Did you like math class as a kid? Or were you more of a literary buff or science geek? I was the type of kid who had a love-hate relationship with math depending on what we were learning and who my teacher was. Honestly though, I often wondered then how numbers or theories could really be used in the real world.

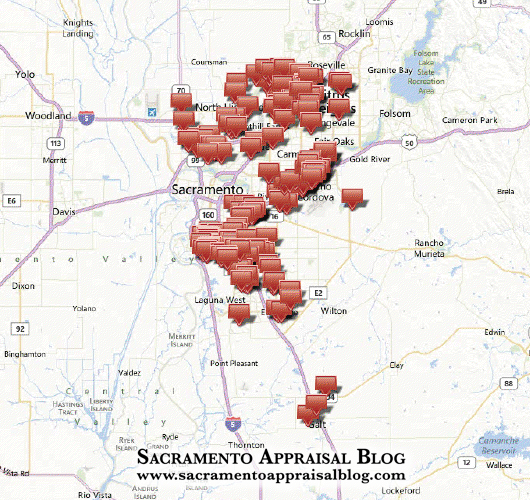

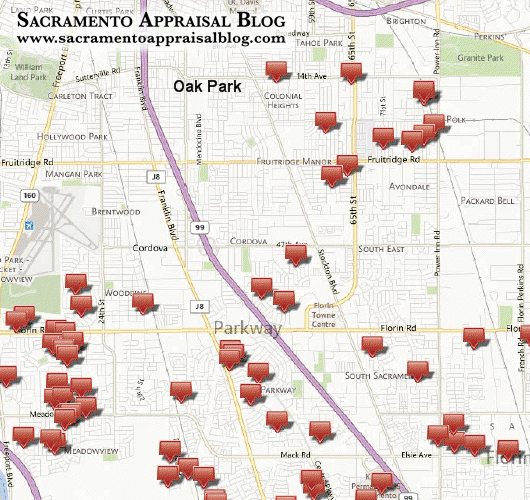

Today let’s look at some stats that are bound to leave an impression – even if you don’t like numbers. Let’s check out the amount of cash in the Sacramento real estate market under $200,000.

Did you know that 50% of all sales in Sacramento County under $200,000 have been cash purchases for about eight months now? How does that strike you? If you’re like most people when hearing numbers like this, it’s astounding. This is only for detached units too. When we include condos and attached units in this figure, we see the percentage increase to 53.12%. Sacramento County has a much stronger cash presence than Placer and Yolo County. For reference, there were thousands of sales under $200,000 in Sacramento County over the past 60 days, but only 80 in Placer County (so take Placer County stats over these past two months with a grain of salt).

The turning point in terms of cash purchases really began in early 2012 as news of the bottom of the market hit and foreclosures began to dry up. But then it went to a whole different level when investors like the private equity fund Blackstone made a very strong entrance in August 2012 by purchasing over 1100 properties in eight months in Sacramento County.

Why does the $200,000 price level matter? This is important because the median sales price is barely above $200,000 in Sacramento County. Remember, the median price is the one in the middle, which essentially means half the sales in the county are above $200,000 while the other half of sales are below that level. Since cash purchases are basically driving the market under $200,000, it tends to have an impact on the entire market by boosting overall numbers. Additionally, one of the byproducts of enormous cash percentages is a decline in FHA loans, which makes it more challenging for many would-be owner occupants.

Question: Did you like math as a kid? How do these numbers strike you? Share them with someone today to see what type of response you get.

If you liked this post, subscribe by email (or RSS). Thanks for being here.