The market feels addicted to low interest rates. So what’s going to happen when rates rise? Let’s travel back to the late 70s for some insight and consider a few thoughts. Then I have a huge local market update for those interested.

A few thoughts about interest rates:

1) Addicted: We have a market that feels addicted to low rates. I guess that’s understandable since rates have been hovering around 4% for the past 6 years. On one hand it seems silly that buyers would freak out about rates near 4.5% because that’s historically low, but at the same time the market is sensitive about rate changes because we’ve become accustomed (or addicted) to low rates. Let’s remember rate changes can make a bigger difference at lower prices too because they can more readily impact affordability.

2) They used to be 18%: Some people say, “You kids are so lucky because when I bought my first house the interest rate was 18%.” There’s some truth there and let’s be in tune with history, yet prices used to be substantially lower too. You bought at 18%, but the price was $112,000.

3) Not the only factor: What interest rates do can end up impacting affordability, sales volume, housing supply, and prices. Check out a deep article by Freddie Mac to read through some of the potential changes coming. Yet let’s remember interest rates are not the only factor for housing. There are many other layers of the market that end up influencing value. We can’t forget about the job market, economy, a housing shortage, financing, creative loans, new construction, cash investors, etc… In short, interest rates are a big factor for the market, but they are not the only factor either. One more thing. Nobody knows the future. While it looks like rates are going to be increasing more, we could be saying something entirely different next year.

When rates doubled from 1977 to 1981 (from Freddie Mac):

1) Mortgage origination fell by 40%.

2) Annual single family home sales volume dropped by 36%.

3) New construction dropped by 51%.

History teaches us a huge change in rates can absolutely sway the market. Obviously an uptick from 4% to 4.5% is not the same thing as 1977, but the effect then reminds us to keep an eye on mortgage origination, sales volume, and new construction (and prices).

I hope that was interesting or helpful. Anything to add?

–——-——- Big monthly market update (it’s long on purpose) ———–——-

It’s starting to look like Spring. Prices are picking up, it took two less days to sell last month, and more listings are hitting the market. It was actually the strongest February of sales volume we’ve seen since 2013. The market has an aggressive feel with multiple offers (when properties are priced correctly), yet in some neighborhoods it almost seems like values have been a bit flat or subdued. Thus it’s a good reminder the market can feel aggressive sometimes without absolutely insane value increases. Keep in mind there are about 100 price reductions every day right now in MLS, and that means buyers are not willing to pay any price despite a housing shortage.

It’s starting to look like Spring. Prices are picking up, it took two less days to sell last month, and more listings are hitting the market. It was actually the strongest February of sales volume we’ve seen since 2013. The market has an aggressive feel with multiple offers (when properties are priced correctly), yet in some neighborhoods it almost seems like values have been a bit flat or subdued. Thus it’s a good reminder the market can feel aggressive sometimes without absolutely insane value increases. Keep in mind there are about 100 price reductions every day right now in MLS, and that means buyers are not willing to pay any price despite a housing shortage.

Sales volume is down (barely): There is lots of talk in the media about how sales volume is slumping nationally and is down 3% or more, but it’s only down 0.28% this year in the region compared to last year. It’s actually up from two years ago, which a big point in my mind. In Sacramento County sales volume is down nearly 1.5%, which is about where it’s been hovering lately. This isn’t a red flag for the market, but it would be if sales volume really started to slough. Moreover, knowing that rising interest rates can impact sales volume, this is important to watch over time.

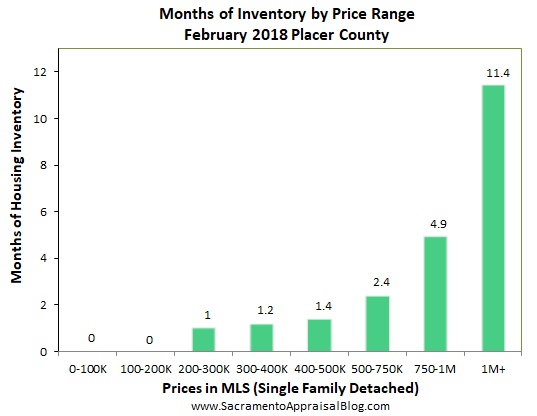

The bottom vs. top: The bottom of the market has less inventory, more competition, and more upward pressure than the top. The highest prices above $1M have over a year’s worth of homes for sale. It’s actually fairly normal to have that much inventory at the high-end, though this month is a bit higher than the same time last year, so let’s keep watching that. Part of having so many listings at higher prices though is sellers are pricing at absurd levels that are totally disconnected from the market. It’s like everyone and their Mom wants to sell for $3M when very few sales in Sacramento fetch those types of prices.

Advice for sellers: Pay careful attention to similar properties that are actually selling in the neighborhood rather than overpriced listings. In other words, price according to the comps and listings that are getting into contract rather than listings that don’t really reflect the market. And don’t use price per sq ft to price your home either.

RENTS: I’ve been focusing more on rents and I’ll keep doing that if people like it. I have a rent folder in the download link below too (data from Yardi Matrix).

I could write more, but let’s get visual instead.

DOWNLOAD 70 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

DOWNLOAD 70 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: How do you think rising rates will impact the market over time (if they do keep rising of course)? Anything I missed? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The stats have been glowing for months in Sacramento County, but last month we finally saw a dip in prices. In short, the glowing stats are now showing a slowing. But that’s not really a surprise because

The stats have been glowing for months in Sacramento County, but last month we finally saw a dip in prices. In short, the glowing stats are now showing a slowing. But that’s not really a surprise because