Where is the market heading? I get asked this question every month when speaking in real estate offices. The most truthful thing I can say is my crystal ball is broken. In fact, predicting real estate is a bit like predicting what Justin Bieber is going to do next. You just never know. At the same time, we can look at the trends and make some educated guesses (still guesses).

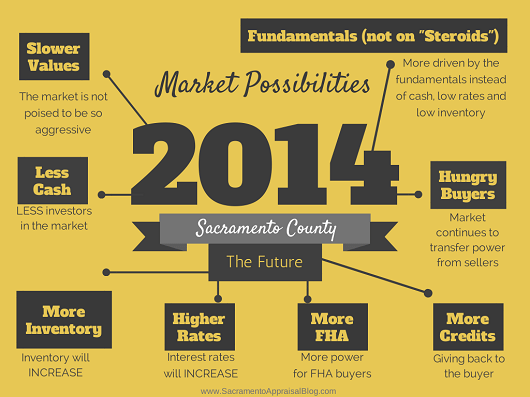

Since I included the image above in a few recent presentations, I wanted to share a bit about what I’ve been saying, and add a few points since I have space to do so here. To be honest I’m really not a fan of making predictions because real estate is like a living organism that can grow and change in unexpected directions. But in light of my recent presentations I wanted to unpack some thoughts on the market.

Driven by the Fundamentals: The dramatic value increases over the past two years were in large part due to a huge increase of cash investors, artificially low interest rates, an extremely low housing inventory and of course very low prices. Now that all those things have changed, it means we’re inevitably going to get a taste of how strong the market really is this year. In other words, the market should be more driven by the economy instead of outside forces like cash investors and interest rates in the 3% range. Additionally, while I am mostly optimistic about the next couple months since there is still pressure to push values up (assuming sales volume does pick up), I’m more interested in the last two quarters of 2014 to see how the market behaves when Spring fever subsides and after a presumed increase in inventory and rates ensues.

Doom & Gloom: There are lots of doom and gloom real estate articles floating around right now. There are definitely points worth considering in these articles since stats are sagging nationally, but at the same time a slower real estate season and typical real estate media cycle tends to breed these types of articles, which is also worth considering. We may see some more positive news stories shortly as real estate Spring fever kicks into high gear. In fact, some of the stats I shared on median price last week could easily make the highlight reel somewhere locally.

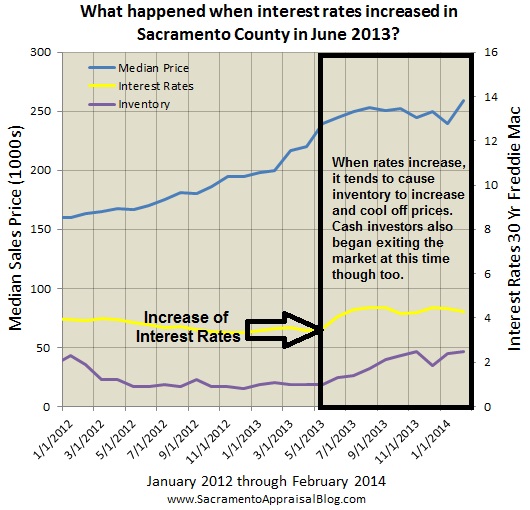

Long-Term Challenges: As inventory creeps up and rates continue to rise, it will definitely challenge the direction of values and can ultimately foster declines in the future if both get too high. Many talk about 5 months of inventory being a normal supply, which may be true nationally. However, any time the market has had 5 months of housing supply over the past 13 years in Sacramento County, values were declining (see this image as support). Granted, we haven’t really had a normal real estate market for some time, so it’s important to consider the context. Ultimately though local real estate has become more sensitive to increases in inventory, which is why I am saying more than four months is getting to be quite a bit for our market to handle. Also, a change in interest rates is something to watch because the market is also very sensitive to increasing rates – which immediately impacts affordability. For instance, when rates shot up half a percent between May and June last year (as shown in the graph above), it was one of the factors that helped create a turning point in the market. Lastly, a stronger national economy will be important in coming time since real estate is in a softening stage after being hyped on “steroids” these past two years.

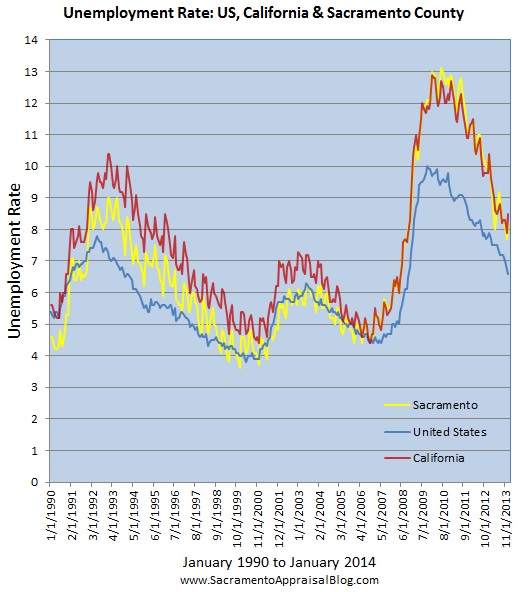

US, CA & Sacramento: Right now the unemployment rate in Sacramento is 8.2%, California is 8.5% and the United States is hovering at 6.7%. Both California & Sacramento shot far above the US unemployment rate when the recession hit in recent years, but slowly they are trying to find their way back to national levels again. The unemployment rate is by no means a perfect barometer for assessing the health of the economy, but it is nonetheless still good to look at the rate along with other metrics.

The Main Point: Since real estate is expected to be more driven by the fundamentals this year and there are less cash investors playing the market, it will naturally be more important for the pool of existing buyers to have jobs that can help them afford higher prices. Last year property values seemed to sprint ahead of the job market, but this year the job market really needs to make some strides forward to try to sustain where real estate went.

Questions: Are your local friends able to find work these days? Would you say the economy is improving or not?

If you liked this post, subscribe by email (or RSS). Thanks for being here.