Do appraisers have to use comps from the past 90 days? Nope. Of course not, but this idea is still pretty common. The truth is sometimes the best comps are much older. Usually they’re not four years old, but they were in this situation. Let’s talk about it. Anything to add?

Warning: This post is a little longer on purpose.

Some details: The subject is located in Old Folsom and was built less than ten years ago whereas most neighborhood homes were built many decades ago. The subject is about 2500 sq ft with a 572 sq ft Accessory Dwelling Unit (ADU). It had a high-quality of construction and the builder nailed the architecture because it resembled the old world charm found in nearby homes.

My appraisal & the sale: I did an appraisal before the subject was on the market to assist the owner in pricing the property. This home was listed by Gail DeMarco at $899,999 and it sold for $925,000 in only six days of market exposure. It had four offers too. By the way, I appreciate getting permission to share about this property too.

Lack of recent comps: There were no recent similar sales. Zero. Most other areas of Folsom are much newer in age too, so using other neighborhoods wasn’t ideal in my book. This is why I chose to focus on older sales to understand the neighborhood market.

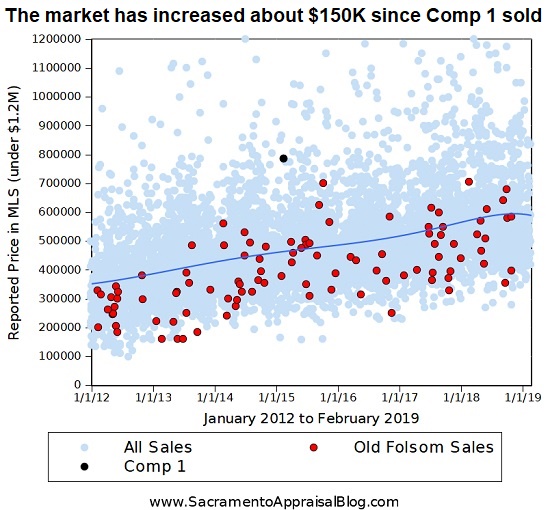

The city vs the neighborhood: I looked up sales to get an idea of what buyers have been paying historically in Old Folsom. Lately there hasn’t been anything above the low $700s, but if I look back in time I can see two outliers in particular. Could those be clues for me?

The best comp: As I looked back in time I found a neighborhood sale that was ideal as a comp because it was newly constructed, had era charm (higher quality), and it also had an accessory unit. It’s like the heavens opened up and gave me a gift. Yet this sale was from 2015. Doh!! But then again, this property sold twice on the open market and commanded a price premium both times, and that helped show what the market was willing to pay for something unique.

I wondered how this one comp competed with the rest of similar-sized sales in Folsom too, so I made some visuals. This gave me clues into what was competitive in the past during both sales. In other words, which areas of town did this property compete with when it sold in 2006 and 2015?

How much has the market changed? I gauged the increase in value since 2015. The market had increased about $125,000 to $150,000 since this property sold based on the trendline on the graph and other sales, so I gave a huge adjustment up in my report. By the way, if you don’t know how to graph, you can always try to see the market by comparing sales in 2015 vs 2019 or maybe crunching numbers on a CMA. But then again, why not learn to graph?

Okay, this is getting too long, but that was some of my process.

CLOSING THOUGHTS:

1) Be sure to look wide enough: Sometimes we focus so heavily on comps over the past 90 days, but there might not be any. At times we need to look much further in time to get a sense for how a unique property might fit into the market. Whatever we do, let’s just be cautious about imposing such a narrow view that we miss older sales that might be relevant. Usually we might have sales within the past 12 months, but this was a unique case. I’d recommend finding more than one comparable sale too because one data point might not be enough to get a sense of value.

2) Keeping lenders happy: Lenders like things to be neat and often ask appraisers for very recent sales, but in my mind there just wasn’t anything adequate to use that was recent. This would be a really ugly appraisal for a lender, and it’s why I told the owner that the appraiser for the loan was going to have a hard time finding two other similar sales that were more recent. I don’t know what the appraiser did, but part of me hopes at least the appraiser used this one older sale because it was the best (in my mind).

3) Crunching old data but using new sales: It’s possible to use old data to help understand the market and still focus on new comps. So in a case like this you could study much older sales but then choose to focus on much newer ones in an actual appraisal or CMA.

4) The fine print of lenders: Keep in mind lenders do sometimes have requirements for how old comps can be. For instance, FHA wants all sales to be within 12 months. So if a buyer here was using FHA, I could study older sales and even give weight to this older sale in the comments in my report, but I wouldn’t actually use this as a comp in my appraisal.

REAL ESTATE AGENTS: If you happen to be having a conversation with an appraiser about sales you used to price the property (without pressuring the appraiser to meet a certain value of course), I suggest you generally try to focus on more recent data because lenders tend to get fixated on new sales. Yet don’t be afraid to talk through older stuff. Just be sure older sales are truly relevant though. For instance, in the case above it would be okay to share this one comp from 2015 because it was truly the best one. But you hands-down need current stuff too.

I hope that was interesting or helpful.

CLASS I’M TEACHING: I’m doing my favorite class at SAR on May 28th from 9am-12pm called “How to Think Like an Appraiser.” Sign up here.

Questions: Anything else to add? What would have you done in this situation?

If you liked this post, subscribe by email (or RSS). Thanks for being here.