The pile of listings is growing, and it’s taking longer to sell. That’s what so many housing markets across the country are experiencing right now. We’re on the cusp of seeing some real change in the stats over the next few months. Here are some things on my mind. Anything to add?

Why have we seen a spike in listings?

We have almost 3,400 active listings today in the Sacramento region. This is actually still lower than a normal level, but over the past two months there has been a dramatic uptick. What is causing this change? It’s not that sellers have rushed to list, but rather we’re seeing fewer buyers. Since April we’ve easily had over one thousand fewer pendings in the region. Instead of getting into contract, these properties have essentially stayed active. In short, we’ve seen a rise in listings due to a fall in demand.

It’s taking longer to sell (check out the actives):

I think this is a helpful way to show market change. Sales in June have gone quickly, it’s taking longer for pendings to get into contract in recent weeks, and active listings are really starting to sit. And when actives close eventually, that’ll really affect the stats. Do you like this visual?

NOTE: Sales in June got into contract in May, so they really tell us more about what the market was like in May.

The stats are hot, but that’ll change more in July:

The market has been changing, but we haven’t seen too much change in actual sales stats yet. The truth is it takes time for temperature change to show up in the numbers. This dotted line projects days on market through July based on pendings so far in June. The black line (2022) is going to get a whole lot closer to the red line (pre-pandemic average). We are still not back to a normal days on market, but that can happen quickly. As I’ve said, we’ve waived goodbye to the most aggressive market ever. This is key to recognize since it’s simply going to take longer to sell today.

Duh, it should be taking longer:

Some of what we are seeing is seasonal because it should take longer to sell at this time of year, but we’ve also experienced a market shift since affordability has been given a severe beating in recent months. So, what we are seeing isn’t just seasonal. This is about a bigger change where buyers are struggling to afford and stay in the game.

I’m exhausted and out of quarantine:

I just got out of quarantine. Covid finally got me after all this time. My family actually had to cancel a New York vacation last week because of this, so that was a real bummer. I honestly so needed a vacation, but that’s water under the bridge now. Anyway, I’m grateful for health, and I’m also really tired, so I’ll be inching back to work and trying to pace myself.

Thanks for being here.

—–——– MORE VISUALS FOR THOSE INTERESTED ———––

GLOWING AND SLOWING:

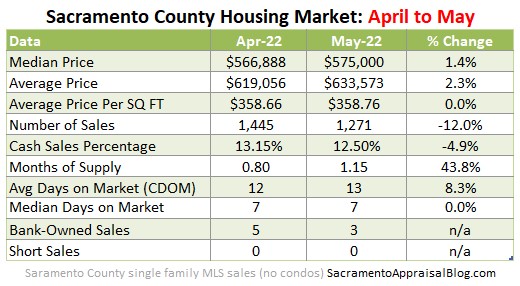

There are two housing markets right now. Glowing sales stats from May. And slowing stats in June. This is important to recognize because we want to understand sales from the past while not ignoring listings and pendings today. The stats from May are still quite elevated in that properties sold a few percent above the list price on average. On one hand this reflects a market that is still statistically above the normal trend, but on the other hand let’s remember sales in May really tell us more about pending contracts in April (that closed in May). My advice? Recognize hot stats from previous months, but don’t ignore slower metrics right now with fewer offers, increasing days on market, dropping sales volume, more price reductions, etc….

There are two housing markets right now. Glowing sales stats from May. And slowing stats in June. This is important to recognize because we want to understand sales from the past while not ignoring listings and pendings today. The stats from May are still quite elevated in that properties sold a few percent above the list price on average. On one hand this reflects a market that is still statistically above the normal trend, but on the other hand let’s remember sales in May really tell us more about pending contracts in April (that closed in May). My advice? Recognize hot stats from previous months, but don’t ignore slower metrics right now with fewer offers, increasing days on market, dropping sales volume, more price reductions, etc….

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Some visuals…

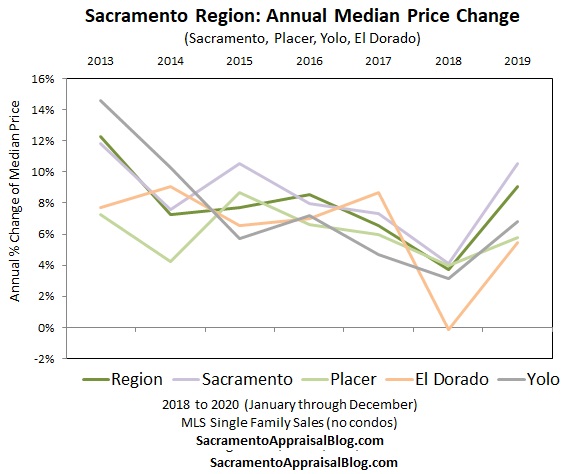

YEAR OVER YEAR:

Annual stats are important to digest, but don’t forget to look at month to month stats. But remember, sales in May really tell us what the market used to be like in April when these properties got into contract. Also, not every location and price range have the same trend.

MONTH TO MONTH:

Looking at sequential months is key too so we don’t just get stuck or hyper-focused on last year (the past).

OTHER VISUALS:

Just in case you’re hungry for more…

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What are you seeing out there in the market? What did I miss? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Free webinar: I’m doing a big market update this week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working.

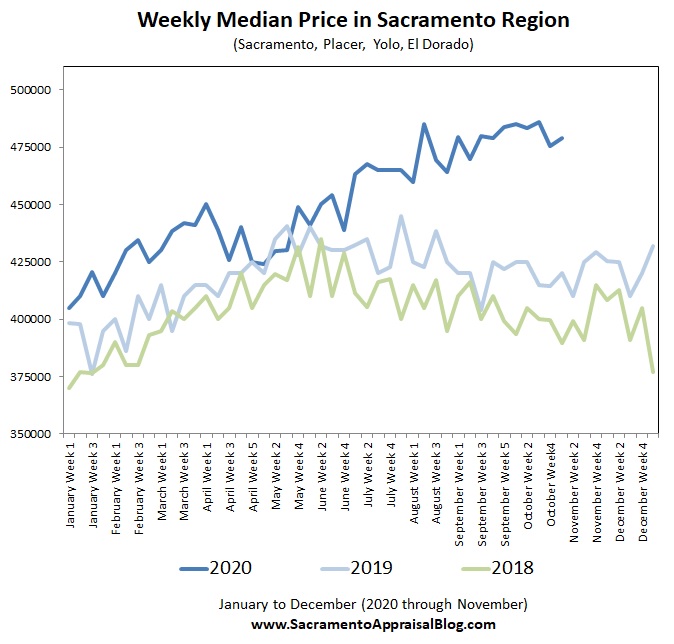

Free webinar: I’m doing a big market update this week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working.  MARKET SUMMARY: In short, the market has been slowing for the season, but it’s still best described as a “hot” market. I keep saying that this fall has not been normal because the market hasn’t softened like it normally does. It’s really felt more like spring than anything… With that said we have begun to see sales volume drop for the fall, but properties are still selling very quickly. In fact, half of all home sold in six days or fewer in the region last month. We literally have about 50% fewer listings right now, inventory is at historic lows, and we had

MARKET SUMMARY: In short, the market has been slowing for the season, but it’s still best described as a “hot” market. I keep saying that this fall has not been normal because the market hasn’t softened like it normally does. It’s really felt more like spring than anything… With that said we have begun to see sales volume drop for the fall, but properties are still selling very quickly. In fact, half of all home sold in six days or fewer in the region last month. We literally have about 50% fewer listings right now, inventory is at historic lows, and we had

THE SHORT VERSION:

THE SHORT VERSION:

Hey girl, let’s have bubble talk: Prices are just about back to where they were fourteen years ago when the market collapsed in 2005. In fact, most price metrics in Sacramento are within 1-3% of the peak. This means with just a little more modest price growth we might be having “Hey girl, we’re back” (yes, that was a Ryan Gosling reference (sorry)).

Hey girl, let’s have bubble talk: Prices are just about back to where they were fourteen years ago when the market collapsed in 2005. In fact, most price metrics in Sacramento are within 1-3% of the peak. This means with just a little more modest price growth we might be having “Hey girl, we’re back” (yes, that was a Ryan Gosling reference (sorry)).