I mentioned last week how hedge funds have been a dominant force in the Sacramento market. THR California LLC (Blackstone) in particular bought nearly 3% of Sacramento County sales on MLS since August 2012. They are buying on MLS and on the court steps, and they’ve purchased 198 properties so far over these past few months.

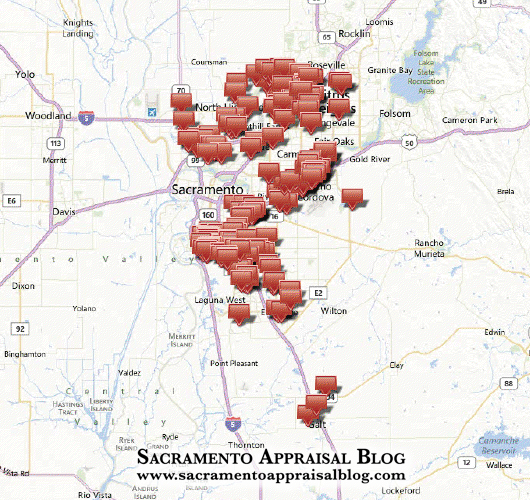

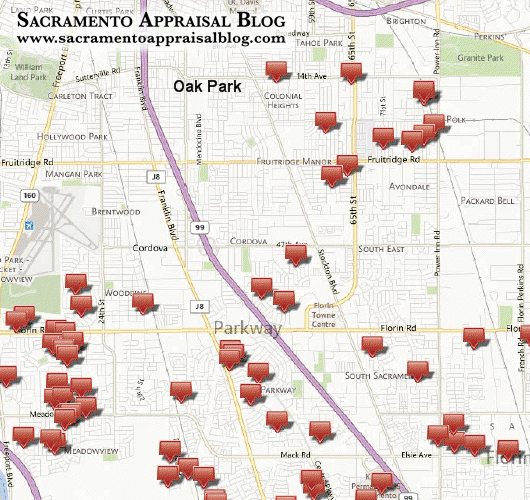

Where is Blackstone buying? This is good to keep in mind if you or your clients are also competing for properties in these neighborhoods. Also, there will be more rentals in these areas in coming time, which will be an important trend to watch.

The map above shows all sales purchased by Blackstone in Sacramento County since August 2012.

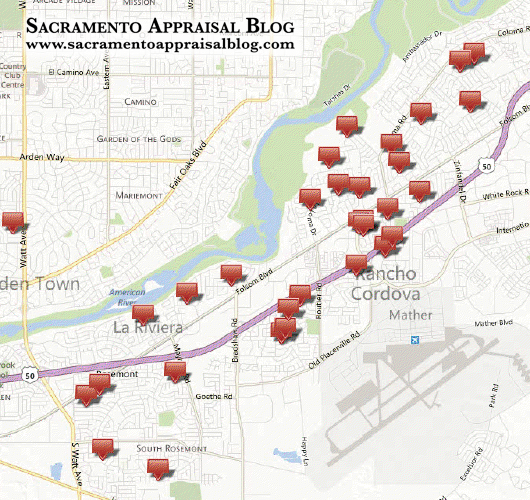

The map above shows all sales in the Rosemont area as well as Rancho Cordova (there was only one sale in Anatolia). There is very little activity in the Arden-Arcade area and only three sales in Carmichael and one in Fair Oaks.

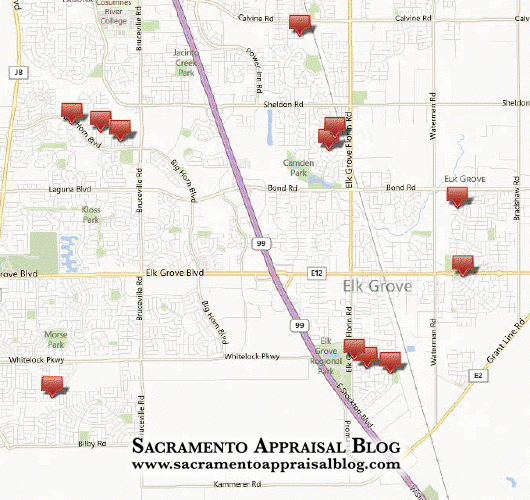

Mostly all purchases in Elk Grove were under $200,000, though some were closer to $250,000 and one slightly over $300,000.

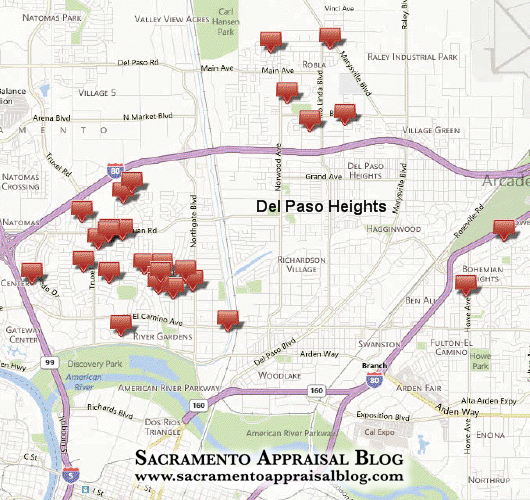

Blackstone appears to be avoiding Del Paso Heights entirely, but they are definitely buying in older Natomas (there are very few sales in newer Natomas).

Oak Park has also apparently not been a target for Blackstone so far. They are buying in Tahoe Park and throughout South Sacramento and Meadowview though.

Summary of Buying Philosophy (my opinion): Ultimately it seems the target property for Blackstone has been under $200,000 for the most part and in neighborhoods that generally have more stability. Many of the areas they are targeting are places very ripe for first-time buyers. The “move-up” more established areas like East Sacramento, Curtis Park and Land Park are being avoided completely. For further reference, THR California LLC (Blackstone) has 5 purchases in Yolo County, 7 in Placer County, 8 in San Joaquin County and 26 in Solano County (zero in El Dorado County).

UPDATE on 11/20/2012: Here is a Blackstone video shared on YouTube over the past week.

What else do you see? I’d love to hear your thoughts below.

If you have any questions or Sacramento home appraisal or property tax appeal needs, let’s connect by phone 916-595-3735, email, Twitter, subscribe to posts by email (or RSS) or “like” my page on Facebook

Spectacular display of information and a great mapping app! I’ve scoured each of these neighborhoods for flip candidates for investors. Prices in these neighborhoods are particularly sensitive to the economy.

Thank you so much Jeff. It’s so good to know what is happening in the market. I always appreciate you stories and experience. You know the market well.

Great research! Where did you access that info? MLS? Big money buying up homes like this is a tell tale sign that real estate a great investment.

Thanks Brad. The data is from Tax Records (Realist). I’ve been talking with quite a few investor contacts about this lately. I first noticed a flood of purchases by THR a couple months ago and began wondering what was going on, so I started paying closer attention, crunching numbers and talking with clients and investor friends. The Sac Bee is coming out with a story in the next few days about Blackstone. I’ll be curious to read what they say. Thanks again.

I wonder who the big investors are in my area (Inland Empire) buying up homes. I think I read 40-50% of all purchases are from investors…all cash. Maybe I can connect with an agent or appraiser to do some research for me in my area.

If you find out, let me know. I’d be curious to hear. I’ve heard of another fund that supposedly has plans for Sacramento, but I’ve yet to personally see any one name on title over and over again like THR. Ironcially, I just got a phone call from an agent in SoCal (in the 714) wanting to find out more about Blackstone. He’s says his listings have been inundated by multiple agents offering on the same property (but using the same funding source – Blackstone). These are interesting times.

Ryan,

Great Article, thanks for the imput. I am a realtor in Thousand Oaks and here is their data here in Ventura County. We have no inventory but not b/c of Blackstone.

http://www.vcstar.com/news/2013/jan/25/big-investment-firm-continues-to-buy-homes-in/

http://www.reuters.com/article/2012/05/10/us-financial-calpers-blackstone-idUSBRE84902H20120510

Thanks Perry. I appreciate you sharing the article too. It’s amazing how many properties they are buying (and how many different locations too).

Hi Ryan,

Here is another one from Vegas naming some of the local players they are teaming up with. As an investor I am going to keep my eye on when they stop buying.

Perry

There is no link, Perry.

Oops, here it is:

http://www.bloomberg.com/news/2012-07-03/blackstone-makes-foray-into-houses-for-rent-mortgages.html

Thanks Perry. I appreciate it.

The flowery video by Blackstone is not the observation I have of what is occurring in the Sacramento Region as I drive from place to place trying to buy a home. What I see is they often buy short sale properties that need little or no fixing up offering cash far higher than listed price thus making it near impossible for home buyers to get a foot in the door! In the long run this will hurt the economy because home buyers spend money remodeling and upgrading while tenants have no interest in doing anything but living in the place at best or at worst tearing them up creating a burden on government services such as Police, Fire, Code Enforcement and Building Inspection.

The video is definitely one-sided Lawrence. There is an element where they are right in that if they are fixing up houses, it can be a good thing. However, one of the most significant downfalls not mentioned is that it would be better to see more owner occupants (good ones) in properties that a private equity fund owning hundreds upon hundreds of newly purchased properties (they own over 1000 in Sacramento right now).

I just ran some stats yesterday and shared that roughly 50% of all sales under $200K so far in 2013 are cash deals. The market is definitely saturated with investors, which has made it very difficult for prospective owners trying to buy at lower price levels. Lawrence, I hope you find something soon. Thanks for the comment. It’s a fight out there.

The key is that such cash sales run up price, but not value. Cash sales from investors and folks moving from high-priced areas like San Francisco outbid many of the local buyers in 2002-2008. That is what we saw before the bubble.

When the median price is higher than the median income affordability, there begins another bubble. The Sacramento region’s economy cannot sustain another real estate bubble in such a short period. Incomes are not as elastic. These cash-flush investors are not a part of the local economy and could care less. They will just move to another location.

Thanks Jeffrey. I agree 100% when you say, “These cash-flush investors are not a part of the local economy and could care less. They will just move to another location.” That’s the truth.

I would say though while cash sales run up prices, there is still a relationship between price and value. Buyers really are willing to pay more because it is worth it to them (value). Even though the market may be artificial in some senses for why it is increasing, it is very real to buyers still to spend more because they think it’s worth it.

It seems high-volume cash purchases, low inventory and historically low interest rates are the perfect storm for driving up prices in the market. Like you, I have concerns about the stability of the market and affordability factor. If interest rates weren’t so low, buyers would be hard-pressed to be buying properties at such high levels.

We shall see how it pans out.

THR California, LLC as a Delaware limited liability corporation is not listed on the Delaware Secretary of State as an existing entity. There is THR LLC, a Calif. limited liability, and THR California, LP a limited partnership…but no THR California LLC…a Delaware limited liability corporation. So how can any of these purchases at trustee sales be valid?

Hi Simonee. Thanks for the comment. I’m not sure how to answer your question since that’s not my specialty. All I know is I see purchases in Tax Records as “THR California LLC” and “THR California LP”. Additionally, THR/Blackstone is also using “IH2 Property West LP” (“IH” stands for Invitation Homes). The IH2 LP is expected to show up more and more in the local market, so it’ll be important to watch.

Ryan, IH2 lp in IL. is making offers automatically on new listings. I am supposed to close on one tomorrow. The selling agent says it is a group of investors and cannot give me any contact information. I would love a shot at representing them. I cannot find them through a google search. Can you help me please?

Sincerely,

Mary Rooney

Counselor Realty

Spring Lake Park MN

763-786-0600.

Hi Mary. Thanks so much for the comment. Its really not all that easy to connect with them. The best way would be to find out who is running their local office. They are probably called Invitation Homes or THR. The guys running things out in my area are only focused on the Sacramento area. They are buying for Blackstone.

Great writeup! I have heard of a number of these offers coming through recently, many of which were significantly under the asking price of a listing, but recently being very close.

As the offer is a little unconventional, I naturally did some research and while their history has been in distressed, there does appear to be a trend into the “executive” properties that may have minimal capital investement required after the purchase.

The whole process seems to be quite hush-hush which causes some uncertainty (10 day inspection period, multiple “inspections”, etc.

Should know in the next day or so if it will continue going forward on an existing offer as the inspections were finished this weekend.

Thanks Jeff. I’m always open to hearing what others are seeing in the market. Keep me posted with what you are seeing. Take care.