It’s the big question right now. Will buyers put their foot back on the gas pedal or will they continue to put on the brakes? For the past couple quarters in many markets around the country buyers seemed to show some resistance to prices and back off the market a bit. So we saw more sluggish sales volume, and now we’re wondering if it’s going to continue into the new year. I have a few quick thoughts and then there’s a big monthly market update for those interested.

What will buyers do in 2019?

1) We need time: Just like a dating relationship needs time to figure out where it’s heading, we need a little space to see where the market is going to go. In the next 30-90 days especially we should get a better understanding of the direction of the market.

2) Interest rates are a band-aid: Mortgage rates are declining again and that can be a steroid to help buyers jump back into the game. During the second half of last year there was a strong negative reaction to rate hikes, so we’ll see if lower rates today can create a similarly strong positive reaction to propel buyers back into the market. But let’s remember low rates are really just a band-aid on a gaping wound. What I mean is low rates offer a temporary solution to create more sales right now without making any dent in the huge issues of a housing shortage and affordability.

3) What to watch: I have a couple quick recommendations for what to watch over the next few months. First of all, know what is normal for the spring market. What normally happens to things like sales volume, inventory, prices, days on market, etc..? Knowing what is normal can help us spot what is not normal. Secondly, I recommend keeping a close eye on listings. Is the market absorbing inventory? Are properties getting into contract? And is the number of pending sales normal or not? Remember, if pendings are anemic today, in a couple of months these properties will close escrow and show up as anemic sales volume. So by watching listings and pendings today we can get an idea of what sales might be like in a couple of months.

I hope this was interesting or helpful.

—–——– Big local monthly market update (long on purpose) —–——–

There were two parts to the market in 2018. The first half of the year was fairly normal, but the second half definitely slumped. Here’s some things to consider right now.

There were two parts to the market in 2018. The first half of the year was fairly normal, but the second half definitely slumped. Here’s some things to consider right now.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

The Camp Fire and volume: Sales volume slumped 11% these past two quarters, but December was particularly sluggish. In fact, it was the worst December in volume since 2007. Furthermore, in 20 years we’ve only seen two lower Decembers in the Sacramento Region. On one hand we figured volume would be anemic for December because it’s been more sluggish for two quarters, but then it was painfully low (25% lower). In short, if this is the actual trend, it could be a big issue if we start to see volume slump each month by 20%+. It would be a sign the market is starting to change even more dramatically. However, there could be more to the story. Let’s not forget the devastating Camp Fire in November. I mention this because in Sacramento the smoke from this tragic fire was with us for two weeks or more, and many locals stayed indoors because of the unhealthy air quality. Thus this could have led to less pending sales in November, which in turn led to less closed sales in December. I’m not saying the fire is the culprit behind our dismal December, but I think we have to at least entertain it could have been a factor to a certain extent. Yet to be fair if we see other areas of California without any fire influence show a similar dip, then I’ll be the first to say the fire didn’t have any effect. For now I think it’s okay to keep it on the table as a possibility, but at the same time let’s not blame the fire for the trend of slumping volume.

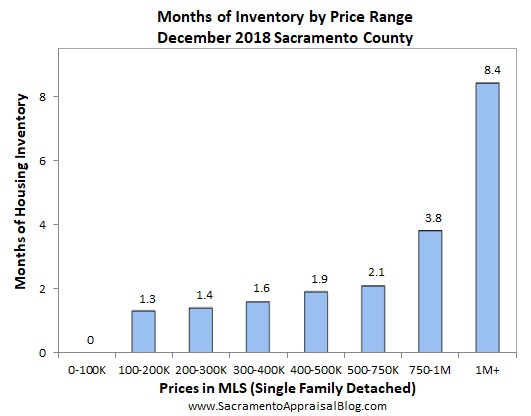

Slowing, blah, blah, blah: We’re all pretty tired of hearing words like softening, shifting, slowing, and slumping, but that’s the nature of the beast when the market changes. The trend graphs below show higher inventory, it took longer to sell these past few months, and prices sloughed as they normally do. Beyond sales volume being anemic, other metrics were fairly in line with what we’d expect to see during the fall. Though still we can easily say this fall was more dull than the past few years for sure.

Hiding behind hot annual stats: I posted some market recap images below and they’re glowing. When looking at annual stats most price metrics are up about 6-7%. Does that sound surprising since we’ve been talking so much about the market slowing? Here’s the deal. Annual stats are sexy, but when we look at the numbers over the past 3-6 months instead we see a much different trend. This just goes to show if we’re not careful we can end up hiding behind hot annual stats and missing a duller trend in front of us.

Less offers: Here’s an interesting way to see the market has changed. I know this is a bit obscure, but then again it’s a cool way to look at the market.

Momentum change: The rate of price changes has slowed lately. What I mean is in years past we’d regularly see 7-10% price increases when running stats, but over the past few months we’re starting to see only 3-6% increases instead. I talked about this recently, and fresh stats show this same trend.

Leftovers: Right now in early January we have a market of leftovers. The reality is lots of properties that didn’t sell during the fall are still on the market. Most of these homes are simply overpriced. If sellers only would’ve looked at similar sales and considered similar listings that are getting into contract it would’ve made all the difference. There are a decent number of pendings in most neighborhoods right now, but the pendings are priced right (and often in good condition).

Listen to the Listings: In case it’s useful I wrote an article in Comstock’s Magazine this month to talk about the importance of giving strong weight to listings. It’s not just about the sales.

I could write more, but let’s get visual instead.

BIG QUESTIONS:

1) 2018 RECAP: What did the market do last year? Here’s some recap images.

2) LAST YEAR VS THIS YEAR:

NOTE: Placer County had very few sales this December, so I wouldn’t put much weight at all on the price figures for this month. The median price actually increased quite a bit from November to December. My advice? Don’t read anything into this.

3) SALES VOLUME: It’s important to look at sales volume in a few ways to get the bigger picture. Here it is by month, quarter, and year. As an FYI, volume was down 11% during the second half of the year in the region.

SACRAMENTO COUNTY:

Key Stats:

- December volume down 24.9%

- 2018 volume down 3.4% (entire year)

SACRAMENTO REGION VOLUME:

Key Stats:

- December volume down 24.8%

- 2018 volume down 4.8% (entire year)

PLACER COUNTY VOLUME:

Key Stats:

- December volume down 19%

- 2018 volume down 6.9% (entire year)

4) SLOWING MOMENTUM: The stats show the market is slowing down when we look at the rate of change by year. Looking at monthly, quarterly, and annual numbers helps give a balanced view of things.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 70+ graphs: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: Do you think buyers are going to put their foot on the gas pedal or brake pedal in early 2019? What do you see happening in the market right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Great information Ryan. You’re right, the next 90 days will be telling. We are all watching and hoping for the best.

Thank you Gary. I appreciate. The waiting game has begun.

Getting rid of the archive and changing the download limit to 4000 is really handy, right?

I was sick for 3 weeks because of the fire so I think you have a good point about the December sales volume decline. The smoke in our region added to the ongoing volume decline.

Solid post as always.

Thanks Joe.

I’m really excited about the downloading. It will definitely save time.

For onlookers, Sacramento is about 80 miles from Paradise and the smoke here was so bad that it looked like a sepia filter all day long.

For any onlookers, here’s soome more depth about volume. One thing to remember is December volume is almost always higher than November volume in the Sacramento Region as a whole and Sacramento County. This is the normal rhythm of the market. For instance, out of the past 20 years in the region we’ve seen 17 years where December volume is higher. This is usually the case because there is one last rush on the market in October after the kids are in school, and then these pending sales from October close and end up padding stats in December. Anyway, it can definitely happen to see lower volume in December, but it’s also not the dominant pattern either. So here we are with a lower December. I’ll be curious to look at stats eventually for California to maybe gauge a little more what is happening here.

I’ll be closely watching what is going on around the country. The Birmingham area tends to lag behind so by tracking other areas we can know what is coming our way along with keeping an eye on the local stats.

Good for you Tom. I’m also watching markets across the country and listening to trends. It’s not always easy to get a straight answer about a market beyond a sensational headline, but I’m listening for stats and trying to capture the narrative. What’s happening with volume in particular? It’s interesting to hear Birmingham tends to lag behind. I think us folks in California like to be ahead of the trend…. I’m not sure if that’s good or bad.

Great market information Ryan! I appreciate the point that you made that an annual trend be very different than what more recent sales are doing. Great visuals as always!

Thank you Jamie. Yeah, that point has really struck me more lately when pulling stats and communicating them. If our view is too wide, we might miss the trend in front of us. And ironically if our view is too narrow, we might miss the trend too…

“Waiting and seeing” isn’t that fun. It’s better to consume data and historical trends and extrapolate that into where things are headed.

It’s amazing how one can develop a crystal ball by consuming data, having lots of experience, and knowing history.

This market has been moving in a pretty obvious direction to me for the past 8 – 12 months. I expect that to continue through 2019 and beyond.

Translation: Real estate prices are coming DOWN.

I don’t think waiting and consuming data are mutually exclusive. We consume data, develop opinions and ideas, and wait. The reality is there isn’t just one potential trend or outcome for the market in the future, so that’s exactly why we exhibit humility. It’s why there is no problem with waiting and seeing too. There are some huge factors to watch right now – particularly sales volume. I’m alarmed to see how low volume was last month. If this is due to the Camp Fire (a possibility), then so be it. If not, then that’s a sincere problem. No matter what though, the market has clearly changed over the past two quarters. We see it in the stats. But to be fair we still need a little more time to know exactly what this means for the new year since the market is in a holding state right now with limited activity in light of the time of year.

I will say if your crystal ball is so informed, tell me how much you think prices are going to come down this year. No pressure. But if you have specific predictions, I’m open to specifically hear them.

There is no way I could project the percentage declines that are coming, there are too many variables.

Conflating obvious market trends developing over the period of months/years with being able to predict specific percentage declines is intellectually dishonest.

I guess it’s a personal question for everyone. At what point do you feel comfortable arriving at the conclusion that a cyclical shift has occured? Does it need to be printed on a newspaper headline first?

It seems that it is popular in the RE community now to say ‘I don’t have a crystal ball.’ I’ve heard that so much lately from agents when others express their pessimism about where the RE market is heading. Ok fine, nobody has a ‘crystal ball.’

But when we are driving in a car we have headlights that illuminate the roadway in front of us. We see where we are going. There is an advantage in life to seeing where you are headed before you get there. There could be a hazard to avoid. Incidentally it is also required if one wishes to have any success investing. Every good investor has the ability to see trends developing before they hit the general public in the face.

The translation of (when used many realtors) that ‘they don’t have a crystal ball’ generally just means, ‘I don’t like what you’re saying about where the market is headed so I’m going to discount it by making an obvious statement about humans not being effective fortunetellers.

I disagree that ‘humility’ is for one to be without a sense of direction waiting until something is painfully obvious and generally accepted by all before accepting it themselves. One can have ‘humility’ and also have conviction that the sun is setting over a mountain, or that the sky is blue.

I think that’s fair. Some people might use “crystal ball” to mask market trends. I use it to express humility about not knowing the future. I will always use it in that way too. But I think you are right that we don’t have to wait to report trouble if we see it. In other words, I can recognize signs or symptoms of a breakup before the breakup happens….

This is exactly why I’ve begun to talk about the market as a slump instead of a slower season. I’m not ready to call this a correction yet as I want to see how 2019 unfolds. But I think it was obviously more than just a slow season.

I also agree that it is not complete settled fact yet. This spring/summer will cement the market direction. Although it is my contention that we have entered a cyclical Buyer’s market and prices will be dropping, there are lots of variables that could come into play and change that course. The future is unknown. But barring what I consider to almost be ‘acts of God,’ you can put a fork in this RE market for the foreseeable future.

Thanks. I like how you said that. It’s not a cemented fact. We’ve see a big change, and now we wait for the specifics.

Also the ‘Camp Fire’ as being a Black Swan event that is currently shaping this obvious cyclical shift to a Buyer’s Market is a very weak weak in my opinion.

One only needs to look at the national real estate market which for the most part is corporately seizing up right now to know that the Camp Fire is not to blame.

Weak ‘argument’ in my opinion.

Re-read what I said. I am not arguing the Camp Fire is behind weak volume. I am saying it is a possibility and we need to watch data to know for sure. I don’t know if you are in Sacramento still or not, but the smoke was really bad for weeks, so I cannot dismiss this as a possibility. This is critical thinking to consider all possible factors and influences that might be shaping the numbers. Like I said above, if the fire has nothing to do with a 25% slump, this is a really big deal. For context, when the housing bubble crash hit its stride at the end of 2005 and early 2006 we were seeing 20-30% volume slumps every month. Markets of course do not have to behave the same way over time since there is no such thing as a “bubble” formula or recipe, but this factoid is nonetheless on my mind as I watch data that are stunning.

I know you’re not suggesting the low volume is a direct result of the Camp Fire, but I think even trying to connect these two events is silly.

As I stated before the median sales price sank and sales volume cratered in Sonoma County following fires there too. If 5,000 units of housing stock getting vaporized did not result in any upward pressure on pricing then we know it was a non-factor. Also other cities across the US are experiencing 25% decreases in sales volume too because we are in a cyclical market shift right now. There were not Camp Fires in Seattle, Denver, Dallas Fort Worth, Florida markets, Salt Lake City, Vancouver, Sydney Australia…I could go on, you get the idea.

Yes I’m still in Sacramento and experience the awful smoke this summer. It was terrible, no disagreement there.

I respect that you are slow to the trigger in calling this market, that is fine, no judgement there. But I think in retrospect given the copious amounts of data you have you will look back and realize you could have called this one much sooner. And ultimately if you are one of the rare voices in RE making calls before things happen (seeing the relationship breakup coming based on the signs) then I think that has more value than making Monday morning QB calls. I’m not saying you do that, you provide an amazing service and truly ‘get’ the market. I’m just trying to get you to ‘stretch’ a bit

I’ve yet to see stats from other markets for December. Many markets haven’t published their data. Sure, they’ve seen large declines in recent months, but I’m most interested in December stats. Like I said, I will completely rule out any connection to the fire upon seeing stats. I know you think it is silly, but I would think it would be silly to not at least entertain the possibility in light of how smoky it was here. Like I said too, the slumping volume though for December completely fits the narrative of what we’ve seen. It’s just the volume slump was enormous and either that’s the market or there is another force that assisted the market a bit too. We almost always see more sales volume in December compared to November. It’s a market rhythm. This Nov & Dec were incredibly far off though, which is an interesting phenomenon to watch. Even in 2005 when the market was tanking sales volume was very close in Nov & Dec (and even slightly higher in Sac County). This is what is interesting from a stats perspective.

And thanks for your thinking. I appreciate it. For me I’ll make a call when I feel ready and I’m looking at the numbers and stats to be the assistant. There is a loss of credibility at times by many who make calls that don’t pan out. I don’t want to be late to the party, but I also don’t want to be early as a false prophet…

Excellent post Ryan, thanks for providing a look into the current data set.

A few friends of mine who have cash on hand keep telling me that they’re waiting for the great housing correction of 2019/2020 to come so they can scoop up blood! They’re out in other states and those spots may behave differently. I just find it funny they have this expectation that there’s going to be something similar to the last housing bubble. I think if anything, prices have risen quickly and like any market, auction market theory says that prices seek out a medium where buyers and sellers can transact, and prices rose to the point where no buyers were found (too expensive) thus the auction being complete to the upside and now we have price discovery to the downside, enticing buyers.

One thing I find interesting, is that Lennar has a lot of projects here in Sacramento that are being worked on over the next 5 years. If there was some correction due at some period, why would a large homebuilder like Lennar be out building up houses to sell? Or does timing not matter to them if their margins are excellent? There’s tons of new homes being built out in Houston Texas and right now their market has been excellent.

Thanks for the commentary. I appreciate it. And now that you have one approved comment you can comment without moderation here (unless you post a link which still moderates).

Anyway, I think it’s difficult to shed the last avalanche of a market from our mind and the expectation is that we’d see a market exactly like that. But there is no formula for how a market needs to behave when it corrects. Prices have grown disconnected from many local markets, so a correction seems fitting, but that doesn’t mean an all-out avalanche either….

I just saw a headline about Lennar buying land very recently too. I think they bought $25M more in Roseville if I’m not mistaken. They are clearly continuing to build along with many others. Builders are here to make profit and as long as they are doing so they are going to keep it up. In other words, they’ll just do it until they can’t do it, and that makes sense. New construction has been on the rise since the market bottomed out in 2012. It’s good to see it come back as we’ve really needed the supply. Though unfortunately the numbers are really only about up to where they were at the last recession. It’s still progress, but it’s too bad serious momentum wasn’t able to happen a few years back instead of right now when the market is slower. On one hand builders are a unique market compared to everything else, but they are surely feeling the trend of the market though too (maybe not smaller infill projects though). Thus if the market as a whole slows, we can’t expect a 100% different dynamic over time to take place in new construction. Sure, it still could be different since it is not the same product, but it’s not like builders build in a vacuum though either. In 2005 of course lots of builders were building and they ended up losing big. As an FYI, here are some stats I watch. I like the annual overview from last year, but they publish month by month data too. https://myemail.constantcontact.com/NORTH-STATE-BIA-RELEASES-JANUARY-SALES-FIGURES.html?soid=1118520161497&aid=wHK13QWNOSo

You said many markets don’t have December data ready, I’m not sure where you are looking and at what markets you are looking at, but much of it is available.

Pick most any global city (since we are in a global asset bubble) and the charts all pretty much look the same. Go back to 2003 on look at the pops in 2006 followed by deep troughs in 09-11ish then see meteoric price leaps blowing past 07 Bubble numbers on a nominal basis and in some cases now on a real basis even!

That debt fueled run-up in valuations is now being followed by an obvious leg down right now marked by plummeting sales volume and declining price appreciation and in some cases now negative YOY median price. Yes it is happening in Seattle, and yes, it is happening Sacramento as well. Just as when an entire apartment building is engulfed in flames everyone’s unit is burning, not just unit #2, the large two bedroom apartment. Even the small studio down the hallway burns just the same.

Try it, go pick a city. Here I will start. Go look at Vancouver (Better Dwelling just did an article with their most recent numbers) and compare it to Seattle, or if you’d like compare it to San Francisco, or if you’d like compare it to London, or if you’d like compare it to Salt Lake City, or if you’d like compare it to NY, or Hong Kong.

This is because we are in a global asset bubble. Of course there are odd outliers, DFW missed the last bubble sort of, and Seattle ran hotter this time around than did Spokane, WA, even though Spokane is way overpriced based on their local median HHI of $54k.

This is a macroeconomics issue. Remaining hyper- focused on Sacramento or any other local market will not allow you to see that this is a global issue caused by $12 TRILLION in printed money by global central banks since 07 and almost a decade at near-zero interest rates. This has been a monetary experiment for the last 10 years–simply reflating the last bubble with massive quantitative easing. Remember, we have never done this before. This is an experiment.

Dear Guy Above who scoffed at the idea that this was a bubble because ‘2008 had NINJA loans!!!’ Your analysis is lacking. Not every bubble is a result of NINJA loans. Do some homework. For those of you that laugh at the notion that this is a Bubble (are there still some of you left??), you are delusional or you just haven’t done your homework and don’t know anything about basic monetary policy. I will give you the benefit of the doubt and assume it’s the latter and that you aren’t that delusional.

This is the reality of what is happening. You won’t prop up this false economy and real estate market with your denial. It doesn’t work that way. Adapt or go extinct like a dinosaur. Sorry if this analysis is too hard hitting for you. Outside of the vacuum, the world is a blunt place.

Thank you. In the next week or so we’ll have more data for many markets. There are surely stats out there and Seattle has been well-publicized too. The Seattle Bubble blog is fantastic of course. Though sources like C.A.R. or CoreLogic don’t have December 2018 data live yet as far as I can tell. That’s what I mean. As it comes I will digest more of it.

I recognize the market is changing and I’ve been documenting it. I’ll continue to do so. I realize there are many markets to watch also, and I don’t discount the importance of watching other areas, but I am writing about Sacramento. This isn’t the “United States Appraisal Blog”. Just a reminder.

These next few months will be very telling. Sales volume normally hits its low point in January and February because those months reflect low pending volume from November and December. This year I’m expecting sales volume for both of these months to be really low – especially in light of how anemic volume was in December. The big question now becomes how 2019 will trend. We know the market is inflated, and I’ve been saying that for years. But how will spring unfold exactly? That’s what I’m watching intently. From a stats perspective, what will we see on paper in light of lower interest rates? Will the market be able to “recover” to a regular level of volume? Low rates are only a band-aid as I mentioned above, but I’m still watching to see how the market responds because this is something we never quite know for sure. This is exactly why need to watch current listings and pendings. We’ll see the activity from today’s listings in the sales stats in a few months from now. If we see today’s listings and pendings continue the slumping trend of the past 6 months, then we have what we need to say the market has clearly changed directions. I know, you are ready to say it has, but I want to see it in the numbers also. If others aren’t okay with that, it’s fine by me. I’m okay with it, and that’s the most important thing. What we have experienced lately is no small matter. Like I said above regarding sales volume showing a big slump in December, that’s a big deal. It is. That’s exactly why we’re talking about it.

You are correct but I think”The Appraisal Blog of The Continental United States And Beyond” has a great ring to it!

Haha. I cannot argue with that…. Thanks for the conversation.

Thanks for the conversation.

I really enjoy all your information that you share. Thanks so much, Kari McCoy

Thank you very much Kari. I appreciate it. This is a real joy for me.