This market is just crazy. Today I have two quick things on my mind and then for anyone interested I have lots of visuals to highlight the Sacramento market.

TWO THINGS:

1) This market feels like an auction: The market feels like an auction where buyers are making really aggressive bids with the hope of winning due to being the highest. Throughout the country we are seeing offers in many markets that are totally disconnected from a reasonable value. On that note someone asked if appraisals need to change so buyers have a better chance of getting deals done in this crazy environment. Nope. The appraiser’s role is to reflect the market, which very likely might not be the highest bidder. Don’t get me wrong, there are many things that need changing in the appraisal profession, but it’s not the appraiser’s job to fix an irrational dynamic in today’s market.

2) Do higher rates matter? I’ve heard the sentiment quite a bit that rising rates really don’t matter. The idea is the market is so hot and nothing can cool it. But I feel like the housing market could say, “Hold my beer.”

Here are a few considerations:

A) No difference yet: Higher rates haven’t slowed down buyers. If anything locally the market has become more aggressive. For reference, purchase mortgage applications increased from the previous week nationally.

B) Still too low: Rates around 3% are freakishly low and that’s just not high enough to alter the market. But what about 3.5%? Or 4.0%? Can you imagine a time when higher rates would matter?

C) Watch mortgage applications: The MBA reported a 43% dip in refinance application volume last week, so clearly borrowers have pumped the brakes a bit. The purchase market is up 2% from last year, but it looks like mortgage applications decelerated last week per Freddie Mac economist Len Kiefer.

D) Rosy narratives & sensitive to rate changes: Over the years the real estate market has become very sensitive to rate changes. I think of 2018 when rates shot up closer to 4.5% and buyers backed off the market. Do you remember the headlines about how dark real estate felt? I share this because recent history reminds us rate changes can make a difference in whether buyers engage or not. My advice? Don’t embrace a rosy narrative to think higher rates cannot change things. They can. Maybe not yet. But let’s not downplay how meaningful low rates have been in creating the market we have right now. Know what I’m saying?

NOTE: Props to a conversation with Ann O’Rourke last week that influenced the auction analogy above.

———————- (skim or digest slowly) ———————–

BIG MARKET UPDATE

For those interested, here’s a big Sacramento market update:

THE SHORT VERSION:

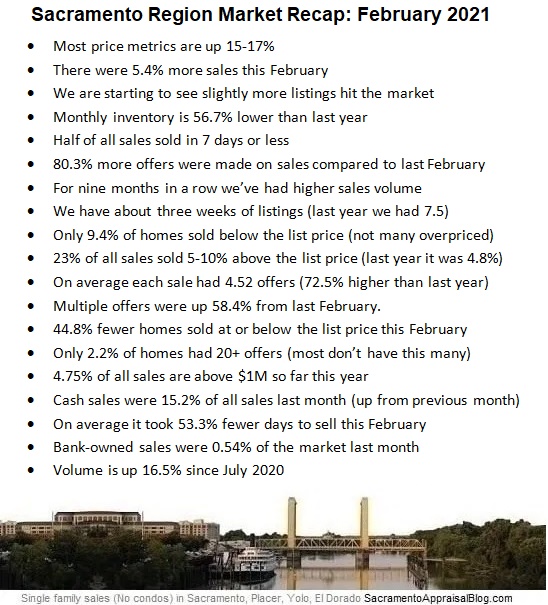

Here is a highlight reel to talk through some of the bigger themes right now. In short, the stats are stunning and this is likely the most competitive market we’ve ever had. Demand is simply excessive while supply is anemic.

QUICK RECAPS:

I’m thinking about doing these charts every month. Do you like them?

NOTE: I’m not going to do Yolo or El Dorado County charts because there aren’t enough sales. Stats would be ALL over the place year over year.

THE LONGER VERSION (organized by county):

1) Sacramento Region

2) Sacramento County

3) Placer County

4) El Dorado County

I welcome you to share some of these images on your social or in a newsletter. Please use this stuff. In case it helps, here are 5 ways to share my content (not copy verbatim). Thanks.

1) SACRAMENTO REGION:

2) SACRAMENTO COUNTY:

3) PLACER COUNTY:

4) EL DORADO COUNTY:

Other visuals: Not that you needed more, but check out my social media in coming days and weeks for extra visuals. I am posting daily stuff on Facebook, Twitter, and LinkedIn. Oh, and sometimes Instagram.

Thanks for being here.

Questions: What else would you add about my two quick topics above? What stands out to you about the market lately? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

It does feel like an auction. Just when I think it can’t go on any longer it does. I wonder if middle or late summer, the pent-up demand for travel and easing of restrictions will distract all the players (agents, buyers, sellers) in the market to take some time off to travel and not buy or sell as much. Could we see a situation where inventory and rates are low but things still cool off a bit?

This market has definitely surprised us all and this reminds us there is no such thing as truly accurate market forecasting. Just today I told someone my crystal ball is broken. I’m not sure he loved that answer, but I wasn’t about to predict the next 5-7 years of the market on a social media thread…

So far March sales numbers are huge (prices). It’s unreal to see this type of growth. I’ll keep a lid on it for a couple of weeks because we still have two weeks of data to compile. But man it’s moving quickly.

Easing restrictions and getting back to normal life is critical for the housing market to have a chance at pre-pandemic normalcy. We frankly need sellers to feel okay with listing their homes. There has been a huge difference in the number of listings coming to the market since this pandemic began, so we’re definitely feeling it.

That’s an interesting last question. At some point with such dramatic price increases lately it’s possible to see price resistance. In other words, at some point the benefit of low rates is diminished with higher prices. We are not seeing buyers resist right now though, but if low rates were prolonged and there wasn’t another mechanism introduced to stimulate the market, we’d have to consider theoretically we could see a market cool. The struggle is there are too many buyers fighting for a limited supply right now, so we could in truth see some buyers leave the game and we wouldn’t notice. Sad but true.

Two words: Irrational exuberance

Exactly!

Been hearing that phrase quite a bit lately online. Thanks Ferris.

Ryan,

I’d like to hear the answers to the questions:

1. Why are the sellers selling?

2. To where are the sellers moving?

We know who the buyers are (Bay Area transplants), but we don’t know the seller’s motivation.

Are they taking their money and running? If so, to where? Idaho, Arizona, Texas? Or, or they moving up locally?

We know that fixed-income retirees are forced to leave California. Is that who these sellers are?

One answer to your survey question…

1) To reap the benefit of this crazy market – taking proceeds and investing in smaller home and more income properties.

2) Downsizing in the same area leaving behind the maintenance of a big house, pool, yardwork when the kids have gone or are going soon.

Good stuff Randi. The dream in today’s market is to buy something smaller and cash out or deploy equity into something else. We are in our tenth year of price growth, so there are definitely opportunities out there for quite a few people.

Hi Tom. Questions like this aren’t always easy to answer because we don’t always have demographics information until years down the road. Moreover, sellers don’t all have the same motivation either. There are Boomers needing to downsize (Silver Tsunami), Millennials are the largest generation and they are at an age ripe for home buying and family building, and so many regular folks are upsizing, moving neighborhoods, deploying their equity over the years into something else, buying out heirs of properties, moving into a so-called better neighborhood, etc… In short, there is lots of incentive out there and it’s not all the same because the biggest factor for moving is lifestyle. And people just have different reasons to move.

We don’t have 2020 stats yet for migration out of the state. USPS did publish some data relating to the Bay Area though and 24,000 Bay Area residents moved throughout the state last year and 4,000 left the state. Among those who left, the top destinations were Texas and Oregon. Interest5ingly enough LinkedIn data showed the same result with people leaving San Francisco going to Austin, Seattle, and the Sacramento was third on the list. I would still say the bulk of our market is not just the Bay Area though. So many locals are moving. For the local market we saw El Dorado and Placer with the largest percentage increases in volume, so it’s been a popular destination. I personally know lots of people who have moved to Shingle Springs or Placerville simply because of the pandemic. In other words the pandemic was a definitive clincher for some to get on with their goals. Increased migration into these counties could certainly represent the Bay Area trend in part, but it also speaks to what people want during the pandemic – outlying areas, more space, more land, newer homes, large backyard, etc… This is a huge deal for people and lots of locals are hungry for change.

An article in the LA Times recently pitched the idea that the California exodus is more hype than not. I would say 2019 stats confirm this to a degree because 653,000 people left the state while 480,000 entered the state (not a shocking difference). But I think we need to wait until we see the stats, which might take another 6-9 months or so if we’re lucky. I would be surprised if the numbers were not higher than 2019, but we’ll see what the numbers actually say.

One thing I’ve observed is it’s easy to attribute this crazy market on exodus out of the state and migration into Sacramento from the Bay Area. Again, both of these are legit factors in our market. But we cannot discount the power of local buyers who are moving and figuring out life – even during the pandemic. We’ve had nine months in a row of higher sales volume and what we are experiencing locally is being experienced in lots of different areas around the country.

At some point we’ll have more data and that will form my thinking more. I’m just speaking out of what I’ve seen so far with sources like the US Census Bureau, LinkedIn, SF Chronicle, etc…

I’d love to hear your take and anyone else looking on.

Thoughts?

Ryan,

You are so well connected in the various Realtor Associations (SAR, PCAR, EDCAR), you could put out a questionnaire to the agents, and ask why their sellers are selling and where they’re going. You’d be way ahead of the statisticians.

Just a thought,

Tom

That could be cool. Thanks for the idea. I’m actually giving a presentation today in an office and I’ll ask them what they are seeing. A survey spread out there could be insightful. Though I’ve also observed part of the results really depends on who everyone is working with. It’s sort of like the saying, “Your perception of the market comes from your last few transactions….” I’d say the vast bulk of agents don’t say the Bay Area is winning at everything, but sometimes I meet agents and they say that’s all their business. I have not met anyone who says the Bay Area isn’t a force though. Everyone has been talking about heightened activity. Anyway, I’m getting off topic. This is a good idea.

Hi Ryan,

With sale prices increasing so much due to the lack of inventory and buyer demand, how many months of sales constitutes a baseline for prices/appraised value? In other words, at what point will we see these exorbitant sale prices be reflected in future appraisals?

Thank you,

Shawna Friesen

Hi Shawna. That’s a really great question. Technically the answer should be RIGHT NOW. A couple weeks ago (or maybe last week) I wrote about the role of pendings in appraisals. We see the current market in the pendings / listings while sales tell us about the past. One of the hallmarks of a bad appraisal in a rapidly increasing market is the lack of consideration for the difference between the two. In other words, appraisers can account for market change to the sales based on a number of different issues – but definitely a difference observed in the pendings. With that said, it’s always easier to see a market with hindsight because that numbers are really clear. Of course it’s not the appraiser’s job to adjust up to meet the highest “auction” offer either. In this market we are seeing irrational offers that don’t reflect a reasonable market value, so I get it when appraisals come in lower. They should in so many cases. But a friend shared an appraisal with me last week and it was unfortunate to see zero adjustments up to three comps that got into contract in January and very early February. It takes skill of course to make those adjustments, but it’s also incompetence not to make adjustments up if the market has indeed changed. One last thing. Regional or county-wide stats don’t always translate perfectly into every neighborhood, so when we see 17% price increases from last year some of that has to do with what has been selling. Fewer sales at the bottom of the market and more at the top. That can make a difference in the stats.

Any thoughts?

Great insight and stats, Ryan. I’d like to share our selling experience. We knew we were going to move and had the house appraised by Don Gossman (remember to thing about a doctor self-prescribing having a fool for a patient?). The real estate agent told us some things to do– nothing very major– and we did them. Then, she said she had seen a house similar to ours that was not getting much action and recommended listing $5k below appraisal. We did. The next day we had five showings and the next day we had four offers. We accepted the one that was at appraised value, $5k over listing. That was not this summer, it was December of 2019… this might have started sooner than most of us realized.

The reason we sold was to retire and move to a more rural (cheaper) location. We had started searching on MLS and Realtor.com back in April of 2019, but now that we had sold we got serious. Then, the pandemic hit.

We had looked at hundreds of houses and seen several dozen in person. Then, the house we wanted came on market. We made and offer for full list price, sight unseen, but with a contingency to be able to cancel within 24 hours and then drove down to look at it. We closed in April 2020, I checked the market a bit, but did not appraise or have it appraised. If you have been looking for a long time and want it, market value does not make a lot of difference. Since then, the market has gotten even crazier.

I know that a personal story from the middle of the country does not prove the kind of market influences in your article. But, it might help to answer some of the questions and does provide some individual insight.

Thank you Steve. I appreciate it. Also, I totally understand not having an appraisal in some situations too where you really know the market well. That might sound weird to say from an appraiser, but I get where you are coming from. After looking at hundreds of homes you have a good sense of the market and the move is simply going to happen no matter what anyway. Congrats on getting things done. I appreciate you sharing your story.

Great post and analogy. One question, how are appraisals suppose to change in order to help buyers get into deals? Honest question, I’m curious if the person that asked had any suggestions.

I don’t think the person had an answer. Very fair question. The idea is appraisals should bend to account for the lopsided market rather than the lopsided market being the problem. I feel for buyers out there right now.