The market is hot. But it’s not so hot that you can command any price you want. Today I have a quick post to show a few trends. These are brand new visuals with some great takeaways (I think). Enjoy if you wish.

1) MULTIPLE OFFERS

Huge change this year: There were 39.3% more multiple offers this October compared to last year at the same time. This speaks to how much more competitive the market has been lately. While we are experiencing a slight seasonal slowing right now, the market is far more competitive than it should be for the time of year.

Not everything: Last month 32% of listings had price reductions. In short, even though the market is super aggressive it doesn’t mean everything is selling above the list price.

10-20 Offers: This year we’ve seen substantially more properties with 10-20 offers compared to last year. The highest number of offers last month was 37 too (just in case you want to sound super smart).

Here’s a look at 5-10 offers too. What a difference!!

NOTE: Our MLS has two fields called “multiple offers” and “number of offers.” This is how I’m extracting the data.

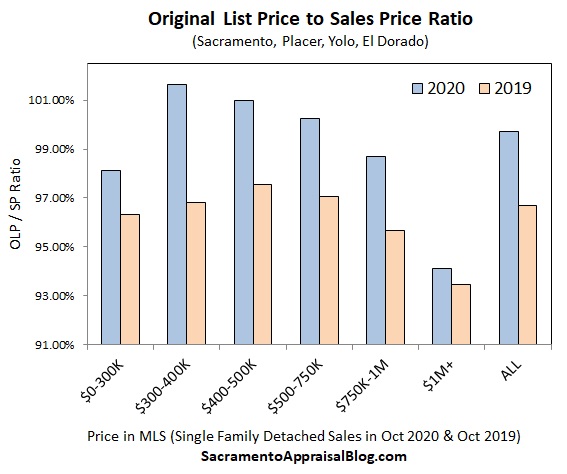

2) THE MOST AGGRESSIVE PRICE RANGES:

This is geeky stuff, but it’s so important for understanding the market isn’t the same in every price range or neighborhood.

The most aggressive: The most aggressive price range in the Sacramento region is between $300,000 to $400,000 (not a shocker). The sales price to original list price ratio is 101.65%, which basically means properties in this range sold on average 1.65% above the original price. In short, the lower the price, the more aggressive the market is. Keep in mind there are few sales below $300,000, so don’t write home over that lower stat.

The most overpriced range: This year we’ve had explosive growth with the number of million dollar sales as there have literally been twice as many over the past four months compared to last year. But this price range is also the most overpriced. On average sales above one million dollars last month closed about six percent lower than their original list price. At times million dollar listings are literally priced hundreds of thousands of dollars too high (or even millions).

And one more visual to show last year vs this year…

Market update: In this market update video I talk quickly through eleven trends. I hope you walk away with some insight. Enjoy if you wish.

Free webinar next week: I’m doing a big market update next week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

Free webinar next week: I’m doing a big market update next week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

QUICK CLOSING ADVICE:

1) Price reasonably and you should be able to get at least a few offers.

2) Price too high and you’ll likely get zero offers (seriously).

3) Sellers, you don’t need to aim to get twenty offers. I suggest aiming for a few solid offers. My stats even show you don’t need 20 offers to get the highest price.

4) Sellers, aim for the market instead of that mythical unicorn Bay Area buyer who will mysteriously overpay for some reason.

5) Buyers, study your competition in your price range and offer accordingly. There is a good chance you may need to offer above list and have cash to pay any difference between the contract price and a lower appraisal. This is not easy on buyers, but it’s the dynamic out there right now.

6) Buyers, start looking at properties that have been on the market for 30 days or more. These ones are likely overpriced and it may be easier to get into contract on something like that.

7) Other. What else?

I hope this was interesting or helpful.

Questions: What are you seeing in various price ranges? I’d love to hear your take from your vantage point in the trenches.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I buy several houses a year as investments. I’m stressing over whether a sharp correction is near or not, so I can try to “time” it all. I am so grateful for your stats and others comments! Please keep up the good work!

Thanks so much Adam. I really appreciate it. If you ever have ideas for what type of stats to parse and different data to look at, I’m open ears. These past six months have been really interesting to watch and I’m in a creative groove of finding new ways to visualize the market. All I’m saying is I want to keep doing that and get better.

Good luck on timing perfectly. 🙂

It is so interesting that your MLS has a field for number of offers. I wish we had that.

Thanks Gary. I love it. I think many colleagues around the country see the graphs I’m making and wish they had access to that sort of data too. Even without the visuals I create I think it’s a really interesting and valuable metric for appraisers. Being able to see how many offers each of the comps is getting can be helpful in assessing the temperature of the market. Of course the hope is agents are being truthful. Yet in my experience after pulling these stats for years is that data from agents shows an unmistakable rhythm to the market, which leads me to conclude agents are doing a good job.

I was thinking the same thing. Our MLS has so many text fields that it is hard to graph anything. I call it a message board. The concessions field bug me, some put %, some put the amount, and others write “none”; which messes my grid. Not to mention I can only download 100 comps at a time. So jealous Ryan : )

Hey Mark. Yeah, we are lucky to have this one field. I’ve actually experimented with exporting different fields and it’s amazing what we can analyze or graph. It’s really too bad you can only export 100 comps at a time. Wow, that is incredibly limiting. Is there a different type of search where you can export more? Our map search allows us to export 2,000 data points and our standard search allows 4,000. Of course I probably couldn’t print a CMA beyond a few hundred properties or so (or maybe 500) and I cannot print out MLS sales in masses, but in terms of data it’s easy to export lots of information in other types of searches. I keep asking MLS if they can increase the numbers more (or make it unlimited), but for now I’m really grateful that they have increased the numbers. Local appraisers have asked and they have listened. Have you ever asked your MLS? It could be worth it.

Great info, Ryan. The video was quite useful, especially toward the end where we see that the increase in median price is heavily influenced by more sales in the higher price brackets, not necessarily that all homes are going up by 16%. Thanks!

Thank you so much Steve. I appreciate you watching the video. That is a really important thing to understand. My sense is sellers and sometimes the real estate community can be prone to apply a 16% stat when that may not make any sense at all on the neighborhood level. Hope you’re well.

Some sellers assume they can sell tired older homes and get top price but then I see them sit. They don’t understand that buyers are looking over a large geographic area. We also have a lot of new construction coming online. Sellers who overprice are chasing the ball down the hill, they would do well to tour their competition which is easily done online.

Good info Ryan!

Thank you Beth. Agreed. Buyers are sensitive too about the product they get. In other words, they won’t pay a mansion price for a shack. Buyers these days really want something that is upgraded and in “move-in” condition where possible. Of course very average homes sell all the time, but they should be priced as such.