The market is cooling, and that’s normal to see at this time of year. Yet beyond the expected chill of the season, the market as a whole is still clearly slowing down to become a buyer’s market. Let’s take a quick look today at real estate trends in Sacramento County so we can better understand what values are doing, and how to talk to clients about the market (don’t miss my 5 tips at the bottom). I’ll have a post on Tuesday to discuss the regional market and Placer County. Remember, you can use some of the graphs in your marketing too (see my sharing policy).

Two ways to read this post:

- Scan the talking points and graphs quickly.

- Grab a cup of coffee and spend a few minutes digesting what is here.

(I was getting spam from the form, so email me)

1) The median price dipped about 2% last month:

The median price declined from $270,000 to $265,000 from October to November in Sacramento County. Remember, it’s normal to see prices cool during this season, and the graph below helps illustrate that. Yet at the same time the overall market is definitely slowing regardless of the season.

2) The median price is 33% lower than it was at the TOP of the market:

Let’s get some context. The median price hit its peak in Sacramento County in August 2005 at $395,000, and now it’s about 33% lower at $265,000. It’s hard to imagine prices were that high, but at the time buyers were willing to buy at those levels.

3) Prices overall are softening

It’s important to look not just at the median price, but other metrics such as average price per sq ft and average sales price. This helps us get a stronger sense of the trends of the market so we don’t put too much weight on one metric.

4) Inventory increased to 2.75 months last month.

Housing inventory increased from 2.47 months to 2.75 months from October to November. This seems like a dramatic increase, but remember that inventory is the relationship between the number of sales last month and the number of current listings. Sales volume was REALLY low last month, so it’s natural to see inventory see an uptick. Having 2.75 months of housing inventory means there are 2.75 months worth of houses for sale right now (active listings).

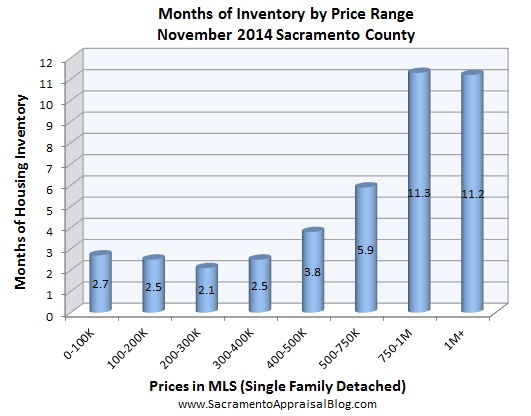

Generally speaking, the higher the price, the more inventory there is. Knowing what the market is doing at various price ranges can help us better market or value properties. The market doesn’t behave the same at every price level.

Generally speaking, the higher the price, the more inventory there is. Knowing what the market is doing at various price ranges can help us better market or value properties. The market doesn’t behave the same at every price level.

BIG POINT: The market has ultimately become much more sensitive to increases in inventory in recent years, so what happens with inventory in coming months will help set the stage for next year.

5) Sales volume was sluggish in November (lowest November in 7 years):

We had a slow November. In fact, sales volume in November hasn’t been this low since November 2007. Granted, volume this year was only down by 4% from November 2013, but it’s still important to note when volume is sluggish.

Remember that sales volume always declines in the Fall months. This is part of the normal real estate cycle, and we see this every year. However, the decline in sales volume was slightly higher this past month than normal. Volume usually declines by about 15% from October to November, but this year was 22%. This isn’t something to write home about because it’s only one month of data. It’s simply important to explain what happened.

6) Cash sales are down 40% in Sacramento County in 2014:

Sales volume is down by 8.5% in 2014 compared with 2013. When we break down the numbers in Sacramento County, this means there have essentially been 1336 less sales this year compared to last year. The chief culprit in lower sales volume is the fact of 40% less cash sales in 2014 compared to 2013. Cash sales represented only 17% of all sales last month, which is far lower than 36% of all sales less than two years ago. This is great news for conventional, VA, and FHA buyers in that there is now more space to get into contract. Furthermore, non-cash sales are about 4% higher in volume this year compared to last year, which is also good news.

7) FHA sales were 25% of all sales last month (buyers are gaining power):

The market is still fairly competitive out there, especially for well-priced listings in good condition, but overall buyers continue to gain an edge in the market. One out of ever four buyers in Sacramento County last month used FHA financing. As you can see in the graph above, as cash declines, FHA has increased (conventional and VA are also increasing). Moreover, the market used to be about 33% FHA, so there is still some room for FHA to take an even greater share of the market.

8) It’s taking an average of 45 days to sell a house in Sacramento:

It took an average of 45 days to sell a home in Sacramento County last month (that’s the same as the previous month). As you can see above, the market doesn’t behave the same in every price range. Generally speaking, the higher the price, the longer it takes to sell. There were only 5 sales above $1M last month, and they sold very quickly. For reference, current listings above $1M have been on the market for an average of 119 days. Take stats below $100K and above $1M with a grain of salt since data is limited in both price segments.

9) Distressed sales are only 5% of the entire market:

The market hit bottom in early 2012, and since then both REO sales (bank-owned) and short sales have seen a dramatic decline. The market simply is not driven by distressed sales any longer. In fact, only 5% of all sales last month were REOs and 6% were short sales. Investors did a great job buying up the distressed market over the past couple of years, and banks have likely done a better job with loan modifications too. Some say there is a “foreclosure wave” coming, but friends, people have been saying that for 6 years. When looking at the stats, there is a slight uptick in foreclosures this year in terms of volume, but it’s more like a rain drop rather than a wave.

10) There are many layers to the housing market

These are some of my favorite graphs because they help show that the market is made up of many layers. Housing trends are never just about supply and demand, but interest rates, the job market, cash investors, the economy, buyer confidence, availability of financing, etc…

Conclusion: The market is experiencing a normal Fall seasonal dip, yet at the same time the market as a whole is definitely cooling. Interest rates have seen a decline lately, which helps buyers gain more power in the market to a certain extent, but increasing inventory is the trump card in that higher inventory carries the most weight to drive values these days in Sacramento.

5 Quick Tips for Real Estate Agents:

- Price Correctly: Houses that are priced right are selling, but overpriced homes are sitting. The market is still very price sensitive, meaning buyers will pull the trigger quickly when the price is right.

- Current Listings: Remember to price according to the most current listings that are actually getting into contract. Of course you’ll want to pay attention to sales, but remember that sales are historical documents in that they tell us what the market used to be like whenever the sales got into contract. Today’s market might have softer prices compared to six months ago, so that’s why current pendings (and listings) can sometimes help give us a better temperature of what the market is like right now.

- Concessions & Credits: As inventory increases, buyers in some price ranges are going to be asking sellers for more credits for repairs and/or concessions in the purchase price. Preparing your sellers for this reality is important. Also, remember to be cautious about padding the price with concessions beyond what it can appraise for.

- Know FHA Standards: One in four sales were FHA last month, so it makes it all the more important to be in tune with what it takes for a property to meet minimum FHA appraisal standards. On a side note, if you do not know where a carbon monoxide detector should be installed, read here.

- Being a “Short Sale Specialist”: There are still short sales happening, but keep in mind only 6% of all sales last month were short sales (which translates to 64 short sales in November in the entire county). It’s still somewhat relevant for your website and business card to say “Short Sale Specialist”, but keep in mind there are lots of agents out there to service this limited pool of sellers. Consider marketing to sellers who have equity again and to buyers who went through a foreclosure or short sale several years ago and can now re-enter the market (these buyers are called “Boomerang Buyers”).

I hope this was helpful. Thank you so much for being here.

Sharing Trends with your Clients? If you want to share graphs online or in your newsletter, please see my sharing policy. Thank you for sharing.

Questions: How else would you describe the market? What are you seeing out there?

If you liked this post, subscribe by email (or RSS). Thanks for being here.