Competitive. Normal-ish. Price sensitive. These are all words that describe Sacramento’s housing market right now. Let’s take a look at some of the latest trends so we can better understand and explain how the market is unfolding.

Two ways to read this post:

- Scan the highlighted text and graphs quickly.

- Grab a cup of coffee and spend a few minutes digesting what is here.

If you want an email with all graphs in this post for free, fill out the form below:

1) Prices have seen a normal-ish seasonal uptick:

The market is showing a fairly normal and steady seasonal uptick in price. Whether you look at median price, average sales price, or average price per sq ft, there has been an increase in recent months. The market has seen about a 4% increase in prices over the past four months, yet at the same time many are describing the market as fairly flat since some neighborhoods are not seeing much of an uptick at all. Remember that just because county-wide stats show a 4% recent increase does not necessarily translate into 4% value increase for each property.

2) Houses are taking about one week longer to sell:

From April to May, sales took about one week longer to sell in Sacramento County. In contrast, Placer County and the Region showed very little change in cumulative days on market. Generally speaking, the more expensive the property, the longer it is taking to sell. Overall, the market is price sensitive, which means if properties are not priced correctly, they are sitting. Expect this trend to continue so long as inventory increases in coming months.

From April to May, sales took about one week longer to sell in Sacramento County. In contrast, Placer County and the Region showed very little change in cumulative days on market. Generally speaking, the more expensive the property, the longer it is taking to sell. Overall, the market is price sensitive, which means if properties are not priced correctly, they are sitting. Expect this trend to continue so long as inventory increases in coming months.

3) Inventory increased only slightly from April to May:

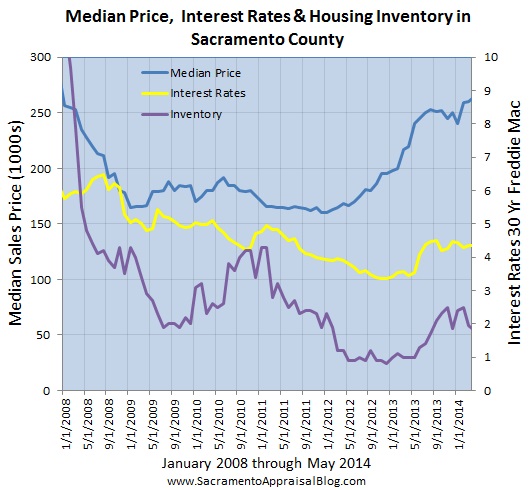

Housing inventory increased from 1.80 months to 2.0 months in Sacramento County from April to May 2014. Inventory is still very low, which is making competition aggressive in certain price ranges.

4) Not every price range is showing the same trend:

Different price ranges experience different trends. This is clearly seen since inventory isn’t the same at every price level.The market is very competitive under $300,000 right now, but anything above $750,000 is far less competitive. There was little change from last month for properties under $500,000, though above $750K saw some increases. Take the 24 months of inventory above $1,000,000 with a grain of salt since there were only 3 sales in this price range last month, but there are 20 or so pendings right now. Ultimately this million-dollar stat is skewed, but it’s still safe to accurately say there is one year or more worth of houses for sale above $1,000,000 in Sacramento County.

5) Volume is down by 15% from last year, but similar to last month:

Sales volume is down compared to last year, but sales in May were about the same compared to April. In the next few days as more sales are entered into MLS, I suspect sales volume for May will increase beyond volume in April. After a very sluggish start to the year in terms of sales, it’s nice to have two consecutive months of more than 1400 sales. Of course volume is still significantly lower than previous years, and that is something to continue to watch over time.

6) Cash sales have been declining for one year now:

Cash sales used to represent closer to 35% of all sales in the county just one year ago, but now they’re only 19.5% of all sales (for April & May 2014). Cash investors were a very significant driver for the market, but now the market is no longer being driven by cash.

7) FHA & conventional sales are both showing increases:

When cash investors took their foot off the gas pedal one year ago, it got much easier for FHA and conventional buyers to get into contract. The market is still very competitive since inventory is low, but owner occupant buyers have much more of a fighting chance these days.

When cash investors took their foot off the gas pedal one year ago, it got much easier for FHA and conventional buyers to get into contract. The market is still very competitive since inventory is low, but owner occupant buyers have much more of a fighting chance these days.

8) Distressed sales continue to be sparse:

Both short sales and REOs have decreased dramatically in recent years and are definitely not driving the market. Banks are tending to spend more time and money fixing up their REOs, while short sales are often still priced aggressively low. REOs have shown a slight uptick recently (especially considering the most recent “quarter” is only comprised of two months of sales. This isn’t anything to write home over per se, but something to watch over time to see how it evolves.

9) Interest rates decreased slightly last month:

Interest rates showed a slight decrease over the past month, and that is something that will help prices be slightly more affordable. In light of massive price increases over the past couple of years, affordability is becoming a challenge for many buyers.

10) “Layers” to watch over the next two quarters:

The real estate market has many “layers” that impact value. Last year the market was heavily influenced by interest rates, cash investors and incredibly low inventory, but things have shifted in 2014. Right now some of the main drivers to watch over these next two quarters are the job market, interest rates, inventory and affordability. Local real estate can no longer be so heavily driven by outside cash investors, which means it will be more sensitive to the health and strength of the local economy. Prices increased over the past two years, but not because people are making more money. How does that strike you?

Summary: Our market has slowed down quite a bit from last year. The market is still competitive, but it is very price sensitive. Real estate is still “hot”, but it is definitely cooler than last year in that days on market has increased, inventory doubled, interest rates are higher than they were, and cash investors are much less of a factor. By the way, I’ll share more Placer County and regional trends in a few days.

Sharing Trends with your Clients? If you want to share graphs online or in your newsletter, please see my sharing policy. Thank you for sharing.

Questions: How else would you describe the market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.