The housing market feels like a reality TV show. New sensational drama every week, juicy gossip, strong opinions, emotions, and big cliffhangers that might affect the future. Anyway, today I want to dig into Dream For All and some of the bigger themes right now (monthly recap stats at the bottom).

Scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

4/12/23 Q&A at Moksa Barrel House

4/13/23 Realtist Meeting 11:30am

5/4/23 Housing Market Q&A 12-2pm

5/10/23 Empire Home Loans event TBA

5/18/23 SAFE Credit Union event TBA

5/22/23 Yolo YPN event TBA

6/1/23 Event TBA

7/20/23 SAR Market Update (in-person & livestream)

DREAM FOR ALL PROGRAM RUNS OUT OF MONEY

The California Dream For All loan program (aka Dream For Some) ran out of money in less than two weeks. Nobody expected $300M in California to last long, but less than two weeks was unexpected, and this helps show there is a tremendous hunger for homeownership. So far, it’s not just one thing I’m hearing from loan officers and agents. Some buyers who didn’t get the loan are still out there, some have backed out, some are waiting for rates to come down, some are stepping back and saving more money, some are planning to target a lower price, and some are investigating other loan programs. I’d love to hear your story in the comments. By the way, I spoke to Channel 3 last night about this program.

GETTING RIDICULOUS UNDER $500K

Check out what’s happening under $500K in the region. It was already tight before Dream For All went into effect, but the loan program made things even more aggressive. Beyond the loan program, part of the issue here is more buyers shopping at lower prices because that’s what they can afford. And not that any governmental officials are reading this, but it’s going to be important ahead to consider how you might unlock supply instead of just increase demand.

Here are listings and pendings under $600K. Can you see why it’s so competitive in these ranges?

HOUSTON, WE HAVE A SUPPLY PROBLEM

As I said last week, the housing market was an ice bath in the fall of 2022, but now it feels like a bloodbath with the level of competition. I was expecting the market to heat up for the spring, but seeing 45% fewer new listings so far in 2023 in the Sacramento region has changed the trend. All that said, having low supply doesn’t mean prices will now go up forever. The market is going to figure this out. How do we deal with a lack of affordability in the midst of an extreme shortage of listings? Time will tell.

And a look at all price ranges. Actives vs pendings.

40-YEAR MORTGAGE FACT CHECK

There have been some viral social media posts about FHA now allowing a forty-year mortgage, but that is NOT true. FHA is only allowing a 40-year mortgage for a loan modification. I’m not saying that’s a good idea, but details and narratives matter. Some think this could open the door to a 40-year mortgage, and that’s fine to talk about. But let’s not perpetuate fake news.

CONCESSIONS ARE ELEVATED (BUT SLIGHTLY LOWER)

Sellers giving concessions is still elevated from what we saw over the past two years, but we’ve seen a dip during the spring season as inventory has been depleted in recent months. It’s important to recognize the market temperature has changed lately, but so many buyers are still in a place where they need some help. Sellers, did you hear that? My advice to buyers is to get as much as the market will give you, and be realistic about what it’s going to take to get an offer accepted today. Don’t forget to target overpriced listings also.

IT’S TAKING LESS TIME TO SELL (NORMAL)

As spring heats up, it’s normal to see a shift in days on market. It’s basically been taking about two weeks longer to sell than the pre-pandemic normal. Look at how lopsided things got in 2021 and 2022 though. It shouldn’t have only taken an average of two weeks total to sell, but that’s what happens when injecting a steroid of sub-3% rates into the marketplace.

TWO THOUSAND FEWER SALES

The market has felt ultra-competitive, but we are still seeing lower volume due to affordability. There were about two thousand fewer sales this past quarter compared to last year at the same time. Here’s a way to look at it with 2023 in black and 2022 in blue. We’ve seen a hit to nearly every price range, so all ships rise and fall with the tide. Basically, as prices have gone down, there are now more buyers shopping at lower price points. This is why we’re seeing the lower categories doing better. It’s as if the entire market was pushed to the left on this bar chart. Oh, and on the positive side, there were more than 3,500 sales that did happen. Sometimes the housing narrative only focuses on the part of the market that is missing, but there are still deals happening.

Here’s a different way to look at the trend. Keep in mind it gets a little weird when we look at percentages at the very highest prices since there aren’t that many sales. I really think we need to look at both of these graphs at the same time to help understand the trend.

DISTRESSED SALES HAVE INCREASED SLIGHTLY

Distressed sales showed an uptick over the past quarter, and they were about 1% of all sales in Sacramento County. This is a very minor increase, so it’s important to not blow 1% out of proportion. However, we should continue to see more distressed sales ahead, but nothing like early 2009 when 84% of all sales were distressed in the county.

REDFIN IS GONE AS AN iBUYER

Redfin is officially gone as an iBuyer in the Sacramento region. In November they announced an exit, but their last property has now officially sold. After months of truly brutal losses, they actually did well on the last unit. It was acquired for $480,000 in December 2022 and sold for $630,000 in April 2023 after paint and flooring was added. By the way, Opendoor owns 75 units right now. In recent years Opendoor has typically owned about 300 to 330 units in the Sacramento region, so they’ve really cut back.

SELLING 3% BELOW THE ASKING PRICE

It’s normal during the spring to see properties sell closer to their list price, and that’s what we’re seeing right now. On average homes sold about 3% below their original list price. Keep in mind this is the average, and there are individual properties that sold way above asking and many that sold way below. Backing up though, 97% is actually a pretty normal number for March.

MULTIPLE OFFERS ARE GETTING LOPSIDED

We’re not seeing 2021 and 2022 levels of multiple offers, but it’s been elevated lately. The percentage of multiple offers for March 2023 was slightly higher than the pre-pandemic average, but current pendings after March look like they will go further beyond the seasonal norm (see dotted line). As I keep saying, the market hit an inflection point around mid-March where we started to see a higher-than-normal percentage of multiple offers. My sense is supply began to be so depleted that low demand finally met low supply, and it created intense competition.

SEEING THE TREES & THE FOREST

This visual is a hot mess, but I like seeing every single sale and how it sold compared to the original list price. This is a good reminder that not everything is selling above asking price too. Ultimately, when hearing about sensational examples, we need to be careful to not isolate one example (a tree), and say it represents the entire market (forest). Maybe. Maybe not.

58% SOLD BELOW THE ORIGINAL LIST PRICE

The majority of homes in March sold below the original list price. Over the next couple of months, we should see this percentage continue to go down – especially in light of the market temperature changing. For now, the total percentage of homes selling below the original price in 2023 (black line) has been above the normal trend (red line).

31% SOLD ABOVE THE ASKING PRICE

I know these visuals are a bit chaotic, but the goal is to understand what normal looks like (red line) compared to other recent years. This year is getting closer to the normal trend, and we’ll see what happens in coming months as the market has been heating up. Part of it depends on pricing of course too. If we start to see lower pricing as a norm, that could change the numbers.

Okay, I’ve said more than enough. Now some recap visuals.

YEAR-OVER-YEAR

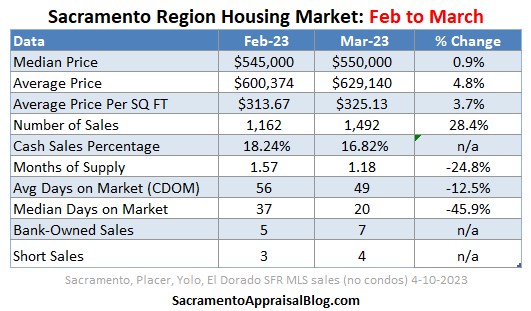

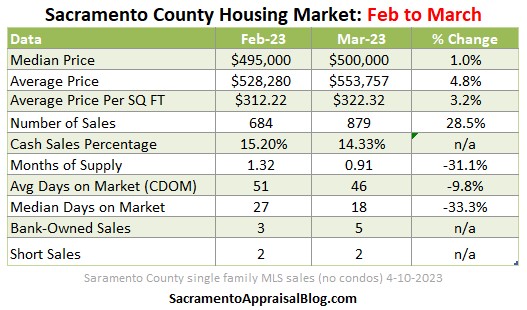

MONTH-TO-MONTH

OTHER VISUALS:

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What are you seeing right now in the trenches of escrow? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Crazy, no inventory below 500 as new supply is far above that. When rates get down to 5% on 30 year fixed things could get crazy again? Is there a build up of millennial buyers? No Supply? Fairly low unemployment? I would guess 2024 Spring rates will be down and market will rise even more mostly on the price range below FHA?

Let me know what you think Ryan? Boom in 2024?

Thanks Christian. There are many moving parts. We’ll see what mortgage rates do. It’s like ping pong from one week to the next where they bounce all over the place. But there is no mistaking lower rates would unlock more demand. And frankly, it’s more likely that we’d see lower rates initially unleash demand rather than supply. Of course, there is an inflection point out there for sellers to list their homes, but it’s likely going to take longer for sellers than buyers to jump into the market since the math doesn’t work so well for sellers who are sitting on a sub-3% rate. Frankly, we’ve only scraped the surface of understanding the consequences of low rates and what that means for sellers. There are definitely Millennial buyers poised to purchase, but they also have to be able to afford the market. I think we need better affordability to see a boom. Some people say the market will just keep going up, but it’s a real problem locally if we see higher prices and low volume since a good chunk of buyers cannot afford current prices. Thus, the real issue is seeing the number of sales get back to normal. I’m way more interested in volume.

“And not that any governmental officials are reading this, but it’s going to be important ahead to consider how you might unlock supply instead of just increase demand.” I couldn’t agree more with this statement you made!!! How can we get this message across to the policy makers???? Maybe the government needs to explore some incentives for sellers? We have the demand…we need supply….

Thanks for reading the fine print of my post, Janet. I really appreciate it. I think consumers are going to need to complain to their representatives. I hate the idea of stimulus to free up supply, but this is a real need right now. This is the byproduct of Fed policy. Low rates felt great at the time, and now we’re living with the consequences.

My biggest take away is that if Ryan Lundquist thinks the market is all over the place, then maybe I’m not crazy! When a current client asks “How’s the market”, you need to see if they have a couple of hours to chat. One of the many questions clients have brought up: Lower employment numbers could reduce overall buyer demand; but lower employment could also impact inflation and interest rates, which could increase buyer demand? As usual, thanks for all the stats and insights Ryan, really helps to cut through all the noise!

Thanks so much Michael. There are many moving parts right now. It’s a weird dynamic too. If this market was a movie title, it would be, “The chaos of low demand and low supply.” But, that would be a pretty lame title. Please keep me posted with anything you’re seeing out there.

Please keep me posted with anything you’re seeing out there.

I think when talking about unemployment, you have to look at which people specifically are unemployed. Unskilled labor isn’t buying anything anyway, and dual-income tech already bought.

Yes, good point. But lets say rates get below 5% next year, do you think unemployment will have any effect on the market. If rates are low and there is little supply I doubt it?

I agree, but it’s not just rates but *anticipated* rates. Equities markets are pricing in a fed cut already. Home buyers are buying with variable rates, anticipating refinancing within a couple years.

Such an unusual market. Thank you for keeping up updated.

Thank you sincerely, Gary.

When does the “volume” of sales effect the state/federal government pockets? Does it?

I suppose fewer sales would lead to lower taxes, but I’d defer to an exhaustive study on that. Lower volume of sales means people are likely spending less money overall though, and that’s where the housing market can affect so many industries.

I’ll admit I was wrong about prices crashing. I thought people would try to wait to buy when prices dropped from interest rates going up. But now I’ve heard from people that buy with an adjustable rate because everyone on the planet thinks the Fed will cut rates. And even if rates go up, that’s only because inflation is bad, which means you’d better get all your money out of cash and into assets… Like a house. I give up on trying to predict prices.

However, as far as inventory goes, if demand for my services as a real estate photographer are any indication, we’re gonna see a lot more SF and MF hitting the market soon.

Joda, I’m so happy to hear you’ve been busy. That’s fantastic. The market is starving for more inventory. In a normal year we should see more at this time. We have seen more listings as the year has progressed, but total new listings are still down by 45%. But if the trend persists and resembles anything normal, we should see more listings in April than March. And more in May than April. Please keep me posted with what you’re seeing on your side of things.

Anecdotally, a lot of people postponed due to the weather. I always imagine most people “need” to sell, but for various reasons (repairs or landscaping, etc), weeks of rain mean weeks of delays.

I suspect weather was an issue for certain people, but we’re seeing fewer new listings nationally too, which suggests there is a bigger trend at play. I do wonder if a more competitive market will thaw out some sellers. The problem is the math simply doesn’t work for so many people right now.

Are you doing a lot of work for Multi-Family? Sellers are priced high and deals don’t pencil because of the hight rates. They will have to come to reality soon and if more product is coing to market that will force them with time.

Hi Ryan. I read this.

Hey, thanks Chris. I really appreciate it.

More multi-family this year than last year. I can’t speak to if, when, and for how much these deals go for. But I do agree, it’s hard to make multi fam pencil unless you anticipate rents going up quite a bit, and can put a lot of cash in up front. Still, some people don’t see inflation going away soon, and hoarding cash sucks when you know your risk-free bonds are producing negative real yield.

Our DFA story? Well funny you should ask. Half of us could buy half the house, the other half could only buy half a house with down payment assistance (higher interest rates, 104% CLTV, less house, etc.). Half of us is white, the other half is black. Half of us was in no hurry to buy a house (even though they easily could), the other half has been looking for years and was well informed of the current housing market and trends. Both halves make the same money. Both halves have excellent credit, even though the second half had debt.

Long story short, the right house popped up right before DFA launched (which half of us knew about), and it was literally a dream come true for both halves. Did one half really need DFA? No, they didn’t. Didn’t even know they wanted a house until after. But the other half, I believe, was the intended target. So it all worked out, pretty much.

Wait, was that only half the story? Thank you for sharing. I really appreciate hearing, and I want to say congratulations to both of you. It’s nice when things line up like that. Thanks for taking the time to share. Best wishes.

Thank you for sharing. I really appreciate hearing, and I want to say congratulations to both of you. It’s nice when things line up like that. Thanks for taking the time to share. Best wishes.