There is so much talk about the housing market bottoming out, and I want to give some perspective on what to watch for. I hope this helps.

UPCOMING (PUBLIC) SPEAKING GIGS:

3/06/23 Matt the Mortgage Guy YouTube Live 3pm PST

3/09/23 Matt Gouge Event TBD

3/10/23 PCAR Market Update Lunch & Learn

3/28/23 Downtown Regional MLS meeting

4/1/23 NAA Conference in Sacramento

WATCH FOR TWO DIFFERENT BOTTOMS:

The previous housing downturn had two different bottoms. There was a bottom for sales volume and a bottom for prices. Can you see that on the visual below? The concept of two bottoms comes from Bill McBride of Calculated Risk, though he talked about watching for a bottom in new home sales and a bottom for residential investment. For local markets, I recommend watching for a price and volume bottom (may not happen at the same time).

VOLUME GOT TO A BOTTOM FIRST

It took just over two years for volume to reach a bottom after the peak in 2005, but it took another fourteen months after the volume bottom for the price decline to slow way down in Sacramento County. Technically, prices declined for multiple years after volume hit its low point, but it was only modest after 2009, which is why I said “near price bottom.” Keep in mind there was a federal buyer tax credit introduced in 2009 that supercharged the housing market and basically helped slow the decline at the time.

VOLUME WILL IMPROVE AS AFFORDABILITY GETS BETTER:

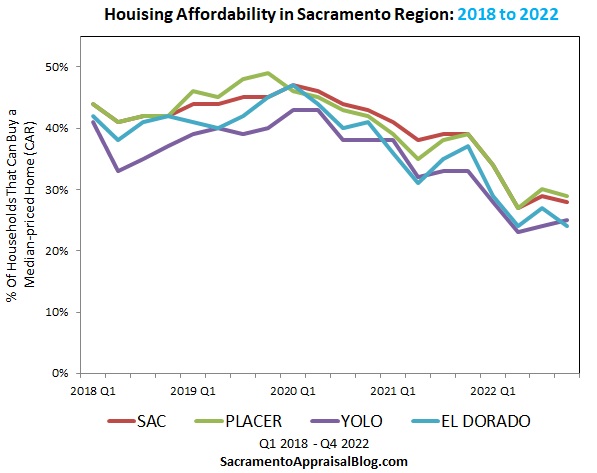

According to the California Association of Realtors, 28% of households can afford a median-priced home in Sacramento County. In light of this, it’s not a shocker to still see subdued sales volume (missing about 40% of buyers). The truth is we will get more buyers back as affordability improves.

Here are a few other local counties. The trend is basically the same, which reminds us all ships tend to rise and fall with the tide.

HANG IN THERE REAL ESTATE FRIENDS

Some quick thoughts and encouragement for real estate friends. I’ve been having so many conversations lately behind the scenes with people who are having a hard time in this market. I just wanted to say you are not alone. And you can’t control the market, but you CAN control your mindset.

CLOSING THOUGHTS:

We are in the midst of the spring market heating up right now, but we need time beyond spring to understand the longer-term housing trend (thanks Captain Obvious). Everyone has ideas about the future, but let’s be cautious about interpreting spring seasonality as a bottom. Time will tell. Let’s keep watching by the week.

RECAP VISUALS:

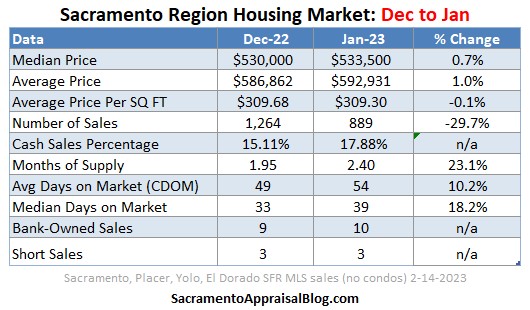

The truth is year-over-year stats don’t tell the full story of the market right now. Someone might say, “No biggie, we’re down 5% from last year.” That’s technically true, but it fails to recognize that five percent from one year ago is NOT the same thing as five percent from the height of spring in 2022.

YEAR-OVER-YEAR

MONTH-TO-MONTH

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: Do you think the housing market has bottomed out? What are you seeing right now in the trenches of escrow? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I so look forward to your blogs! and I know cause everyone in my office of 190 agents read and most of us discuss your blog info in our team meetings.

That’s so cool to hear. Thank you sincerely Johnny.

Thanks for running the local numbers to show Bill’s point. Here’s hoping the volume bottom is soon.

Thanks. For sure. I really like his phrasing. Though his definition is more like new construction bottom and then investor bottom. But this is definitely his concept, so it’s important to give credit. I’ll run these numbers for some surrounding counties too. I did Placer, but I didn’t have time to solidify the image. There was definitely a bigger difference in the median price from 2009 to 2011 compared to Sacramento, but the really sharp price change was still more subtle after 2009 – even in Placer. It just goes to show when prices drop, it’s not always the same speed (same with increases).

Thank you for always bringing something new to the discussion. Looking forward to seeing the bottoms emerge. Okay, that sounds bad.

Haha. Yeah, checking out bottoms sounds like something else…

Thoughtful insights as always. Thanks for all you do Ryan, greatly appreciated!

Thank you sincerely Michael. I hope all is well with you.

It will be interesting to see how rates play into the housing market this year as they put more pressure on affordability as we are once again approaching 7% for mortgage rates. Sales are way down but to me that’s just inventory that’s being pent up that will eventually have to move… we’ll see how long sellers will hold their breath with their sub 3% rates and being stubborn to move into 6%s. I don’t consider the 15% drop in prices from peak to bottom as an indication of how much prices have dropped as that was just a quick last minute panic runup. I think the more realistic number to focus on is closer to the 5% YOY value drop. I imagine we still have room for values to drop to bring affordability back along with the eventual drop in mortgage rates. The 28% affordability for Sac metro seems very affordable compared to rest of CA but still a concerning number with a little bit more room to go down before we see reprieve, in my opinion. I’ve always focused on affordabilty as the key indicator of where things are going and first time home buyers coming back as a signal of housing market recovering.

Thanks Paul. I always appreciate your take. There was so much optimism about rates going down, but now they’re getting higher. Ultimately, this puts more pressure on prices to decline, which is a healthy thing in today’s climate because we need more affordability. It seems like the rate narrative is a game of ping-pong by the week depending on whether they went up or down. It can be a manic housing narrative if we’re not careful…

I get what you’re saying about 5%, but the year-over-year figure is only a snapshot from price only one year ago. In a normal market without massive change, I really like the year-over-year metric. But in today’s market I think we’re in a place where it’s prudent to consider both of the stats. In other words, year-over-year doesn’t capture all that has happened since May. When pulling comps right now, for instance, there is a really good chance prices are down much more than just 5% since May. Thus, a quick way to overprice would be to pick the best stuff from May and apply a downward 5% adjustment. Of course, it’s going to vary by the price range and neighborhood. I’m just trying to illustrate why both of these stats are key. I won’t split hairs with people over needing to use both stats, but I will say last week someone accused me of bias due to sharing the May stat. I found that to be ironic because one of the easiest ways to promote a glowing housing narrative is to only focus on year-over-year change (which is much more subdued than May stuff). Anyway, numbers and narratives matter. I appreciate getting to talk about stuff like this.

Agreed about affordability. It seems like a healthy level of affordability in Sacramento is somewhere around 50% for this affordability index. I have some graphs from the 90s to help show Sacramento around this level then too. Maybe that’s not realistic for today. We’ll understand more as the market changes ahead.

Regardless of rates, this period is a continuing buying opportunity.

Thanks Huck. There are buyers in any market. The way I look at it is we’re missing 40% of buyers, which means 60% of buyers are still here. I think the 60% gets lost in the narrative at times. Yes, we’ve seen a huge shift in the number of buyers, but that doesn’t mean nobody is literally buying like some narratives suggest. Not true.

A very informative read and your stats were well received. Although when weighing out listing’s online I question yours and their price per SQ. FT. cost. The average price difference appears to be much, much greater mostly in the $400. to $500. area per SQ. FT. in its cost point for both Sacramento and Placer County. Why is that?

Hi David. Thanks for your thoughts. Keep in mind this is the average price per sq ft. There is a massive range of price per sq ft when looking at actual homes, so it’s going to vary substantially. For instance, in East Sacramento, over the past 90 days of sales (as of last week), the range went from $321 to $680, and in Rosemont it was $240 to $439. I mention this to show there can be a massive range. There isn’t just one price per sq ft that’s going to make sense for all properties. I wrote about price per sq ft last year in case it’s helpful. Some of the visuals might help in showing a pretty big range. https://sacramentoappraisalblog.com/2022/03/15/starbucks-cups-price-per-sq-ft-in-real-estate/

I’m not sure exactly what you mean by your last question. My tea might not be working yet today. But a couple of things. Placer stats can bounce around more from month to month depending on what has sold. The numbers in Sac & Placer happen to be more similar this month, but Placer was higher the previous month (Sac stats tend to be more stable since there are more sales). Also, on average properties in Placer County are pretty easily 400 to 500 square feet larger than Sacramento County on average, so if the numbers look similar this month, it doesn’t mean prices are similar in both areas.

Great insights Ryan. Down here in the East Bay, it seems like prices have already started to rebound to Sep-Oct 2022 levels which correlate exactly with interest rates. I am hearing about agents seeing literally hundreds of people at open houses again and some appraisals are coming in under contract again. It’s wild how hard the market is swinging, especially in places with high-dollar buyers who are less sensitive to rates. Thanks for the good work.

Thanks Kyle. I appreciate you pitching in. The market is NOT the same in every location. That is for sure. It seems like the west coast has had a much sharper change overall compared to lots of other areas of the country, so I imagine some real estate professionals are shocked when seeing the sharpness of some west coast markets. But to your point, even within the west coast, the temperature isn’t going to be the same everywhere. With that said, I’ll be curious to see what the stats look like when all sales are compiled this spring. By the way, I don’t know if you follow Patrick Carlisle, but I like his stuff on LinkedIn. He covers the Bay Area. It’s not my market obviously, but I like to keep tabs since there is a Bay Area to Sacramento connection. Please keep me posted Kyle. Thanks again. https://www.linkedin.com/feed/update/urn:li:activity:7027097267513823232/

Wow thanks for the resource. I devoured those graphs. If you are looking for more granular data on the East Bay, check out my newly released blog. http://www.ebvaluereport.com. You have been a huge inspiration for getting it going. Let me know what you think.

Oh dang. I didn’t know you had a blog. Can’t wait to check it out. Right on Kyle.

Thanks Ryan! Always great info!

Thank you as always DeeDee.