Is it 2007 again? There’s so much talk online about today’s housing market being like 2007, but what are the stats showing? Today I want to walk through three parts of the market. I suspect many locations are experiencing the same trend as Sacramento too. Skim by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

9/26/23 Orangevale MLS Meeting

9/28/23 Yuba City Big Market Update (in Yuba City (register here))

10/4/23 KW Sac Metro Big Market Update (register here)

10/6/23 How to Think Like an Appraiser at SAR (register here)

10/27/23 AI Fall Conference (San Francisco)

It’s a strange market today with low volume and low supply. It feels a little amateurish to call it weird, but that’s a pretty good description.

THREE WAYS TO COMPARE 2007 & 2023

1) INVENTORY IS NOT BUILDING LIKE BEFORE

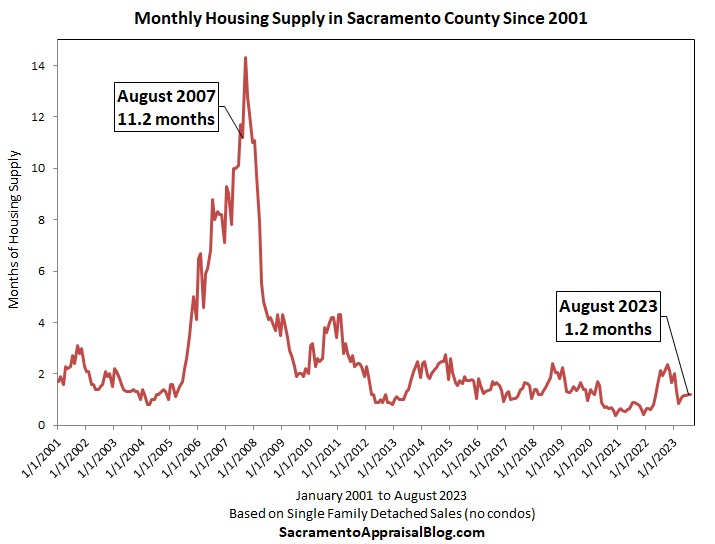

One thing that is REALLY different today is inventory is not building like it did in 2007. Supply has actually been subdued in today’s market as sellers have pulled back from listing their homes, and that’s the opposite of what we saw between 2005 and 2008. In fact, when prices peaked in August 2005, housing supply literally tripled in one year in Sacramento. Prices weren’t all that impacted the first year, but in the background, there was a tidal wave of supply building. Look, I’m not trying to sugarcoat today’s market, but we have a different vibe today where supply is not showing 2007 vibes. Granted, this doesn’t mean the market is healthy today. I’m just saying it’s way different.

Housing supply is actually lower today than one year ago.

New listings are down 34% from last year and 44% from the pre-2020 normal. Basically, we’re missing 7,700 new listings in the entire region compared to last year and 11,900 from the pre-2020 normal. I don’t have stats for 2007, but do you see what was happening in 2008? Yikes.

2) LOW VOLUME TODAY FEELS LIKE 2007:

One part of the housing market that feels really similar to the previous housing crash is the number of sales happening (volume). In 2005 prices peaked, and while prices weren’t down all that much the first year, the real change was seen in volume falling off a cliff. In real estate it’s easy to obsess over prices, but the real trend is often seen with volume.

We’ve basically had the lowest volume we’ve seen through August, so today really does feel like 2007 in terms of volume.

Not to beat the dead horse, but here’s another way to look at volume.

3) COMPETITION DOESN’T SMELL LIKE 2007

The stunning part about today’s market is how competitive it is in the midst of some of the worst volume ever. This is why I often call today a hybrid market. It’s like 2007 volume and 2020 competition gave birth to 2023.

Here’s a different way to compare competition in 2023 and 2007. Any dot above the 0% line went above the original list price, and anything below went below. Striking difference, right?

And days on market:

CLOSING THOUGHTS:

First of all, what happened last time isn’t the new template for every future housing correction, so even though I’m ironically writing a post about 2007, let’s remember that 2007 isn’t the new formula for every future downward cycle. With that said, today’s housing market feels like 2007 with volume, but it’s an entirely different beast with low supply, intense competition, and very few foreclosures. Ultimately, it’s not accurate to call this 2007 because it feels so different. Every time someone says it’s 2007, a puppy dies. Okay, that’s probably not true, but we do need to let stats form our narrative.

Though like 2007, we’re in a place where it would be healthy for prices to come down so more buyers and sellers can participate. The reality is sellers sitting back this year has so far catered toward keeping prices higher rather than fostering more much-needed affordability. I know, to some people it sounds like real estate sin for me to say this, but we have an affordability problem, and it’s not a healthy dynamic to see higher prices with lower volume. That’s not good for buyers, sellers, or real estate professionals.

What’s going to happen ahead? It’s impossible to predict the future with certainty since we’ve not had a market like this before. We have ideas for how long sellers might sit out, but the truth is nobody knows for sure. What happens with rates is a huge factor, and rates have persisted to be stubbornly high. No matter what, it’s important to not minimize the struggle of affordability today. In a traditional system low supply can help keep prices higher, but we’re not in a traditional market today, so over time we’re going to find out which is the more meaningful force. Affordability or low supply.

For now, we have a market that feels very stuck with a good chunk of sellers and buyers on the sidelines. It won’t be this way forever, but we seem poised to continue to see low volume and low supply until something changes the trajectory of the trend (rates, economic pain, etc…).

It does feel like 2007 in some ways, but in other ways it’s just so different.

—————— LOCAL HOUSING MARKET RECAP ——————

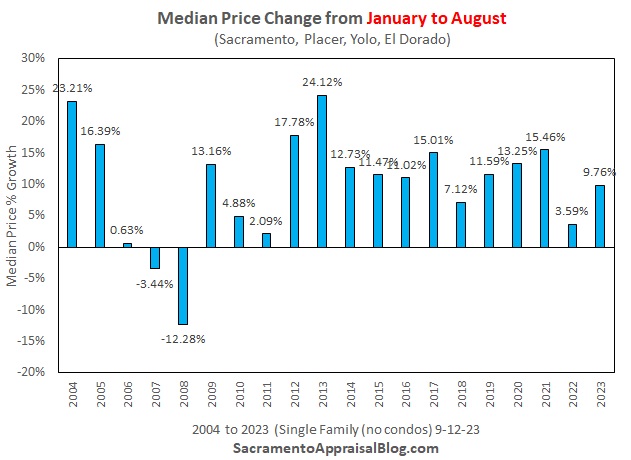

I have so much to say about today’s housing market, but let’s keep this short and sweet. I’ll push out a ton of stuff these next two weeks on my blog and my socials. Basically, we’re experiencing a pretty normal seasonal slowing so far. It does not feel like the crash-landing market last year in 2022 where most metrics saw incredibly sharp change. Basically, all the metrics are showing pretty normal seasonality so far (and they’re even more competitive than the pre-2020 normal). It looks like prices and volume have peaked for the year, which is normal to see. It’s worth noting we’re starting to see slightly higher prices compared to one year ago. Of course, volume is depressed and inventory is still sparse, so it’s a strange market.

I have so much to say about today’s housing market, but let’s keep this short and sweet. I’ll push out a ton of stuff these next two weeks on my blog and my socials. Basically, we’re experiencing a pretty normal seasonal slowing so far. It does not feel like the crash-landing market last year in 2022 where most metrics saw incredibly sharp change. Basically, all the metrics are showing pretty normal seasonality so far (and they’re even more competitive than the pre-2020 normal). It looks like prices and volume have peaked for the year, which is normal to see. It’s worth noting we’re starting to see slightly higher prices compared to one year ago. Of course, volume is depressed and inventory is still sparse, so it’s a strange market.

SHARING POLICY:

Please share some of my images on your socials or in a newsletter. Here are 6 ways to share my content (not copy verbatim). Thanks.

ANNUAL STATS

Remember, some annual stats like volume get a little weird because we’re now comparing today with a slumping market last year. But we still need to know these numbers, so I’m going to be pushing them out.

EL DORADO STATS:

Someone in the comments asked about El Dorado stats. Send me an email if you want some stuff. lundquistcompany @ gmail dot com.

MONTH TO MONTH:

JUST A FEW IMAGES:

I hope this was helpful.

Questions: What are you seeing out there in the market? What stands out to you above? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Hi Ryan,

I haven’t commented in a long time but this was one of your best posts ever. Thank you.

With that said, housing market prices (like any market) follows supply and demand. For prices to go up, one needs a sleuth of desperate buyers with a shortage of inventory. For prices to go down, we would need a lot of desperate sellers with a surplus of inventory. Right now, sellers don’t seem desperate…and as you said, inventory remains low.

Government forces can change that in either direction. If the Fed goes back on a rate cutting binge, then it would lower mortgage rates and possibly bring buyers back into the market. If they continue raising rates aggressively and impose things like rent control/caps, then these millions of landlords sitting on rentals would suddenly see it as a much less attractive investment and it may cause them to want to cash out on it.

We shall see.

Thanks Brandon. I really appreciate the encouragement. And I agree about markets changing. Right now there isn’t a mechanism in place to change supply or demand in a meaningful way, but that could change. The market is always moving (I actually have a sign in my office that says that). This market won’t last forever, but we are definitely stuck at the moment. It seems like there is a new sensational idea every week about what could bring change to the number of listings, but so far nothing has made any real difference. Right now we have student loans to watch. And we’ll see what comes in the future. Let’s keep comparing notes.

I wish it was 2007 again. I would be able avert some medical stuff. But I digress. This market is so weird right now, the only word that comes to mind is schizophrenic. Weird inventory, seeing some weird loans with builders paying $$$$$$$ to buydown loans, some ARM loans I am hearing about and for the love or all creation Multiple Offers on properties in some areas and then some markets with 30 to 70 days on market. So maybe a little like 2007, but just too damn weird for me to say it is 2007. Now maybe they are looking at it from a standpoint of High Interest rates and what is potentially going to happen with the economy. I know everyone is predicting a soft landing, but the Fed has a way of breaking things and usually in many pieces. So let us see what they do. That will give us some insight into if it is really 2007/2008. As always good stuff young man. Not sure about the picture with something afoot. yep, I will be 70 next month so not up on all the latest and greatest. I do recognize the masks on airplanes, hope not to use them on the up close and personal basis.

Haha. The photo about something “afoot” is basically a play on the movie, Bill and Ted’s Excellent Adventure in the later 80s. I’m thinking you might have missed that one. And yes, the Fed is trying to break something. It seems like they’re not succeeding. But at the same time, the housing market feels profoundly broken right now in terms of volume and buyers and sellers being able to participate. Prices haven’t broken, but volume sure has.

And yes, the Fed is trying to break something. It seems like they’re not succeeding. But at the same time, the housing market feels profoundly broken right now in terms of volume and buyers and sellers being able to participate. Prices haven’t broken, but volume sure has.

Haha. Yes, the era of Bill and Ted, Wayne’s World, etc. EXCELLENT!!! Did you know they have a sequel to Bill and Ted’s which came out recently. Keanu was in that one too. I haven’t watched it yet.

You know, I haven’t watched it. I need to get to that. I did see the original over the past year, and I think it held up for what it is.

Ryan – if rates and/or prices drop and affordability comes back in line, do you think we’ll see a flood of sellers come to market with all the pent up demand that’s been created from covid dating all the way back to 2020? Is there just as much demand pent up on the buyers side including new households?

Hi Paul. A flood sounds like it would stem from a sharp change, and that would likely happen if there was a big difference in affordability / rates or some type of an event that changed people’s minds or circumstances. It could be possible to see a grand inflection point for sellers or even buyers, but if rates remain elevated, it seems like it could be more of a slow burn of sellers and buyers finding their way back into the market rather than a mass-entrance. Only time will tell, of course. We only have ideas for now. I think lots of people are hoping for a big group of buyers and sellers to appear, and there is so much hope for that to happen, but a modest change in rates seems like it wouldn’t unlock a huge amount of buyers and sellers either. In other words, it’s hard to imagine a flood of activity without a bigger change to affordability, economic pain, or some other aspect not on the radar at the moment. Of course, if rates went down to 5% today, that would be a huge event (seems like a fat chance of that happening).

There should be some blatant pent-up demand though as I think about so many sellers NOT listing this year. It’s mind-blowing to consider we’re down nearly 8,000 listings from last year (which was already a low year). And we’re also missing almost 7,000 sales, so there are clearly many buyers who will be ready at some point in the future theoretically. This is something to watch because this list is getting long.

On a related note, there are definitely people out there who talk about strong demographics being a safety net for the housing market, but I’m always aware that people have to be able to afford the market, so just because demographics are ripe for home-buying doesn’t mean buying can reach high levels.

Anyway, that’s my take. Thoughts?

You always leave me wanting to know what happens next. I think it’s likely that everyone who has been waiting will eventually decide to come back at the same time. What will be the big change that causes that to happen? How long until it happens? Nobody knows.

Thanks Gary. Yeah, we’ll see. Affordability is what so many people are waiting for. People who want to move have to be really frustrated at the moment. The market feels very broken at the moment. The Fed didn’t break prices, but they have broken volume.

This post was spot on! Volume levels at the low end, but still no sign of that “crash” everyone seems want to predict. Ryan, do you still expect the modest appreciation levels to continue like they have?

Thanks Nick. Not a price crash. I think we could make the argument we’ve seen a volume crash. I expect to see a price uptick in the spring because that is almost always what happens to prices. There should be more attention on the market in the spring because that’s normal for demand. It’s hard to commit to beyond the spring, but it would be atypical to not see a modest uptick in the spring because that’s what normally happens. In terms of future growth, that’s going to hinge on what happens with rates and the economy. We are still living with lots of uncertainty, and the market is in a weird spot. If conditions like today persist, how long can we can we see low volume and high prices? I suppose that’s the question. And I don’t know the answer since we’ve never had a situation like this with sellers sitting out like this. If we can somehow get more listings, that’ll put more downward pressure on prices most likely.

On a related note, it’s very difficult to erase spring seasonality from the housing market. We even had a seasonal price uptick in Sacramento in the midst of some of the worst years ever like 2007 and just slightly in 2008. Granted, there was a very sharp price decline in both 2007 and 2008 overall, but the decline was after the spring season (July downward in 2007 and very early downward trend in April in 2008). In short though, I recommend preparing for a seasonal market in the fall and a seasonal market in the spring. Mastering the season is so key in real estate because it helps us set expectations and spot anything that is not normal too.

Hi Ryan…. always great reading your blog. I remember 2007 very well. I lived through it! This is nothing like that. Seller’s have a ton of equity in their homes if they have bought even in the last 3 years. Who is going to walk away from their equity??? No one. In 2007 no one had equity because banks gave 100% financing to anyone that asked! So then the crash came. Today, seller’s are like fat cats in a bird cage waiting for the right time to sell and for interest rates to pull back. Why sell when you have a 3% interest to buy a high priced home at 7%. No incentive.

The few deals I have done this year are “lifestyle deals”. Divorce, Bankrupcty, 1st time buyers and Relocations.

Thanks for the great data as always!!

Thank you John. Yeah, I lived it too. That was a gnarly market. Lots of pain behind the stats during those days. I concur about the trend too. It’s lifestyle for the win at the moment while the rest of the market is stuck (for now).

I have at times also been intensely curious at times about what the data looked like around 2007, so I have also taken a look at the data (just for Sacramento County) and it has really been eye-opening. Other than the present crash in volume, I’m not seeing any of the other signs of “impending doom”, as it were. Everyone calls it the crash of 2008, but our local housing data clearly showed strains beginning as early as the Fall of 2005.

A few additional tidbits I have uncovered in the data (beyond your excellent analysis) that you and your audience might find interesting:

1. In the MLS, a mere 4-in-10 (40%) transactions were actually closing in 2007. Which means 6-in-10 (60%) transactions in the MLS where either expiring or being cancelled each month. In today’s MLS, about 80% of all transactions are closing which seems to be even just a little better than our normal.

2. The numbers of cash-purchase and FHA-financed transactions began to soar beginning in 2008. These numbers remain fairly consistent these days.

3. You’ve covered foreclosures in other reports, but it bears repeating that the number of bank repossessed (REO) properties sold thru the MLS suddenly jumped and plateaued in 2007, then skyrocketed in 2008. Today’s MLS still doesn’t show very much NOD, short sale, or REO activity.

4. Closely tied to inventory is the absorption rate. Between cancellations, expirations, and an absence of buyers in 2007, there were nearly 3x as many new listings as there were closed transactions. In fact, as early as January 2006 the absorption rate was down near 30%, whereas for all of 2023 it has been around 80% (which looks very healthy when comparing to decades of data).

It can’t be too strongly noted that the principle of the self-fulfilling prophecy applies here. If enough people lose faith in the market (rightly or wrongly), that will change behavior on a scale that can move the market in big ways. I am certainly not panicked at all looking at today’s market (other than finding clients), but I do confess to being a bit bearish as consumer sentiment remains low (which is another metric that resembles 2007/2008). So, I’ll keep watching these numbers right along with you.

Great stuff. I really appreciate your thoughtful commentary and bringing something interesting to the table in terms of both stats and perspective. Keep it coming please. Yes, our market peaked in 2005 whereas many areas around the country had their moment in 2007. Though locally we saw intensely sharp change in 2007, so I do emphasize 2007 sometimes for that reason (the second half of 2007 especially). One thing to keep in mind is the REO and short sale category wasn’t in MLS until basically 2009. I don’t trust the data before Q1 2009 for both categories. It’s like CDOM not being a stat until 2003 or so. I haven’t pulled the stat for absorption, but it looks to be somewhere between 70-80% in the entire region based on following new listings and sales closely. So, you’re right.

Please keep me posted with anything you’re seeing. Thanks again.

What I’m seeing elsewhere in the media I follow is a lot of talk about the Fed lowering interest rates– Because they “MUST” or because they’ve been so dovish in the past decades and that’s just the expectation now. You hear a lot of talk about a “soft landing” in inflation, which implies rates will come down.

I’m hearing buyers talk about being willing to get in over their heads right now, thinking it is inevitable that rates will go down and they can refinance within a year or two. It’s dangerous thinking– but only leads to catastrophic outcomes if *lenders* take it to heart and become more lenient with qualifications. I do fear that these slower times may in fact encourage them to do just that.

On the flip side, those skeptical of the Fed’s intervention and fearful of runaway inflation are desperate to park their capital– That’s why the stock market is still/again near all-time highs, bitcoin is at 25k, and demand for real estate is strong.

I may have missed it if you did an article about it, but I’m interested in the vacation rental/Airbnb scene. If spending slows on travel/experiences, then short-term rental revenues decline and more owners will get out of the business. If this happens rapidly, we could see a flooding and crash in this sub-market. It’s also more “primed” for a crash because the down payment is larger, interest rates are higher, and qualifications are more strict (and therefore there are fewer buyers than there are in the primary-residential sector). It was actually the excess in resale tickets to Burning Man that got me thinking about it– Are people tightening their wallets, buying- you know, groceries- instead of going on vacation?

Oh, interesting how Burning Man has spurred some thoughts. Ha. I had a friend there, and I’m glad she got home. I think one way to consider consumer issues is to watch delinquency rates for credit cards and mortgages. I know the California Policy Lab has a credit card dashboard that I watch closely. To me that’s a leading indicator if consumers start to get into more trouble. There has been an increase, but so far it’s basically back to pre-pandemic levels in Sacramento at least. Credit Card Dashboard for California areas only: https://www.capolicylab.org/california-credit-dashboard/financial-distress/#

I did write about Airbnb. I think there is both a real dynamic to the narrative in that there has been a change in the rental market (fewer bookings, lower rent, possibly saturation in some markets, etc…), but it’s also being used as a doom talking point that is sometimes sensationalized. Again, there is no mistaking the market has changed, and I really get the red flags, but I think sometimes the trend is being used to pitch a narrative of fear. The frustrating part is when one isolated example is used to paint the entire market. It’s like judging the forest by a tree at times. Again, there is no mistaking this is something to watch, but it also feels like it’s been a pet narrative among the doom perspective for the past few years (not just over the past year). https://sacramentoappraisalblog.com/2023/06/28/hot-graph-summer-airbnb-doom/

On the subject of doom, what I don’t like about some of the narrative being pitched by a prominent doom prophet is that he basically says it would only take just a little bit of a change to tip the market. He has said this about vacant properties, Airbnb units, investor-owned units, and probably lots of other things. He even said Zillow failing as an iBuyer in November 2021 could flood the market with listings. So in my mind it starts to sound like there is a pattern here rather than real analysis. And like a cult, there is always some truth in there somewhere.

Thanks Joda. Always appreciate your take.

Annual and Monthly Stats for El Dorado County?

I’m feeling left out Ryan. LOL!!

Haha. Thanks for the prod. Let’s correct that. If my El Dorado people are listening, I’ll respond. I just can’t today. Prod me again though. Send me an email and I’ll get some stuff to you. I do have a panoramic view of median price change in multiple counties since 2000 I think. I recently added El Dorado into the mix.

If my El Dorado people are listening, I’ll respond. I just can’t today. Prod me again though. Send me an email and I’ll get some stuff to you. I do have a panoramic view of median price change in multiple counties since 2000 I think. I recently added El Dorado into the mix.

I didn’t get to El Dorado stats this month. Not yet anyway. I’m more sporadic about the county, but I do have stats to share. Technically, El Dorado is represented in the regional stats I shared, but I know what you want. In truth, El Dorado bounces around all over the place because there aren’t many sales, so I’ve never shared sequential months for the county. When I do share year-over-year stats, I include 90-day chunks also. I can’t get to this today, but if you reach out again by Monday, I’m happy to push something out. I do have some other El Dorado images I’ve been sharing, but feedback has been pretty limited too, which influences what I focus on.