The housing market has really started to heat up lately, and today I want to talk about how I’m thinking about prices right now. I also have some thoughts about checking the “declining” box. Scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

5/4/23 Housing Market Q&A 12-2pm

5/10/23 Empire Home Loans event TBA

5/18/23 SAFE Credit Union event TBA

5/22/23 Yolo YPN event TBA

6/1/23 DJ Lenth Event TBA

7/20/23 SAR Market Update (in-person & livestream)

THE DANGER OF GENERALIZING ABOUT PRICES

I’m not a fan of saying the market is doing just one thing because the trend might not be the same in every neighborhood and price range. I will say we’d been seeing a modest spring price bump this year in the region, but we hit an inflection point in mid-March where things started to get really hot. I wrote about that last week. Some of this change was from the Dream For All loan, but the inflection point started almost two weeks prior to the loan being available.

THE WORD ON THE STREET

This isn’t a scientific poll, but I asked people on my Instagram stories a few days ago what prices are doing, and here’s what they said. The bulk of votes are from people who work in real estate locally. I think it’s striking that few people said prices are going down. But it’s also clearly a mixed bag (a good way to describe the market). I did a poll like this one month ago, and at the time 17% of people said prices were going down and 14% said they were going up.

IT’S GETTING REALLY TIGHT IN HERE

The market is really feeling a lack of new listings, which has started to create an aggressive trend again. It’s freakish to see more pendings than actives right now in the region as that is NOT a normal trend (but it did happen in portions of 2020 through early 2022). Since the Dream For All loan ended, there are maybe slightly more listings available, but it’s still slim. And this is why I’m hearing more about appraisal gaps being written into contracts. The wild part here is we’re still struggling with affordability. It’s a weird dynamic to feel this competitive in the midst of so many buyers not being able to participate.

NOTE: There are still overpriced listings out there, so buyers won’t pay literally any price. Sellers, did you hear that?

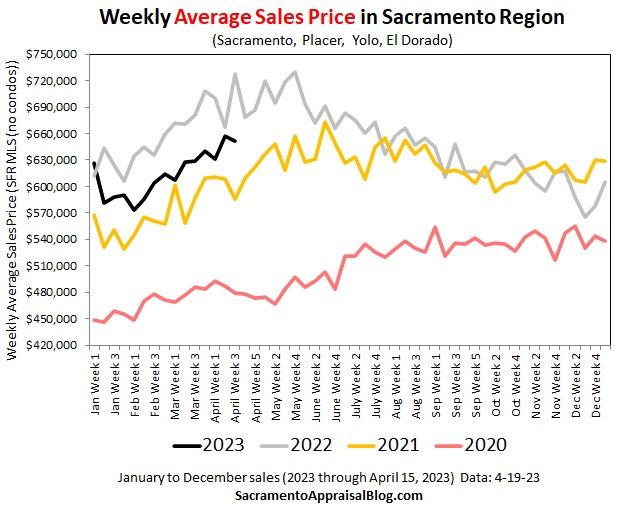

WEEKLY PRICES HAVE BEEN RISING

The weekly median sales price and weekly average sales price have been increasing lately (black lines). So far, the monthly median for April is up compared to March also, which shows a seasonal price bump at the least. Let’s remember the latest week of closed sales really reflects properties that got into contract about one month ago.

WE’RE AROUND MID-2021 PRICE LEVELS

A Fair Oaks home sold for $531K in April 2021 and it sold again in the same condition for $543K in April 2023. In the graph below I’ve highlighted red bars to signify when this property got into contract during each sale. In short, the sale of this property ended up lining up really well with the county trend. This doesn’t always happen, but sometimes it does. The median for April is not listed yet, but it’s around $515,000 for now, which is somewhere around mid-2021 (though technically fall 2021 was pretty similar to mid-2021 also).

WE HAVE TO LOOK TO NEIGHBORHOOD TRENDS

It’s a mistake to impose county or ZIP code price trends on a neighborhood, so we have to look to the comps to understand the market. Are prices going up? Well, if they are, we’re probably seeing upward pressure in the pendings through higher prices, multiple offers, maybe less credits, etc… In many areas right now in my appraisals I am seeing some upward pressure, but sometimes it still feels a little flat. But I have NOT been seeing a hardcore declining market like we had during the second half of 2022. Anyway, the neighborhood graph below isn’t a perfect way to see the trend, but check out pendings in black and actives in yellow. This is only a snapshot, but pendings are clearly NOT at the lowest price points. I know, this could be due to size or other aspects, but I’m seeing this dynamic consistently in many areas where properties are no longer competing at the lowest prices.

IT’S NOT JUST ABOUT PRICES

Many people only focus on prices in real estate, but I think volume tells the bigger story. If we see higher prices with paltry closed sales, then prices aren’t the real story. And in real estate, volume pays the bills. Not prices.

CHECKING THE “DECLINING” BOX

There isn’t one right box to check, and I defer to appraisers to figure it out. If you didn’t know, in the appraisal report appraisers are asked to say whether prices are rising, stable, or declining. For me, I have not been checking the declining box in my appraisal reports lately like I was in later 2022 since we’ve been seeing a seasonal price bump locally. I’ve found myself gravitating toward stable and maybe increasing depending on the neighborhood. I also find myself adjusting older comparable sales up since the market is willing to pay more lately. In my market description I’m talking about a massive decline last year and prices leveling off or showing an uptick this year so far. This doesn’t mean we’ve bottomed out and prices will only rise ahead. All I’m saying is the market was an ice bath from mid-2022 through December 2022, but that’s not what it’s like right now.

To my colleagues, I don’t care which box you check. Seriously. No pressure from me. Do your thing. I would only say our duty is to support the trends we say exist, and nailing the trend makes all the difference in our appraisals. However, if you are saying prices are declining, but that’s not what we’re seeing in neighborhood stats when comparing pendings and recent sales, county stats, and what we’re hearing in the trenches of escrows, that’s something to consider.

Here’s my thing. We have to be able to see the market before the sales start closing in the future. This is why we need to give strong weight to what we’re seeing in current pendings and actives. Sales tell us what the market used to be like when these properties got into contract maybe months ago. Look, I’m not going to base my perception of the market on one lone-ranger pending. I’m just saying if we only recognize a price bump or decline once properties have actually closed, then we’re lagging the trend. Check out the image below that shows the preliminary median price for April. Here’s the question. If prices have gone up this spring, is that being reflected in how I describe the market and adjustments I give? That’s the key.

One more thing. I will NEVER be an appraiser who gives in to pressure to check the stable box because it’s easier for a client to do a loan. I recall being young in the profession and hearing older appraisers jokingly say things like, “The market was stable on the day in 2007, so that’s the box I checked.” Sorry, that’s not okay on so many levels. We have to reflect the market that exists, whether it’s declining, stable, or increasing. If we only check one box and it’s always that one thing, we have to ask if we’re doing our job or not…

Let’s talk more in the comments if you want.

Here’s an example of some language I used to describe the market about one month ago. I shared this at the ACTS conference recently. Just in case it’s helpful to see what one dude is saying.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What are you seeing right now in the trenches of escrow? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Ryan, that is an excellent post! I completely agree with you! In our reports, as appraisers, we need to explain why we check a particular box. On an annual basis, things may have declined. However, in a shorter measurement, prices might be increasing again. I recently completed a report for lending purposes where I checked the declining box because, on an annual basis, competing sales prices had declined. However, the sales I used all sold within the past six months, and I made positive adjustments to all of them because while the prices declined on a year-over-year basis, they began increasing again within the past six months. I explained this in my report and the bank I completed the appraisal for had no questions. The price changes depend on many factors. Thanks for shedding some light on this subject! I appreciate you, Ryan!

Thanks so much Jamie. I love the example. There is always a tension with annual stats and the market in front of us. I hear some appraisers say we cannot say the market is increasing until annual stats show a positive change. But if that’s true, it would be very possible to lag the market trend by a very long time whenever a market changes… Our median price is down by about 10% from one year ago, so the decline was sharp locally. At the moment, declining is not the best word I’d use to describe the price trend though. Are we still in a declining cycle though? Typically declining cycles last 5-6 years in Sacramento and California. Time will tell ahead on this. I think one little box doesn’t say all we need to say about the market, so this is where commentary needs to come into play. I wouldn’t split hairs if an appraiser said we’re in a declining cycle, but then adjusted up. There are different ways to skin a cat. There can be pressure from the lender side of things though at times because there are consequences with some lenders when appraisers say the market is declining (meaning some Borrowers might have to qualify for 5% more if the box is checked (been hearing that a few times lately)).

You bet! I completely agree with all that you have said. We just have to explain what we did and why. The banks I work for are reasonable as long as I adequately explain things. Including charts in our reports can add a lot of value. Especially in these times! You are the chart master! We can all learn from yours!?

Thanks Jamie. That’s nice of you to say. And agreed about explaining. There isn’t just one way to do this, which is comforting. What we don’t want to do though is check boxes without thoughtfulness. On a related note, I find there is a huge appetite for clarity in the midst of uncertainty. People want to understand what the market is doing so they can explain it to their clients and/or make real estate decisions. I think appraiser colleagues have an opportunity to speak into market conditions, and I’d love to see more colleagues speaking up about their markets by putting out data or visuals. You don’t have to write a dissertation. Just start pushing out information, listen, and create conversation. The cool part is there is never any need for spin. There is no doom or rosy lens. It’s a powerful thing when we share neutral perspective formed by stats and rooted in understanding local seasonality.

So true!!!

Great discussion. I think checked boxes in appraisal reports are ridiculous, even for factors that don’t need context like market conditions. The market conditions box is the most ridiculous. These are professional reports, not questioners for a dental visit.

Ha. Thanks Gary. I’m okay with the boxes, but I find the boxes to be meaningless without commentary. And sometimes we see boilerplate commentary that just makes the entire market conditions section a joke. To me, that’s my favorite part of the report.

Yup. This is the normal seasonal bump. We saw it every Spring during the 2006-2011 housing downturn. Seasonal upward bump. Long-term, we’re in a downward trending market, and (crystal ball) will probably be thru 2024.

Thanks Josh. I think some people are looking at a seasonal uptick and calling it a market recovery or bottoming. I’ve been surprised sometimes at how disconnected people are from the seasonal market. In many of my price visuals showing an uptick, I often mention that we had a seasonal price bump even in 2007 locally… It would be really healthy to continue to see price drop after a seasonal spring bump. I don’t get to make the rules. What is so awkward right now is having almost half as many listings coming to the market locally. That really changed the dynamic. Yet, it also doesn’t automatically mean prices will go up forever. It’s really a fight between two forces. Anemic supply and glaring affordability issues.

It would be really healthy to continue to see price drop after a seasonal spring bump. I don’t get to make the rules. What is so awkward right now is having almost half as many listings coming to the market locally. That really changed the dynamic. Yet, it also doesn’t automatically mean prices will go up forever. It’s really a fight between two forces. Anemic supply and glaring affordability issues.

Great post, agreed. You check the most appropriate box but if there is any ambiguity between the stats and the adjustments, if there are any, explain it. Don’t just check a box and gloss over a coverall stock statement. Sometimes the task of writing the market condition down on paper/screen forces you to consider or re-consider conclusions you may have made during the initial phases of your work. Better yet, draft your market statement early on if you have a general handle on the market with decent stats and then reconcile it with your final conclusions.

Love it. Thank you Paul. Explain it!! That’s the key. And adjust if needed. Up or down. Sometimes I wonder if we’re better about adjusting in a down market instead of an up market. I wonder if there are statistics that show either way. I’d be curious to see.

In my non-Rush conversations with the chief appraisers for Fannie and Freddie, residential appraisers in general are terrible about time adjustments either way.

It’s always harder for me to adjust when the market changes. Catching that change in direction is the most challenging for me.

Thanks. And to be fair, it does take some time to see the trend and understand it. For instance, last year the market began to shift in March 2022, but big price and volume changes didn’t show up right away. There were subtle clues at first with a change in the narrative among real estate professionals, and then a change in the number of pendings, more price reductions…. It wasn’t an immediate shocking decline though. Of course, the trend tends to show up last in the prices, which makes it challenging. On that note, part of the struggle with graphs is it takes time for a trend to show up visually since many visuals are based on closed sales.

Great topic Ryan!

One problem with the check box is that we don’t have standard guidance or context to say increasing/stable/declining compared to what? Increasing is the long term 5 year trend, declining is the 12 month trend, stable is the 6 month trend, but pendings are showing an uptick. Whatever box the appraiser checks may seem arbitrary because we must explain anyway.

However, some investors (Citi, for example) have rules that say when the declining box is checked, the LTV takes a 5% hit. So this arbitrary decision becomes very significant for borrowers. This isn’t the appraiser’s problem, of course, but appraisers should be aware of how box checking might have a profound impact on the loan terms. Really, if investors are going to rely on which box is checked to determine the LVT requirements, they need to provide better guidance on the criteria for determining which box should be checked. That’s my take anyway!

Excellent commentary, Paul. I’m really glad you pitched in. I think it would likely be helpful for some sort of clarity with definitions. The hard part is markets can change quickly though, so any definition could quickly become irrelevant. Case-in-point. Traditional metrics for monthly supply are still technically low, but that doesn’t mean prices cannot go down (last year proved it was possible). This underscores how rules don’t always rule so to speak… But to your point, one could argue prices have been increasing overall since The Gold Rush, so we are in an increasing market… I’ll have to see if Fannie Mae has any guidance here regarding lender appraisals.

On a related note, I’ve heard some appraisers say it’s not a trend until it shows up in year-over-year stats, but that would be awful for market conditions if we had to wait that long for the trend to show up in the numbers like this.

And yeah, there are real consequences. I had a local agent DM last week about a 5% hit, so this can show up in escrows, and it can be tough in a market that is already struggling with affordability. Why 5% though? That seems arbitrary.

I think I understand it… An analysis of the YoY changes can help identify whether the trend is seasonal, or whether it is general. In markets where there is a heavily seasonal pricing trend, where median prices go up in the spring, and down in the fall, some appraisers may not find it appropriate to check Q1 stable, Q2 increasing, Q3 stable, Q4 decreasing. Rather, only if the YoY price comparisons (March 2022 vs. March 2023) yield a substantial change will they check the increasing/decreasing box. That said, marking a “stable” check box shouldn’t dictate whether an adjustment should be applied for the seasonal changes.

And if it weren’t complex enough already, I have observed that the median prices in a geographic data set (Zip, Neighborhood, City, Metro) might exhibit far more seasonal pricing patterns than if you filtered down into the competitive market segment. This is because a geo-only analysis doesn’t account for physical changes to housing stock throughout the year. (All RE is local, so this may not apply in Sacramento.)

“It’s a mistake to impose county or ZIP code price trends on a neighborhood, so we have to look to the comps to understand the market.” I would agree, but I would also say “market segment” instead of neighborhood. Sure enough, in many cases those could be identical groupings, but this is not always the case in urban markets that have bifurcated housing stock, or where redevelopment is changing the makeup of the housing.

That said, any sentence which begins “It’s not a trend until…” is always incorrect, because in RE market conditions, there’s always a trend! Similarly, I have reviewed reports where the appraiser analyzed “seasonally adjusted” trends which group a total of 12 months of activity into one data point to determine a time adjustment. That, in my mind, that is often going to lead you astray. It is maybe helpful in determining the overall trend for the checkbox, but less so the adjustment to be applied to comparable sales.

Good stuff, Paul. I appreciate your commentary. And I think you are spot on about the value of really understanding the seasonal market so we can identify change that is not seasonal. The second half of 2022 was exactly that. And for the record, year-over-year declines in Sacramento didn’t happen for about six months after the market started changing, so it would have been really dangerous to wait all that time to say the market was declining. It was actually remarkable to even get to a year-over-year decline in about six months though since our market had seen such incredible gains. It just goes to show what a sharp change we experienced. To piggyback on your point, it was incredibly obvious that the market was declining based on so many other stats and an analysis of behaving way different than the normal seasonal pattern. In other words, we didn’t need year-over-year stats to understand the trend.

I’m with you on seasonally adjusted data also. I’ve actually been seeing some seasonally adjusted data from Zillow regarding Sacramento, and it shows a decline from February to March, but it’s awkward data because that’s not what is happening in the trenches (and not what is happening with price metrics in real time). It just goes to show we can adjust numbers in certain ways, and sometimes the story ends up being different.

It is hard work to identify trends, and I’ll say it takes time to understand what the market is doing. We need more than one data point, you know. And of course, we’re all experts with hindsight… This is what makes real estate exciting though. The market is always moving, so there is always something to analyze and talk about.

Good stuff!

Zillow isn’t the only one! I could be wrong, but I believe Fannie uses an geo-only HPI to assist the determination of a wavier/value-acceptance. Knowing what we know, this could present some serious issues when a shift occurs. Also, I know when Covid initially upended the RE market in 2Q20, I saw some alarming looking price trend graphs from (I think) Collateral Analytics showing a 10-20% price correction had already taken place. Yikes!

That’s interesting to consider about waivers (or value acceptance now I think?). Haha.

I really like seeing price metrics from a variety of sources. The idea of controlling for seasonality is wonderful. However, I think it’s easy to believe in an index too much. I get the problems with the median price, but an index isn’t perfect either. My observation in the fall of 2022 especially was that various indexes were pretty conservative for Sacramento. So while an index can brag about controlling for various factors such as seasonality or size, the index doesn’t always feel like it fits the market.

Great article. In the past two weeks I’ve been relying heavily on conversations with listing agents on what their contract prices are. Something I have run into lately is lenders not allowing me to put weight on pending sales, but asking me to revise my report to only using closed sales as basis for my reconciled value. To me this makes no sense especially when the prices are increasing so rapidly.

Thank you so much Michelle. I really appreciate hearing. And props to you for gleaning information from agents. There is often such a negative bias toward agents within the appraisal profession, but there is so much valuable information that can be exchanged. That’s absurd to hear from the lender because it really goes against how real estate works. Fixating on the sales can be a huge problem in a market that is changing quickly (up or down). This reminds me of a request for a value to fall within the unadjusted range. That might not be possible. While bracketing can be a useful method, it gets awkward when all of the sudden appraisers are basically asked to find one higher sale to justify value. Nah, we see higher or lower value through market condition adjustments. By the way, now that you have an approved comment, you can post without moderation (unless you share a link).

For any appraisers looking on, I’d love to hear your two cents. What are you seeing out there? How are you interpreting today’s market? There isn’t just one way to do this, and each market is going to look different (though many markets are likely to show some similarities too).

Interesting… I like the polling idea. While we see lots of data and generally have a good pulse on what is happening, what the market thinks of the bits and pieces they are hearing about can be quite different. Understanding their perspective is essential as well. Thanks for the great post.

Thanks Troy. I appreciate you pitching in. Yeah, we have to be careful with what people say. Ultimately, the word on the street is really important in real estate. Granted, a few stories don’t mean it’s a trend. But the stories of today become the stats of tomorrow, so it’s key to keep our ear open to market participants (while sifting through subjectivity). I actually did a poll yesterday about open house traffic, and it was interesting to hear just over 30% of answers saying traffic has slowed. The rest of the pack states no difference or it’s the same. I definitely got a few DMs stating it’s bananas out there still. No matter what, the results are lining up with what I’m starting to hear from a few agents. Moreover, it’s possible the percentage of multiple offers has peaked in the region too as that’s not uncommon for the time of year. We’ll know more over the next couple of weeks.