Dear Sellers, if you’re overpriced, I have some thoughts for you today. This is coming from a good place, and I want you to have success in selling your home if that’s what you really want to do. Scroll by topic and let me know if you have any questions or thoughts. I hope this helps.

UPCOMING SPEAKING GIGS:

6/13/24 Sacramento Realtist Association (details TBA here)

6/21/24 Exporting data from MLS (register here)

7/9/24 Future Homes Q&A (private I think)

7/11/24 She Invests – REI Networking Group 6pm (register here)

7/23/24 Matt Gouge Private Event

9/17/24 Downtown Regional MLS Meeting Q&A 9am

9/20/24 How to Think Like an Appraiser class (details TBA)

10/18/24 Prime Real Estate (private)

10/29/24 Orangevale MLS Meeting

NOTE: There are still some really aggressive examples out there, but this post is about the stuff that is NOT selling. And yes, this is a Xena Warrior Princess meme. New high or new low? You decide.

BEING STUCK IS MORE COMMON:

At this time of year, the market starts to slow, and we begin seeing a growing club of sellers who are overpriced and need to find the market through price reductions. Many areas around the country are still quite competitive, but there is no mistaking the market is different this year with more supply in just about every location.

MORE INVENTORY IS CHANGING THE VIBE:

We are no longer at pandemic lows. It’s just not 2021 any longer. We are seeing more new listings across the country, and it’s something we’re also seeing locally. Listings have increased much more in portions of Texas and Florida especially, so it’s important to recognize the trend isn’t the same in everywhere. The first visual is from Lance Lambert (highly recommend following him on X and subscribing to his daily emails).

I’m not a huge Zillow fanboy, but I think this visual packs a punch to show how different locations don’t have the same temperature.

And here’s local supply. We’re getting closer to a normal level historically, but we’re still very low when considering the number of actives especially. In the region, we had 500 more new listings in May 2024 compared to May 2023 (this is about 1,200 fewer new listings compared to the pre-2020 normal). Like many markets around the country, we have more supply than last year, but we’re still below pre-pandemic levels. And you know what? We’re feeling the difference. It might not be close to normal yet, but we can feel the change with more inventory. By the way, 36.2% of active listings have had a price reduction in the region as of today.

GET IN TUNE WITH BUYER BEHAVIOR:

Buyers tend to be picky about price, location, and condition these days. And they’re choosy about getting into contract AND staying in contract. Sellers, if you haven’t gone to a mortgage calculator to see what the monthly payment would be for your house, please do that. My advice? Price it right AND make the transaction feel like a win for the buyer too – not just your side.

TEST THE MARKET:

I’ve found it’s either multiple offers or crickets when it comes to buyer activity today. In other words, you either attract a few offers or it’s dead silent. The truth is we don’t really know for sure how a property will fare until it’s actually listed for sale. In this regard, test the market, and if things end up looking different than expected, it’s time to adapt. Sometimes sellers get stuck on the original list price, but that’s a mistake. It would be like someone fishing getting stuck on using one type of bait. Hey, if it’s not working, try something else or move to a different spot. Know what I’m saying?

FIXATE ON ACTIVES & PENDINGS:

A closed sale today doesn’t really tell us about the market today. Nope. It tells us more about the trend one month ago when the property got into contract. Where is the market at right now? This is where we want to give strong respect to other similar units that are actually getting into contract. Forget about other overpriced listings. What is actually going pending at the moment? That’s what matters most. Of course, we’ll look at recent sales too. Let’s just not get stuck on sales from the past while ignoring current listings that are sitting.

DON’T BE THAT PERSON:

Some sellers feel like they’re losing value when the price is lowered. I get it, but if it was never worth that much to begin with, value isn’t lost. The sooner this is acknowledged, the easier it’s going to be to sell. A price reduction is simply one step closer to being able to sell.

ACKNOWLEDGING A SPRING PEAK:

The most aggressive part of many markets across the country tends to be from February to May. Like clockwork, demand tends to peak around May or so. This doesn’t mean competition is at zero, but it means buyers have let up on the gas pedal from the faster speed in spring, and things start to slow down for the rest of the year. Keep in mind the speed change can feel a little different each year, which is why we always need a little time to understand how the second half of the year is going to go. The problem is many people believe the hottest time in the housing market is in the summer. Nope. That’s the weather. In short, it’s time to dig into some local stats and acknowledge a spring peak.

CONCESSIONS AREN’T YOUR SAVIOR:

HOW MUCH DO YOU NEED TO REDUCE THE PRICE?

What is similar and getting into contract right now? That’s your competition, and if you plan to sell, you need to be in the zone of what buyers are willing to pay. It’s sort of like what Jay Papasan says, there’s a difference between being “in the market” and “on the market.” A general rule of thumb is to reduce enough to get the attention of buyers or find yourself in a different price threshold. I’d love to hear advice from real estate agents in the comments.

IT’S GOING TO TAKE LONGER TO SELL:

It’s no longer 2021 where everything was flying off the shelves. Don’t get me wrong. Some stuff is going to sell very quickly today. All I’m saying is we’re no longer in a crazy hot market like 2021, so we need to adjust expectations and be patient when something isn’t in contract after the first weekend.

A MINOR REDUCTION MEANS VERY LITTLE:

Okay, I have some local data, but hopefully there are some takeaways for onlookers too. Basically, a reduction under $10K has meant VERY little for most pending contracts over the past two weeks. That’s what the stats show. So, if you’re overpriced, chances are a more substantial reduction needs to happen. The sweet spot locally has been $10-25K lately with 42% of reductions happening in that range. Or we can see 51% of reductions were under $25K. However, don’t sleep on the need to reduce a much greater amount if needed since 18.8% of reductions were above $50K. Look, if you’re overpriced by $80K, then a modest $10K reduction likely won’t whet the appetite of buyers. As always, look to the comps to know how much you need to reduce.

NOTE: These charts show pendings since June that needed a price drop before going pending. I realize this is not a ton of data, but I wanted a hyper recent focus instead of parsing stuff from two months ago. Remember, there are properties that went pending at the original price too. This post is about the ones that needed a reduction though.

A CLOSER VIEW TO SHOW THE STORY ISN’T THE SAME:

Here’s a closer view of reductions. Sometimes all it takes is a minor price drop, but in other cases it’s much more. This is true in many markets – not just Sacramento. About 29% of pendings needed a price drop of less than $15K. Or another way to look at this is 81% of recent pendings needed a price drop less than $50K. However, take a look between $400-500K. There are some properties with a 1% reduction, but others had a 10% drop. This reminds us the reduction needed hinges on the reasonableness of the original price.

NOTE: The final closed price might end up lower than the reduction too. The goal here is to reduce to a point where a contract happens.

THE BIGGEST REDUCTIONS:

Some properties have needed a price cut by $100-250K. I find some people online conclude the market is collapsing, but do you know what the problem is for the vast bulk of situations? The list price simply isn’t realistic. Look, if you have a $5M listing that is really worth $3M, it’s not sensational news to see a hefty reduction, right?

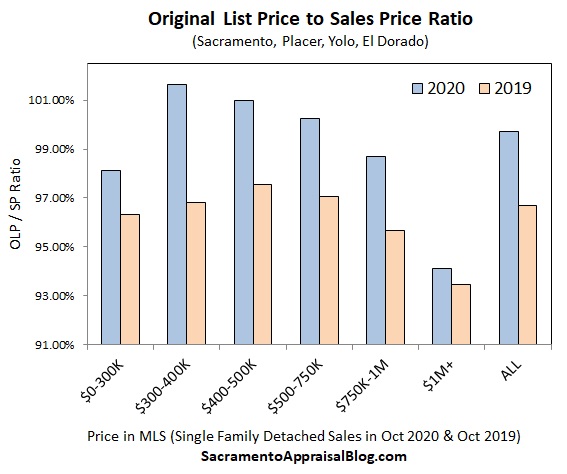

MORE DATA FOR CLOSED SALES FOR THOSE INTERESTED:

My stats above are narrow since the focus is on June pendings with a price drop, but when stepping back, here’s a bigger way to see the overall market. There are lots of properties that close higher than the original price or at the list price. Ultimately, there are still some really aggressive examples of properties getting bid up, but this post is about giving attention to the ones that are NOT selling.

I hope this was interesting. Thanks for being here.

Questions: What resonated with you the most above? What advice do you have for sellers? Any stories to share? What did I miss?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Free webinar next week: I’m doing a big market update next week for SAFE Credit Union on November 19th from 9-10am PST.

Free webinar next week: I’m doing a big market update next week for SAFE Credit Union on November 19th from 9-10am PST.