The housing market has really started to heat up lately, and today I want to talk about how I’m thinking about prices right now. I also have some thoughts about checking the “declining” box. Scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

5/4/23 Housing Market Q&A 12-2pm

5/10/23 Empire Home Loans event TBA

5/18/23 SAFE Credit Union event TBA

5/22/23 Yolo YPN event TBA

6/1/23 DJ Lenth Event TBA

7/20/23 SAR Market Update (in-person & livestream)

THE DANGER OF GENERALIZING ABOUT PRICES

I’m not a fan of saying the market is doing just one thing because the trend might not be the same in every neighborhood and price range. I will say we’d been seeing a modest spring price bump this year in the region, but we hit an inflection point in mid-March where things started to get really hot. I wrote about that last week. Some of this change was from the Dream For All loan, but the inflection point started almost two weeks prior to the loan being available.

THE WORD ON THE STREET

This isn’t a scientific poll, but I asked people on my Instagram stories a few days ago what prices are doing, and here’s what they said. The bulk of votes are from people who work in real estate locally. I think it’s striking that few people said prices are going down. But it’s also clearly a mixed bag (a good way to describe the market). I did a poll like this one month ago, and at the time 17% of people said prices were going down and 14% said they were going up.

IT’S GETTING REALLY TIGHT IN HERE

The market is really feeling a lack of new listings, which has started to create an aggressive trend again. It’s freakish to see more pendings than actives right now in the region as that is NOT a normal trend (but it did happen in portions of 2020 through early 2022). Since the Dream For All loan ended, there are maybe slightly more listings available, but it’s still slim. And this is why I’m hearing more about appraisal gaps being written into contracts. The wild part here is we’re still struggling with affordability. It’s a weird dynamic to feel this competitive in the midst of so many buyers not being able to participate.

NOTE: There are still overpriced listings out there, so buyers won’t pay literally any price. Sellers, did you hear that?

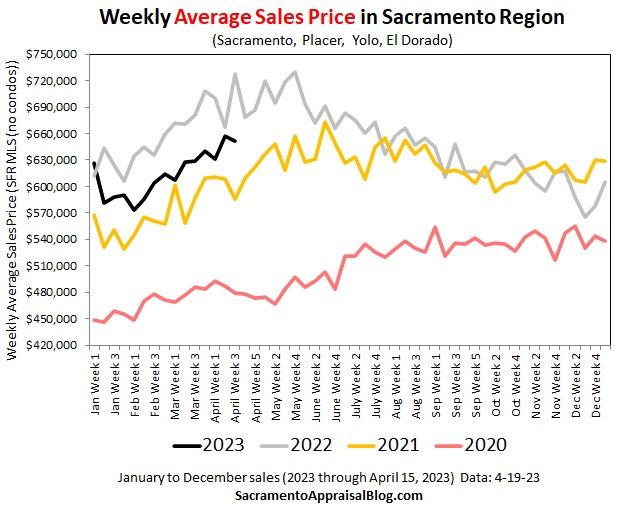

WEEKLY PRICES HAVE BEEN RISING

The weekly median sales price and weekly average sales price have been increasing lately (black lines). So far, the monthly median for April is up compared to March also, which shows a seasonal price bump at the least. Let’s remember the latest week of closed sales really reflects properties that got into contract about one month ago.

WE’RE AROUND MID-2021 PRICE LEVELS

A Fair Oaks home sold for $531K in April 2021 and it sold again in the same condition for $543K in April 2023. In the graph below I’ve highlighted red bars to signify when this property got into contract during each sale. In short, the sale of this property ended up lining up really well with the county trend. This doesn’t always happen, but sometimes it does. The median for April is not listed yet, but it’s around $515,000 for now, which is somewhere around mid-2021 (though technically fall 2021 was pretty similar to mid-2021 also).

WE HAVE TO LOOK TO NEIGHBORHOOD TRENDS

It’s a mistake to impose county or ZIP code price trends on a neighborhood, so we have to look to the comps to understand the market. Are prices going up? Well, if they are, we’re probably seeing upward pressure in the pendings through higher prices, multiple offers, maybe less credits, etc… In many areas right now in my appraisals I am seeing some upward pressure, but sometimes it still feels a little flat. But I have NOT been seeing a hardcore declining market like we had during the second half of 2022. Anyway, the neighborhood graph below isn’t a perfect way to see the trend, but check out pendings in black and actives in yellow. This is only a snapshot, but pendings are clearly NOT at the lowest price points. I know, this could be due to size or other aspects, but I’m seeing this dynamic consistently in many areas where properties are no longer competing at the lowest prices.

IT’S NOT JUST ABOUT PRICES

Many people only focus on prices in real estate, but I think volume tells the bigger story. If we see higher prices with paltry closed sales, then prices aren’t the real story. And in real estate, volume pays the bills. Not prices.

CHECKING THE “DECLINING” BOX

There isn’t one right box to check, and I defer to appraisers to figure it out. If you didn’t know, in the appraisal report appraisers are asked to say whether prices are rising, stable, or declining. For me, I have not been checking the declining box in my appraisal reports lately like I was in later 2022 since we’ve been seeing a seasonal price bump locally. I’ve found myself gravitating toward stable and maybe increasing depending on the neighborhood. I also find myself adjusting older comparable sales up since the market is willing to pay more lately. In my market description I’m talking about a massive decline last year and prices leveling off or showing an uptick this year so far. This doesn’t mean we’ve bottomed out and prices will only rise ahead. All I’m saying is the market was an ice bath from mid-2022 through December 2022, but that’s not what it’s like right now.

To my colleagues, I don’t care which box you check. Seriously. No pressure from me. Do your thing. I would only say our duty is to support the trends we say exist, and nailing the trend makes all the difference in our appraisals. However, if you are saying prices are declining, but that’s not what we’re seeing in neighborhood stats when comparing pendings and recent sales, county stats, and what we’re hearing in the trenches of escrows, that’s something to consider.

Here’s my thing. We have to be able to see the market before the sales start closing in the future. This is why we need to give strong weight to what we’re seeing in current pendings and actives. Sales tell us what the market used to be like when these properties got into contract maybe months ago. Look, I’m not going to base my perception of the market on one lone-ranger pending. I’m just saying if we only recognize a price bump or decline once properties have actually closed, then we’re lagging the trend. Check out the image below that shows the preliminary median price for April. Here’s the question. If prices have gone up this spring, is that being reflected in how I describe the market and adjustments I give? That’s the key.

One more thing. I will NEVER be an appraiser who gives in to pressure to check the stable box because it’s easier for a client to do a loan. I recall being young in the profession and hearing older appraisers jokingly say things like, “The market was stable on the day in 2007, so that’s the box I checked.” Sorry, that’s not okay on so many levels. We have to reflect the market that exists, whether it’s declining, stable, or increasing. If we only check one box and it’s always that one thing, we have to ask if we’re doing our job or not…

Let’s talk more in the comments if you want.

Here’s an example of some language I used to describe the market about one month ago. I shared this at the ACTS conference recently. Just in case it’s helpful to see what one dude is saying.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What are you seeing right now in the trenches of escrow? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

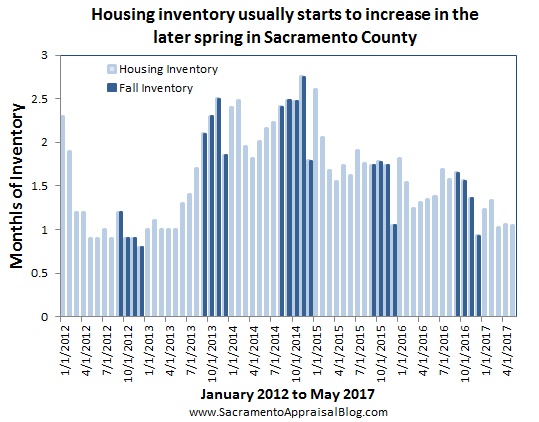

If you didn’t know, sales volume last month was the strongest May we’ve seen over the past 4 years. But don’t get too excited because sales volume for the entire year is about the same as last year. No matter how we look at it, price metrics are up 7-9% from 2016 and they increased by 2-4% last month. One of the themes that won’t go away is we have a shortage of housing. In fact, housing supply is 22% lower right now compared to last year, and it’s been putting pressure on values to increase – particularly at entry-level price ranges. The tricky part lately is many contracts are getting bid up due to multiple offers (even beyond a reasonable appraised value). This can favor sellers accepting offers from buyers who have more cash to make up the difference between the appraised value and the contract price, though FHA sales stats show first-time buyers are still finding ways to close deals. In higher price ranges the market feels much softer, though we are still seeing multiple offers when properties are priced correctly. This is a good reminder that it’s possible for the market to feel more aggressive than actual value increases. In other words, having multiple offers doesn’t mean values are increasing rapidly or at all. Lastly, we are starting to hear more about lenders rolling out 100% financing to help buyers artificially afford higher prices (sounds healthy, right?). I could go on and on with words, but let me share some graphs to show the market visually.

If you didn’t know, sales volume last month was the strongest May we’ve seen over the past 4 years. But don’t get too excited because sales volume for the entire year is about the same as last year. No matter how we look at it, price metrics are up 7-9% from 2016 and they increased by 2-4% last month. One of the themes that won’t go away is we have a shortage of housing. In fact, housing supply is 22% lower right now compared to last year, and it’s been putting pressure on values to increase – particularly at entry-level price ranges. The tricky part lately is many contracts are getting bid up due to multiple offers (even beyond a reasonable appraised value). This can favor sellers accepting offers from buyers who have more cash to make up the difference between the appraised value and the contract price, though FHA sales stats show first-time buyers are still finding ways to close deals. In higher price ranges the market feels much softer, though we are still seeing multiple offers when properties are priced correctly. This is a good reminder that it’s possible for the market to feel more aggressive than actual value increases. In other words, having multiple offers doesn’t mean values are increasing rapidly or at all. Lastly, we are starting to hear more about lenders rolling out 100% financing to help buyers artificially afford higher prices (sounds healthy, right?). I could go on and on with words, but let me share some graphs to show the market visually.

Two ways to read the BIG POST:

Two ways to read the BIG POST: