I have two things on my mind today. Yesterday I had a conversation about appraisal waivers and “hybrid” appraisals, so I wanted to share my take. Then I have some new graphs to help tell the story of the foreclosure crisis.

APPRAISAL WAIVERS & “HYBRID” APPRAISALS:

Here’s a Q&A with with Scott Short on appraisal waivers and “hybrid” appraisals. I get things changing for appraisers in light of big data, but diminishing the role appraisers play seems like a bad idea for the housing market. Watch here. If you want to just hear the “hybrid” part, it’s at 7:12.

By the way, a local appraiser named Barry Cleverdon had an accident a few weeks ago and is currently in a coma. Here is Barry’s GoFundMe.

THE FORECLOSURE CRISIS:

1) Healing: The foreclosure rate in the United States is way down. I would guess most markets have essentially healed. In Sacramento County ten years ago 84% of sales were distressed and now that number is less than 2% when considering both short sales and bank-owned sales (REOs).

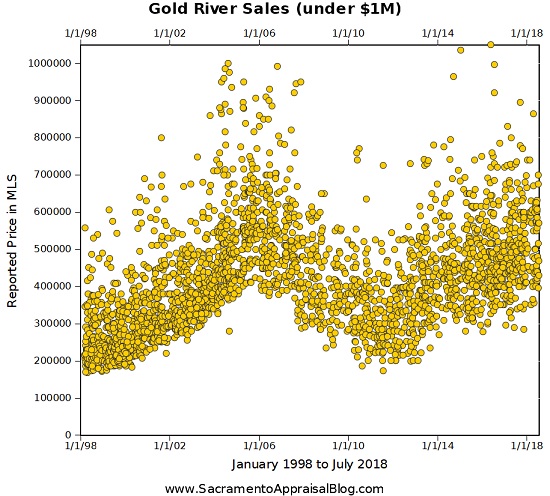

2) Not the same in every neighborhood: When it comes to distressed sales, some areas and price ranges did better than others as you can see below. This reminds us the market doesn’t experience the same exact trend everywhere.

3) The power of equity: Areas with more equity and higher prices tended to fare better with the number of distressed sales. I know that’s what we’d expect to see, but it’s interesting to actually see it. It’s amazing how equity (and probably better jobs) can create opportunity and even help people weather a storm.

4) The promise of a new wave: Many have promised a new wave of foreclosures, but we just haven’t seen it. I hear things like, “Dude, there are so many Notice of Defaults right now.” That may be true, but not all of these NODs end up hitting the market. Or if they do go into foreclosure they may likely be sold on the court steps before MLS.

Two weeks ago I asked friends on LinkedIn which areas they wanted to see, and that’s how this post was born. I didn’t get to everywhere, but I got to most areas.

MAKE GRAPHS LIKE THIS: If you want to know how to make a graph like this, here’s a tutorial for how to put a few different layers of data on one graph.

BLOG BASH: Just a reminder my wife and I are hosting a party at Yolo Brewing on Saturday March 2nd. It’s an excuse to get together and you’re invited. It’s okay if we’ve never met too. I’ll be buying the first 100 beers. Details here.

Questions: What do you think of appraisal waivers and “hybrid” appraisals? What stands out to you most in the images above?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

While initially some of her stats seem startling, I do think she is right that trees add to the overall value of a property. This doesn’t mean a house is automatically worth 2 or 9% more due to having the tree set-up she mentioned, but trees generally do yield a value contribution. In an objective sense, trees add worth due to boosting energy efficiency due to shade, while there is also a subjective element where they tend to increase curb appeal among buyers. It’s hard to ignore that some of the most highly priced and sought-after streets in the Sacramento area are lined with enormous trees. Think the Fabulous 40s, Curtis Park, Land Park or Arden Park to name just a few. Granted, these streets typically have very large and well-maintained houses too, but there is no mistaking that a canopy of mature trees stretching along a particular street tends to give a very positive impression to buyers in the market for that street in comparison to others. Agree? Disagree?

While initially some of her stats seem startling, I do think she is right that trees add to the overall value of a property. This doesn’t mean a house is automatically worth 2 or 9% more due to having the tree set-up she mentioned, but trees generally do yield a value contribution. In an objective sense, trees add worth due to boosting energy efficiency due to shade, while there is also a subjective element where they tend to increase curb appeal among buyers. It’s hard to ignore that some of the most highly priced and sought-after streets in the Sacramento area are lined with enormous trees. Think the Fabulous 40s, Curtis Park, Land Park or Arden Park to name just a few. Granted, these streets typically have very large and well-maintained houses too, but there is no mistaking that a canopy of mature trees stretching along a particular street tends to give a very positive impression to buyers in the market for that street in comparison to others. Agree? Disagree?