening, but we don’t quite see it in the sales stats yet. Let’s remember sales from February tell us more about what the market used to be like in December and early January when these homes got into contract. So we have to look to the listings and pendings right now to understand the market.

It feels kinda normal-ish: It’s felt like a somewhat normal spring lately. We’ve seen prices tick up, multiple offers on many listings (if they’re priced well), it’s taking less time to get into contract, inventory is going down, etc… We’ve basically been seeing all the stuff we’d expect to see in the spring. Of course the real test is whether sales volume will be normal in March, April, and May, but we just don’t know that yet.

Dude, call the market already: Some people want to know definitively what the market is going to do in 2019, but we don’t have enough information yet. Besides, interest rates went down, and that’s like injecting a steroid into the market. So in some senses we have to wait until this steroid wears off.

Flattening rents: We’ve seen rents flatten lately. They’re still up, but the rate of increase is not as aggressive as it used to be.

The market isn’t slow, but it’s slowing: I get a little pushback when I say the market is slowing because the spring has felt more competitive. Here’s the thing. We’re having a hotter spring, but in the bigger picture of the market it’s just not as aggressive as it used to be. I think Barry Habib’s analogy says it perfectly. It’s like the market was driving 80 mph and now it’s driving 30 mph. In other words, we’re still seeing forward price progress, but it’s not 2013 anymore. If the stats over these next few months say differently of course, then I’ll change my tune based on new information.

Less offers (but actually more): Multiple offers are down about 13% in the region this year compared to last year, but the number of multiple offers actually increased from January to February. But that’s normal for spring, so I wouldn’t write home over it. The takeaway? Buyers, you need to bring a strong offer. Don’t think you are running the show. You’ve gained power from last year, but you’re not in charge.

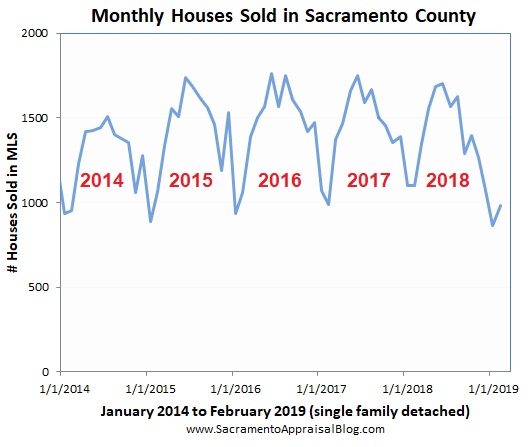

Nine months of slump: Sales volume has slumped for the past nine months in the region. This means the number of sales was lower compared to the same exact month the previous year. In short, if this doesn’t change over time and get back on track, then we could be talking about the market starting to embark on a different trend. This past month volume was down about 7% in the region, which is much better than over 20% in December.

Normal pendings & steroids: Last month pending sales looked fairly normal, which suggests the market is trying to flirt with normalcy for the spring compared to the slump of volume we had over the past 9 months. What’s making the change? It’s most likely due to interest rates declining. Low rates are like a steroid for the market. Remember, if pendings were fairly normal in January and February, that could lead to fairly normal sales volume in March & April. But let’s see how it shakes out. We don’t have those stats yet.

Not many listings yet: There’s not much on the market yet, but that’s fairly normal for the time of year. Historically listings hit their stride between April and the end of summer, so we can expect lots more in coming time. For now inventory is declining, and that’s normal for the time of year.

Final thought before the graphs: In closing, the market is in an interesting spot. It feels like it’s juggling uncertainty from last year with a striving for normalcy today. We only have two months of data and we need to keep watching to see how this market is going to emerge.

I could write more, but let’s get visual instead.

BIG ISSUES TO WATCH:

1) SPRING GETTING HOT: The market is heating up for 2019 and here’s proof. We’re seeing price changes, lower inventory, and increased sales volume.

2) SLOWING MOMENTUM: Despite the heating, stats show the market is slowing down when we look at the rate of change by year. Looking at monthly, quarterly, and annual numbers helps give a balanced view of things. As a side note it’s going to be interesting to see price metrics these next few months.

3) SALES VOLUME SLUMP: It’s important to look at sales volume in a few ways to get the bigger picture. Here it is by month and year.

SACRAMENTO COUNTY:

Key Stats:

- February volume down 10.5%

- Volume is down 5.2% over the past 12 months

SACRAMENTO REGION:

Key Stats:

- February volume down 6.7%

- Volume is down 6.6% over the past 12 months

PLACER COUNTY:

Key Stats:

- February volume was up 13.3%

- Volume is down 6.8% over the past 12 months

EL DORADO COUNTY:

Key Stats:

- February volume was up 23%

- Volume is down 7% over the past 12 months

NOTE: El Dorado County monthly stats vary significantly. I wouldn’t put much weight on volume being down 23%.

4) LAST YEAR VS THIS YEAR: Here’s a comparison of last year compared to the same time this year. What do you see?

Quick note on how NOT to use my content: Please use these images in blog posts or on social media, but don’t copy my post verbatim or alter the images in any way. I recently saw someone remove my blog link on an image. Look, I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Now here are a bunch of images. Please enjoy.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

NOTE: This is the beginning of sharing more for El Dorado County (as long as people want it). What type of graphs would you like to see?

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What are you seeing out there? Which metrics above stand out to you the most? What are you hearing from buyers and sellers lately?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great visuals! We are seeing similar trends in our market. Prices are appreciating but at a much slower pace, volume down YoY and marketing times are increasing. You give such a thorough market update. Well done.

Thanks Shannon. I appreciate it. It’s fun to run the numbers. Granted, it’s incredibly time-consuming. It makes me a better appraiser though.

as always a great blog Ryan. Hope all is well at your end. All these charts and graphs are great but you left out the 10 year treasury. That is the chart that we should all be watching. That is the hingepin for the 30 year mortgage. When the 10 year hit 3.23% the 30 year hit 5% or slightly over. The market came to a screeching halt where I am at. The RE agents thought there phones were disconnected. Sales where happening but not at the prior year pace. We should be watching that 10 year chart as well. As it will predict the future for appraisers.

Thanks Brad. That’s definitely another thing to watch. I agree and appreciate you bringing this up. I’m typically more inclined to report on mortgage rates, but what is behind shaping rates? Good question and I can get behind that.

Mortgage rates have basically declined for a few decades, so the market doesn’t historically move only one direction based on what rates are doing (since we’ve had a few up and down markets during this period of declining rates). Though in today’s market with higher prices, the direction of the market feels much more tied to what happens with rates. In other words, the market feels very sensitive to rate changes right now.

Great overview as always. I love the perspective you give with this one. I get asked all the time “how’s the market”? My answer is always it depends on what part of the market you are asking about. That typically stumps them and sparks more of a conversation. As you state, the market will always be good or bad for some people, it depends on their situation. Now, if we can just get the news reporting outfits to stop glorifying the headlines to get eyeballs and share real information (like you do), we can have better conversations about what is really going on.

Thank you so much Richard. I appreciate your take and your kind words. I like your questioning too because it’s a good thing when conversation goes beyond a simple YES or NO. Good for you. On a somewhat related note, in my market updates lately I’ve talked about the dullness the single family market saw for two quarters (which is less present right now in the spring). But I’ve had to draw a line to say, “Hey, the 2-4 unit market hasn’t seen this same dull trend”. Thus the market is different depending on what property type we’re talking about too…

I get asked that question constantly! Good or Bad is a hard judgement to make for the very reasons you point out. I forecast this will be a rational and “normal” Spring buying season followed by a slower than average Summer. However national politics may have a hand in that forecasted future….

As always, Ryan, you’re awesome! Thanks

Thank you so much Brad. It’s funny because we like to think in terms of “good” or “bad” for the market, but that’s such a subjective term. I agree about politics. There is a tremendous amount of uncertainty.

Great update, Ryan. It does look like things are cooling in your area. Most people want a simple answer when they ask how the market is. Like you say, there really is no simple answer and as always it depends on a lot of different things.

Thanks Tom. I appreciate it. Like many things in life, we need more than just a few words to explain it… At least I do.

Wow! This was a hug market update! Packed with great information. I love the point you made that whether or not it’s a good or bad market really is a matter of perspective. Thanks also for sharing how you make some of these charts in Excel in your YouTube page. That is so cool. Thank you for freely sharing your knowledge with us!

Thanks Jamie. Yeah, it’s just true about good and bad. There were lots of great deals in 2012 when the market bottomed out in my area, but the only problem is financing wasn’t available to so many people in light of a recent short sale or foreclosure. Thus even though prices were low, it ironically wasn’t a good market for many. I always remember this because price isn’t the end-all factor in determining whether a market is good or not…

Oh, and you are welcome about that video. For any onlookers, here is a tutorial for how to make a bar chart median price graph…. https://youtu.be/AEvR5rkYqvo

Thank you for all the information about the Sacramento real estate market Ryan. There is no better source. I don’t want to say you’re “good” but you’re definitely not bad.

Haha. Too “good” Gary. Thank you.

Hey Ryan, Great post. Thank you for all the fresh stats. According to the charts, it looks like inventory has been ticking up again? Is that true or am I reading the charts wrong? I wish I could see an expanded chart going back past 2013. That way I can get a better picture of things. I definitely can see by the charts that the market is finally slowing. I think at some point, prices will start to reverse. I think we’re either at a top or close to it. Seattle’s market has already been crashing for a while now.

Hi Brandon. Last year inventory seemed to creep up again (though it’s still only about two months). But compared to the past couple years it is absolutely higher. Though compared to 2014 & 2015 it is still slightly lower. In the immediate time we’ve seen inventory decline from last month to this month, and that’s normal for the time of year. I actually have a few charts in the download section that show inventory over a longer period of time. You can check those out in this zip file if you wish. https://sacramentoappraisalblog.com/February-2019-Market-Trends.zip

Thanks for your take on the market. At some point in the future we would expect prices to decline. It’s a safe bet because that’s what markets do. They go up and down. In my presentations lately I’ve been talking a lot about market cycles. Just as the market has a seasonal rhythm each year where it goes up and down, it also seems to have a wider seasonal rhythm over decades where we can see a similar up and down rhythm. After a seven year run, I think many are feeling the same that we’re closer to the top. But whenever prices change eventually, how much will they change? That’s the big question and we just don’t know for sure. I always remember there is no formula for how a market has to change either. What we saw in 2005 is not the end-all recipe or pattern for the future.

By the way, for any onlookers, here’s part of a presentation I gave to a group of investors last month (at a tap house (which was cool)). My talk was an hour long, but this is the part where I talked through market trends in 2005. I was wanting to show what it was like in the past to spot a market that REALLY changed. Despite there not being any “bubble” formula so to speak, I think there are still clues here for what to watch. Hint: listings, sales volume, and then eventually prices. Here is the link to that part of the presentation. If you keep watching I also talk about some ideas for where to focus business for investors and real estate professionals: https://youtu.be/pU2l7124goI?t=4825

Thanks Ryan.

Like you, I study charts for a living too and I can honestly say that according to the post-2008 Sac County Inventory chart which you provided, the inventory trend seems to have reversed. I still think that we are in the early stages of a slowdown. The next step will be falling prices to accommodate reduced buying demand. Once that happens, investors (faced with rent reductions and looking to take their massive profits before an imminent collapse) will begin selling and inventory will begin flooding the market. That’s when we will have a market crash. lol. Of course, I could be wrong or early but I do see a downturn starting to form.

As far as the video you sent, I watched a bit and it looks like you presented some interesting facts in the video. I will be sure to watch the whole thing later tonight.

Thanks Brandon. Inventory really did seem to bottom out in recent years. On one hand it’s not increasing exponentially, but on the other hand it’s definitively up from a couple years ago. Though to be fair it’s good to see it up because a one-month supply is simply anemic. Historically around two months is still low, but our market today can maybe only handle three months or so.

The market will change at some point and investors could cut bait, though they are sitting on sensationally higher rents also, which could cause some to hold instead of sell.

I appreciate your take.

I notice that in many parts of the country, rents have flattened out and in other parts, it has actually reversed.

Personally, as an investor, I would not have any incentive to hold properties if prices began declining and rents got capped or began declining as well.

I would sell while it’s high and re-buy while it’s low. It’s the same thing that moves the stock market cycles.

Once upon a time, Real Estate was owned by owner occupiers. Today, a large amount is owned by investors, so gone are the days of a stable market.

Welcome a new type of housing market that will mimic stock market cycles

Thanks Brandon. Rents really are flattening. When I give market updates I often ask if rents are still skrocketing and many people say YES. But they’ve really been flattening locally. We still have an undersupply of units, but at some point rents being disconnected from local wages becomes the big factor.

I think your plan is what every investor wants to do. Sell at or near the top. There are certainly investors doing that in today’s market. I’ve also seen some investors move their portfolio from Sacramento (or California) to other states.

Also, I think what’s been happening already in cities such as Seattle will begin spreading to other coastal cities first. Then from there, it will spread to the rest of the US.

I do believe that we will see another crash like 2005-2008, but this time, it will be driven by investors looking to take profits rather than by mortgage defaults and foreclosures like last time. I believe that the market has actually evolved in the sense that it has become more of an investment vehicle (high degree of investor owned properties as compared to owner-occupier properties such as it was in the past). For this reason, volatility in the housing market is probably here to stay (just like it is in the stock market).

Anyway, most people may think I’m crazy, but that’s just the way I see it. I know I’m probably more bearish about the market than most of your readers right now, so my apologies. lol.

Anyway, keep up the good work. I think stats work both ways and am always open to seeing the actual data before determining my “trade” strategies. I couldn’t ask for more with your blog. Thank you.

I couldn’t ask for more with your blog. Thank you.

P.S. Although I don’t see foreclosures as a problem this time, I have read that around 25% of toxic mortgages from before the last crash are still in default and those homes can also be put on the market at some point. Is that true? If so, I think that would have an effect too.

I think your commentary underscores the reality that markets are not built the same. In other words, there is no such thing as a “bubble” formula. What I mean is markets change for many different reasons. So while we might not have adjustable rate mortgages today, we have other unhealthy elements.

No worries on being more bearish. Be where you are at. I appreciate the different perspectives and thank you for understanding the way I’m looking at stats here. In terms of right now, there are two stories to tell. What is the market doing right now in the immediate spring? And secondly, what is the bigger story happening? We need to keep our eye on both. In my mind low rates are helping to temporarily boost the market. I’m more interested to see what happens after rates go up.

We are in a unique spot with housing where so many tech companies are looking to get into the market and make a buck. Many of course will not own the homes, but they’ll certainly attempt to manage all aspects of getting people to own them. But a company like Opendoor is interesting and something to watch because they are actually buying homes (and then selling them immediately). That’s a different model for sure.

For now we’ve been seeing the home ownership rate increase lately, which is a good thing. It basically declined after the “bubble” popped in light of investor activity (until recently). As a side note, Len Kiefer on Twitter has the best graphs when it comes to home ownership rates. https://twitter.com/lenkiefer/status/1101469777774739456

It’s really hard to say about that 25% figure. That’s pretty high though. I’d guess most of these mortgages have been dealt with as short sales, foreclosures, and loan modifications. It was really hard to hold on during the last recession, so many of these owners had to find solutions. Are there still some stragglers? I imagine so. I’d personally be surprised if it was as high as 25% though.

What I can say definitively is distressed sales like that have not been hitting the market in mass. There are definitely properties that end up selling at the court steps prior to MLS and some of these properties in default will be handled there. In other words, anything that is distressed like this could easily be taken care of outside of MLS at the present time. Unless there happened to be a flood of these properties, I’d suspect they’d be handled instead of hitting the market. I did a quick scan of some recent bank-owned sales and there was a real mixture. Some were reverse mortgages, some took out huge loans prior to 2005, some bought in 2009 or 2010 and just couldn’t hang on. Then there was that one dude who probably lived rent-free since 2011 and this property finally came to the market (I hope he saved money over time).

I recently read an article from some msm news source (I forgot which one). I believe they put the figure at around 25% but I could be misquoting them. I need to track down that article and read it again for accuracy.

I remember that the article discussed many people that have been living in these distressed properties rent free since the financial crisis.

The article also mentioned that once these properties get put back on the market, it would create a huge problem.

I don’t know how much truth is in all that.

Thanks Brandon. I appreciate it. If you find the link, let me know. I’d be curious to read it. There are definitely people out there who have been living rent-free for years. I just have a hard to imagining this is a really significant number.

Ryan as always a great blog. My question is do you use Excel for your graphs or gnumeric or something else.

Hi Rick. Thanks so much. I use Excel for my big market update graphs, but I use Gnumeric for mostly everything else I do in actual appraisals. So my neighborhood scatter graphs in reports tend to be almost exclusively Gnumeric, but every graph here in this post was made in Excel. The charts are basically data tables from MS Word. Let me know if you have any questions.

Blog post idea: is there a correlation between rainfall and real estate? Like inches of rain vs. number of active/pending listings.

That would be really cool. Thanks Marcy. On a side note, I’d like to study the effect of breweries on local real estate prices too… I’m guessing having participants in a study wouldn’t be hard to find. Seriously though, I appreciate the idea. It sure has been a wet winter. It’s felt more like Portland lately. Bring on the sunshine.

Seriously though, I appreciate the idea. It sure has been a wet winter. It’s felt more like Portland lately. Bring on the sunshine.

Marcy, I just heard someone else comment about real estate and rain. I wondered if people have been saying the rain is slowing the market. Have you heard that sentiment? I responded to your initial comment by giving props to your idea of course (because it’s a good one), but then I quickly inserted a tangent on breweries because that’s where my mind went. Maybe your question is deeper here though, so let’s chat.

When thinking of the market over the past few months, if anything pendings have looked fairly normal in January and February. So in my mind it’s harder to argue rain had a dramatic effect. We’ll know for certain of course once March and April sales volume stats are out.

For me it’s hard to imagine that buyers were looking less on Redfin and Zillow and MLS though since buyers are absolutely obsesssed. Much of the hunt begins online these days and rain would not seem to hamper that. Could it have stopped some showings and such though? I suppose. Could it have stopped some sellers from wanting to list right away? I can see that. Did it stop some Realtors from showing homes? I’m guessing certain ones on certain days. For sure. But did all of that show up in the stats in a significant way? That’s the big question that we’ll have to see about in coming time. For now the clues (pending sales) suggest rain wasn’t a driving force, but we’ll see.

Let’s step back though and see the bigger picture. If anything the market has been slowing down and sales volume has slumped for 9 months in a row. Thus if volume ends up being down in March and April, I don’t think we can say it’s the rain. It’ll be tempting to go Milli Vanilli (“Blame it on the Rain” (sorry, not sorry)), but I think we’d have to recognize any lower volume would reflect a bigger narrative or slowing that goes beyond just the season.

Anyway, I’m probably writing too much, but now I’m intrigued. If you have any insight or thoughts, I’d love to hear your take. Thanks again.

I heard two of the “more experienced” agents in my office say that when buyers ask how the market is in Jan/Feb it used to (before the draughts) kind of depend on the amount of rain we had. This weekend was beautiful and my open houses were absolutely packed. And I got to talking to a buyer that sold their home in Palm Desert and apparently the extreme heat completely kills the market in the summer. So that’s what made me think of it! And maybe we “feel” slow during the rain and busy during the sunshine but the stats might not show that. Idk!

That makes sense. There is definitely something to the weather. I think we can all see that in our own lives too. I certainly feel more optimistic about an extra hour of daylight and better weather this week. It’s been great.

Yet my sense is even during the drought years though that the spring seasonal market didn’t always wake up at exactly the same time despite there being less rain (translation: no rain). In fact, I can go back and look at my market updates in January and February for the past five years, and they might say something slightly different each year. At times the market starts to run fast in early January and other times it takes a few weeks. It’s interesting how that happens. On one hand the market is predictable in that there is a seasonality and rhythm to things, but at the same time it is not quite exactly the same every single year either. I know for certain I’ve written “the market woke up early this year” at some point in the past few years. It’s on my blog somewhere as proof. Could that have been due to better weather? Sure. Maybe your office friends are right. They probably know quite a bit from experience, and that is not something to discount. It’s extremely valuable. Let’s just remember though the market is moving for so many reasons beyond just weather, and I’d guess the other factors are more important unless weather is severe.

Could that have been due to better weather? Sure. Maybe your office friends are right. They probably know quite a bit from experience, and that is not something to discount. It’s extremely valuable. Let’s just remember though the market is moving for so many reasons beyond just weather, and I’d guess the other factors are more important unless weather is severe.

It’s interesting to hear about Palm Springs. I can only imagine how that heat affects real estate…. and life.

On a side note, there are many real estate truths out there. We hear things or say things like, “The market is stronger when the weather is better,” or “The market is stronger during a presidential year,” or “The market always heats up the week after the Superbowl”, or “The market starts to cool after the 4th of July.” These things all sound like they could be true, and we could probably argue they are generally true. But they are not precisely true to the same extent every year, which is why I can’t forget to look at the actual numbers more than anything… Case-in-point. Last year the spring market ended earlier than it usually does.

By the way, congrats on all the traffic. I hope some of that leads to offers. You guys keep up the great work!! Thanks again for the comment. It got me thinking and I always appreciate conversations like this.