Last year was a strange time in housing. On paper, it looked like home prices should have tanked in 2023 since we had some of the worst sales volume ever. Yet, prices didn’t dip that much. Today, let’s talk about what happened in a big recap. I hope you get something out of this. Any thoughts?

UPCOMING (PUBLIC) SPEAKING GIGS:

01/12/24 Prime Real Estate (private event (I think))

01/17/24 Gateway Event (private)

01/31/24 Joel Wright & Mike Gobbi Event 9am (on Zoom here)

2/09/24 PCAR WCR Event (11:30am-1pm (more details))

2/13/24 Downtown Regional MLS Meeting 9am

3/11/24 Yolo Association of Realtors (YAR only)

3/26/24 Orangevale MLS meeting 9am

4/11/24 Lindsay Carlisle Event (private)

4/25/24 HomeSmart iCare Realty (details TBA)

SELLERS STEPPING BACK WAS THE X-FACTOR

Sellers stepping back from the market was the x-factor for 2023. We saw about 42% fewer new listings in the Sacramento region, and that completely changed the trend from an ice bath in the fall of 2022 to a much more competitive market for the remainder of 2023. We were missing just over 15,000 listings from the pre-2020 normal, and that basically led to low supply meeting low demand (which made things more competitive despite a glaring problem with affordability). On the positive side, over 21,000 sellers DID LIST their homes (some people think nobody did).

OVER 10,000 MISSING BUYERS IN 2023

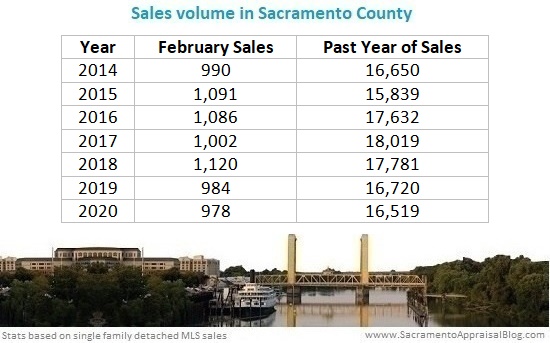

We had our second worst year of volume in decades in 2023 as we were missing 10,600 buyers from the pre-2020 normal (that’s 2016-2019). In the region, volume barely inched above 2007 levels despite population growth since that time. In Sacramento County, it was the worst year ever though, and that’s notable since Sacramento County has the largest local population. On the positive side, over 17,000 sales DID HAPPEN this past year. Again, some people talk about housing as if zero sales are happening.

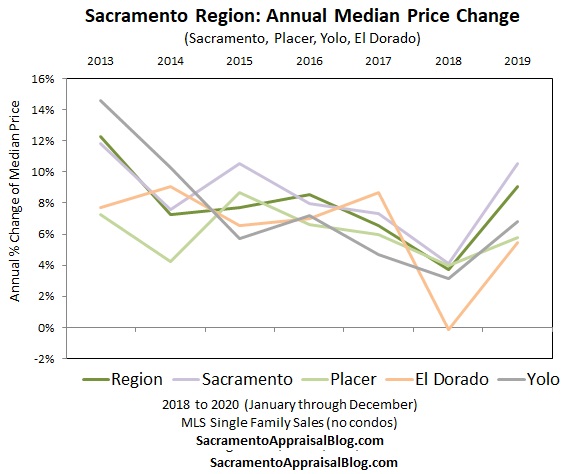

PRICES DIDN’T DIP THAT MUCH

One year ago, it looked like prices were getting ready to see a big drop in 2023, and I thought we’d see a much bigger change, but that didn’t happen since sellers stepped back from the market. It turns out the trend changes when 42% of sellers step back. Ultimately, prices are down a few percent from their 2022 levels, and it’s likely most of the downward dip occurred in 2022. I’m not sugarcoating here either. This is what the stats are showing.

OTHER BIG THEMES

When looking at the stats below, we saw an increase in distressed sales, it took longer to sell in 2023, there was a higher percentage of cash buyers, and larger homes sold compared to the previous year. 2023 was a year where we started to get further away from the craziness of competition in 20221, but it still felt really competitive (more like early 2020 competition).

NEW HOMES VOLUME WAS STRONG

One of the bright lights in the housing market has been brand new home construction. 2023 was only outpaced by 2020 and 2021. This is a much different trend than the existing real estate market that felt like it got a beatdown. For reference, when we add the existing market (older homes) and newer homes together, brand new homes were about 27% of everything.

HERE’S A WIDER VIEW OF PRICE CHANGE

In case you wanted to see the average price and median price through the years, here you go. There have been so many comparisons of 2023 to 2007 because volume felt like 2007, but price change was nothing like 2007, and inventory did not build like we saw years back then either.

ANNUAL RECAP IMAGES FOR 8 COUNTIES:

Here’s a look at eight counties in the wider region. Remember, annual stats compare the entire year of 2022 with the entire year of 2023. We also want to look at prices year-over-year because that can be different (see below).

WAIT, AREN’T PRICES UP 7% FROM ONE YEAR AGO?

This is super important, and I’m guessing some people might even get confused about this. Year-over-year prices are actually up from last year by 7-8%, so it might be surprising to see prices dipped when looking at the entire year. I posted year-over-year prices for all eight counties on my STATS TAB on the navigation bar. Please see that tab. But for now, I made a video to explain why year-over-year price change is so lofty right now. I’ll post this in a few other places today in case you can’t watch on Instagram.

NOTE: There are different ways to look at prices. We can compare year-over-year (December 2022 with December 2023), annual metrics (all of 2022 with all of 2023), or even how things have changed from the peak in May 2022. My advice is to know all of these stats to be able to talk about what the market is doing. If we give too much attention to just one of these things, we might have an imbalanced view of the market.

If people are confused about this, I’ll dig in a little deeper in coming weeks.

View this post on Instagram

Anyway, there is so much else we can talk about, but that’s it for now. I’ll have so many other visuals out in coming weeks. Stay tuned.

Thanks for being here.

Questions: What surprises you most about the stats? What are you seeing in the market right now in 2024? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

THE SHORT VERSION:

THE SHORT VERSION: