Slow. Flat. Price sensitive. Competitive if priced correctly. These are words that describe the Sacramento real estate market. Some consumers may not be in tune with this reality because last they heard the market was “on fire”, but those in the trenches of the industry know the real estate train is slowing down. Let’s take a look at ten quick talking points to help explain how the market is unfolding and why it is moving the way it is. I hope this is helpful for you and your clients.

Two ways to read this post:

- Scan the highlighted text and graphs quickly.

- Grab a cup of coffee and spend a few minutes digesting what is here.

1) The median price has been the same for three months in a row:

The market saw a normal seasonal uptick for the spring of 2014, but the median price has been flat now at $270,000 for three months in a row. Keep in mind that not every neighborhood and price segment in Sacramento are experiencing the same flat trend as shown above, though charts for surrounding counties do have a similar flatness. Remember too that real estate markets are constantly changing, so it’s not a surprise to see the market has been flat – especially as summer begins to fade away.

In the midst of a flat median price and average price per sq ft, the average sales price did see an uptick last month. If we were to isolate the average sales price, we’d say the market is increasing in value, but this is why it’s important to look at more than one metric. What are all the metrics saying together?

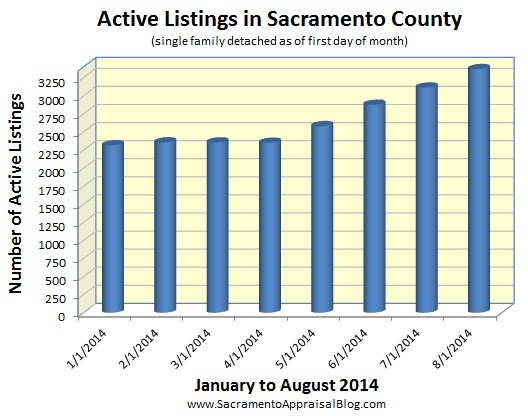

2) The number of listings is increasing (so are price reductions):

There were 8% more listings that hit the market in July. It’s normal to see more listings during the spring and summer, yet what is happening with these listings is the real story. Over the past two months in particular there have been increasingly more price reductions, which shows many properties are simply overpriced and that the market is getting soft. If inventory continues to increase, this trend of price reductions will likely persist since sellers will need to compete for a limited pool of buyers. This is important news for sellers because it underscores the need to price properties correctly. At the same time this is welcome news for buyers since they can be slightly more selective.

3) Inventory increased again last month and is now at 2.2 months:

Inventory increased again this past month and is now at 2.23 months of housing supply, which is about where it was when the market bottomed out in early 2012. This essentially means there are 2.23 months worth of houses for sale based on how many sales there were last month.

Inventory is increasing, and that is causing the market to slow down, but inventory is ultimately still fairly low. It is still a sellers’ market, but buyers are very noticeably gaining power. As you can see above, inventory is not the same at each price level. Generally speaking, the higher the price, the more houses there are for sale.

4) Sales volume is down 8% from last year but up from last month:

Sales volume in July 2014 is down 8% from July 2013. When looking at the past 90 days in 2014 compared to the same time last year, volume is down by 10%. In the Sacramento region, sales volume is about 11% lower. However, the good news is that sales volume increased from last month to this month, and has been increasing all year mostly (after a couple of very slow months to begin the year).

5) FHA sales were 25% of all sales in Sacramento County last month:

FHA has been making quite the comeback over the past year and has been filling some of the gap left by cash investors exiting the market. In fact, FHA sales represented 25% of all sales in Sacramento County last month and 32% of all sales under $200,000. We have not seen FHA percentages this high since 2012. Keep in mind FHA sales used to be 30% of all sales in Sacramento County between 2009 and 2011, so there is a precedent for FHA buyers being able to absorb even more of the market. As the market inches toward a buyers’ market, be sure you are familiar with FHA minimum property requirements.

6) There have been 40% less cash purchases in 2014 compared with 2013:

Cash investors drove the market for quite some time until they began to pull back just over one year ago. In fact, there have been about 40% less cash sales so far in 2014 compared to the same time period last year. When investors stopped buying it created a gap of sales, and over the past year the market has been trying to figure out how to respond to this gap. In other words, if we added in the number of extra cash sales from last year to this year’s total sales volume, we’d have a very similar number for both years. Remember, if cash volume was still as high as it was last year, inventory would be incredibly low, and the market would feel much like it did in early 2013.

7) It’s taking 37 days on average to sell a house:

On average it’s taking 37 days to sell a house in Sacramento County and 40 days in the Sacramento Region. Last month it was taking 35 days to sell a home in Sacramento County. When a property is priced correctly it will sell very quickly and even have multiple offers, but an overpriced property is going to sit on the market. Generally speaking, the higher the price, the longer it takes to sell. For further context, it was taking almost 90 days to sell a house just a few years ago.

8) Interest rates are hovering in the 4% range:

Interest rates took a very slight dip last month, and they’ve been hovering in the lower 4s all year. What happens with interest rates will impact affordability for buyers over the long haul, but very minor changes probably won’t impact the market like increases in housing inventory will. The Fed hasn’t given any indication they will raise rates aggressively since they know how fragile the housing market is these days. Remember that one of the reasons why values increased so rapidly these past two years was because interest rates went below 4% for the first time ever. You can see in the graph above how the Fed deliberately lowered rates when the recession hit in 2008.

9) Today’s market is being driven by other factors compared to 2013:

Part of being in tune with real estate or becoming a local expert (for agents and appraisers) is being able to explain how the market is moving and why the market is moving. The real estate market has many “layers” that impact value, and the key factors that were driving the market in early 2013 were cash investors, interest rates in the 3s, and a housing supply of less than one month. Now the “layers” of the market have shifted where inventory is over 2.2 months, interest rates are in the 4s, cash is now at a normal level (about 20% of sales), and the local economy is bound to be a bigger player in shaping the real estate market. While our economy seems to be slowly improving, it’s still not easy to get a job.

The unemployment rate in Sacramento County and California have both been declining, but take the jobless rate with a grain of salt when you see it on graphs like the ones above. An improving job market does help real estate values, and it’s important to watch over time, but since there are essentially less people participating in today’s job market, it’s only natural to see unemployment decline.

10) The median price is 32% lower from the peak in 2005:

Lastly, in case you needed some market trivia to impress your friends or you’re playing a game of real estate Jeopardy, the current median price in Sacramento County is about 32% lower than the peak in 2005. At times the real estate community is fixated on comparing current values with the previous peak of the market, and sometimes we even hear conversations about values getting back to those levels. But let’s remember how unaffordable and unsustainable that market was at the time. At the same time there is surely value in knowing the peak of the market and how far we’ve come since then, but ultimately what the house is worth right now is probably more valuable for current sellers and buyers.

Summary: After a typical seasonal uptick during the spring, the market has definitely changed over the past few months and is showing clear signs of slowing down. We are seeing this change show up with properties taking longer to sell, a flat median price, an increase of price reductions, higher inventory, more credits from sellers to buyers, and generally buyers starting to feel like they have more power to negotiate. The market is still competitive because inventory is still low, but it is extremely price sensitive, which is seen with buyers being more picky. Keep in mind it is fairly normal to see the market slow down as summer fades away, though the slowness seemed to slow up a bit sooner than usual this year, which means it will be interesting to see how this trend unfolds in coming months.

Sharing Trends with your Clients? If you want to share graphs online or in your newsletter, please see my sharing policy. Thank you for sharing.

Questions: How else would you describe the market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Nice breakdown of the market Ryan. It’s very important for everyone but especially real estate agents to know what is driving the market and its impact on the list price of a home. If you price it with last years market characteristics then that could adversely affect the ability to sell the home, however by being on top of things you can effectively list and sell a home. Thanks for sharing what’s going on in your part of the country.

Thanks so much Tom. Very well said too. Markets are always changing, so we always have to watch the trends and really pay attention.

A bit long for a blog post but otherwise very nice. This sort of thing will go a long way towards establishing or reinforcing your credibility as a respected local resource. I was just about to start something similar for my area of the country so thanks for the template. Keep it up!

Thanks so much Mike. Yes, it is definitely long, which is why I try to break it up with talking points so it can be scanned. I wouldn’t recommend a blog post to ever be this long actually. I could break it up into multiple posts, but I try to post no more than twice a week, so multiple posts would just mess up that rhythm. I’m hoping people can either know this post is insanely long each month, and they’ll just embrace it, or at worst they can scan it. The good thing is this post is often one of the top posts each month from a stats perspective. I see on my Facebook page yesterday that it was shared eleven times too. My post on Thursday will be the same. About the second or so week of the month this is what happens though. Long but stellar market updates overtake my blog.

I’m hoping people can either know this post is insanely long each month, and they’ll just embrace it, or at worst they can scan it. The good thing is this post is often one of the top posts each month from a stats perspective. I see on my Facebook page yesterday that it was shared eleven times too. My post on Thursday will be the same. About the second or so week of the month this is what happens though. Long but stellar market updates overtake my blog.

I hope you do start something. Let me know when you do. I’d love to read it.