We’re about to have more real estate “bubble” conversations. Why? Because prices are very close to where they were at the previous peak of the market. Here’s a few things that come to mind when these conversations come up. Then for those interested I have a big monthly market update. Anything to add?

Higher prices fuel conversation: As prices rise, it inflames conversation about a real estate “bubble”. Media outlets cover this topic of course, but it’s also on the mind of the public.

Stats are VERY close to the peak: Markets throughout the country are different, but in Sacramento most price metrics are getting very close to the peak from 2005. In fact, the average sales price in the Sacramento region is now the SAME as it was back then.

No formula: As a friendly reminder, there is no “bubble” formula that says the market will plummet if we get back to prices from 10+ years ago.

Hello inventory: As news of high prices gets out there, some sellers will put their homes on the market thinking we are at the top. So let’s watch inventory very closely in coming time.

Normal seasonal slowing: Right now the market is slowing, and some are saying, “It’s starting to turn. Pop. The Bubble is happening!!!” Here’s the thing though. Markets tend to have a seasonal cycle where things are hot and then they cool off. When the market begins to soften each year we tend to hear a little more doom & gloom because sometimes we confuse a seasonal slowing with the market tanking. At the moment the stats in Sacramento look normal for the season and don’t indicate the market has made a big turn down, so I’ll keep saying that unless I have a reason not to. Make sense?

Normal seasonal slowing: Right now the market is slowing, and some are saying, “It’s starting to turn. Pop. The Bubble is happening!!!” Here’s the thing though. Markets tend to have a seasonal cycle where things are hot and then they cool off. When the market begins to soften each year we tend to hear a little more doom & gloom because sometimes we confuse a seasonal slowing with the market tanking. At the moment the stats in Sacramento look normal for the season and don’t indicate the market has made a big turn down, so I’ll keep saying that unless I have a reason not to. Make sense?

Less room: There is less room for prices to increase unless the job market and wage growth really start to move. So it seems logical for the market to slow down. Yet there are many dynamics that make prices move, and nobody has a crystal ball to say exactly what prices will do in the future.

Don’t forget Inflation: This might sound anal, but let’s get technical about comparing older prices with today’s prices. We’ve had thirteen years of inflation since 2005, and that means it’s gotten more expensive to buy the same goods today than it was in the past. For instance, the peak of the market in Sacramento saw a median price at $395,000 in 2005, but when adjusting that figure for inflation with an inflation calculator, a price at $395,000 in 2005 would technically have the same purchasing power of $511,000 today. So as today’s median price approaches $395,000, we have to realize it’s really not the same $395,000 as it was in 2005 because of how the value of the dollar has changed over time.

But the market doesn’t care about inflation: Okay, let me now throw a curveball. It’s important to understand how inflation works for the sake of comparing older stats, but I don’t think most buyers and sellers actually care about inflation. They don’t say, “Sweet, prices today look like they’re the same as 2005, but technically they’re lower because of inflation.” No, people tend to see prices and say, “Holy heck, we’re back to the peak.” I’m not dismissing the need to understand how inflation works, but only being real about how the bulk of buyers and sellers tend to think. Besides, it doesn’t matter how close we are to the previous peak anyway because there is no formula that says the market will “pop” at that level.

Preaching doom: Some preach doom & gloom, and that’s fine. My advice though? Be realistic about your ability to predict the future. Some have been making annual real estate predictions about how the market is about to collapse, and I’m hearing many say the big change is now coming later this year or in 2019. The problem is when these predictions don’t come true the “prophecies” simply get pushed back another year. The irony is if a person keeps making the same prediction every year, at some point that person could be right.

Seeing only red flags: It’s getting less affordable. The economy isn’t that great. Interest rates are rising. Home prices have outpaced wage growth. Lenders are getting more creative with financing. These are red flags for sure. But let’s remember just because unhealthy elements exist in a market does not mean it’s starting to crash. My advice? Be honest about the red flags, but let actual stats inform what you say and think about the market. Keep in mind many articles in coming time are going to preach doom, but take a step back from the articles and look to the stats. What do the stats say? And what is the mood among buyers and sellers in the market? That’s the only thing that matters.

Open letter to worried buyers: Last year I wrote an open letter to buyers worried about another housing bubble. I have some practical advice and tips in there in case it’s relevant.

I hope that was interesting or helpful. Anything to add?

-—-—- Big monthly market update (long on purpose) ———–

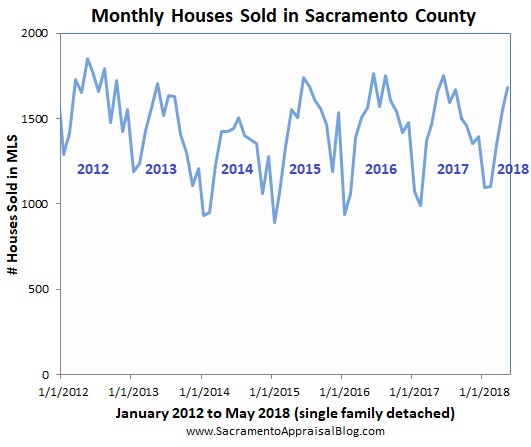

We saw what we would expect to see last month. It felt like a normal May. Well, actually it was the strongest May of sales volume since 2013. Prices ticked up again, it took three less days to sell, and inventory remained sparse. Overall the stats are glowing, but it’s important to recognize the market is starting to slow for the season. We are seeing way more listings hitting the market, and this is transferring some power from sellers to buyers. We are also seeing more price reductions. In a few months we will likely see this slowness in the stats, but for now check out some glowing numbers below.

We saw what we would expect to see last month. It felt like a normal May. Well, actually it was the strongest May of sales volume since 2013. Prices ticked up again, it took three less days to sell, and inventory remained sparse. Overall the stats are glowing, but it’s important to recognize the market is starting to slow for the season. We are seeing way more listings hitting the market, and this is transferring some power from sellers to buyers. We are also seeing more price reductions. In a few months we will likely see this slowness in the stats, but for now check out some glowing numbers below.

The previous “bubble” vs now:

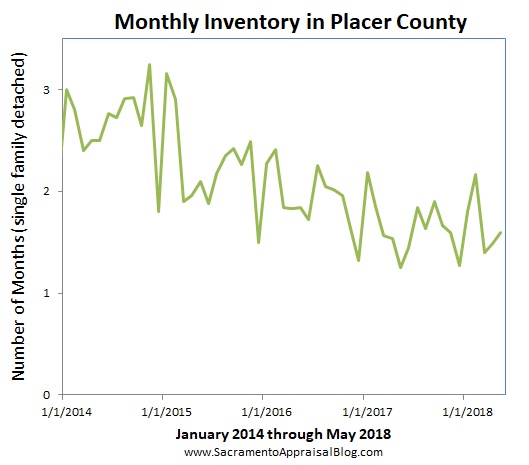

1) Housing inventory: Since late last year housing inventory has begun to increase subtly. Right now we have 1.5 months of housing supply whereas one year ago we had 1.26 months of supply. Some might interpret this to mean the market has begun to collapse and really change directions, but this is still a very anemic level of housing supply, and the market has been able to handle this change easily because of strong demand. For reference, when the market collapsed in 2005 inventory literally doubled in 90 days from the summer to the fall. That’s a far different story than what we’ve seen so far this year with a minor uptick in inventory over the past two quarters.

2) Sales volume: If we did have a “bubble” and it burst, I would expect to see more listings hit the market and most likely a drop in sales volume. In 2005 the market changed and properties simply stopped selling as you can see below. In one year sales volume literally dropped by 43%. Yikes!! In contrast, right now sales volume has been very steady. Let’s keep an eye on sales volume and inventory though because both metrics might help us gauge if the market really is changing. Remember though, before we see a change in sales, we’ll hear of a change in the mood of buyers and sellers. Thus the trend always happens in the listings first before we start to see it in the sales. That’s why the word on the street is so important in real estate (agents, please keep emailing me to let me know what you are seeing out there).

I could write more, but let’s get visual instead.

DOWNLOAD 61 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

DOWNLOAD 61 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What are you hearing buyers and sellers saying about the market? Do you think the market has turned or are we seeing a seasonal slowness? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.