Lots of us are wondering about the future as COVID-19 cases are rising. When will this be over? What’s it going to take to beat it? And in terms of real estate, what would happen to the market if we went on lockdown again?

This isn’t about fear or politics, but conversation. This isn’t a prediction post either. My only purpose is to consider things that might affect housing. So let’s talk.

LOCKDOWN THOUGHTS:

1) Suppressed demand: There are many things that can affect a housing market. Mortgage rates, jobs, the economy, access to financing, etc…. and even the government. A mandated lockdown, whether national or statewide, is something that can suppress demand because the market isn’t able to operate as it normally would. When I say “lockdown” I’m talking about something akin to earlier in the year where occupied properties were not allowed to be shown.

2) Buyers & agents have learned: This time around we have more experience. The real estate community has learned to show homes virtually and buyers are more used to the idea also. However, if buyers and agents don’t have full access to real estate because of imposed rules then it’s hard to imagine seeing no effect on the housing market.

3) Sellers: One thing to watch is sellers pulling their listings from the market or waiting to sell if strict rules were imposed or if COVID numbers got out of control. Throughout the pandemic we’ve seen substantially fewer listings and it wouldn’t be surprising to see fewer during a lockdown or grave situation. Yet not all sellers are the same and there will be people who list no matter what.

4) Buyers: I imagine mortgage rates below 3% will keep propelling lots of buyers to hunt for homes because that’s exactly what’s been happening these past months. In short, mortgage rates have pulled far more buyers into the market than the coronavirus has pulled people out. In other words, so far the pandemic hasn’t hampered buyer demand. But what happens if access to real estate is limited or a feeling of uncertainty about the economy, housing, or future ensues? All I’m saying is we need to continue to watch buyer sentiment because it’s not something that always stays the same.

5) It is a real market: When the pandemic first began I heard things like, “This isn’t a real market,” but that wasn’t true. Prices slowed. There were far fewer pending contracts. And the market felt dull. In other words, we had real trends and stats even though there was an element of the market feeling suppressed due to governmental regulations. That didn’t make it a fake market though.

6) No effect whatsoever: Our market has done very well within the confines of current restrictions, so if those persist we may not see too much difference as long as demand remains high. But if the rules change and access to the market changes, that’s where we might expect to see a difference in the way the market feels (or a change in the stats). As a guy who follows the market closely what I am looking for is a change in buyer or seller sentiment or a change in something that would affect access to real estate.

7) Could we see a “W”? When the pandemic began we saw a huge drop in volume and then a massive recovery. This created a “V” shape because there was a drop and then an increase. Well, if we have a second round of outbreak and a lockdown, could we see another “V” which would then form a “W”? I wrote about this a few months back in a conversation with an economist. Or would the crazy momentum we have right now simply press through a lockdown? This is the question and we’re going to have to wait to see how it pans out. If anything we ought to be wary of predictions. I don’t think anyone at the beginning of the year predicted the market we’re in right now… This doesn’t mean we need to be shy about asking questions about the future though.

8) Commercial real estate: This has been a brutal year for many business owners and a second round of lockdown could be a deathblow. What happens to business owners and commercial property owners over the next few years?

9) Other: What else do we need to consider? What is on your mind? I’d really like to hear your take in the comments or via email.

Free webinar: I’m doing a big market update this week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

Free webinar: I’m doing a big market update this week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

Thanks so much for reading my post today.

Any thoughts?

———————- (skim or digest slowly) ———————–

For those interested, here’s a big Sacramento market update:

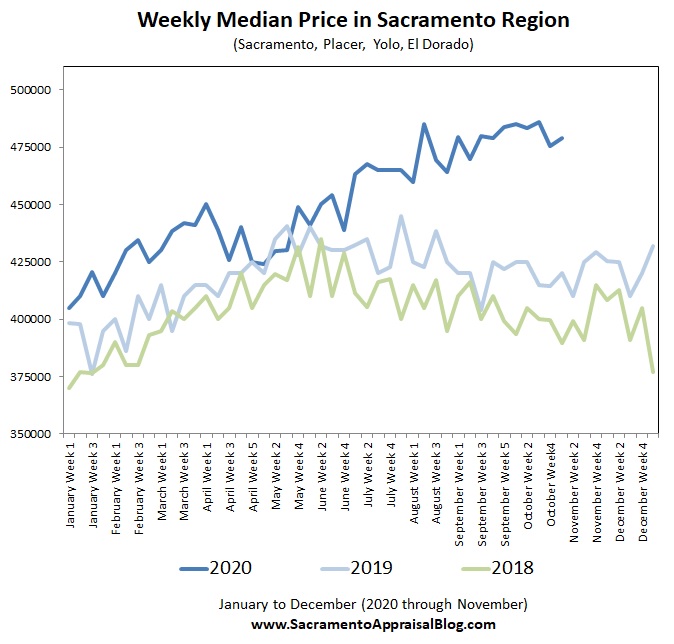

MARKET SUMMARY: In short, the market has been slowing for the season, but it’s still best described as a “hot” market. I keep saying that this fall has not been normal because the market hasn’t softened like it normally does. It’s really felt more like spring than anything… With that said we have begun to see sales volume drop for the fall, but properties are still selling very quickly. In fact, half of all home sold in six days or fewer in the region last month. We literally have about 50% fewer listings right now, inventory is at historic lows, and we had 39% more multiple offers last month compared to a year ago. The big news is sales volume has finally caught up to last year after being down due to a slump at the beginning of the pandemic. What I mean is as a result of the past four months of heightened demand we’re finally back to 2019 levels. Well, Sacramento County is still down, but El Dorado and Placer County being up has effectively pushed us back to normal.

MARKET SUMMARY: In short, the market has been slowing for the season, but it’s still best described as a “hot” market. I keep saying that this fall has not been normal because the market hasn’t softened like it normally does. It’s really felt more like spring than anything… With that said we have begun to see sales volume drop for the fall, but properties are still selling very quickly. In fact, half of all home sold in six days or fewer in the region last month. We literally have about 50% fewer listings right now, inventory is at historic lows, and we had 39% more multiple offers last month compared to a year ago. The big news is sales volume has finally caught up to last year after being down due to a slump at the beginning of the pandemic. What I mean is as a result of the past four months of heightened demand we’re finally back to 2019 levels. Well, Sacramento County is still down, but El Dorado and Placer County being up has effectively pushed us back to normal.

WAY TOO MANY VISUALS:

You are welcome to use these in newsletters and social media with proper attribution. Scroll quickly or digest slowly.

SACRAMENTO REGION:

SACRAMENTO COUNTY:

PLACER COUNTY:

EL DORADO COUNTY:

Other visuals: I have lots of other graphs. Check out my social media in coming days and weeks. I am posting daily stuff.

Thanks for being here.

Political comments: I will not approve any comments that are exclusively political because this is a blog about housing. We can touch on politics as it affects real estate, but overt political rants are best for other blogs.

Questions: Do you think we’ll go on lockdown? What are you seeing out there right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Interesting points, and as it turns out, most of California is back on lockdown effective today (11/27/2020). My market continues to defy all logic. I expect more of the same. The shortage of inventory, low interest rates, the California exodus and pandemic driven movement away from city centers seem to be contributing to a robust purchase market here in the OC, San Diego and LA.

Thanks Mark. That sounds very similar to Sacramento. It’s been an incredibly vibrant market. My big question here is what happens if we go back to what we saw in mid-April with buyers not allowed to see occupied homes in person? There were some real clamps on access to the market for a while there and it made a huge impact. Moreover, if we see COVID cases skyrocket, what does that do to the psyche of buyers and sellers? Could that bring pause? We’ll see. So far mortgage rates have been a stronger force for housing than COVID, but we haven’t really had increasing numbers as much these past few months as much and there was no mandated sheltering in place either.

Hey Ryan, timely post. My concerns are the same as yours: rates and inventory. I hope we see continued activity in a safe manner.

Thanks Joe. I’m glad this has been on your mind too. Let’s keep watching.

I appreciate your thoughts here Ryan. The Cleveland market has been the hottest I have ever seen. It seems like as long as interest rates remain low coupled with a shortage of inventory, things will likely stay strong in housing for a little while. There are so many variables at play, it is difficult to know how long things will remain strong in housing. If businesses continue to have to adjust, and layoffs continue, it will probably have a negative impact on housing at some point. Hang in there!

Thanks Jamie. Yeah, these past four months have been about as aggressive as I’ve ever seen. I think it rivals the very beginning of 2013 when investment funds were playing the market in Sacramento and purchasing in mass. It was a major steroid and at the time I routinely heard agents say stuff like, “I’ve never seen a market like this before.”

It’s wild to think we have had a market like this after momentum was so very clearly slowing from 2018 onward. But then mortgage rates went down (during a pandemic) and it totally changed the trajectory of the market as well as the narrative.

What a time…

What a time indeed!

No predictions from me this time. Things never seem to play out as I expect. I’m just hoping for the best with a quick distribution of vaccines, a quick economic recovery, and time with friends and family when this is all done.

Thanks Gary. Yeah, no predictions from me either. I will keep ideas in my mind about potentials. Thus I cannot help but wonder what might happen to the market if there is the government clamps down and creates rules that limit access to real estate. It’s wild that we would even have to consider this as a layer of the market, but here we are.

I hope too for a quick distribution of vaccines and I cannot wait to move beyond this time. I miss seeing people in mass and I hope we can return to some level of normalcy at some point – whatever that is.

NYC just shut its school system down, the largest in the country due to the spread. Nothing really matters until the vaccines are in circulation. Until this it’s wave after wave.

Thanks Jonathan. Yeah, this is a big deal. In California real estate is deemed “essential”. At the beginning of the pandemic last time there was uncertainty about that, but for now real estate is still able to operate. If things got really bad I suppose that could change though, which is exactly why we need to have these conversations and keep our eyes open.

Sorry to hear that Jonathan. NYC is sometimes a template for the whole state in such matters.

Regarding markets I am starting to see a lessening of the ‘bid up” mentality. Some recent comps sold only at list(gasp!). Just a pause or coming trend? Time will tell.

Sure hope the Guv calls us essential if we are heading for a lock-down.

Wait, selling at list only? What’s wrong with the property? I wonder if what you are seeing is a seasonal trend or a bigger direction in the market. Usually multiple offers tend to slough as fall ensues, though right now it feels more like spring, so in Sacramento they’ve just kept climbing thus far.

I wonder if what you are seeing is a seasonal trend or a bigger direction in the market. Usually multiple offers tend to slough as fall ensues, though right now it feels more like spring, so in Sacramento they’ve just kept climbing thus far.

Middle Tennessee is still holding strong despite the pandemic. I will say though that the pandemic has forced “some” Realtors to adhere to their due diligence with regards to listings. I am seeing more virtual listings and actual photos of the interior due to COVID restrictions or sellers not wanting people to tour homes. I love your charts and as an Excel guru, I would love to create the monthly county and regional charts for my area. Are you including any criteria or just searching all within those areas? Thanks!

Thanks Laryssa. I’m always open to hear about other markets, so please share any time. Now that you have an approved comment you can basically comment whenever too just so you know.

My market is still incredibly strong. We’ve basically been having a spring season during the fall and it’s been remarkable to watch.

Regarding the visuals I tend to include criteria at the bottom. So I might say, “Single family detached MLS sales (not condos)” or something like that. If I am missing something like this then it’s by accident. I tend to focus on the single family detached market basically. Condos are a different beast and I don’t include them on purpose.

If you have pointed questions about charts, let me know which ones. I have a ton. I am ALWAYS glad to help fellow appraisers. We have such a unique role to be able to tell the story of the market. I do have some tutorials here: https://www.sacramentoappraisalblog.com/graphs

Let’s stay in touch.

Thanks, I am actually working on a report now and mimicking your table chart. My main question is other than SF detached, are you narrowing criteria such as age, GLA, etc. based on a subject property or looking at the data for SF detached as a whole county, city, and region? Our MLS does not have the functionality to chart historical data on listing activity, just closed sales. Thanks again.

Got it. The stats I share on my blog tend to deal with larger areas like particular counties or the entire region. I don’t typically narrow down data for these larger market updates unless it’s by price range. But in my reports I definitely look at the neighborhood market as a whole and I usually put a range on square footage to get a sense of a tighter competitive range within the neighborhood. In a graph like this one on YouTube, I typically have a few layers of data. I don’t often use bathroom count because homes of a similar size often have a fairly similar bathroom count, but sometimes I might use lot size or something else that might be important to narrow value. I don’t actually use any of the county visuals in this post in any of my appraisals ironically. https://youtu.be/eWZs2J5ryH4

https://youtu.be/eWZs2J5ryH4

My MLS doesn’t offer an easy way to chart listings. It is technically possible to chart listings and pendings, but it is incredibly tedious. I was doing that for a number of months at the beginning of the pandemic, but I decided to focus on other things instead because it was too time-consuming. There is a data company that does this through our MLS. They only post once a month, but I just can’t be the guy to do this weekly or daily. Just too much. I’ll rely on that company for their research instead.

Great, and thanks. I will use it as a model and just play with it based on the data I have and can quickly calculate with each report. Easy to do with a Pivot Table. thanks