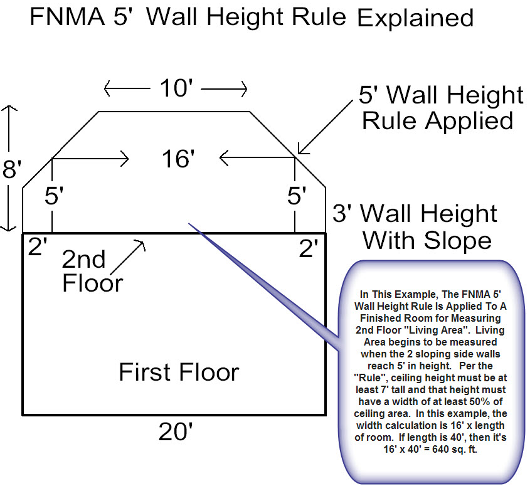

Do you know about the 5-foot rule for calculating square footage? This rule really matters. According to Fannie Mae standards for measuring the living area in a house, any portion of a wall under five feet in height cannot be included as living area. This is very relevant to understand especially for converted attics and second stories in places like East Sacramento, Midtown and Land Park where upstairs walls are often not 90 degrees like most standard tract homes.

In the image below from my friend Bill Cobb, we see two portions on the outer edge of the upstairs of a house where the ceiling height is less than five feet (see video explanation here). This extra area is best considered “building area” and not “living area” due to Fannie Mae / ANSI guidelines. The square footage is calculated based on 16′ x 40′ (640 sq ft), but if the entire second story (regardless of wall height) was used, the square footage would be measured incorrectly at 800 sq ft (20′ x 40′). That’s an error of 160 sq ft. Can you see how misunderstanding this rule might result in overpaying or falsely marketing or measuring a property?

Here are some photos of areas that would need to take the 5-foot height rule into consideration. I hope these images and the explanation above helps to explain the importance of this concept. Any thoughts or insight?

If you have any real estate appraisal, consulting, or property tax appeal needs in the Greater Sacramento Region, contact me at 916.595.3735, by email, on our appraiser website or via Facebook.

Fantastic reminder, thanks! In my upper attic, if I ever finished it, I would take that angled wall and make a low cabinet storage out of the extra low edge space that could not go to 5′ height for this exact reason!

Thanks. That sounds like a good plan for you to do. I only wish I had attic space to make that happen (ours is tiny).

Great info! I have a room with exactly that shape, and a lot of homes here in NW Austin do, too.

Thanks, Alison.

Great post Ryan. I don’t think many of those in the real estate business are aware of this.

Thank you, Michael. I hope this will be a good resource. I agree that many RE folks out there may not know about this.

Great info. Ryan, I am passing this along to my Realtor friends. I don’t think many understand exactly what is counted and what is not.

Thanks so much, Tom. I appreciate it.

Great info. Thanks Ryan!

Thanks so much Beth. Glad it was useful. 🙂

Ok, so if taxes are paid on the “floor area” and listed as such on the public records; how can you discriminate on value based on the 5 foot rule. I have seen many frivolous litigation cases and if fanne Mae is lending based on five foot rules on a refinance, however you paid based on the “floor space” this raises a few questions .

1. Is the county or city collecting taxes on the unusable five foot area? If so do they owe a refund ?

2. What if the buyer is only 4.8 inches , there are millions of adults this size, and another buyer is 6’6″ tall. Do we now have two values?

There should be no variance or subjective opinion on measurements. I am not litigious but based on your comments I have been getting ripped off from the county on our “a” frame cabin … Not to mention the fact that 19 years ago I paid based on value listed on county records that show the higher square footage.

Leave it to government agencies to establish rules that result in permit fees based on floor space , yet fanne Mae lends only on “subjective” math; i am venting as we are dealing with this now on a refinance.

Numbers never lie, one rule should apply here. The a frame cabin owners are being discriminated against .

Thanks for the comment, Ryan. There could definitely be a difference between how the Assessor views the property and how Fannie Mae views the property. The same standards may not apply in both cases since Fannie Mae deals with loans and an Assessor deals with taxes. The area under 5 ft would technically be considered as Gross Building Area. It is definitely still space that can be used for something and may contribute to the value of your home, despite probably not being included in the appraisal as living area. Thus I can understand why an Assessor would tax based on it. After all, if the Assessor came over, they’d probably see you are using the space for something. At the same time I completely understand what you are saying about the area being included as full living space. I would be curious to hear whether in your market all properties like yours are listed in Tax Records based on the building area or living area (I’m guessing building area, which includes all space from the very edge of the property). If it’s there, you’ll be assessed on it. That is the motto of the Assessor. Now whether anyone owes you a refund is something I do not know. I would encourage you to talk with the Assessor to see how they are handling your situation. If there is a square footage discrepancy, maybe you can get it fixed, and then your taxes can be adjusted. Otherwise if the Assessor measures every house like this from the outside, there is probably no argument. A buyer that is 4’8″ would enjoy that space more. You’re right about that. My own kids would like the space. This just shows there is some use for the space, but it is ultimately not deemed living space according to ANSI standards. From a value perspective it doesn’t mean the extra area is useless either. I know I would rather have the area than not in a home, and I would pay more to have it there. I bring this up because the Assessor may view the property like this too. It’s not like the space has no use or value. It does. Thanks again Ryan. If you need anything else, chime in.