We love fast things. Cars, making money, and especially information. When it comes to talking about real estate though, it’s not always possible to digest a market in Twitter-sized chunks. Today I have my BIG monthly post to recap Sacramento real estate over the past month. I hope this will be a great resource for you and your clients to get a sense of where the market is at right now. I do suggest clearing your desk for a few minutes and digging in to the post, but you can also run through it quickly by scrolling through the images.

Two ways to read this post:

- Briefly scan the graphs below in 1 minute.

- Take several minutes to digest the graphs and commentary.

Enjoy and let me know what you think.

The Median Price Scoop: The median sales price in Sacramento County is now $260,000 as of March 2014. For some perspective, current county-wide price levels are similar to early 2008 and late 2003. The median sales price saw an increase from January, which is fairly normal this time of year, though I tend to take the median price increases with a grain of salt lately since sales volume has been very low. It’s important to remember that less data points can lead to weaker sales figures, which can ultimately boost numbers. Many areas feel really soft right now to say the least, yet other areas are more stable or seeing a slight increase. Overall the market is more price sensitive as inventory is moving when it is priced correctly, but sitting when it is not. This is not a market to price a property too high or make offers like it was Q1 2013 either.

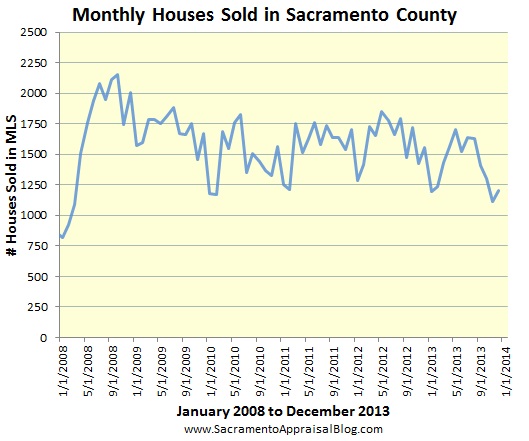

The Story of Inventory: Housing inventory has been ping ponging between 2 to 2.5 months over the past quarter or so. The market is still a seller’s market since inventory is still very low (technically at 1.95 months right now). For context there were about 1200 sales last month and there are roughly 2400 active listings on MLS right now (single family detached) and close to 2600 current pending sales.

Investors have “left the building”: Cash sales in Sacramento County have dropped by almost 14% over the past three quarters. This has been an X-factor for cooling off values and also an explanation for why sales volume has been sluggish these past months. The market was heavily driven by investors for the first half of last year, but now real estate is learning to be driven a bit more by the fundamentals (jobs & economy). Overall the market felt a bit weird to many locals over the past quarter. The number of sales was definitely lower, but the number of pending sales has been high at the same time for months. It’s been easier to get properties into contract, but not as easy to close escrow. The market is adjusting to less cash, slightly higher interest rates and more inventory. It seems the market is poised to be quasi-normal over the next few months, but the real test will be what happens the second half of the year after Spring fever subsides.

It’s worth noting cash sales under $200,000 saw an increase this quarter, but keep in mind how low sales volume has been before sounding the alarm that cash is on the rise again. As volume presumably increases over the next quarter, we’ll see how the stats adapt.

SacBiz Journal Mention: Speaking of cash, I was mentioned in a Sacramento Business Journal article two days ago, which is always an honor. Check it out at Appraiser: Decline of cash home sales doesn’t mean market is dead.

FHA & Cash: One of the downfalls of less investors playing the market is a softening of values. Yet one of the most helpful byproducts is more first-time buyers and conventional buyers getting contracts accepted. Right now FHA has a similar sales volume as cash. I know I’ve had quite a few FHA appraisals come across my desk lately. Overall there has been a very slight decrease in FHA sales this quarter, but that may be attributed to escrows taking longer to close in general and FHA typically taking longer in light of needed repairs to make sure properties meet minimum FHA standards.

REOs & Short Sales: There has been a slight uptick in REO sales. We could say something like REOs increased by 10% last quarter, but let’s look at the numbers. There were about 25 more REOs over the past 90 days compared to the previous quarter, which is technically 10% more sales (but still only 25 sales, right?). Another way to look at the uptick would be to say we saw a 2% REO market increase from last quarter to this quarter. Of course if sales volume had not been so sluggish these past few months, we probably wouldn’t have seen any REO percentage increase at all. Ultimately this is a minor uptick, but it is something we should watch over time. Short sales have persisted to represent about 10% of the market.

Interest Rates: After a dramatic increase of interest rates last May (3.5% to 4.0%), rates have been hovering close to the mid 4.0% range lately. On one hand increasing rates is inevitable because they simply cannot be this low forever. Yet it’s important to note The Fed previously said it would raise interest rates when unemployment was down to 6.5%. But now they are back-pedaling as the current unemployment rate is 6.7% in the United States, yet the economy is definitely not where it needs to be yet. If The Fed does continue to keep rates lower for a season, it will help continue to artificially stimulate the housing market (and economy).

US, CA & Sacramento: Right now the unemployment rate in Sacramento is 8.1%, California is 8.5% and the United States is hovering at 6.7%. The economy added 192,000 jobs last month, which is seemingly good news. But at the same time critics warn many of these jobs are part-time and low paying in light of employers not wanting to hire full-time workers to pay for Obamacare. So as I always say, take unemployment figures with a grain of salt, but still be sure to look at them.

I hope this was helpful for you and your clients. Please forward or share if it was. Remember that knowing trends helps us be professional, a better resource to our contacts and even points out who are our future clients might be.

Questions: What stands out to you above? What are you seeing in the trenches of the local market? I’d really love to hear your insight. Comments are welcome below.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The honeymoon is over. That’s right. The real estate market in 2013 felt like a honeymoon because it was full of glittery optimism, sensational news headlines and the sweet aroma of a quick recovery. Just as a honeymoon in real life comes to an end, we all knew such rapid appreciation was not sustainable, inventory could not be that low forever and interest rates wouldn’t endlessly hover at historically low levels either. Of course this doesn’t mean the market is not still ripe for positive growth, but only that this year probably won’t feel as good as last year.

The honeymoon is over. That’s right. The real estate market in 2013 felt like a honeymoon because it was full of glittery optimism, sensational news headlines and the sweet aroma of a quick recovery. Just as a honeymoon in real life comes to an end, we all knew such rapid appreciation was not sustainable, inventory could not be that low forever and interest rates wouldn’t endlessly hover at historically low levels either. Of course this doesn’t mean the market is not still ripe for positive growth, but only that this year probably won’t feel as good as last year. Housing inventory decreased last month below 2 months of supply, which is understandable in light of the holidays and colder weather. Otherwise inventory has been flirting with 2.5 months. I said above that the real estate “honeymoon” is over, but keep in mind inventory is still very low, which means there is still room for some growth ahead (though I do not believe we will see the same rapid appreciation like we did last year since the market is different this time around in terms of inventory, interest rates and cash investors). The median price in December saw a slight uptick from November, but overall is still hovering around the $250,000 range as it has been for about six months. Can you see why people are saying the market is flat?

Housing inventory decreased last month below 2 months of supply, which is understandable in light of the holidays and colder weather. Otherwise inventory has been flirting with 2.5 months. I said above that the real estate “honeymoon” is over, but keep in mind inventory is still very low, which means there is still room for some growth ahead (though I do not believe we will see the same rapid appreciation like we did last year since the market is different this time around in terms of inventory, interest rates and cash investors). The median price in December saw a slight uptick from November, but overall is still hovering around the $250,000 range as it has been for about six months. Can you see why people are saying the market is flat? Here is a broader picture of median price and inventory. Current values are tending to resemble values in both 2003 and 2007/2008.

Here is a broader picture of median price and inventory. Current values are tending to resemble values in both 2003 and 2007/2008. Sales were sparse for the

Sales were sparse for the

The jobless rate is thankfully going down in Sacramento County, but 8.1% is still not a pretty statistic. Can I be a resounding gong by saying we need more JOBS, JOBS & JOBS?

The jobless rate is thankfully going down in Sacramento County, but 8.1% is still not a pretty statistic. Can I be a resounding gong by saying we need more JOBS, JOBS & JOBS?