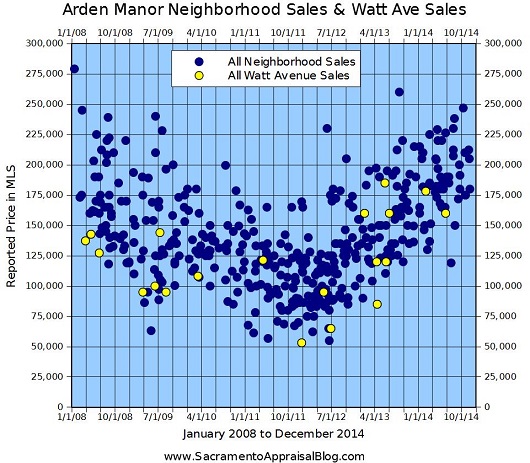

How does a location on a busy street impact value? It’s sometimes easy to think a busy street might have only a minimal effect on value of $5,000 to $10,000, but it can actually be quite significant. Let’s take a look at the Arden Manor neighborhood in Sacramento for reference. What do sales on Watt Avenue, a busy 4-lane street, sell for compared to the rest of the neighborhood?

What do you see when looking at sales over the past ten years?

The best way to determine an exact value adjustment for sales on Watt Avenue is to compare similar sales on Watt Avenue to similar sales in other parts of the neighborhood. For instance, if a 1081 sq ft model sold on Watt Avenue, how much did a competitive model sell for on a more standard street without an adverse location? When we find a few data points like that, we can begin to get a sense of a percentage adjustment. However, let’s make some general observations so this doesn’t end up being an exhaustive blog post.

Observations about Value on Watt Avenue:

- Sales on Watt Avenue tend to sell at the bottom of the market unless they are updated.

- Even when properties on Watt Avenue are upgraded, they don’t sell at the top of the market. You might see the one sale in 2005 though that closed at $385,000. I’m not sure how that happened, but I will say this same property actually just sold the day after I made this graph for $155,000 (not at the top of the market).

- If an appraiser or agent adjusted $5,000 for the location difference, do you think that would be enough? Would you only pay $5,000 for the difference? That’s probably not very close, right? For instance, currently there is a renovated listing on Watt Avenue at $169,000, while other competitive sales on standards streets have closed on the lower end at $180,000, but mostly between $200,000 to $212,000. This means a quick conservative adjustment would be closer to $10,000 (6%), but otherwise there are quite a few sales that sold for $30,000+ more (15-20% easily). A reasonable adjustment could only be narrowed down with research, but at face glance $5,000 doesn’t look like it cuts the mustard so to speak.

The houses literally across the street: Arden Park

The interesting thing about Watt Avenue is that the Arden Manor neighborhood on one side of the street has profoundly different values compared to Arden Park that is literally on the other side of the street. For the most part it looks like there is a difference of close to $100-150K, right? Some properties have sold at similar levels of course, and we have to consider the impact of low-ball bank-owned sales and/or aggressively priced short sales in 2010-2012, but otherwise the value difference is striking.

Things to Remember About Location Adjustments:

- The best way to find out how much a busy street (or any adverse location) is worth is to start comparing sales on a busy street with other similar sales on standard streets.

- There is no adjustment that will work for every neighborhood because real estate adjustments are about location, location, and location.

- Location adjustments tend to get larger when a market is soft since buyers have their pick of properties, but when inventory is tight, adjustments might be smaller.

- If there are no recent sales on a busy street for comparison, go back in time to find older sales. What were those sales selling for at the time compared to other properties on streets with less traffic flow? Get a good sample too because having only one pair of sales isn’t enough to establish a solid adjustment.

Questions: How have you seen location impact value? Any further insight, questions, or stories to share?

If you liked this post, subscribe by email (or RSS). Thanks for being here.