We love sensational real estate headlines, but here’s what tends to happen. We talk about something like it’s the biggest thing ever, it ends up being no big deal, and then we move on to the next thing. It sort of reminds me of Y2K because there was so much fear about worldwide chaos, but then nothing happened. All bark. No bite. Anyway, let’s talk about a few issues, and you decide if these are hyped-up “Y2K real estate trends” or not. Then I have a big Sacramento market update for anyone interested. Any thoughts?

Rising interest rates:

For years we’ve heard interest rates would rise, but nothing really happened. Well, now things have begun to change. It’s like Mom & Dad were threatening a punishment, but they never followed through, so we didn’t believe them…. until now. Interest rates are finally ticking up and it’s bound to make an impact on prices if the increase hits buyers in the wallet. What I mean is if buyers in mass can afford the increase, then it’s not a big deal unless buyers start showing resistance. An increase in rates won’t hit everyone the same either as buyers at the lowest price ranges will feel it the most. Keep in mind rising rates in the near future could actually lead to buyers rushing the market instead of withdrawing from it. What will happen? Nobody knows. Heck, rates are still incredibly low, and we don’t even know if they’ll continue to rise. But the Fed has been more forthright about coming rate hikes, so that’s why this feels like more than pure hype. Anyway, let’s see how this plays out and keep an eye on creative financing from lenders too.

Are there too many million dollar listings?

Headlines are talking about the high-end market softening in portions of the country. Locally I’ve heard that sentiment since inventory seems imbalanced at the top right now in the Sacramento region. It sounds alarming to think there is a year’s worth of million dollar listings, so it’s easy to conclude the high-end market is sagging. But last year at the same time we saw nearly the same number of listings. If you need to see the numbers, at the beginning of February 2017 there were 213 listings above $1M and this year there were 220 listings at the beginning of the month. It would be insanity to see twelve months of housing inventory at the lowest prices, but it’s actually fairly normal for January stats for the high-end. In short, it could be possible the million dollar market is softening, but for now let’s not use the number of listings alone as evidence.

Is sales volume slumping?

I’ve been noticing real estate headlines talking about slumping sales volume in many markets across the United States. For Sacramento County we actually had the strongest January since 2013, yet it is true that yearly volume is down 2.5%. This isn’t shocking news because nearly all of last year volume was down 1-2% depending on the month. Here’s the thing though. Sales volume in 2017 was slightly lower than 2016, but it was actually higher than 2015. This reminds us if we only look at one year of sales we might miss the bigger trend. Anyway, volume is also down in the entire region, though only by 1%. Overall it’s fair to talk about lower volume because that’s a fact, but it’s probably not fair to hype the issue too much – especially since volume is actually higher than 2015. Let’s keep watching though because it would be a huge deal if sales volume really did start to decline significantly.

Overpricing because the market is so “hot”:

In case you wanted some background noise while working, I did a Facebook Live Q&A last week with Realtor Justin Vierra and we talked about pricing for the “unicorn.” Overpricing is a real issue in today’s market. By the way, if anyone wants to do podcasts and interviews, I love that stuff. You can listen to our hour-long conversation here too in case you wanted more than just this clip.

I hope that was interesting. Anything to add?

–——-——- Big monthly market update (it’s long on purpose) ———–——-

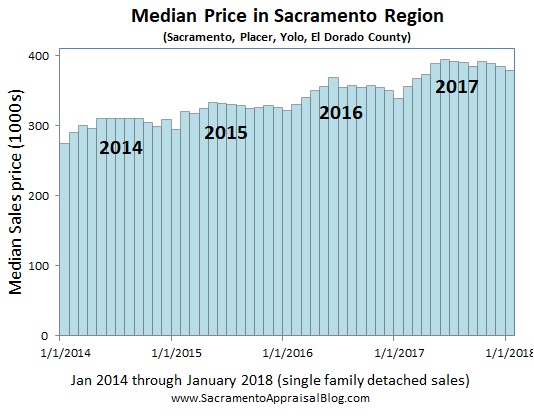

Right now we’re in that weird place where sales stats are sagging from a slower fall season, but the market is heating up. For January stats we saw all the typical signs we’d expect to see. Sales volume declined, it took an extra day to sell, most price metrics sloughed, and inventory increased. The median price in Sacramento County actually has been fairly flat, but last week I talked about how the market really did slow down despite the flatness. Anyway, I have quite a few visuals below to help show how the market has moved in recent time.

Right now we’re in that weird place where sales stats are sagging from a slower fall season, but the market is heating up. For January stats we saw all the typical signs we’d expect to see. Sales volume declined, it took an extra day to sell, most price metrics sloughed, and inventory increased. The median price in Sacramento County actually has been fairly flat, but last week I talked about how the market really did slow down despite the flatness. Anyway, I have quite a few visuals below to help show how the market has moved in recent time.

Housing supply: Inventory is up a bit right now. It’s not much, but this January was up 6.5% in the region compared to last year at the same time. Over the past few months inventory has actually ticked up slightly, and that’s welcome news for the market. Yet before writing home to say the housing shortage is over (it’s not), let’s wait to see what happens during the spring market. I’m not overly impressed at a few months of slightly higher inventory around the slower fall months. Let’s watch the spring market, which will be the bigger test.

I could write more, but let’s get visual instead.

DOWNLOAD 62 graphs HERE: Please download all graphs in this post and more here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

NOTE: I cut out a few graphs and data this month. If you miss something, let me know.

DOWNLOAD 62 graphs HERE: Please download all graphs in this post and more here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What are you seeing out there in the market? Is the top softening? What are buyers saying about interest rates? Anything I missed? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.