What will happen to the housing market if we have a second wave of outbreak? Quite a few states are seeing an uptick in COVID-19 cases right now, so this is an important question to ask. This isn’t about politics or fear, but having conversation.

From V to W? The market has seen a “V” shape so far where we had a decline when the pandemic began and then we rebounded. Today I interview economist Ralph McLaughlin to talk about his concept of a Flying W. It sort of takes the “V” that we’ve already seen and talks about why we might see another “V”.

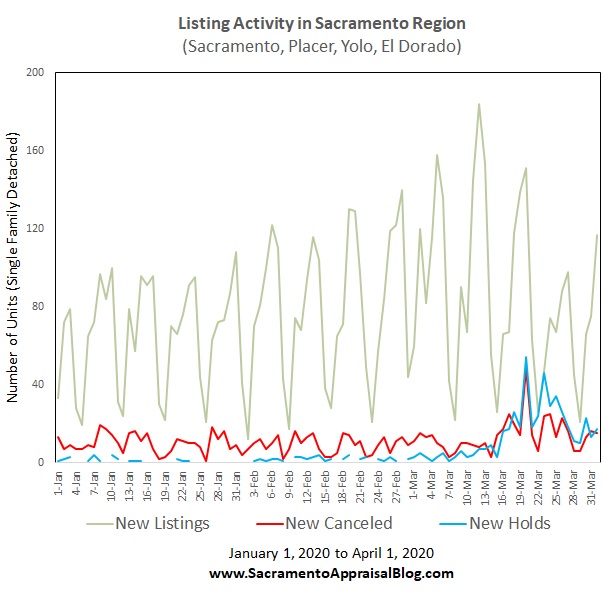

Market update: Here’s my latest market update where I unpack glowing stats from this past week and some things to keep in mind if we do see another outbreak. Watch below (or here).

Ralph: The “Flying W” is generally the shape of the housing market recovery that we’re forecasting at Haus, which essentially is a wavy one. You can think of it as really two “Vs” next to each other, where the initial drop in activity due to the pandemic is sharp and severe, followed by a rebound to near pre-pandemic levels, and then the process repeats itself until we’ve recovered sometime next year. We’re thinking the process will repeat itself for a second time for three reasons. First, we think the initial rebound is simply due to pent-up demand for home buying that would have otherwise occurred in March, April, and May but will simply be pushed to June, July, and August. But after that, we’re not expecting new demand to replace it at comparable levels, which will lead to another drop in activity. Second, and I think we’re seeing this already, is that the virus will make a comeback, which will lead to less demand for homebuying in the fall. Third, there’s a possibility that we’ll see a broader impact on housing demand (including rentals) if the federal unemployment insurance bonus runs out at the end of July.

Ralph: The “Flying W” is generally the shape of the housing market recovery that we’re forecasting at Haus, which essentially is a wavy one. You can think of it as really two “Vs” next to each other, where the initial drop in activity due to the pandemic is sharp and severe, followed by a rebound to near pre-pandemic levels, and then the process repeats itself until we’ve recovered sometime next year. We’re thinking the process will repeat itself for a second time for three reasons. First, we think the initial rebound is simply due to pent-up demand for home buying that would have otherwise occurred in March, April, and May but will simply be pushed to June, July, and August. But after that, we’re not expecting new demand to replace it at comparable levels, which will lead to another drop in activity. Second, and I think we’re seeing this already, is that the virus will make a comeback, which will lead to less demand for homebuying in the fall. Third, there’s a possibility that we’ll see a broader impact on housing demand (including rentals) if the federal unemployment insurance bonus runs out at the end of July.

Closing Thoughts: I’m really careful about discussing the future, but today I wanted to talk with Ralph because I think we need to think through what might happen to the market with a second outbreak and plan ahead. In my mind the two big issues that could influence the market include people’s perception of safety and governmental regulations. If we go on lockdown again, for instance, that could be a huge factor in slowing down the real estate market. Would it be exactly the same thing we saw in late March? Nobody knows. For now though it’s fascinating to consider whether our “V” shape could turn into a “W”. Let’s keep watching…

Manage your mental health: One last note. I realize this is a stressful time for many (including myself), so my hope is that you would have a deep sense of peace no matter what happens. And if you’re getting triggered by so much virus talk, maybe tune out of social media. My sense is having peace is not going to happen by accident so we all need to figure out how to cultivate that. Know what I’m saying?

Thanks for being here.

Questions: How do you think a second outbreak might affect the housing market? Do you think we’re going to go on lockdown again? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.