We love sensational real estate headlines, but here’s what tends to happen. We talk about something like it’s the biggest thing ever, it ends up being no big deal, and then we move on to the next thing. It sort of reminds me of Y2K because there was so much fear about worldwide chaos, but then nothing happened. All bark. No bite. Anyway, let’s talk about a few issues, and you decide if these are hyped-up “Y2K real estate trends” or not. Then I have a big Sacramento market update for anyone interested. Any thoughts?

Rising interest rates:

For years we’ve heard interest rates would rise, but nothing really happened. Well, now things have begun to change. It’s like Mom & Dad were threatening a punishment, but they never followed through, so we didn’t believe them…. until now. Interest rates are finally ticking up and it’s bound to make an impact on prices if the increase hits buyers in the wallet. What I mean is if buyers in mass can afford the increase, then it’s not a big deal unless buyers start showing resistance. An increase in rates won’t hit everyone the same either as buyers at the lowest price ranges will feel it the most. Keep in mind rising rates in the near future could actually lead to buyers rushing the market instead of withdrawing from it. What will happen? Nobody knows. Heck, rates are still incredibly low, and we don’t even know if they’ll continue to rise. But the Fed has been more forthright about coming rate hikes, so that’s why this feels like more than pure hype. Anyway, let’s see how this plays out and keep an eye on creative financing from lenders too.

Are there too many million dollar listings?

Headlines are talking about the high-end market softening in portions of the country. Locally I’ve heard that sentiment since inventory seems imbalanced at the top right now in the Sacramento region. It sounds alarming to think there is a year’s worth of million dollar listings, so it’s easy to conclude the high-end market is sagging. But last year at the same time we saw nearly the same number of listings. If you need to see the numbers, at the beginning of February 2017 there were 213 listings above $1M and this year there were 220 listings at the beginning of the month. It would be insanity to see twelve months of housing inventory at the lowest prices, but it’s actually fairly normal for January stats for the high-end. In short, it could be possible the million dollar market is softening, but for now let’s not use the number of listings alone as evidence.

Is sales volume slumping?

I’ve been noticing real estate headlines talking about slumping sales volume in many markets across the United States. For Sacramento County we actually had the strongest January since 2013, yet it is true that yearly volume is down 2.5%. This isn’t shocking news because nearly all of last year volume was down 1-2% depending on the month. Here’s the thing though. Sales volume in 2017 was slightly lower than 2016, but it was actually higher than 2015. This reminds us if we only look at one year of sales we might miss the bigger trend. Anyway, volume is also down in the entire region, though only by 1%. Overall it’s fair to talk about lower volume because that’s a fact, but it’s probably not fair to hype the issue too much – especially since volume is actually higher than 2015. Let’s keep watching though because it would be a huge deal if sales volume really did start to decline significantly.

Overpricing because the market is so “hot”:

In case you wanted some background noise while working, I did a Facebook Live Q&A last week with Realtor Justin Vierra and we talked about pricing for the “unicorn.” Overpricing is a real issue in today’s market. By the way, if anyone wants to do podcasts and interviews, I love that stuff. You can listen to our hour-long conversation here too in case you wanted more than just this clip.

I hope that was interesting. Anything to add?

–——-——- Big monthly market update (it’s long on purpose) ———–——-

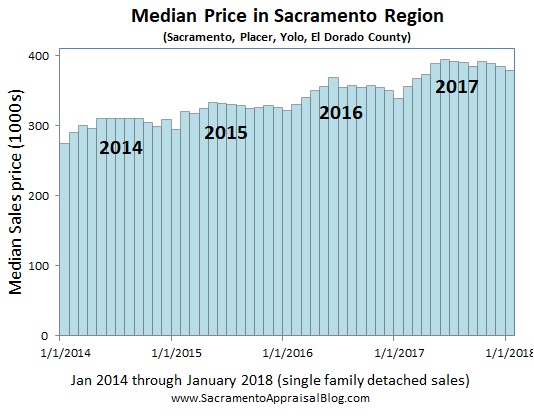

Right now we’re in that weird place where sales stats are sagging from a slower fall season, but the market is heating up. For January stats we saw all the typical signs we’d expect to see. Sales volume declined, it took an extra day to sell, most price metrics sloughed, and inventory increased. The median price in Sacramento County actually has been fairly flat, but last week I talked about how the market really did slow down despite the flatness. Anyway, I have quite a few visuals below to help show how the market has moved in recent time.

Right now we’re in that weird place where sales stats are sagging from a slower fall season, but the market is heating up. For January stats we saw all the typical signs we’d expect to see. Sales volume declined, it took an extra day to sell, most price metrics sloughed, and inventory increased. The median price in Sacramento County actually has been fairly flat, but last week I talked about how the market really did slow down despite the flatness. Anyway, I have quite a few visuals below to help show how the market has moved in recent time.

Housing supply: Inventory is up a bit right now. It’s not much, but this January was up 6.5% in the region compared to last year at the same time. Over the past few months inventory has actually ticked up slightly, and that’s welcome news for the market. Yet before writing home to say the housing shortage is over (it’s not), let’s wait to see what happens during the spring market. I’m not overly impressed at a few months of slightly higher inventory around the slower fall months. Let’s watch the spring market, which will be the bigger test.

I could write more, but let’s get visual instead.

DOWNLOAD 62 graphs HERE: Please download all graphs in this post and more here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

NOTE: I cut out a few graphs and data this month. If you miss something, let me know.

DOWNLOAD 62 graphs HERE: Please download all graphs in this post and more here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What are you seeing out there in the market? Is the top softening? What are buyers saying about interest rates? Anything I missed? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Love all the data. It is pretty normal in our area (not Sacramento) to also have a year or more in inventory of the high-end homes. I have also noticed that in our area, the the higher end homes have a shorter selling season with a more defined seasonal slump than the median homes.

Thank you Gary. I appreciate hearing about Portland. This underscores how important it is to know the local market. The thing is I might see a 6-9 month supply of homes for sale in a the 1M+ range, but that could easily be a balanced supply of inventory. Yet if I saw 6-9 months of supply at the lowest end of the price market in Sacramento, it would be an enormous oversupply. This reminds me how important it is for us appraisers to be in tune with trends so we can communicate well in our reports and support the trends we say exist.

Thanks for the info Ryan. I cannot get a read on this market at all. I’ve been wrong for a while regarding its direction of travel. This is a very very hard read for me. I was a major bear 12-18 months ago, and now I’m a confused animal.

Thank you Mr. Miyagi. Before saying anything, I have to pause and say your use of “bear” and “animal” was great.

The market can be surprising and humbling. If only we could know the future with certainty. There are so many ideas about future trends for real estate, the stock market, bitcoin, etc… I will say quite a few in the real estate community seem worried about rising interest rates and concerned about values over the next couple years. That doesn’t necessarily mean anything as far as what the market will do, but it seems like emotions are a bit heightened right now when I talk with people and visit real estate offices. It could just be my perception of course.

Let’s keep watching. As always, thanks for your thoughts.

Hey Mr. Miyagi,

I remember some of your old posts. You must remember that a market can “stay irrational longer than what seems rational”. The most basic principle is this: People have a habit of buying until they can’t afford to buy any more.

Right now, yes, prices are very expensive especially in parts of the bay area, but I believe that due to lower debt ratios now days and higher incomes, people can still afford a higher monthly mortgage payment. Remember, people always tend to spend until they can no longer afford to and as long as people are buying prices keep rising.

I too got caught in the bear trap. I sold my property in 2015 due to a divorce and now I’ve been punished for it dearly. I’m living with my parents again now because of that and have since gotten priced out of this market. Believe me no one wants to see this market crash more than I do, but looking at history, although we may feel that the market is overpriced and anyone that buys today is ignorant, the problem is that we can not stop consumers from buying and as long as they continue to buy, prices will get even higher.

I feel very sorry for the people of my generation. I am on the border of GenX and Millenial. The only thing that the new generations have going for them is a possible inheritance boom in the future due to all the rich parents and grandparents out there that took advantage of the asset boom of the last 40 years. I think it accumulates to somewhere around 25% of all millenials expecting to receive large inheritances within the next 30 years. For the rest of us however (with parents and grandparents that made bad financial choices in life), I guess that we’re just screwed.

Anyway, this tax plan definitely doesn’t help either. If people have more money they will spend more. As long as they can afford it they will buy houses further driving up prices. The only hope for someone like me is to try to outpace the market, but that is very hard since the average home in CA rises about $1k per month which is a faster rate than most people can save. It’s ridiculous and I hate it but it is what it is.

Hi Brandon. I always appreciate your take and thank you for sharing some life details here. I’m sorry to hear how things have been lately. I may have to buy you a beer one of these days to help bring gladness to the heart.

Anyway, I think you are spot on with, “People have a habit of buying until they can’t afford to buy any more.” Also, I think you are correct about GenX being able to inherit properties and such. Unlike GenX, Baby Boomers have a pension in many cases and retirement is a much smoother ride compared to what it will be for GenX. Due to rising costs with everything, it’s not easy on younger folks, so it’s a real safety net to inherit property or bank accounts to be able to afford to retire. It’s too bad that things are the way they are, but that’s how it is right now.

Thanks again.

Hey Ryan, thanks. I dont drink alcohol anymore but perhaps a smoothie or coffee may be a good substitute for me Anyway thanks a bunch for your blog. As always, you have a lot of insight into the market and I always look forward to reading your posts. Hopefully one day I can see more bearish stats and then I would know I can afford a house again. Until then, I wont hold my breath. Lol.

Anyway thanks a bunch for your blog. As always, you have a lot of insight into the market and I always look forward to reading your posts. Hopefully one day I can see more bearish stats and then I would know I can afford a house again. Until then, I wont hold my breath. Lol.

Good for you Brandon. Coffee has way less calories anyway… Well, I’m game at some point if you ever want to grab a drink. Let’s keep watching the market. You are not alone in hoping for a crash. I hear that sentiment quite a bit.

Well, I’m game at some point if you ever want to grab a drink. Let’s keep watching the market. You are not alone in hoping for a crash. I hear that sentiment quite a bit.

Of course. That would be awesome. Would love to meet you personally at some point and discuss the housing market with you. Would love to share some of my stock/options investment insight with you in exchange as well. Shoot me a personal email and I’ll send you my contact info. TTYL.

Sounds like a plan. I’ll email you.

I always the love the depth and analysis of your market. Of course, I compare your numbers to what I see in our market. They have been very similar for a while now. Same low inventory, January price decline, overall increase YoY, except- we are seeing a decrease in the supply of million dollar homes. The median sale price in our market is lower than Sacramento and we have of course a smaller number of buyers for the upper end of the market. Not sure if those relocating here are buying them up or if they were aspirationally priced then lowered to market demand. Maybe both- In two of the counties where we have seen the most growth, the number of million dollars sales has declined but in the other 2 counties, they have increased. Something that bears watching for sure.

Thank you Shannon. I appreciate the comment. Thanks for reading closely too.

It’s interesting to hear about your market. There are definitely some similarities as you have Californians coming to buy in Texas (with more money because of what they sold for here), and we have Bay Area buyers coming with more money to Sacramento (with more money because of what they sold for there). I’ll be curious over time to hear if you figure out why sales are growing in a couple counties and softening in others. It’s fascinating to see demand change over time, and it’s always a wonder what is driving that demand. New neighborhoods, proximity to Downtown, better economy, improving school district….?

Keep up the great work.

I agree. We watch the trend changing but it sometimes takes a while to really determine the key factors driving the change in the trend. Usually, it is more than one factor as you mentioned.

Definitely. At times it’s confusing what a market is doing too. We like to think we can understand everything and explain trends perfectly, but that’s not always the case.