The market has been white hot, but there is also lots of uncertainty right now too. Let’s talk about this and take a deep dive into the latest stats for those interested. I’d love to hear your take in the comments.

A few things I want to mention:

1) Layers: There are many layers that make the housing market move and sometimes unexpected things happen. Who would have thought we’d be talking about rates at 3% or a virus?

2) Dumpster fire: Social media is like a raging dumpster fire right now in light of coronavirus posts. It’s been unreal, so I’ve had to distance myself from scrolling too much. Can you relate?

3) Keeping my blog name: This won’t become the COVID-19 Appraisal Blog, but we’ll talk about the virus as needed as it relates to housing. No fear. No hype. Objective thoughts and analysis. Ultimately it’s important to have honest housing conversations and consider things that could affect the future.

4) Be at peace: I’m profoundly aware of the need to remain calm and have a sense of peace, but I’m also aware that probably won’t happen by accident. This might seem odd to mention, but I want to encourage everyone to find ways to cultivate peace right now in uncertain times. If you need ideas too, reach out. This is way more important than anything else I talk about, which is why I’m mentioning it.

Anyway, that’s what’s on my mind. Now for those interested let’s take a deep dive into local housing trends.

—–——– Big local market update (long on purpose) —–——–

This post is designed to skim or digest slowly.

THE SHORT VERSION:

THE SHORT VERSION:

- Prices are back to summer

- Has coronavirus affected the market?

- Watching for a coronavirus effect

- Lack of confidence

- More competitive at lower prices

- More multiple offers

- The market is accelerating

- Mortgage rates & Debbie Downer

- You still have to price it right

- Sales volume is lackluster

- Back to the nominal peak

- More visuals for surrounding counties

DOWNLOAD 90 visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE LONGER VERSION:

Back to summer: The median price in Sacramento County jumped $20,000 from January to February. I know that sounds sensational to see a $5.3% increase, but keep in mind the median price was $385,000 at the height of summer last year, so the bigger story is we basically got back to where summer was plus a few percent. It’s pretty common by March or so to see the median price back to where it was during summer, but in a more aggressive year this can happen in February. On paper the market is glowing, but the big elephant in the room is the coronavirus, so let’s talk about it.

Has coronavirus affected the market? Someone called me yesterday and asked if coronavirus has affected the housing market. I wrote about this last week and I basically told the guy we don’t have any real data yet. So far in Sacramento this year the market has felt competitive and any threat of an outbreak has seemed to be hampered by the sexiness of low mortgage rates. However, we haven’t really had many COVID-19 cases manifest locally and people haven’t been too concerned. Though this week social media began to panic and it seems like we’ve reached an inflection point as events get cancelled, people are practicing social distancing, and familiar faces like Tom Hanks have the virus. In short, it seems like many people have shifted to take this more seriously and in terms of real estate that’s something that could easily affect buyer and seller behavior in coming time. I realize a focus on real estate right now seems trivial when talking about a pandemic, but that’s what my blog does. In short, let’s pay closer attention to the stats in coming weeks especially.

Watching for a coronavirus effect: If we’re looking at recent sales, it likely won’t show us an effect of the coronavirus because sales tell us what the market used to be like when properties got into contract 30 to 60 days ago. If we begin to see an impact it’s going to start with what buyers and sellers are thinking right now, which will translate into what they do. Thus it’s important to listen for seller and buyer sentiment and to watch whether sellers are listing their homes and whether buyers step aside with a “wait and see” stance. More specifically, I recommend watching the number of new listings hitting the market, expired listings, price reductions, the number of sales happening, days on market, the number of pendings, number of multiple offers, credits being offered, etc… It’s tempting to look at prices as a gauge for any COVID-19 effect, but prices are the last place a trend shows up.

Lack of confidence: The big deal happening right now is consumers are losing confidence. On one hand the stock market doesn’t technically mean much for most buyers trying to qualify for a mortgage because their income isn’t based on Wall Street. But losing money in a 401K over time can certainly lead to less confidence about making other big financial decisions. So far the housing market has felt hyper-competitive this year locally because of low rates, but that can change quickly depending on how consumers feel about the economy, job market, and of course health. I know, housing is a need, so it’s different than choosing whether to eat out right now or not. But it’s also true buyers and sellers don’t always feel the need at every moment to pursue buying and selling. Like I said last week, markets don’t like uncertainty, so infusing more uncertainty into the economy and housing market is a big deal for how the market feels and what the market does. In all of this we’d be wise to avoid hype and sensational ideas. Let’s look to data to inform our perception of what is actually happening.

Okay, back to some stats.

More competitive at lower prices: Buyers know this. It’s been hard to get into contract lately – especially at lower prices where the market is more aggressive. Let me show you this with a bunch of yellow dots representing the sales price to original list price ratio. If you’re not familiar with this metric, when a property sells at 100% it means it sold at exactly the price it was listed. Likewise when the ratio is 103% it’s a sign a home sold three percent higher than the list price. Anyway, when looking at all February sales there are more properties selling above 100% at lower prices. This tells us homes are getting bid up more at lower prices. Duh, thanks Captain Obvious. I know this isn’t a surprise, but it’s fascinating to see visually. Here’s a big takeaway though. NOT everything is selling for more than the list price – even at lower prices. I know it doesn’t seem that way in the trenches of escrows, but there is no denying this reality when looking at the stats.

More multiple offers this year: This has been the most aggressive beginning of the year in several years. Technically the market saw 27% more multiple offers this year compared to last year at the same time.

The market is accelerating: For a long while I’ve been talking about how the market is slowing because that’s what the stats were showing, but I’m changing my tune because the market is accelerating again. Here are two images to consider. When we look at the median price in the region based on the previous twelve months, price growth has clearly tapered. It’s like you’re driving on the freeway and you take your foot off the gas pedal. You’re still moving forward, but you’re not going as fast. But when we look at the past 90 days in each respective year it’s obvious the market is starting to accelerate again.

SLOWING TREND:

SPEEDING UP LATELY:

Mortgage rates & Debbie Downer: This year the market has felt dramatically different than last year and the culprit is low mortgage rates. Having rates between 3 to 3.5% has been like injecting a steroid into the housing market because it’s made things super competitive. For some it’s helped create more affordability or at least incentive to get into the game, but this also artificially inflates prices and it’s not sustainable. I know I sound like Debbie Downer, but such low rates are a bit like injecting Cortisone into a bad hip. It feels good for a while until it wears off.

You still have to price it right: It’s tempting to think the market is so aggressive that you can price however you want. Nope. It’s still a price-sensitive sellers’ market. Even though it feels crazy right now due to low rates, buyers are still in tune with prices and not willing to offer any price out of desperation. Case-in-point: Here is what just about every neighborhood looks like. The longer a home is on the market, the further it tends to sell from its original price. It seems in most areas bidding wars happen in the first seven days and if the market is not biting at your price you better give serious consideration to doing a price reduction. If the market is speaking, it’s time to listen.

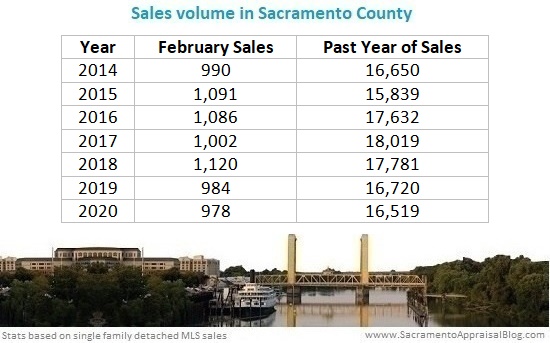

Sales volume is lackluster: Prices have been glowing and we’re seeing multiple offers, but sales volume is lackluster. On in more positive terms we could say the number of sales is pretty normal – but definitely on the lower side of normal. In the region we seem to have a new rhythm these past two years of 26,000 sales, but that’s clearly down from 28,000 in previous years (see image). Some say more new homes is the reason, but new construction hasn’t been that robust. Moreover, sales volume started to suffer as soon as mortgage rates shot up in 2018, so to me lower volume has more to do with buyers backing off (and affordability). With that said, we’ve been seeing fewer listings this year especially, so over time this can lead to fewer sales too.

Back to the nominal peak: The median price is officially back to where it was at the peak of the market in 2005. This honestly doesn’t mean anything because there isn’t any formula for the market where a “pop” or change happens when reaching a certain price level. But as a guy watching data closely for so many years, the numbers geek in me has been waiting a long time to see this happen. But again, it doesn’t mean anything. Technically when comparing value today with a date in the past it’s important to factor in how the value of the dollar has changed over time. If we use an inflation calculator the value of the dollar in 2005 at $395,000 would actually be worth $520,000 today. This is seriously anal and most people could care less about this technical conversation, but I wanted to mention it because it’s worth knowing. Also, I’ll hopefully avoid persecution on Twitter from the economics community. For me there is a practical takeaway here though because you’ll not hear me say stuff like, “Values are back to 2005”. Nope. Technically they’re not. But the nominal price is back to 2005, so that’s why I say things like, “Prices metrics are back to where they used to be.”

I could write more, but let’s get visual instead.

Thanks for respecting my content: Please don’t copy my post verbatim or alter the images in any way. I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Please enjoy more images now.

SACRAMENTO REGION (more graphs here):

SACRAMENTO COUNTY (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

DOWNLOAD 90 visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What stands out to you about the market right now? What else would you add? What are you hearing about coronavirus?

If you liked this post, subscribe by email (or RSS). Thanks for being here.