The housing market is trying to get back to normal, but how close are we? On one hand we’re feeling some seasonal slowing, but it also still feels really competitive. Today let’s talk about what normal looks like. If you’re not local I’d love to hear what you’re seeing in your market. Any thoughts?

Background noise: Last night I did a YouTube Live Q&A to talk about appraisal stuff. If you need some background noise, here’s two hours. Watch below (or here). I love doing stuff like this, so don’t forget to hit me up.

What does normal look like?

Comparing to 2019: The last normal-ish fall season we had was in 2019, so it’s a good frame of reference to consider what fall should maybe look like. Technically I should take the average of five years of fall data to establish normal, but I’m honestly just slammed this week and I can’t pull that off until someone hires me full-time to crunch numbers all day.

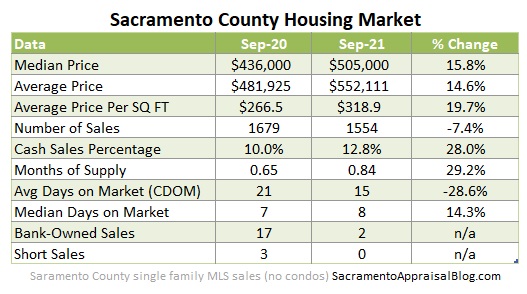

How does 2021 compare? In short, the market right now is showing some seasonal slowing, but it’s still far more competitive than it should be for the time of year. Check out some of these stats.

Brand new visual (do you like this one?):

Breaking it down: Today we have more multiple offers, properties are selling in half as much time, and we even have fewer price reductions. Most notably buyers last month paid above the list price whereas two years ago on average they paid about three percent below the list price. This is striking because in 2019 in a normal-ish September buyers on average paid $13,808 below the original list price, but this past month buyers still paid almost $6,000 over asking price. Another way to say this is buyers today paid about $20,000 more than a normal year in 2019 (13,808 + 5,951 = 19,759).

30% more aggressive? If I had to put a number on it I’d say the market is conservatively 30% more aggressive than it was in 2019 (maybe even more as some stats are still about twice as aggressive as they should be). For reference, stats for price reductions especially show this as there are 31% fewer reductions right now compared to two years ago. Check out Altos Research for price reductions.

Anyway, I hope that was helpful.

—–——– BIG MARKET UPDATE FOR THOSE INTERESTED ———––

Skim or digest slowly.

Skim or digest slowly.

QUICK SUMMARY:

The market is experiencing seasonal slowing and it’s clearly not what it was at the height of spring season. This is important for sellers to understand to price according to today’s trend instead of headlines from the past. With that said, things are still really competitive and mostly all stats are not normal yet (still more aggressive than usual). On one hand buyers have gained power, but it’s still fierce out there. Here’s a good way to put it: “The market is not slow, but it’s slower than it was.”

Some visuals eh…

NOT AS MANY MULTIPLE OFFERS:

For five months in a row in the region we’ve seen multiple offers subside. Last month 56% of sales had more than one offer and that’s one of the most competitive months ever, but there is no mistaking a cooling seasonal trend.

AUGUST TO SEPTEMBER SEES SOFTENING:

For months I’ve been talking about the market starting to slow and we are finally starting to see it in the stats. Not every single stat is dull, so my advice is to look at the bigger picture of all stats together rather than hone in one stat. In short, it’s starting to take longer to sell, we have slightly more inventory in the region, and even prices have softened (part of that has to do with smaller homes selling).

LAST YEAR VS THIS YEAR:

Year over year comparisons get a little weird these days because the market was so atypical last year, but in my opinion this is still worth digesting since we want to be good students of the market. I suggest taking these percentages with a grain of salt and recognize these percentages DO NOT actually mean every house is worth that much more either. Also, remember that we are now comparing a market that is trying to be normal today with a super aggressive fall last year.

IT’S LESS COMPETITIVE:

The market is still ultra-competitive, but this image is crystal clear that the temperature of the market has changed in recent months. This is exactly what we should be seeing at this time of year. Keep in mind we should have closer to half of sales selling at or below the list price, so this market is NOT normal yet.

OTHER VISUALS:

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What are you seeing out there in the market?

If you liked this post, subscribe by email (or RSS). Thanks for being here.