The housing market is trying to get back to normal, but how close are we? On one hand we’re feeling some seasonal slowing, but it also still feels really competitive. Today let’s talk about what normal looks like. If you’re not local I’d love to hear what you’re seeing in your market. Any thoughts?

Background noise: Last night I did a YouTube Live Q&A to talk about appraisal stuff. If you need some background noise, here’s two hours. Watch below (or here). I love doing stuff like this, so don’t forget to hit me up.

What does normal look like?

Comparing to 2019: The last normal-ish fall season we had was in 2019, so it’s a good frame of reference to consider what fall should maybe look like. Technically I should take the average of five years of fall data to establish normal, but I’m honestly just slammed this week and I can’t pull that off until someone hires me full-time to crunch numbers all day.

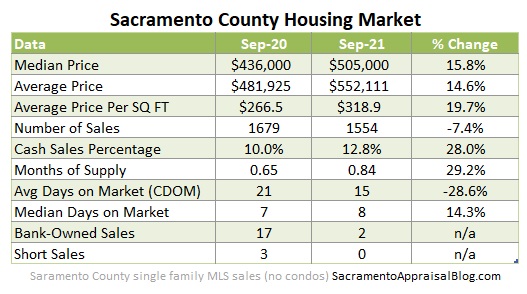

How does 2021 compare? In short, the market right now is showing some seasonal slowing, but it’s still far more competitive than it should be for the time of year. Check out some of these stats.

Brand new visual (do you like this one?):

Breaking it down: Today we have more multiple offers, properties are selling in half as much time, and we even have fewer price reductions. Most notably buyers last month paid above the list price whereas two years ago on average they paid about three percent below the list price. This is striking because in 2019 in a normal-ish September buyers on average paid $13,808 below the original list price, but this past month buyers still paid almost $6,000 over asking price. Another way to say this is buyers today paid about $20,000 more than a normal year in 2019 (13,808 + 5,951 = 19,759).

30% more aggressive? If I had to put a number on it I’d say the market is conservatively 30% more aggressive than it was in 2019 (maybe even more as some stats are still about twice as aggressive as they should be). For reference, stats for price reductions especially show this as there are 31% fewer reductions right now compared to two years ago. Check out Altos Research for price reductions.

Anyway, I hope that was helpful.

—–——– BIG MARKET UPDATE FOR THOSE INTERESTED ———––

Skim or digest slowly.

Skim or digest slowly.

QUICK SUMMARY:

The market is experiencing seasonal slowing and it’s clearly not what it was at the height of spring season. This is important for sellers to understand to price according to today’s trend instead of headlines from the past. With that said, things are still really competitive and mostly all stats are not normal yet (still more aggressive than usual). On one hand buyers have gained power, but it’s still fierce out there. Here’s a good way to put it: “The market is not slow, but it’s slower than it was.”

Some visuals eh…

NOT AS MANY MULTIPLE OFFERS:

For five months in a row in the region we’ve seen multiple offers subside. Last month 56% of sales had more than one offer and that’s one of the most competitive months ever, but there is no mistaking a cooling seasonal trend.

AUGUST TO SEPTEMBER SEES SOFTENING:

For months I’ve been talking about the market starting to slow and we are finally starting to see it in the stats. Not every single stat is dull, so my advice is to look at the bigger picture of all stats together rather than hone in one stat. In short, it’s starting to take longer to sell, we have slightly more inventory in the region, and even prices have softened (part of that has to do with smaller homes selling).

LAST YEAR VS THIS YEAR:

Year over year comparisons get a little weird these days because the market was so atypical last year, but in my opinion this is still worth digesting since we want to be good students of the market. I suggest taking these percentages with a grain of salt and recognize these percentages DO NOT actually mean every house is worth that much more either. Also, remember that we are now comparing a market that is trying to be normal today with a super aggressive fall last year.

IT’S LESS COMPETITIVE:

The market is still ultra-competitive, but this image is crystal clear that the temperature of the market has changed in recent months. This is exactly what we should be seeing at this time of year. Keep in mind we should have closer to half of sales selling at or below the list price, so this market is NOT normal yet.

OTHER VISUALS:

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What are you seeing out there in the market?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Thanks as always for sharing these. The last 18 months have been absurd, haven’t they? Did an appraisal last night where I conservatively adjusted 2% per month for time.

Looking forward to more normal trends….

Thanks Joe. It really has been absurd. I find the difference has been striking with date of death valuations too where the date of value is from the first couple of quarters in 2020. Just amazing. I think everyone is craving more normalcy. It’s good to see a bit more now even though we’re not quite there yet.

Great information as always. Are you looking for someone to pay you to crunch numbers all day ?-)

I would be open to the right opportunity. It would REALLY have to be the right one. I guess that did sound like I was putting a resume out there… On a serious note I do like to put out a gentle reminder that I am not working full-time with numbers. 🙂

I am not the number, graphs, smart and better looking guy like you. So before I start to think things are getting back to near Normal, I have to wait a little longer. I did complete a DOD Estate appraisal recently for July 2020, and spent a better part of a page describing what in the blazes went on in May and June 2020 and how I really couldn’t use sale data before March 2020. Estate attorney read the report and called. Her comment, YIKES, I thought the market was going to go down due to Covid. Told her, me too. But since I was wrong about that you might want to fire me…… Good news she didn’t fire me. We in SoCal are seeing all sorts of weird things right now. Some over ask, some at list and even a few believe it or not below ask. Of course that really had something to do with starting near the orbit of the Bezos Space Flight. This really not knowing where the market is at or going is like October 2008 – April 2009 When all heck broke loose back then. Knew the market was heading in a direction, just not sure how fast and when it would change back to move forward. Thanks BlackRock and KKR for coming in and buying 3500 shadow inventory homes down this way. That screwed up the market big time. Hmmmmm No wonder I don’t have much hair left. Thanks for the great post as always Ryan. Take good care and be safe young man.

Ha. Thanks as always Brad. I always enjoy your commentary and you sling together words. We are having hints of normalcy, but we’re not normal yet. I totally agree there. As a supplementary note, I have had a couple of people tell me today “normal” isn’t really a good word to use in real estate, but I’m actually okay with it. We have normal seasonal rhythms and there is a sense of normalcy with things like annual volume, listings, how long it takes to sell, SP/OLP ratios, etc… In short, we can know the market enough to get some sort of a baseline for these things in order to give commentary to current trends (and then say whether something right now looks consistent or not with previous trends). Granted, I get the concept here because what is normal is always shifting. But that doesn’t mean it’s not knowable or outside the scope of reasonable discussion.

Anyway, I’m rambling, but this is a really important conversation. I find talking about hints of normalcy right now and what normal typically looks like is an important layer to conversation. In my mind knowing what is a bit more normal for the market gives us context. And that makes all the difference for interpreting stats.

If they aren’t comfortable with the word “normal” in RE, then maybe, just maybe they need to go watch Young Frankenstein the movie. In there as many will recall they dropped the normal brain and picked up a brain titled

AB normal. To me that is this market ABnormal. Ryan you the MAN, they can call it what they want but this market needs to get back to NORMAL and not ABnormal. all my best to you and your family. Take good care. PS if you post next week I will miss that one. I will be out chasing and branding cows and riding in the wide open spaces. NO Cell phones, NO internet, just 3 dogs, 5 wranglers and a bunch of cows that need moving. You take good care my friend.

Ha. Thanks Brad. You enjoy chasing and branding cows next week. You are the real deal. I would be a poser if I were to try something like that. It would be a bit like Billy Crystal in City Slickers. Enjoy that time away. You deserve it.

Great job as usual. As a fellow numbers junky, I always enjoy your insight!

Thanks so much Brad. I appreciate it. I’m fascinated by this question and I think it’s a big one.

For any onlookers, I just posted a new visual to show a couple more Septembers. The difference is astounding. I wonder at times if we’ve become so accustomed to stats on steroids that it almost seems like it’s not realistic to see what normal looks like…. https://twitter.com/SacAppraiser/status/1448300030981328896

Thanks, Ryan for your insight. Our markets are experiencing some of the seasonal cooling as well, but when compared to pre-pandemic numbers, it’s much more active and prices are much higher just as you are seeing. I always appreciate your insight and commentary!

Thanks Shannon. Yeah, our markets have seemed very similar as I look at the graphs you post. It’s amazing how that happens.

I guess normal is a relative term. The new normal is 1-2% monthly price increases. Homeowners love this normal. Homebuyers pray for an ABnormal market. Normal in HB is coming out of the water covered in oil after navigating around all of the cargo ships parked in the ocean. I prefer abnormal

Indeed. It is very relative. Rightly so. I think normal simply changes over time and it doesn’t remain the same. There were things that were normal for me when I was a teenager that would absolutely not work in my life today because my normal has changed. All that said, just because what is normal is constantly shifting doesn’t mean we cannot know it or discuss it.

The new normal for inventory, for instance, is nowhere near what real estate folklore says is normal at 5 months or whatever. Our monthly inventory right now in Sacramento is closer to one month, which is freakishly low and essentially highly abnormal. But I’d say a normal-ish level for today’s real estate world in my area would be 2 or so months very easily and probably a bit higher. Closer to three months would really challenge the market though I think as we have become very sensitive to inventory changes.

You are probably not saying this, but I just wanted to say it’s reasonable to compare today with what has been normal in very recent years before the pandemic. I think it helps provide context so we know where we are at. Some might say today’s trend is the new permanent normal or even a temporary normal, but that doesn’t matter to me. Regardless of what today is, talking about normalcy vs not helps us wrap our minds around trends and it gives us powerful context to interpret what is happening right now.

You are so right about the tension between buyers and sellers craving normal or abnormal. And frankly, we need some time here to figure out what the future looks like with housing. But one thing is for certain…. The market is always moving and it won’t stay the same. This is the fascinating part.

I have yet to see pics of HB. We’ll be down in December and hopefully some of it will be cleaned up by then. Very sad.

Hey Ryan, as always good insight. After 36 years in the business, I don’t think the word normal and real estate should be used in the same sentence except as follows. The only normal aspect in real estate is that it is constantly changing. Seems we usually have 2 or 3 years out of 10 where the market is stable, prices appreciating at 1-4% per year and inventory and demand in relative equilibrium. The others either boom or bust, oversupply or undersupply of inventory. As for our current disposition, I believe we are in the final throes of an overexuberent market, although I sold 2 listings this month to the same LLC, cash offers over asking as long term rentals. My gut feeling is that as we get more rentals on the market, more sellers will feel comfortable in selling their homes knowing they have rentals available. That increase in available rental homes will allow many homesellers to cash in on equity with the comfort of knowing they can find a rental home. The buyer pool right now in the areas I work (95843, 95747, Antelope and West Roseville) is not what it was even 4 months ago. Showings over a 5 day period have gone from 20-25 to 5-12, some even lower. It will not take much to satiate that demand. jmho. George Brown

Thanks George. I always appreciate your take and I welcome you to pitch in your thoughts any time. I hear what you are saying too about normal and I think you are right that normal is not static. The market is constantly moving and changing. Yet I would argue we do have new normals and can help understand this year by filtering it through previous years to understand how we are different and similar. There is real value in that and I imagine we’re on the same page about that.

I’ve found resistance to this language and maybe I’m not doing a good job communicating. There is a very practical element here where we have to watch closely for normal seasonal patterns and then even bigger patterns that tended to be present in recent years (such as the number of new listings, number of closed sales, number of pending contracts, percentage of price growth for the year, number of new homes built, percentage of cash in the market, FHA percentage, etc…). Look, all of these things are constantly changing, but the market still has normal elements for various seasons.

Being that we have been in a highly unusual market, I think it’s quite relevant to compare now with say 2017 to 2019 were possible (though 2018 was a darker year). This helps us establish how different we are right now and it helps paint a context as well as help in interpretating. But here’s the thing. It’s not like 2017 and 2019 were totally normal years either in many ways. I’m not saying they were. But ultimately I would still say there are normal patterns present in these years to help us establish somewhat of a baseline or maybe even a target for what we want to get back to if possible… More normal appreciation. More normal days on market. More normal amount of new listings hitting the market…. Again, I get it about the word normal and how the market changes, but let’s not lose sight of the value in interpreting our market and really understanding the trends in very recent years so we can understand truly how close or far we are from these recent trends.

Know what I’m saying?